Rental Expense Journal Entry - Web journal entry when prepaid rent actually applies. Web the journal entry is debiting rental expenses and credit cash. The journal entry is used to record the amount of money spent on rental. Probably the easiest part of working out the. Under the previous accounting standard, asc 840, accounting for prepaid rent would look like the example below. The rent expense journal entry is not too complicated: Web journal entry for rent paid in advance. When no advanced payments are made and rent is paid after every use, the entry would be: For example, on january 01, 2021, we rent a car to use in our business operation. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

The rental fee is $800 per month and due to special conditions,. Dr rent expense (profit and loss account) cr accruals (balance sheet) the above.

Finance Lease Journal Entries businesser

The rent expense journal entry is not too complicated: How do you record rent paid in. Web journal entry to record the payment of rent..

journal entry format accounting accounting journal entry template

Prepare a journal entry to record this transaction. The journal entry is used to record the amount of money spent on rental. The rental fee.

Rent Expense Journal Entry

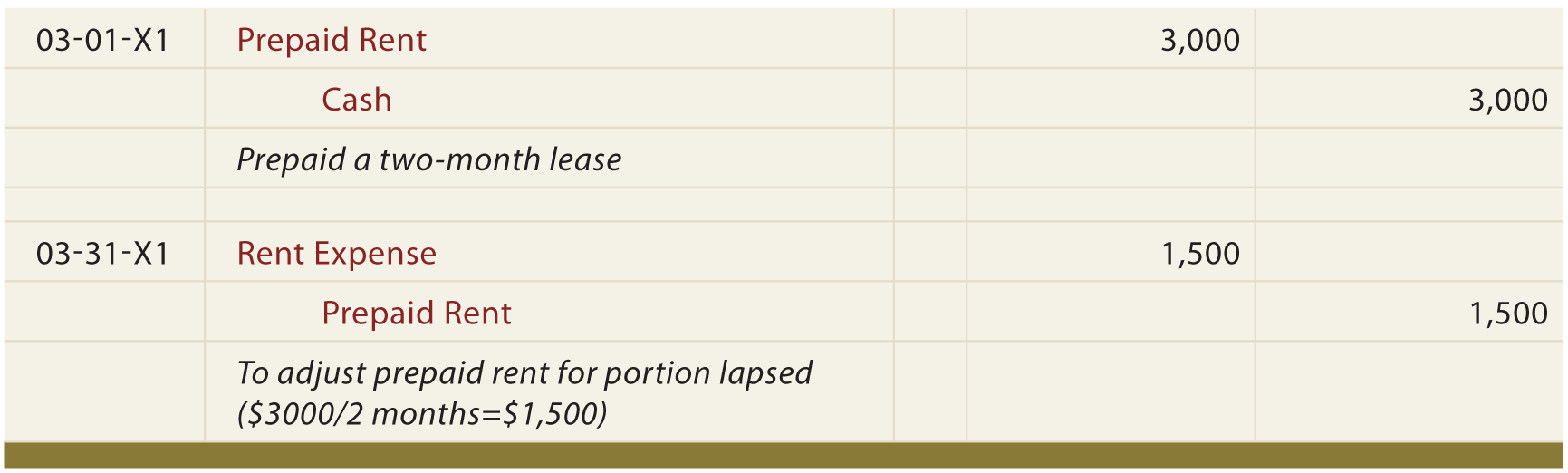

Under the previous accounting standard, asc 840, accounting for prepaid rent would look like the example below. Web make an entry for the first rental.

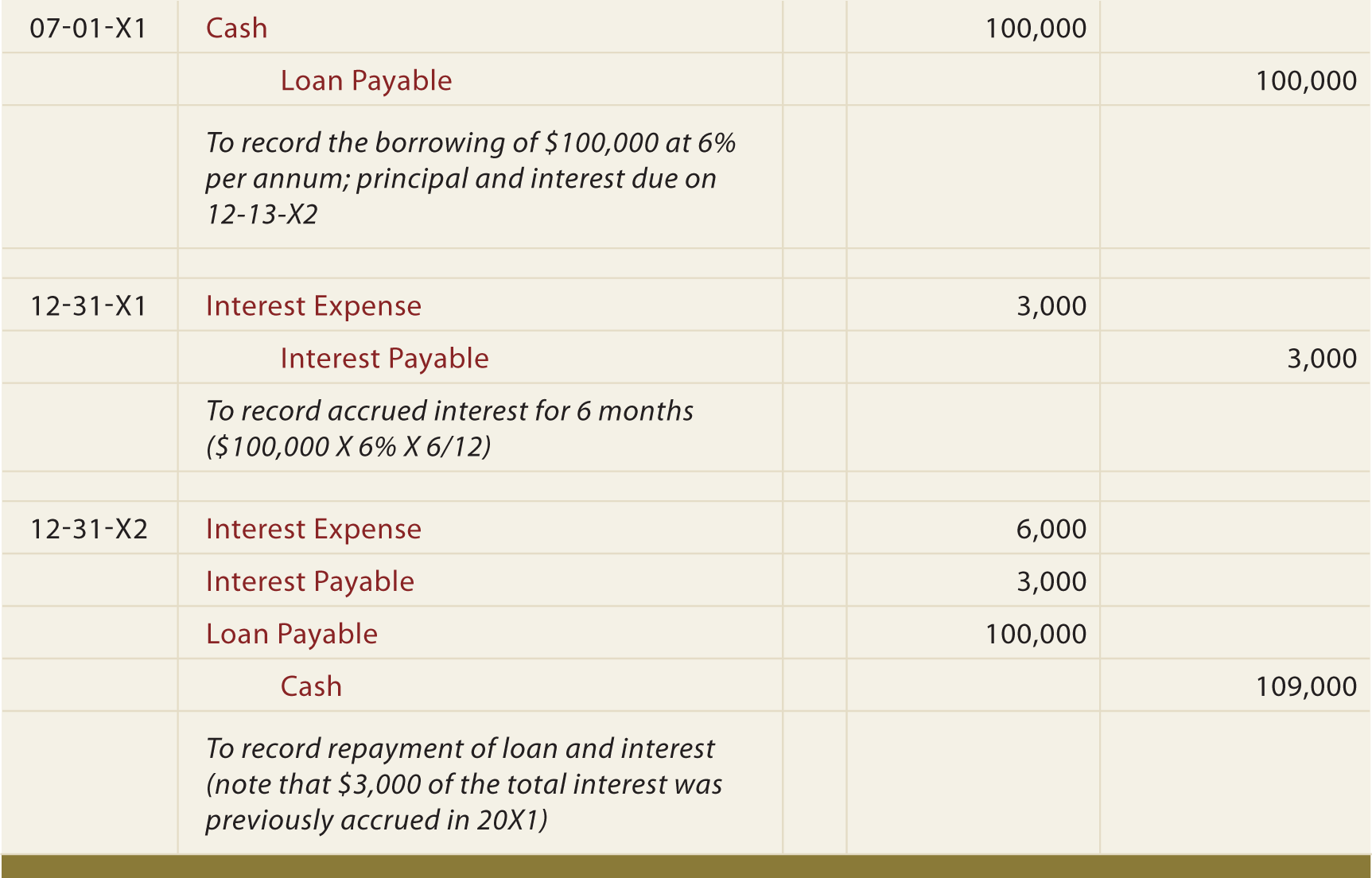

Accrued expenses journal entry and examples Financial

Accounting for accrued rent with journal entries. The company can make the journal entry for the rent paid in advance by debiting the prepaid rent.

Prepaid Expenses Entry Calculation In Excel Printable Templates

Web accrued rent expense example. 3) rent paid journal entry: Accounting for accrued rent with journal entries. Dr rent expense (profit and loss account) cr.

Journal entries for lease accounting

Company abc is in the. Web the journal entry is debiting rental expenses and credit cash. The rent expense journal entry is not too complicated:.

Self Study Notes The Adjusting Process And Related Entries

Under the previous accounting standard, asc 840, accounting for prepaid rent would look like the example below. If the business pays for advanced rentals, the..

Self Study Notes The Adjusting Process And Related Entries

Web journal entry for rent paid in advance. When no advanced payments are made and rent is paid after every use, the entry would be:.

The Company Can Make The Journal Entry For The Rent Paid In Advance By Debiting The Prepaid Rent Account And Crediting The Cash.

Accounting for prepaid rent with journal entries. For example, on january 01, 2021, we rent a car to use in our business operation. Adjusting entry to accrue rent expense: Web make an entry for the first rental payment on january 1, 2021.

Web The Journal Entry Is Used To Match The Amount Of The Rental Expense To The Income Statement.

Web accrued rent expense example. Here is an example of. Web journal entry when prepaid rent actually applies. Web the journal entry for a rent accrual is as follows:

When No Advanced Payments Are Made And Rent Is Paid After Every Use, The Entry Would Be:

Prepare a journal entry to record this transaction. 3) rent paid journal entry: Web journal entry to record the payment of rent. The rent expense journal entry is not too complicated:

[Q1] The Entity Paid $12,000 For Monthly Rent.

Is prepaid rent an asset? Cash balance increases by $20,000. How do you record rent paid in. Under the previous accounting standard, asc 840, accounting for prepaid rent would look like the example below.