Repurchasing Shares Journal Entry - The common shares are again eliminated at their new average cost: A stock buyback program that is intended to reduce the overall number of shares and thereby increase the earnings per share. Even though the company is purchasing stock, there is no asset recognized for the purchase. Usually, they gather their previously issued stock from the market. Web on october 1, 2021, the company repurchased and cancelled a further 11,000 shares at a cost of $14 per share. Web on june 1, 2020. Web for example, if a company repurchases 100,000 shares at $15 when the par value is $10 per share, the journal entry would be: Web the following journal entry is recorded for the purchase of the treasury stock under the cost method. Web in this journal entry, there is no treasury stock account. When a reporting entity repurchases its common shares, it is distributing cash to existing shareholders to reacquire a portion of its outstanding equity.

Changes to Accounting for Repurchase Agreements The CPA Journal

Web updated april 30, 2021. Accounting for the repurchase of shares: Web for example, if a company repurchases 100,000 shares at $15 when the par.

Journal Entry Examples

Then, it classifies those shares under treasury stock. As the company abc does not retire the repurchased stock, it can record it as the purchase.

Changes to Accounting for Repurchase Agreements The CPA Journal

What is the journal entry for treasury stock? Treasury stock = $1,500,000 ($15 per share * 100,000 shares) debit: The common shares are again eliminated.

2 Buy Back of Shares Journal Entries / CMA / CA INTER By

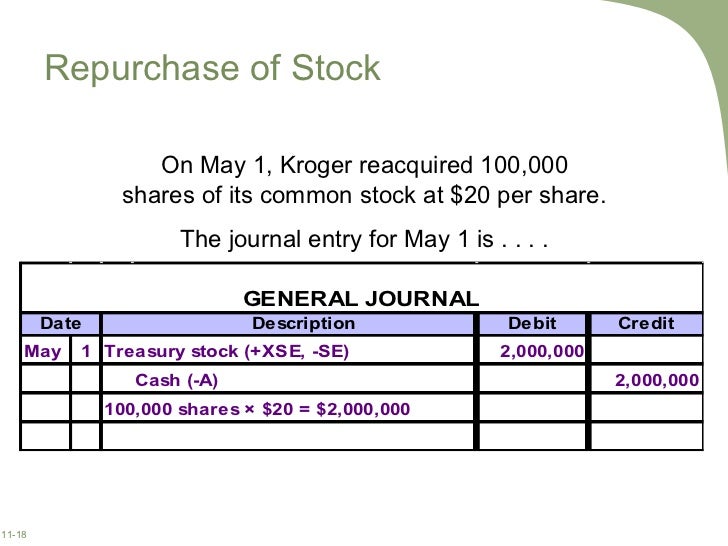

At the time of a stock buyback when treasury shares are repurchased, a company will debit the treasury stock contra equity account and credit the.

(Forfeiture and Reissue of Shares). Complete the following Journal

The company repays the holders the market value of those shares to reacquire them. Web on the cash flow statement, the share repurchase is reflected.

Chap011

Also, this is journal entry is assumed that the company pays the same amount as the amount received from issuing the stock. A reporting entity.

journal entry format accounting accounting journal entry template

Even though the company is purchasing stock, there is no asset recognized for the purchase. Treasury stock = $1,500,000 ($15 per share * 100,000 shares).

DK Goel Solutions Chapter 7 Company Accounts Issue of Share

Web updated april 30, 2021. Web what is the journal entry to record share repurchases ? A company may elect to buy back its own.

Issue of Shares Practical Problems and Solutions Definition & Examples

A limited company may not purchase its own shares unless they are fully paid. When a reporting entity repurchases its common shares, it is distributing.

It Means That The Company Has Received Cash By Selling Its Shares.

Web repurchasing of a company’s share. A stock buyback program that is intended to reduce the overall number of shares and thereby increase the earnings per share. The company repays the holders the market value of those shares to reacquire them. An entity cannot own part of.

A Reporting Entity May Repurchase Its Common Shares For A Number Of Reasons, Including To:

Web the following journal entry is recorded for the purchase of the treasury stock under the cost method. The cost method ignores the par value of the shares and the amount received from investors when the shares were originally issued. In this journal entry, the $10 par value of the common stock is not used to. What is the journal entry for treasury stock?

Also, This Is Journal Entry Is Assumed That The Company Pays The Same Amount As The Amount Received From Issuing The Stock.

Even though the company is purchasing stock, there is no asset recognized for the purchase. The common shares are again eliminated at their new average cost: Additionally, there may also be certain strategic benefits in repurchasing shares. This type of journal entry is often used when a company wants to reduce the size of its outstanding share capital, which can be achieved by buying back its own shares from the shareholders.

Increase Earnings Per Share Or Other Financial Metrics (E.g., Return On Equity) That May Be Of Interest To Shareholders.

A limited company may not purchase its own shares unless they are fully paid. When a reporting entity repurchases its common shares, it is distributing cash to existing shareholders to reacquire a portion of its outstanding equity. Even though the company is purchasing stock, there is no asset recognized for the purchase. A company may elect to buy back its own , which are then called.