Retirement Of Bonds Journal Entry - Web retirement of bonds when the bonds were issued at par; On each june 30 and december 31 for 10 years, beginning 2010 june 30 (ending 2020 june 30), the entry would be ( remember, calculate interest as principal x. Web there are several ways to retire bonds. The bonds are callable at 98. The balance in premium on bonds payable is $2,000. Web prepare journal entries to reflect the life cycle of bonds. Bonds payable is debited and cash is credited. See the debits and credits for each scenario and the bond formulas and calculations. Web learn how to make journal entries for retirement of bonds before maturity with gain, loss or no gain. A bond is said to be retired early when either the issuer or bondholder redeems the bond in exchange of cash before its original maturity date.

[Solved] Could you help me with this? Is it 50,000 instead?. Several

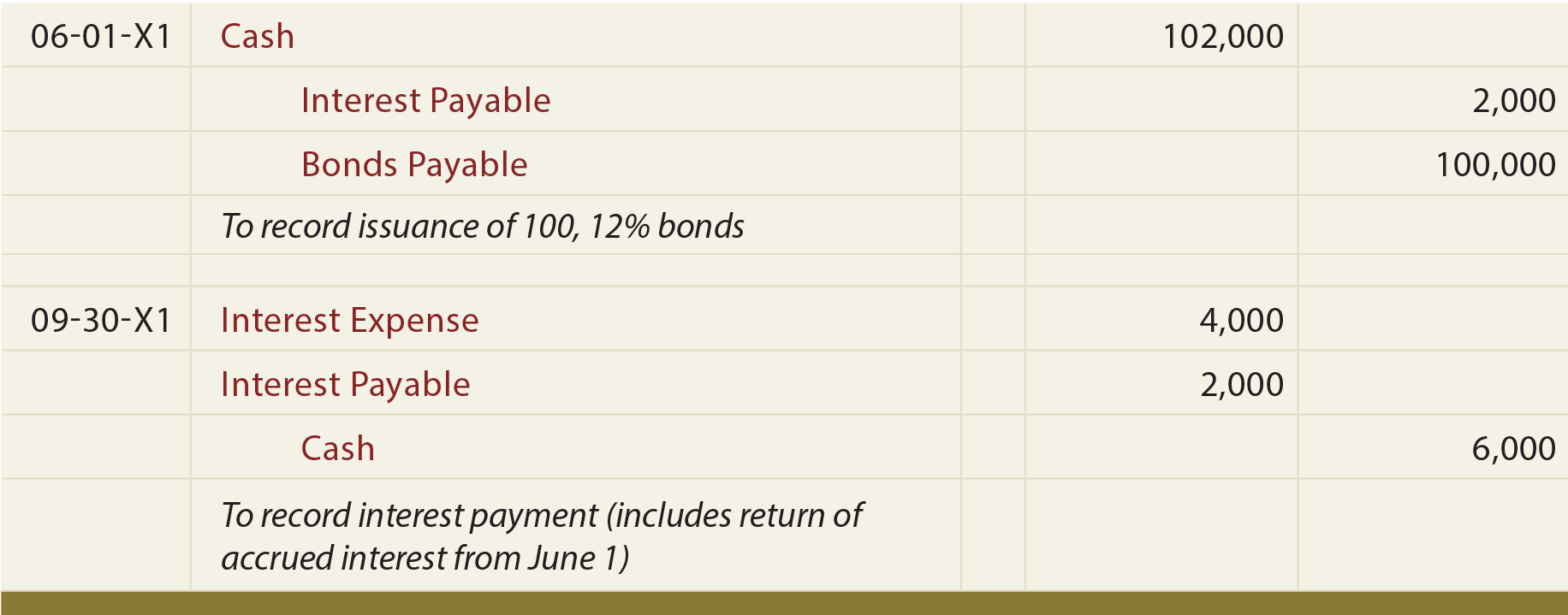

Bond retired before maturity a company has $100,000 bonds payable. When bonds are repaid at maturity, the journal entry is straightforward. On july 1, 2010,.

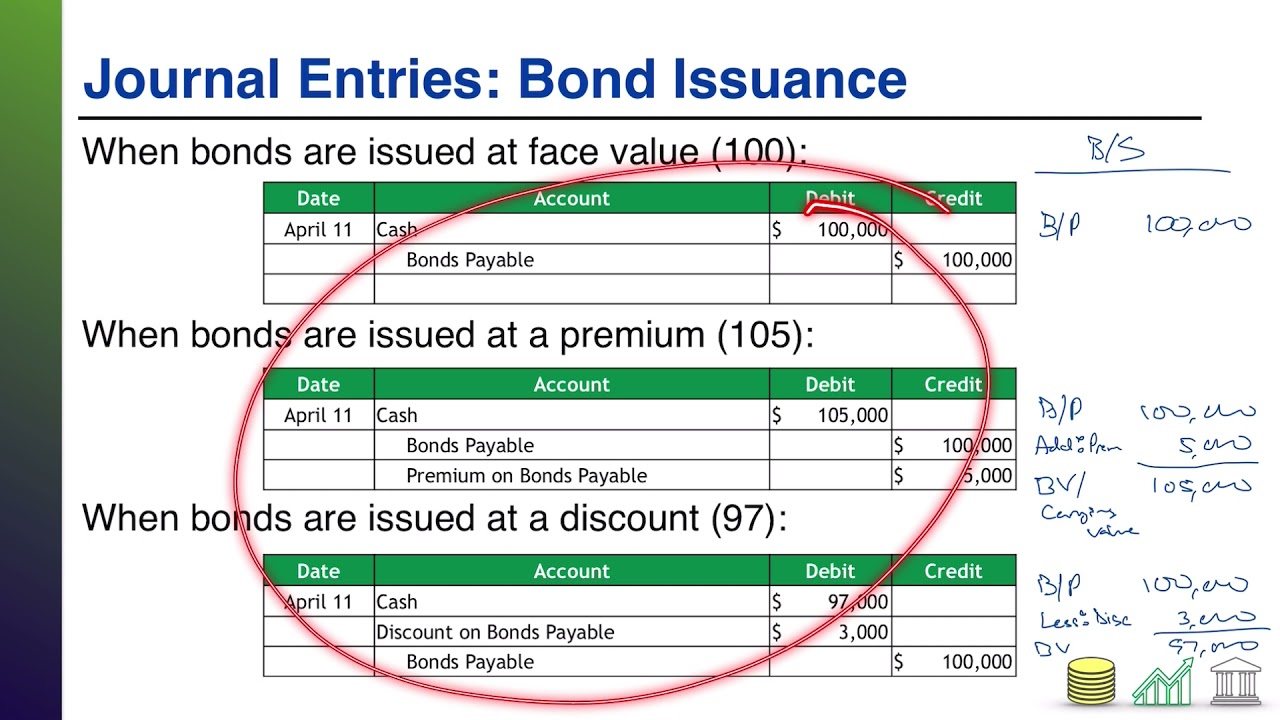

Bond Issuance Journal Entries and Financial Statement Presentation

See examples of different methods of bond retirement, such as maturity, call, sinking fund, and refunding. Web learn how to make journal entries for retirement.

Early retirement of bonds journal entry Early Retirement

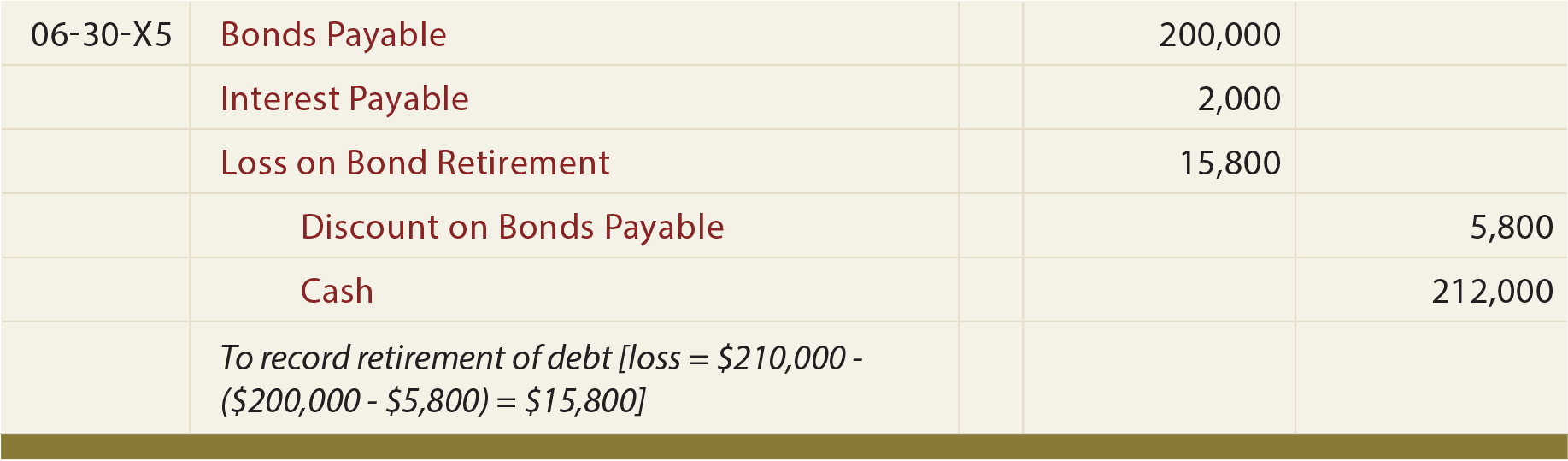

Assuming the final interest payment is made, the journal entry to retire the bonds is presented below. When bonds are repaid at maturity, the journal.

Financial Accounting Lesson 10.12 Early Retirement of Bond YouTube

The amount of the debt will be equal to the face value of the bonds being retired. By obaidullah jan, aca, cfa and last modified.

***Please explain how to get •interest payable •discount on bonds

Web retirement of bonds when the bonds were issued at par; This entry will typically involve the debit of the bonds payable account and the.

bond retirement Journal Entry

See the debits and credits for each scenario and the bond formulas and calculations. Learn how to record bond retirement at maturity, before maturity, and.

Bond Retirement Journal Entry to Retire a Bond YouTube

See examples for face value, discount and premium bonds and the effect on income statement. See the debits and credits for each scenario and the.

Early Redemption of Bonds Wize University Introduction to Financial

See examples of bond retirement journal entries with calculations and explanations. Find out the difference between retirement at maturity, before maturity, and by conversion, and.

Early retirement of bonds journal entry Early Retirement

Web when a company retires bonds, a journal entry must be made to record the transaction and adjust the accounts accordingly. By obaidullah jan, aca,.

See Examples For Face Value, Discount And Premium Bonds And The Effect On Income Statement.

Bond retired before maturity a company has $100,000 bonds payable. Prepare the journal entry to record the redemption. Web learn how to make journal entries for bond retirement at maturity or before maturity, with gain or loss, and with discount or premium. Web retirement of bonds when the bonds were issued at par at some point, a company will need to record bond retirement , when the company pays the obligation.

The Balance In Premium On Bonds Payable Is $2,000.

On july 1, 2010, the company retires (pays off) the bonds, at a price of 101.5. Bonds payable is debited and cash is credited. These include repayment of the bond at maturity, early extinguishment of the debt before maturity, and conversion of the bond into common stock. By obaidullah jan, aca, cfa and last modified on oct 31, 2020.

Assuming The Final Interest Payment Is Made, The Journal Entry To Retire The Bonds Is Presented Below.

Learn how to record bond retirement at maturity, before maturity, and by conversion with examples and explanations. Explore the process of recording bonds that are sold and those retiring at maturity. Web learn how to make journal entries for retirement of bonds before maturity with gain, loss or no gain. The company retires 45% of the bonds on september 1st, 2021 immediately after paying the coupon.

Web Retirement Of Bonds When The Bonds Were Issued At Par;

See examples of different methods of bond retirement, such as maturity, call, sinking fund, and refunding. Web retirement of bonds when the bonds were issued at par; Web learn what bond retirement means, how it affects issuers and investors, and how to record it in a journal entry. Find out the difference between retirement at maturity, before maturity, and by conversion, and the gain or loss on retirement.