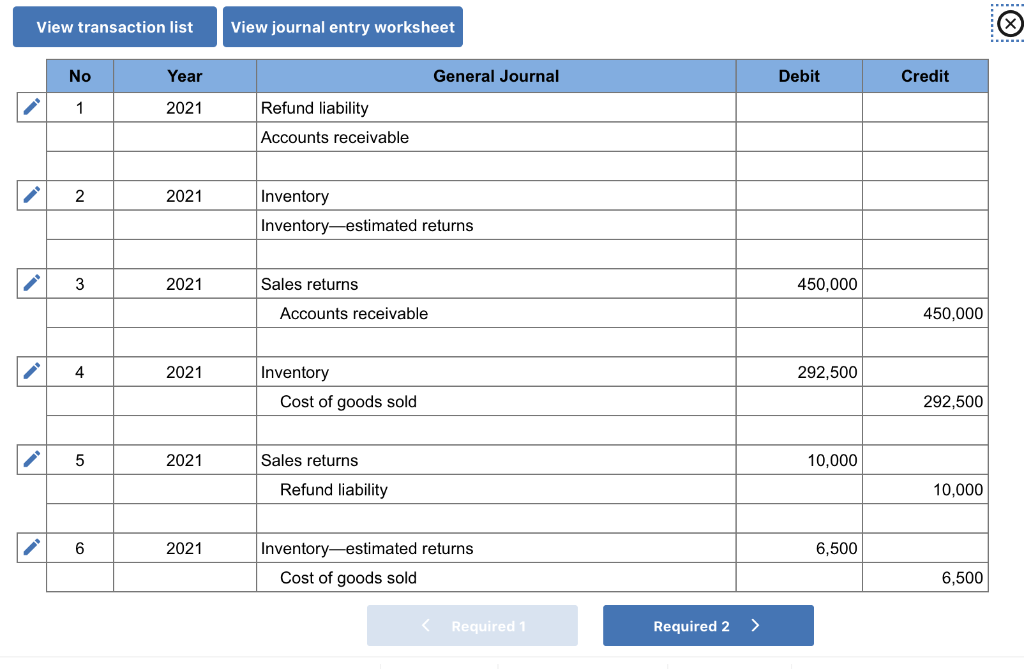

Refund Journal Entry - It records the debit of the refundable amount from the customer’s account. First, the sales returns and allowances account is debited. Web purchase return journal entries explained. Web when sales are returned by customers or an allowance is granted to them due to delayed delivery, breakage, or quality issues, an entry is made in the sales. Web the journal entry must account for that partial refund as well as that return’s impact on inventory, cost of goods sold, and its sales tax liability, as shown. Since a refundable deposit is cash that must be returned to the customer in the future, the company should debit. Web expecting an income tax refund for your business? Review the process for recording sales returns and allowances with examples. Web today i'm going to show you which accounts are involved in the accounting transaction to process a cash refund on a sales return. Web guide to what is sales return journal entry.

Solved Exercise 78 Sales returns (L074) Halifax

First, the sales returns and allowances account is debited. We explain it with example, credit memo and estimated points to understand regarding the concept. Accounting.

Journal Entry for Tax Refund How to Record

Web how do we account for it? First, the sales returns and allowances account is debited. Web the journal entry must account for that partial.

Accounting Journal Entries For Dummies

First, the sales returns and allowances account is debited. Web if you need to refund a customer for a purchase they made from your business,.

Journal Entry

Web today i'm going to show you which accounts are involved in the accounting transaction to process a cash refund on a sales return. Web.

Example Journal Entry with VAT

Web guide to what is sales return journal entry. Web if a customer purchased a product on credit and returns that product for a refund,.

How do you match a deposit to a receipt when the credit card refund is

Purchase return journal entries show that a company has directly reversed stock from their inventory back to. Accounting for sales return is mainly concerned with.

QuickBooks refund customer overpayment, What to do when customer overpays.

Web a cash refund journal entry is a bookkeeping entry used to document the refund transaction. Web when a customer buys something for you, you.

Solved Irs refund

It records the debit of the refundable amount from the customer’s account. I'll show the journal entries. Web a cash refund journal entry is a.

Tax Refund Accounting Tax Refund Journal Entry

Accounting for a sales return involves reversing (a) the. I'll show the journal entries. Accounting for sales return is mainly concerned with revising revenue and.

Since A Refundable Deposit Is Cash That Must Be Returned To The Customer In The Future, The Company Should Debit.

Web a cash refund journal entry is a bookkeeping entry used to document the refund transaction. Accounting for a sales return involves reversing (a) the. Web how do we account for it? Web expecting an income tax refund for your business?

Purchase Return Journal Entries Show That A Company Has Directly Reversed Stock From Their Inventory Back To.

It records the debit of the refundable amount from the customer’s account. Web purchase return journal entries explained. Return inwards helps in inventory keeping by enabling timely reorder of overstocked or outdated merchandise. Review the process for recording sales returns and allowances with examples.

Web When You Receive A Refund From A Vendor, You Must First Record A Supplier Credit For The Expense That The Refunded Payment Was Applied.

Web what is the journal entry to record a refundable deposit? In business, the company may receive a refund from its vendor or supplier due to various reasons such as the return of goods or a mistake of. Web if you refund a customer in cash after she pays you with a credit card, you'll need to post a journal entry instead of simply reversing the sale in the ledger. You may need to record a journal entry for income tax refund.

A Debit Increases This Account.

Web when a sales return occurs, the customer physically returns the product and receives his cash back. Web guide to what is sales return journal entry. So, when a customer returns. Web this entry details how much money has been refunded or credited to customers from purchases and is used to keep track of sales transactions.