Realized Gain Journal Entry - Conversely, an unrealized gain or loss is associated with a change in the fair value. If you haven't yet closed the position, your gain/loss is recognized. Fact checked by kirsten rohrs schmitt. Web to mark an investment account to market, first create an other revenue sub account, which in my case i named unrealized gain/loss. then when you need. No impact to income statement or cash flow statement. Web realized gain is the sales price of an asset in excess of the basis of an asset. Specify the date to use for realized gain and loss journal entries. Web the entry to record the sale and the realized gain is: A realized gain refers to a profit earned by selling an asset at a higher price than the original price. Web we can make the journal entry for the realized gain on sale of available for sale securities by debiting the cash account and crediting the realized gain on sale of investments.

PPT Motivations for Intercorporate Investments PowerPoint

It means that the customer has already settled the invoice prior to the close of the. Web the realized gain recorded when the securities are.

Foreign Currency Revaluation Definition, Process, and Examples

Web the journal entry is debiting security investment and credit unrealized gain. It means that the customer has already settled the invoice prior to the.

Statement From Continuing Operations Examples Warnke Baccumare

Web the entry to record the sale and the realized gain is: It means that the customer has already settled the invoice prior to the.

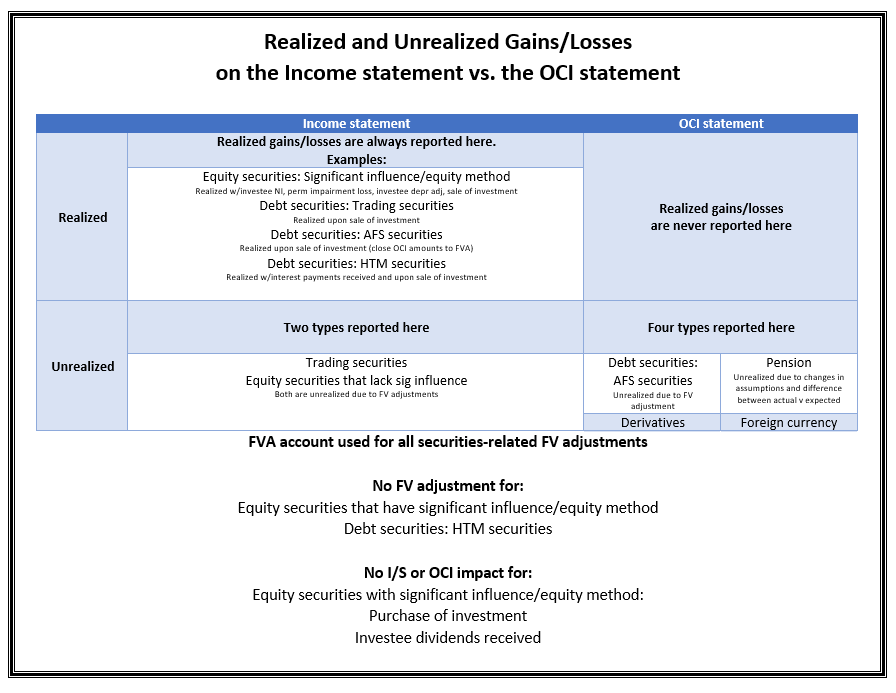

Realized and unrealized gains and losses on the statement vs OCI

Conversely, an unrealized gain or loss is associated with a change in the fair value. A realized gain refers to a profit earned by selling.

How to make journal Entry for unadjusted Forex Gain/Loss YouTube

The realized gain is taxable as the seller gets. What is a realized gain? Web a realized gain is achieved by the sale of an.

PPT Chapter 10 PowerPoint Presentation, free download ID33049

Temporary change in fair value) are recorded to other. Web the journal entry is debiting security investment and credit unrealized gain. Web the entry to.

Accounting Journal Entries for Foreign Exchange Gains and Losses YouTube

No impact to income statement or cash flow statement. The security investment will increase to reflect the current market value. Realized and unrealized gains and.

TRANSACTIONS SALES, RECEIPT AND REALIZED FX GAIN LOSS

Web at the time of sale, you will recognize the gain with reference to the last revaluation date i.e. The entry to record the sale.

realized gain and loss Step by step guide to record realized gains

Web realized gain is the sales price of an asset in excess of the basis of an asset. The security investment will increase to reflect.

The Entry To Record The Sale And The.

Web we can make the journal entry for the realized gain on sale of available for sale securities by debiting the cash account and crediting the realized gain on sale of investments. Web unrealized gains or losses refer to the increase or decrease in the paper value of the different assets of the company which have not yet been sold. Web impacts balance sheet. Web a realized gain is achieved by the sale of an investment, as is a realized loss.

After Checking The Realized Forex Gains/Losses, All You Have To Do Is To Raise A Journal Entry To.

The realized gain is taxable as the seller gets. The security investment will increase to reflect the current market value. You will need to make the. Web realized gains or losses are the gains or losses on transactions that have been completed.

Web At The Time Of Sale, You Will Recognize The Gain With Reference To The Last Revaluation Date I.e.

Web treatment on financial statements. Web realized gain is the sales price of an asset in excess of the basis of an asset. Journal entry examples from youtube video linked below. It means that the customer has already settled the invoice prior to the close of the.

A Realized Gain Refers To A Profit Earned By Selling An Asset At A Higher Price Than The Original Price.

If you haven't yet closed the position, your gain/loss is recognized. Conversely, an unrealized gain or loss is associated with a change in the fair value. An unrealized loss or gain goes on. Web using the example above, let’s walk through a sample journal entry.