Recovery Bad Debt Journal Entry - Web we may come across two methods of journal entry for bad debt expense as below: Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. In this accounting lesson, we explain what bad debt and bad debt recovered are. A recovery is a payment received after it has been designated as uncollectible. We show how to record. What is the bad debt expense allowance method? Establishing a bad debt reserve. The main reason that it is recorded as the other income since it is not the main source of. Web bad debt recovery refers to a payment received for a debt that had previously been written off and considered uncollectible. Web the process of accounting for it is called a bad debt recovery.

Bad Debt Recovered Explained with Journal Entry Example YouTube

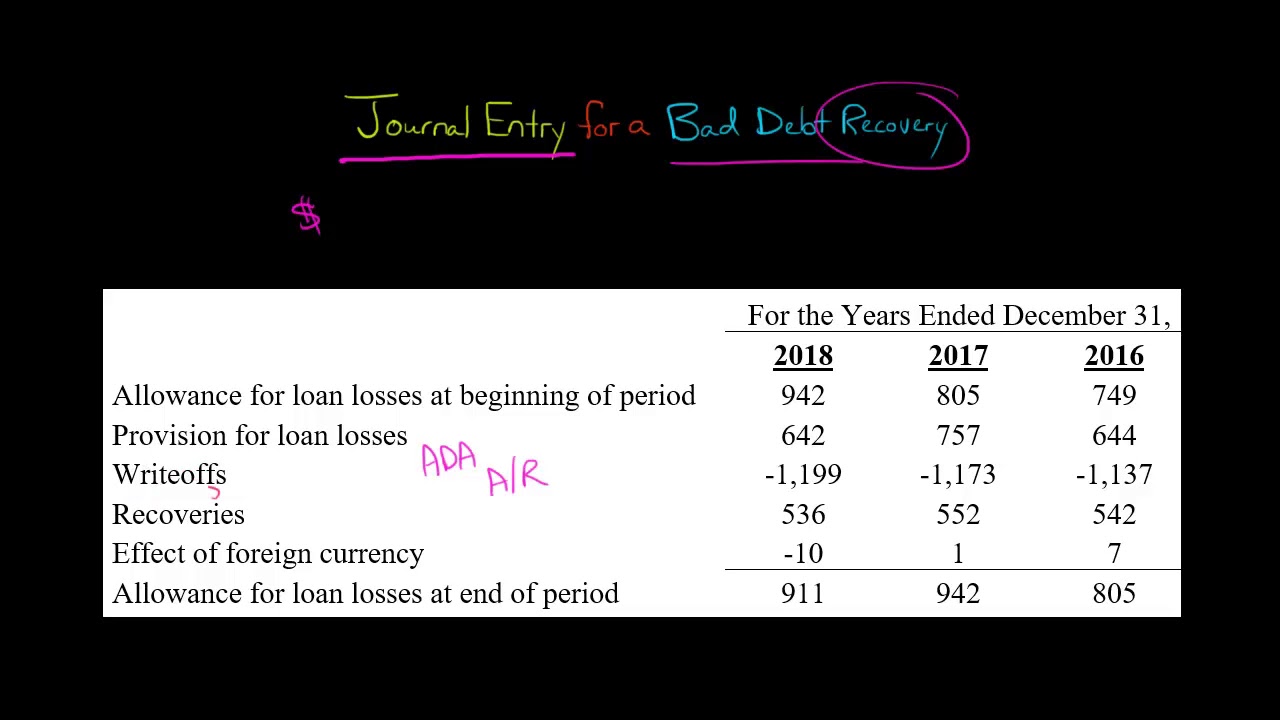

Web the process of accounting for it is called a bad debt recovery. Web last updated january 23, 2024. A debit to allowance for doubtful.

Bad Debt Recovery Allowance Method Double Entry Bookkeeping

As mentioned, under the allowance method, the company needs to restate or put back the customer’s account to. The purpose of making an allowance for.

Bad Debts Recovered Journal Entry CodyaxBray

Web how to record the bad debt expense journal entry. The purpose of making an allowance for bad debts is to try to guess the.

LEC11JOURNAL ENTRIES6 COMPOUND AND SIMPLE ENTRIESENTRIES FOR BAD

Web the process of accounting for it is called a bad debt recovery. As mentioned, under the allowance method, the company needs to restate or.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

In this accounting lesson, we explain what bad debt and bad debt recovered are. What is the double entry for recording recovery of bad debts.

Journal Entry for a Bad Debt Recovery YouTube

This site displays a prototype of a “web 2.0” version of the daily federal register. When the amount that is earlier written as bad debts,.

Bad Debt Journal Entry Bad Debt Recovered 28 Journal Entries

Web london stock exchange | london stock exchange. Web the process of accounting for it is called a bad debt recovery. Web last updated january.

Bad Debt Expense Is Debited When Accounting Methods

First of all, let's make. Web the bad debt expense journal entry is executed by debiting the bad debt expense account and crediting the allowance.

Bad Debts Recovery Concept Journal & Adjustment Letstute

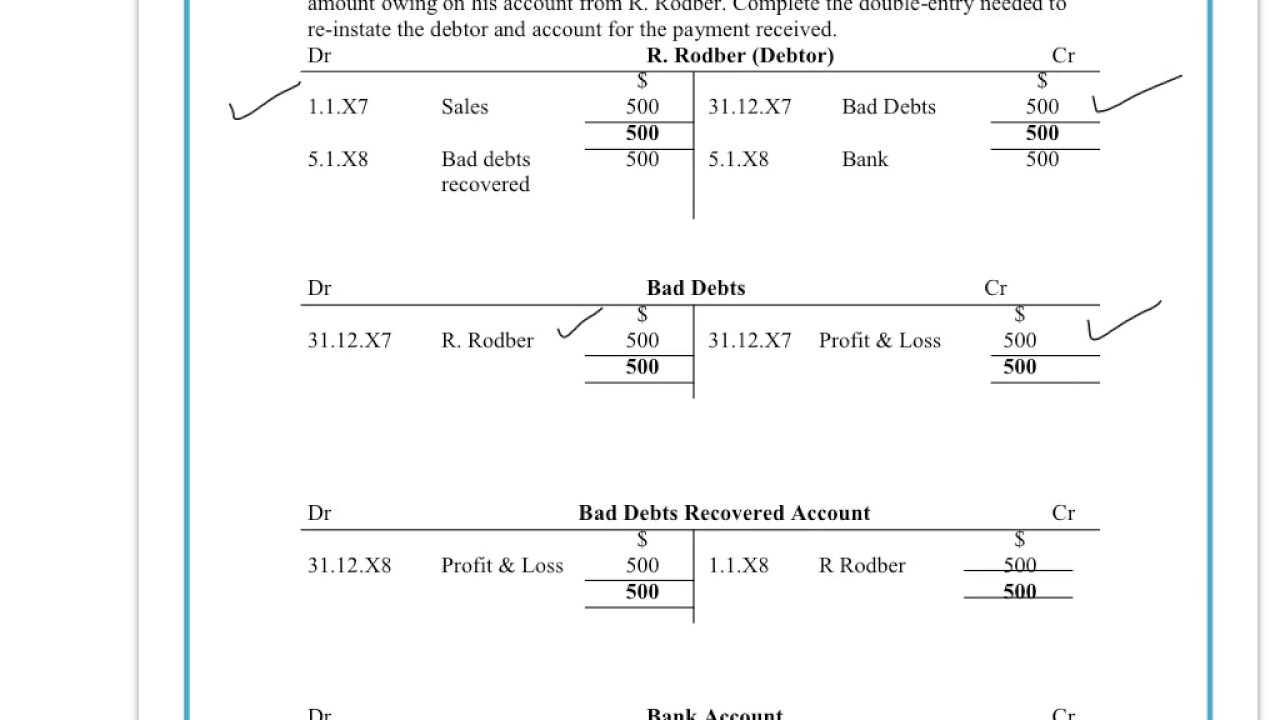

What is the double entry for recording recovery of bad debts in control accounts? ( dr.) accounts receivable $5,000 (cr.) bad debts recovered $5,000. Web.

Web The Journal Entry To Record The Bad Debt Recovered Is Debit Cash And Credit Other Income.

Web the process of accounting for it is called a bad debt recovery. Web how to record the bad debt expense journal entry. When you decide to write off an account,. A recovery is a payment received after it has been designated as uncollectible.

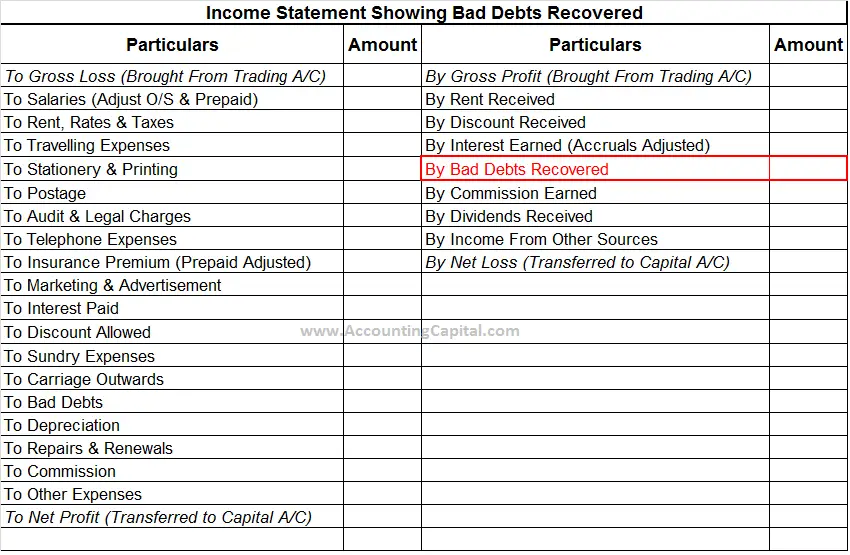

Web Bad Debts Recovered:

Web last updated january 23, 2024. Web the daily journal of the united states government. What is bad debt recovery? When the company receives the cash payment from the customer’s account that had been written off, it needs to make two journal entries for the bad debt recovery.

What Is The Bad Debt Expense Allowance Method?

How does the bad debt expense. First, the company can make the journal entry for bad debt recovery by debiting the accounts receivable and crediting the allowance for doubtful. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. Web journal entry for recovery of bad debts?

Web The Entry To Write Off A Bad Account Affects Only Balance Sheet Accounts:

What is the bad debt expense in accounting? ( dr.) accounts receivable $5,000 (cr.) bad debts recovered $5,000. A debit to allowance for doubtful accounts and a credit to accounts receivable. Web a journal entry for the recovery of uncollectible debt involves debiting cash and crediting the bad debt account.