Purchased Land Journal Entry - On 1 april 20x3 the company revalued the building to its fair. Cash balance increases by $20,000. Web for example, the journal entry for the purchase of land and buildings for $50,000 is a debit to land for $50,000 and a credit to cash for $50,000. Web home > bookkeeping basics > purchase transaction journal entries. Assets purchased are not represented through purchases but with the. An accounting journal entry is the written record of a business transaction in a double entry accounting system. Web a property purchase deposit journal entry records a deposit paid for a property acquisition. Web when land & building sold for cash, then the journal entry would be as follows: Sold the land to a third party for $450,000. What is the journal entry to record an asset purchase that includes both land and equipment?

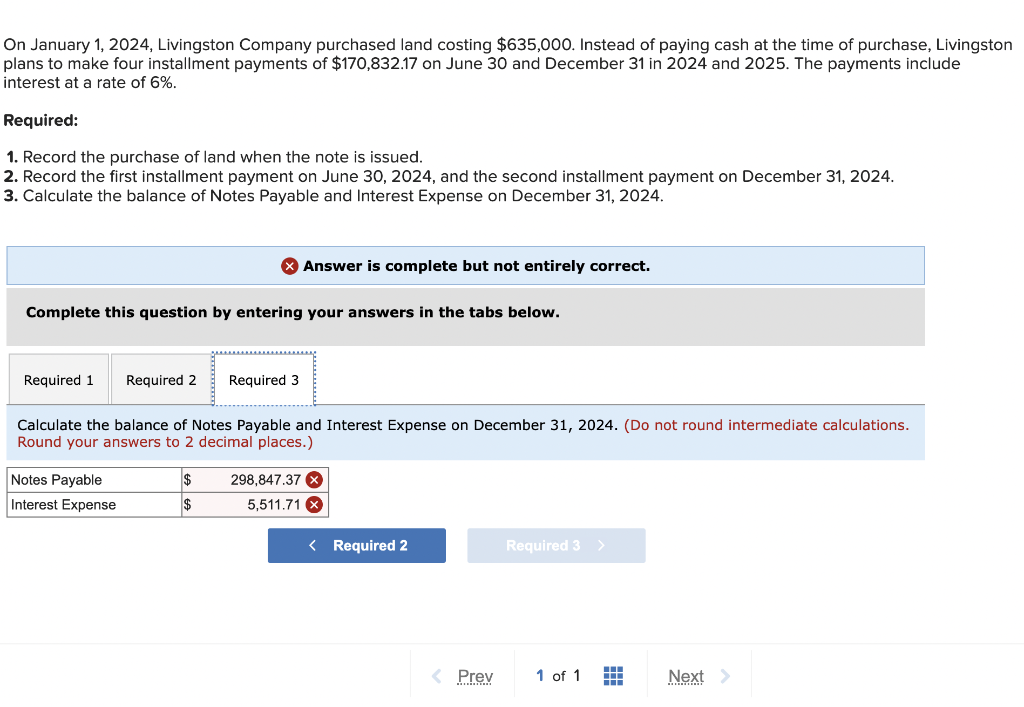

Solved On January 1,2024 , Livingston Company purchased land

On 1 april 20x3 the company revalued the building to its fair. What is the journal entry to record an asset purchase that includes both.

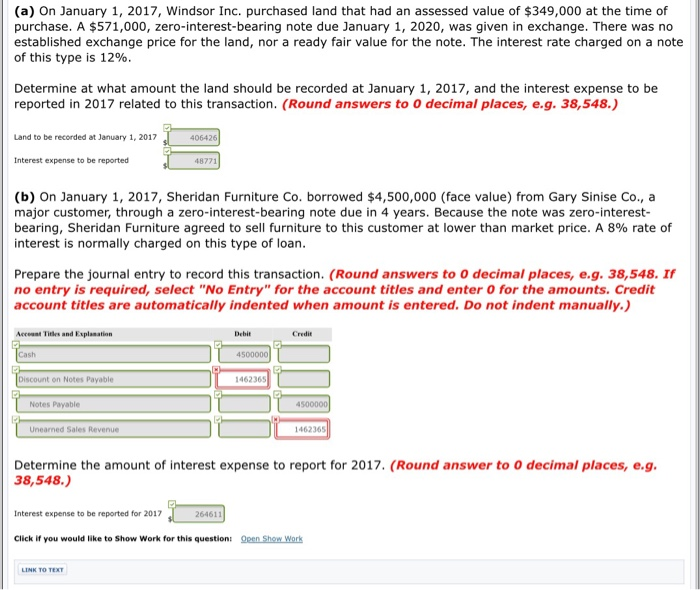

Solved (a) On January 1, 2017, Windsor Inc. purchased land

The land was revalued on december 31, 2023, and the fair value is $1.2 million. This is for a pure land purchase — no buildings,.

Journal Entry Examples

Sold the land to a third party for $450,000. Web when land & building sold for cash, then the journal entry would be as follows:.

Accounting Journal Entries For Dummies

Web for example, the journal entry for the purchase of land and buildings for $50,000 is a debit to land for $50,000 and a credit.

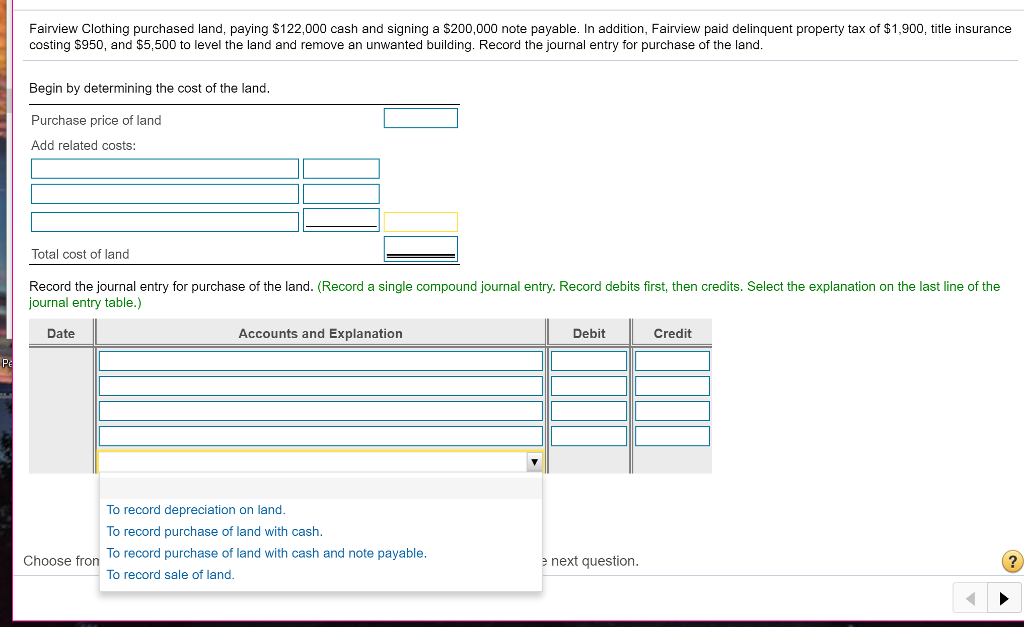

How to Record the Purchase of A Fixed Asset/Property

Web a growing city on the north carolina coast has invested in land to expand its electric operations to keep up with an influx of.

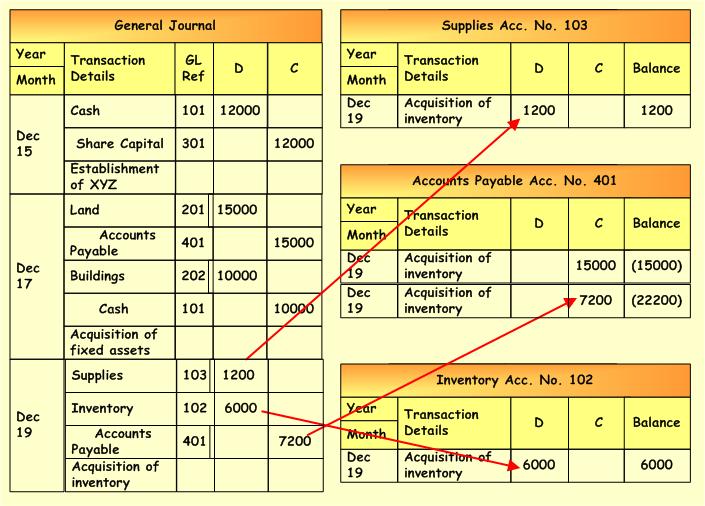

General Journal Accounting Corner

Web a company purchased a building on 1 april 20x1 for $100,000. The purchase transaction journal entries below. What is the journal entry to record.

How to use Excel for accounting and bookkeeping QuickBooks

The deposit is refundable and shown as a current asset. Web a growing city on the north carolina coast has invested in land to expand.

Journal Entry Examples

Web on january 1, 2023, a company purchased a piece of land for $1 million. Web assets (machinery, building, land, etc.) can also be purchased.

How to Journal Entry for Sale of Land in QB for a Loss A StepbyStep

Web for example, the journal entry for the purchase of land and buildings for $50,000 is a debit to land for $50,000 and a credit.

The Deposit Is Refundable And Shown As A Current Asset.

Web home > bookkeeping basics > purchase transaction journal entries. Purchased a piece of land in 2020 for $500,000. The asset had a useful life at that date of 40 years. Web example of the accounting for the sale of land.

The Company Needs To Remove Land From Balance Sheet When They Sell The Land.

An accounting journal entry is the written record of a business transaction in a double entry accounting system. This is for a pure land purchase — no buildings, fences, wells, etc (technically these must be assigned value at purchase and then depreciated). Web here’s her reply: Web journal entry for a loss on the sale of land.

The Land Was Revalued On December 31, 2023, And The Fair Value Is $1.2 Million.

(goods sold for cash) if land & building sold on. Web calculate each asset’s percent of market value. Web on january 1, 2023, a company purchased a piece of land for $1 million. Web a property purchase deposit journal entry records a deposit paid for a property acquisition.

Web What Is A General Journal Entry In Accounting?

Web land element is classified as a finance lease under ias 17 as significant risks and rewards associated with the land during the lease period would have been transferred to the. The purchase transaction journal entries below. Web a company purchased a building on 1 april 20x1 for $100,000. Web journal entry for sale of land.