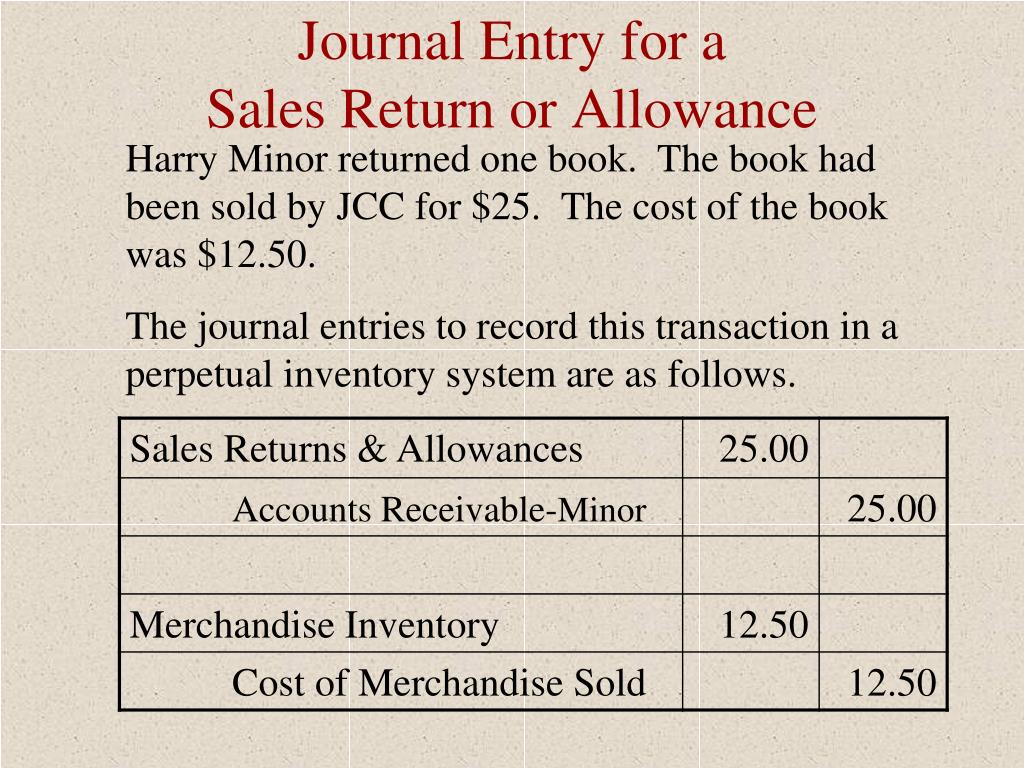

Return Merchandise Journal Entry - Web cbs determines that the returned merchandise can be resold and returns the merchandise to inventory at its original cost. Web this journal entry of return of damaged goods to the supplier under the perpetual inventory system will decrease both total assets and total liabilities on the balance sheet by $5,000. In this case, the company. Web spscc — acct&202 working. Web journal entries for purchase returns. A returned merchandise journal entry is a financial record that a company creates when a customer returns. Edited by ashish kumar srivastav. Sometimes merchandise must be returned to the. Web the journal entry to record this transaction in a perpetual inventory system is as follows. When this happens, the purchaser no longer has the.

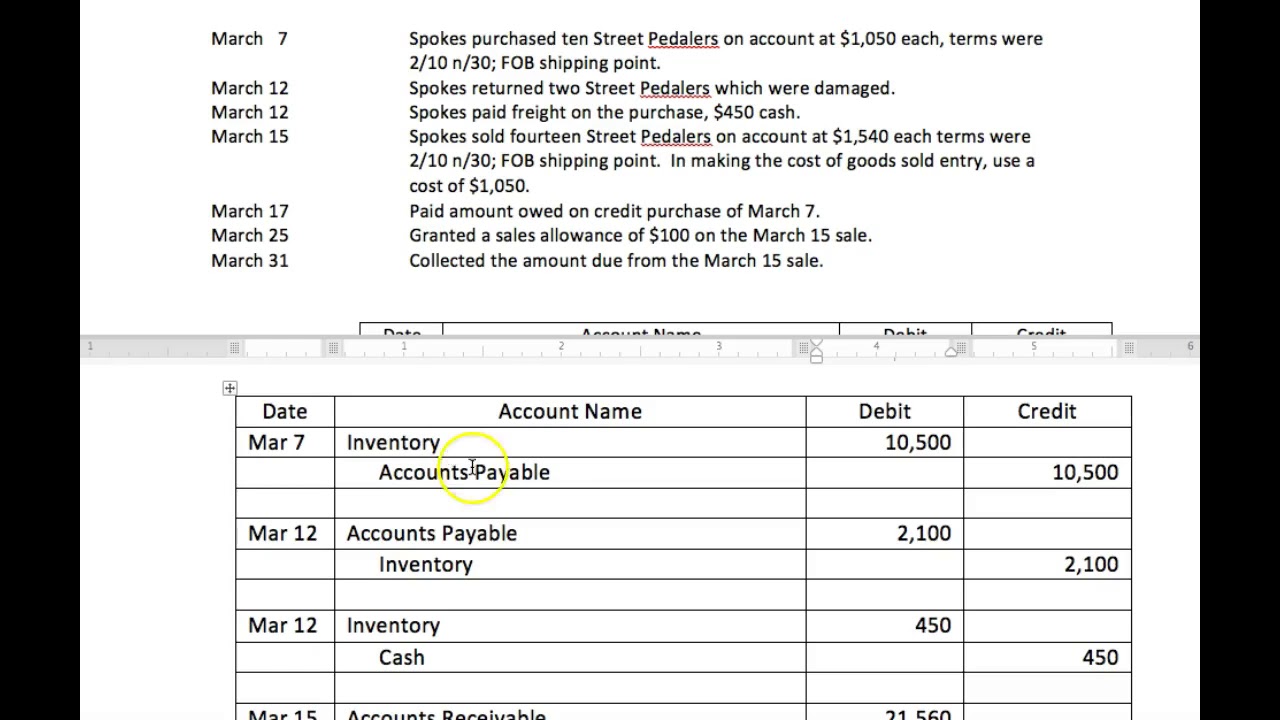

Example of Merchandising Entries YouTube

Web this journal entry of return of damaged goods to the supplier under the perpetual inventory system will decrease both total assets and total liabilities.

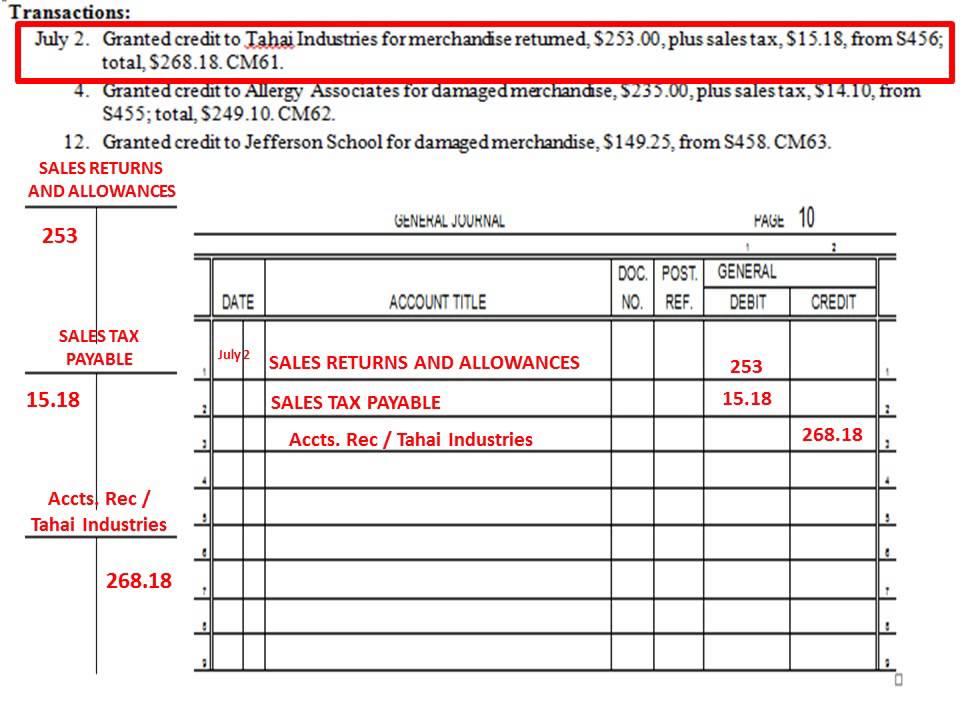

Chapter 10.3 Journalizing Sales Returns and Allowances Using a General

Sometimes due to various reasons goods sold by a company may be returned by the respective buyer(s). Web what is a returned merchandise journal entry?.

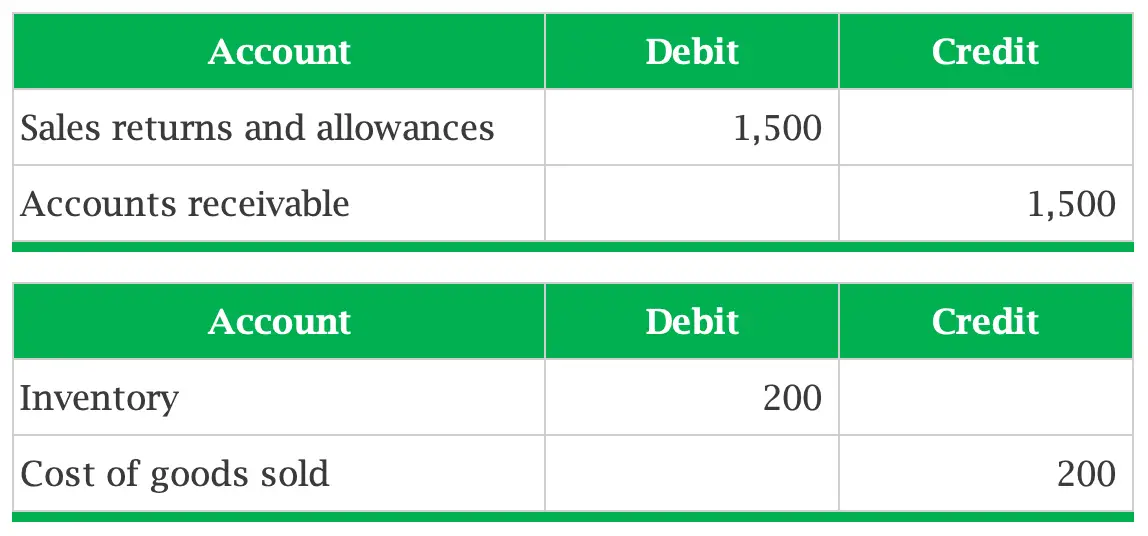

Accounting for Sales Return Journal Entry Example Accountinguide

In this case, the company. Analyze and record transactions for the sale of merchandise using the perpetual inventory system. Web this journal entry of return.

Perpetual Inventory System Journal Entry

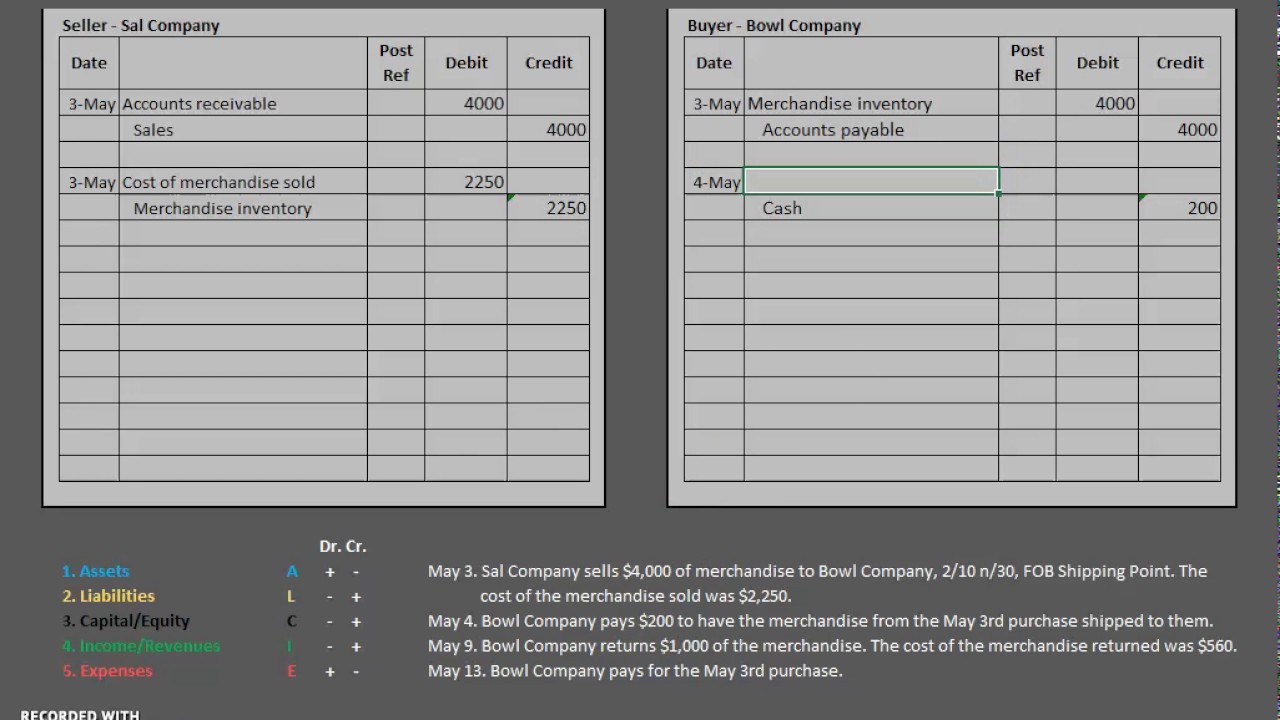

On may 1, cbs purchases 67 tablet computers at a cost of $60 each on credit. Web sales return journal entry. Web what is a.

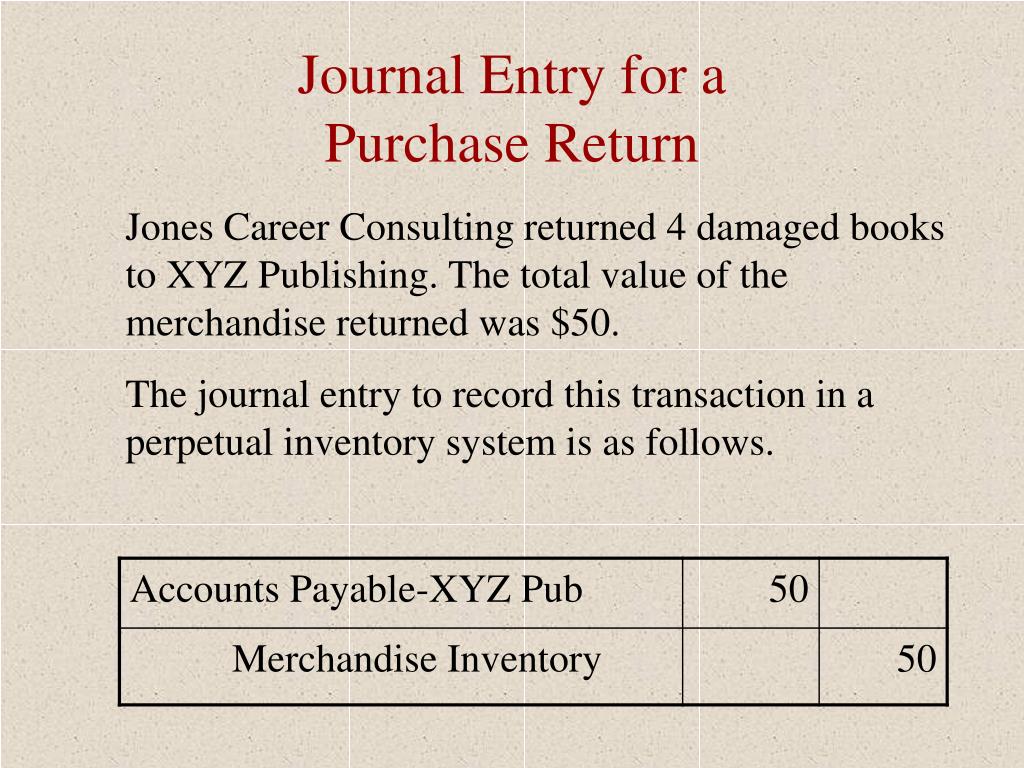

PPT Accounting for Merchandising Companies Journal Entries

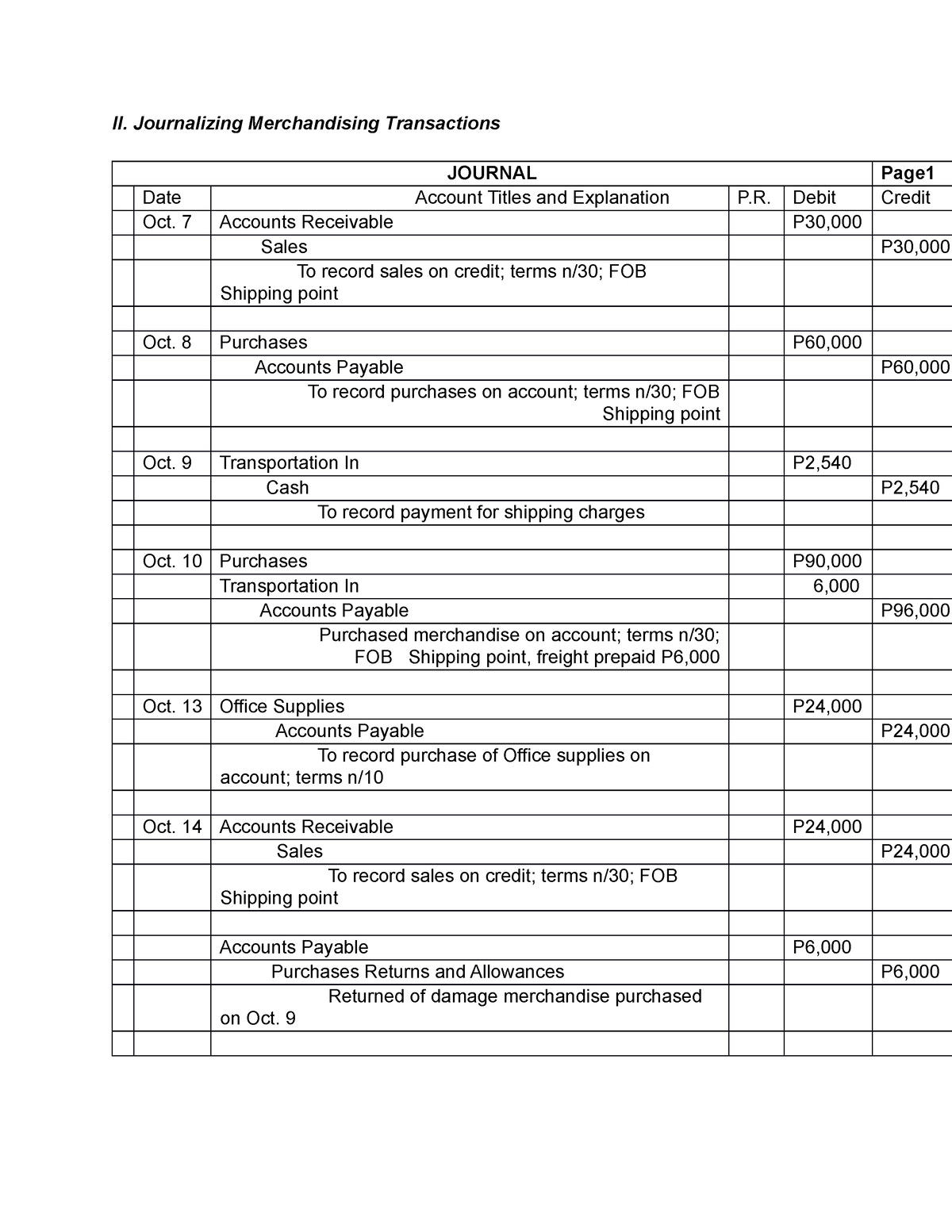

In this case, the company. The payment terms are 5/10, n/30, and the. In merchandising business, purchasing merchandise is one of the main activities that.

Pt 5 Journal Entries for Merchandising Business Purchases, Purchase

Web spscc — acct&202 working. The advantages of a purchase return journal entry. Return inwards helps in inventory keeping by enabling timely reorder of overstocked.

PPT Accounting for Merchandising Companies Journal Entries

Edited by ashish kumar srivastav. The payment terms are 5/10, n/30, and the. This account is for deductions from revenue that result from returns. Sometimes.

Journal Entry For Returning Merchandise

This account is for deductions from revenue that result from returns. In this case, the company. Web purchase discount transaction journal entries. A purchase return.

Merchandising business Example of a journal entry II. Journalizing

What is the purchase return. A return occurs when inventory is purchased and later returned to the seller. Web if you need to refund a.

In This Case, The Company.

Sometimes merchandise must be returned to the. To record a returned item, you’ll use the sales returns and allowances account. Web sales return journal entry. The payment terms are 5/10, n/30, and the.

A Purchase Return Is When A Buyer (Either A.

Return inwards helps in inventory keeping by enabling timely reorder of overstocked or outdated merchandise. A return occurs when inventory is purchased and later returned to the seller. The following entries occur for the sale and. Web spscc — acct&202 working.

Web Sales Return And Allowances Refer To The Sales Adjustment As A Result Of The Return Of Goods Or Merchandise Inventory Or A Reduction From The Original Selling Price Due To Damages.

Web the journal entry for purchase of merchandise on account is the same as the journal entry for purchase of merchandise for cash, except that the accounts. On may 1, cbs purchases 67 tablet computers at a cost of $60 each on credit. Web purchase discount transaction journal entries. Web return of a sale entry.

Reviewed By Dheeraj Vaidya, Cfa, Frm.

Web the following entries show the purchase and subsequent return. When this happens, the purchaser no longer has the. This account is for deductions from revenue that result from returns. Web the perpetual inventory method is a method of accounting for inventory that records the movement of inventory on a continuous (as opposed to periodic) basis.