Record Bad Debt Expense Journal Entry - Web the journal entry to record bad debts is: There are two ways in which companies may record bad debts. Web bad debt expense journal entry. Web in that case, you simply record a bad debt expense transaction in your general ledger equal to the value of the account receivable (see below for how to make a bad debt expense journal entry). Under the allowance method, the company records the journal entry for bad debt expense by debiting bad debt expense and crediting allowance for doubtful accounts. How to calculate and record the bad debt expense. Web the journal entry for the bad debt expense increases (debit) the expense’s balance, and the allowance for doubtful accounts increases (credit) the balance in the allowance. Web the correct bad debt expense journal entry depends on which method you’re using. Web journal entry for bad debts expense is as follows; Business expenses can include a range of things, like rent, payroll, and inventory.

Accounting Q and A EX 914 Entries for bad debt expense under the

The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense.

Bad Debt Expense Is Debited When Accounting Methods

Web bad debt expense journal entry. Web direct write off method. Web the bad debts expense remains at $10,000; Web in this case, the journal.

Bad Debts Recovered Journal Entry CodyaxBray

Web direct write off method. The journal entry debits bad. The journal entry debits bad debt expense and credits accounts receivable (a/r). There are two.

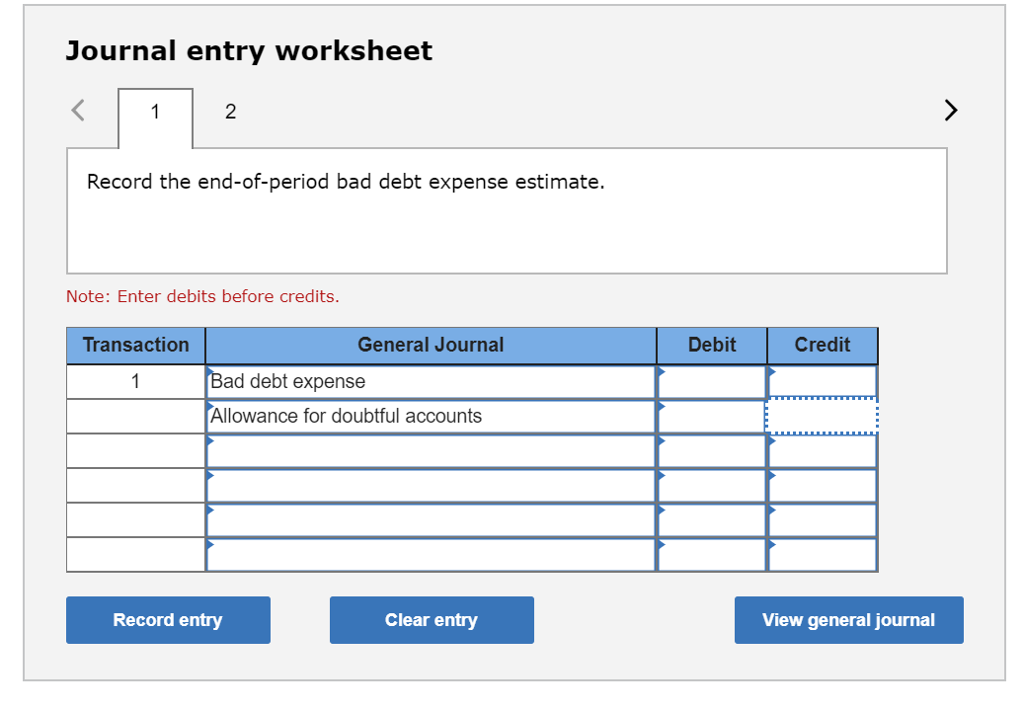

Solved Journal entry worksheet 2 Record the endofperiod

Web the journal entry for the bad debt expense increases (debit) the expense’s balance, and the allowance for doubtful accounts increases (credit) the balance in.

How to Calculate Bad Debt Expense? Get Business Strategy

The three primary components of the allowance method are as follows: The allowance for doubtful accounts is a contra asset account and is subtracted from.

How to calculate and record the bad debt expense QuickBooks

Bad debt assumption = 1.0% of revenue Based on the company’s historical data and internal discussions, management estimates that 1.0% of its revenue would be.

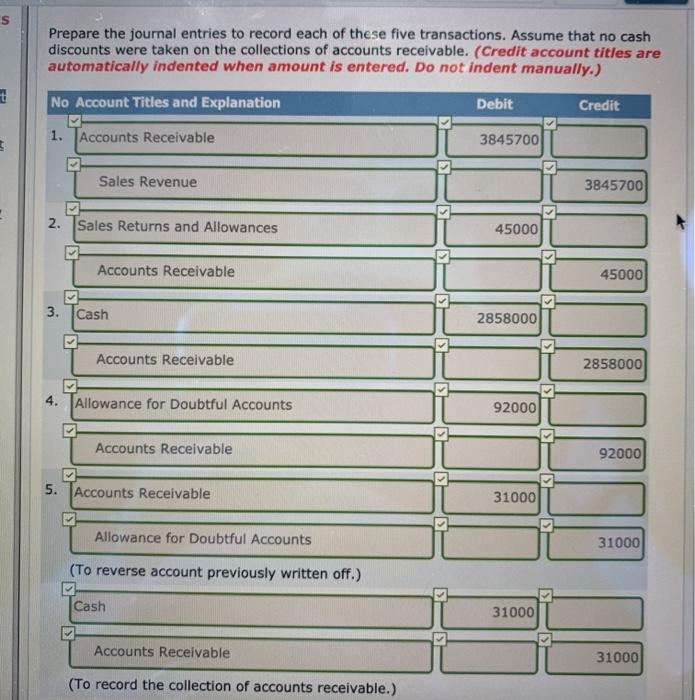

[Solved] Prepare the adjusting journal entry to record bad debt expense

Web a provision for bad debts is recorded in the accounting records as follows: When you sell a service or product, you expect your customers.

Solved Prepare the journal entry to record bad debt expense

Web journal entry for bad debts expense is as follows; Web with that said, here’s how to record a bad debt as a journal entry:.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Record the journal entry by debiting bad. Journal entry example (debit and credit) suppose a company recorded $20 million in net revenue during fiscal year.

Web In That Case, You Simply Record A Bad Debt Expense Transaction In Your General Ledger Equal To The Value Of The Account Receivable (See Below For How To Make A Bad Debt Expense Journal Entry).

The accounting records will show the following bookkeeping entries for the bad debt write off. When you sell a service or product, you expect your customers to fulfill their payment, even if it is a little past the invoice deadline. The company may be able to achieve financial accuracy by recording the debts properly in their relevant journals. Record the journal entry by debiting bad.

Dr Bad Debts Expense Cr Allowance For Bad Debts.

The bad debt journal entry is a crucial accounting process that ensures accurate financial reporting and a strong financial position for a company. Web bad debt expense journal entry. Web it means, under this method, bad debt expense does not necessarily serve as a direct loss that goes against revenues. When a company can't collect money that customers owe, it's critical to accurately record those debts on a balance sheet.

The Journal Entry Debits Bad Debt Expense And Credits Accounts Receivable (A/R).

Web updated september 30, 2022. Web journal entry for bad debts expense is as follows; In that case, the expense is direct as it affects the company’s accounts receivable directly. The journal entry debits bad.

The Allowance For Doubtful Accounts Is A Contra Asset Account And Is Subtracted From Accounts Receivable To Determine The Net Realizable Value Of The Accounts Receivable.

First of all, bad debts may relate to specific accounts or customers. Web the accounting records will show the following bookkeeping entries for the bad debt written off. It would be double counting for gem to record both an anticipated estimate of a credit loss and the actual credit loss. The three primary components of the allowance method are as follows: