Revenue Deferral Journal Entry - Whether deferring a payment hurts credit. Web what is the journal entry for deferred revenue? In this case, the balance for cash/bank (debit balance). Services contract paid in advance. Web a deferred revenue journal entry is a financial transaction to record income received for a product or service that has yet to be delivered. In accounting, deferred revenue can. Learn why it’s so important for small businesses to properly recognize it. This represents a good or service that. Deferral, in general, means a company’s. Let us understand the process of recording deferred revenue with an.

Unearned Revenue Journal Entry LizethkruwSmith

Web the entries to record such revenue are as follows: Deferred revenue journal entry example 2: Defer if the cash has been received but the.

Solved M410 Preparing Journal Entries for Deferral

Rent payments received in advance. How to record deferred revenue. Services contract paid in advance. Defer if the cash has been received but the revenue.

Deferral Adjusting Entries YouTube

Web deferred revenue is a liability account that represents the obligation that the company owes to its customer when it receives the money in advance..

Accrual vs Deferral Accounting The Ultimate Guide

Web the entries to record such revenue are as follows: Web deferred revenue journal entry is passed to record the advance payments received for goods.

What is Deferral? Definition + Journal Entry Examples

Web deferred revenue journal entry is passed to record the advance payments received for goods and services. Web deferred revenue (also called unearned revenue) is.

Deferred Tax Liabilities Explained With Reallife

In this case, the balance for cash/bank (debit balance). How to record deferred revenue. Learn why it’s so important for small businesses to properly recognize.

Payroll Journal Entry Template Excel

Services contract paid in advance. A revenue deferral is an adjusting entry intended to delay a company’s revenue recognition to a future accounting period. Web.

Deferred Revenue Journal Entry Double Entry Bookkeeping

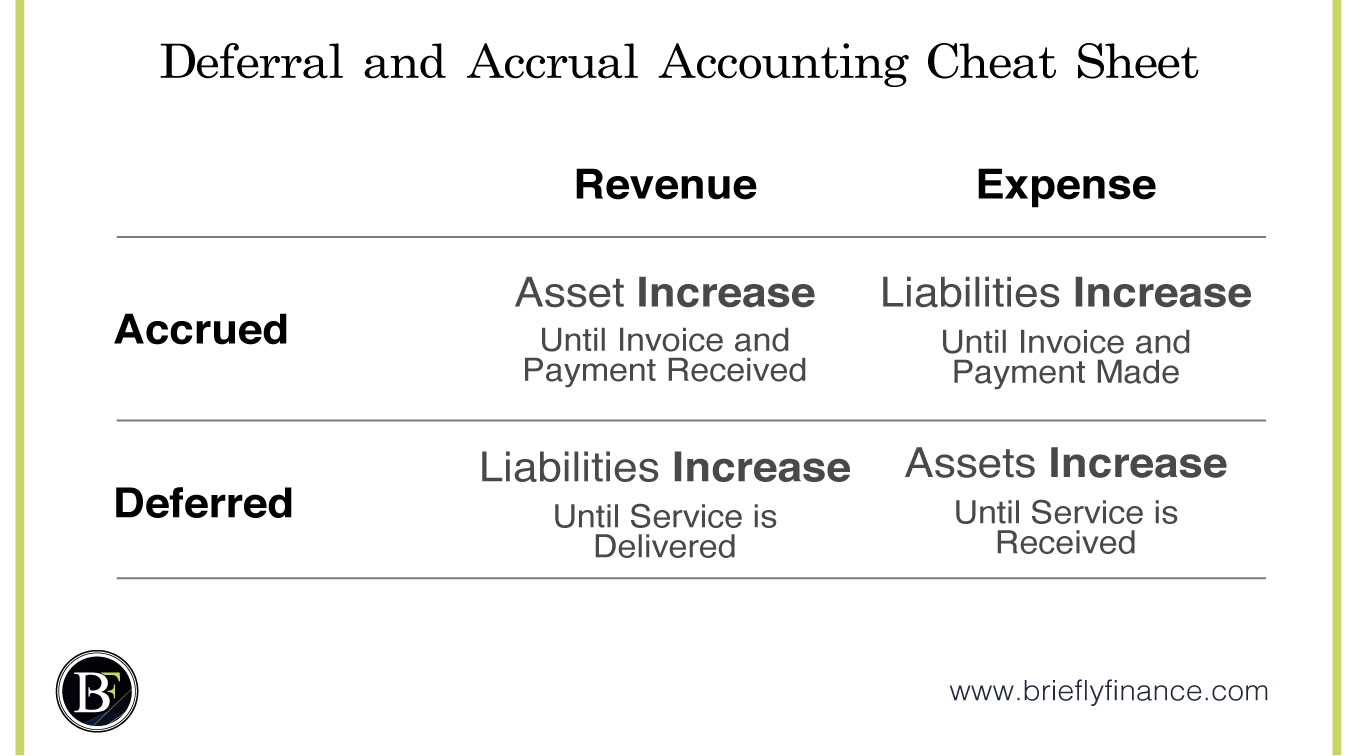

Web deferrals are adjusting journal entries that help align the timing of cash flows with gaap revenue recognition and expense matching. Deferred revenue is listed.

Accruals and Deferrals JC Accounting, Bookkeeping & Consultancy

The accounting for deferred revenue involves a debit to the cash or accounts. Web how to record a deferred revenue journal entry. Web deferrals are.

Web The Adjusting Entry Ensures That The Correct Amount Of Revenue Earned Appears On The Income Statement, Not As A Liability On The Balance Sheet.

Web understanding deferred revenue journal entry: Defer if the cash has been received but the revenue has not yet been earned (unearned). Deferred revenue is listed as a liability on a company’s balance sheet. Deferral, in general, means a company’s.

Web Deferred Revenue Is A Liability Account That Represents The Obligation That The Company Owes To Its Customer When It Receives The Money In Advance.

Web the deferred revenue journal entry upon receipt of the customer payment is: A revenue deferral is an adjusting entry intended to delay a company’s revenue recognition to a future accounting period. This journal entry increases cash for the amount received and records a liability for. Web deferrals are adjusting journal entries that help align the timing of cash flows with gaap revenue recognition and expense matching.

Web The Entries To Record Such Revenue Are As Follows:

Web treatment of deferral in accounting, with journal entries. Web journal entries for recording deferred revenue. How to record deferred revenue. Web deferred revenue is money that you receive from clients or customers for products or services that you haven’t delivered yet.

Web Deferred Revenue Journal Entry Example 1:

Suppose a manufacturing company receives $10,000 payment for services that have not yet been delivered. Web deferred revenue journal entry is passed to record the advance payments received for goods and services. Web how to record a deferred revenue journal entry. In this case, the balance for cash/bank (debit balance).