Rent Expense Journal Entry - Web learn what rent expense is, how it is recorded in accounting, and how it affects businesses. Web if you are a tenant, you will record a journal entry like the following—a debit entry to a rental expense account and a credit entry to a creditors account. Web the journal entry is debiting rental expense and credit cash paid, withholding tax liability. Web the closing journal entries required to transfer the balance on each of these accounts to the retained earnings account is as follows: Decrease in assets (cash) by $1,500: Web increase in expenses (rent expense) by $1,500: [q1] the entity paid $12,000 for monthly rent. See how lease incentives, abatements,. Under the previous accounting standard, asc 840, accounting for prepaid rent would look like the example below. Web rent paid journal entry is passed in order to record the necessary rent payments against rented assets.

Rent Expense Journal Entry

Web increase in expenses (rent expense) by $1,500: [q1] the entity paid $12,000 for monthly rent. Web rent paid journal entry is passed in order.

Journal entries for lease accounting

The rent expense journal entry is not too complicated: Find out how to manage rental payments,. Web journal entries for expenses are records you keep.

journal entry format accounting accounting journal entry template

The debit to the rent expense increases this balance, while the credit to the bank account decreases this asset. When no advanced payments are made.

Accounting Journal Entries For Dummies

Web the entry to extinguish rent payable liability at the time of payment to landlord or property owner is given below: Web learn how to.

Journal entries for lease accounting

Web the closing journal entries required to transfer the balance on each of these accounts to the retained earnings account is as follows: Web rent.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

It is typically among the largest expenses that companies report. Web the entry to extinguish rent payable liability at the time of payment to landlord.

Self Study Notes The Adjusting Process And Related Entries

Web learn how to record rent paid in cash, cheque or advance in the books of a business. Web the entry to extinguish rent payable.

Accrued expenses journal entry and examples Financial

Web the journal entry is debiting rental expense and credit cash paid, withholding tax liability. Probably the easiest part of working out the. When no.

How to Adjust Journal Entry for Unpaid Salaries

Prepare a journal entry to record this transaction. See how lease incentives, abatements,. Find out how to manage rental payments,. Web the journal entry for.

Web Increase In Expenses (Rent Expense) By $1,500:

The rent expense journal entry is not too complicated: When no advanced payments are made and rent is paid after every use, the entry would be: See how lease incentives, abatements,. Rent payable [debit] cash [credit] under accrual system, the.

See Examples Of Rent Accruals, Invoice Receipt, And Payment.

Web learn how to record rent paid in cash, cheque or advance in the books of a business. Web the journal entry is debiting rental expense and credit cash paid, withholding tax liability. Prepare a journal entry to record this transaction. See examples, rules and presentation in the financial statements.

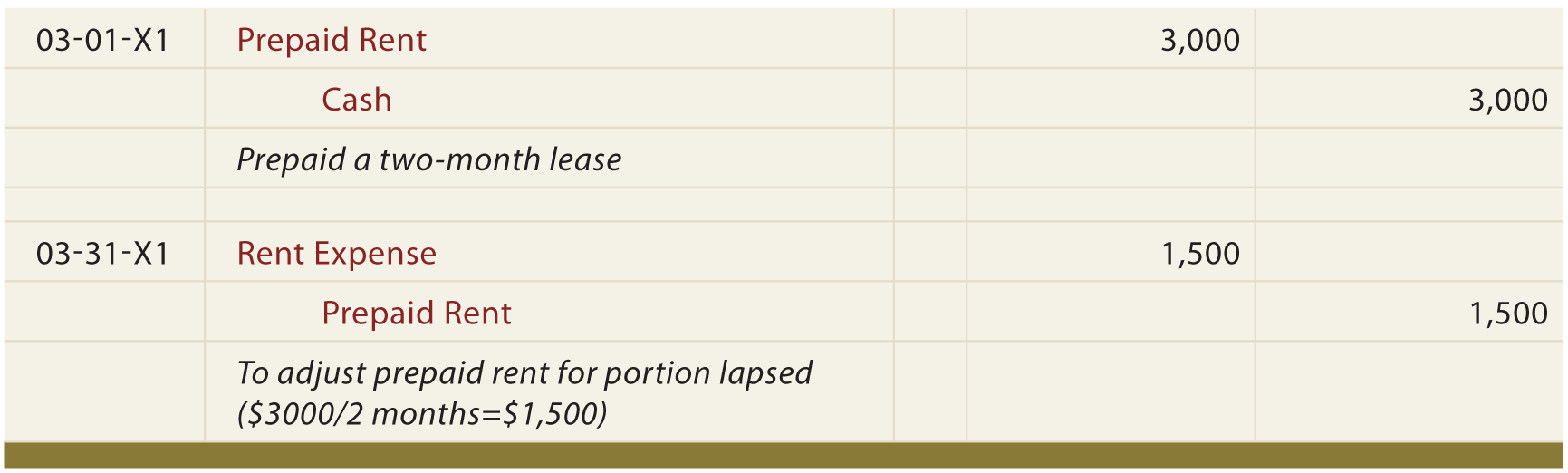

In Accounting, The Rent Paid In Advance Is An Asset, Not An Expense, As The Amount Paid Represents The Advance Payment For The Future Use Of The Rental Property.

If the business pays for advanced rentals, the. It is typically among the largest expenses that companies report. Web rent expense journal entries. Web if you are a tenant, you will record a journal entry like the following—a debit entry to a rental expense account and a credit entry to a creditors account.

Web Prepaid Rent Journal Entries.

Rent is an expense for business and thus has a debit balance. Here is an example of. Web journal entry to record the payment of rent. Web learn how to record rent accruals in the profit and loss account and the balance sheet using journal entries.