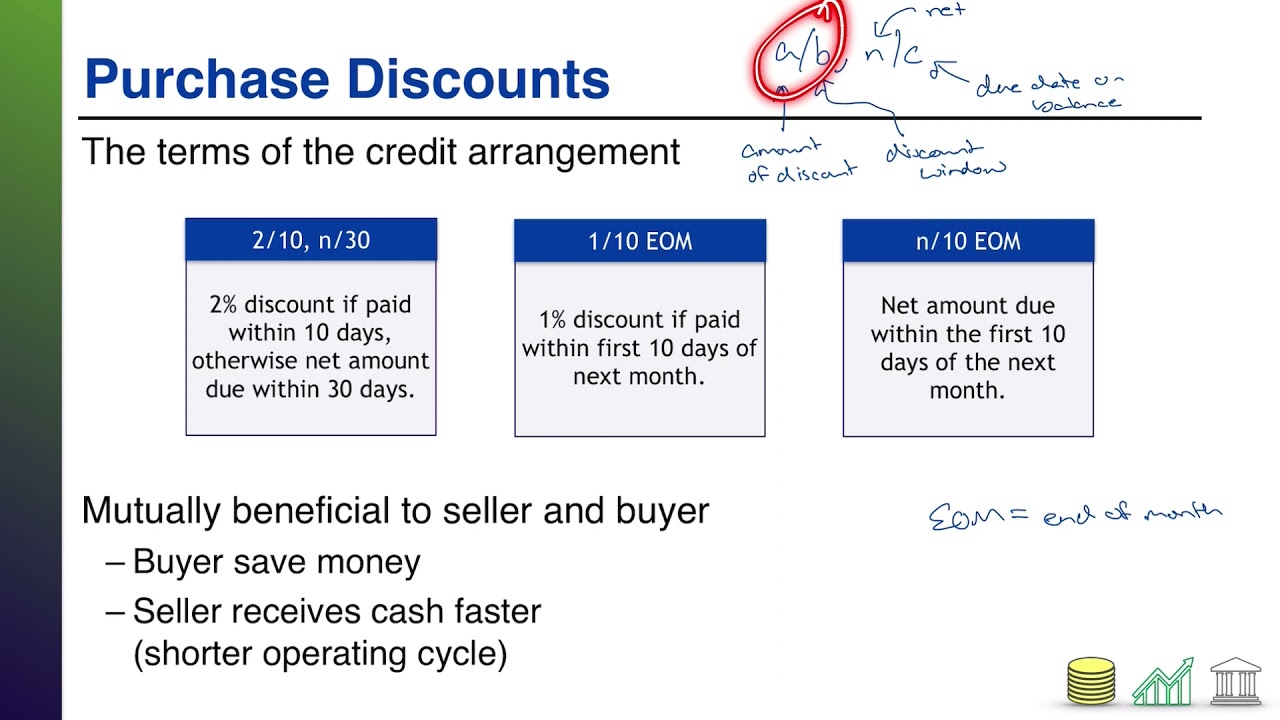

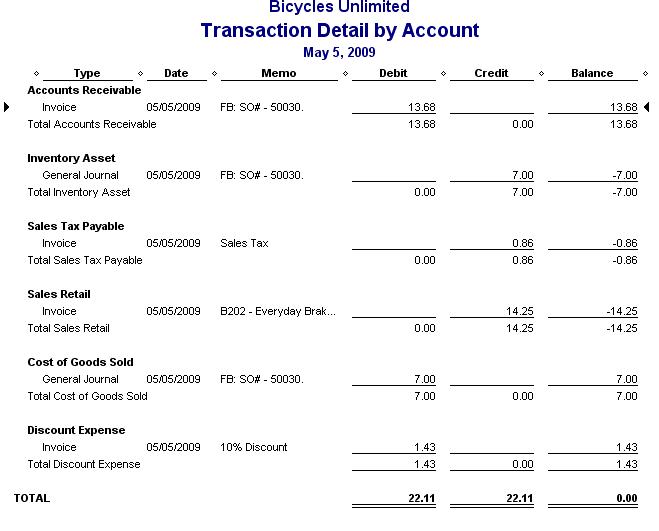

Purchase Discounts Accounting Journal Entry - Web purchase discount refers to the discount that the buyer avails of the goods to settle a particular debt earlier than the actual settlement date. Web an inventory purchase journal entry records the acquisition of goods that a business intends to sell. Web this journal entry is made when we receive the cash discount after making the cash payment for the credit purchase that we have made within the discount period that is given. Web simplifying the entry with the help of modern rules of accounting discount allowed by a seller is discount received for the buyer. When the company makes the purchase from its suppliers, it may come across the credit term that allows it to receive a discount if it makes cash payment. Web journal entry for trade discount. We explore how to recognize discounts in different situations, below. Accounting for sales discounts requires two journal entries. Examples of entries for goods purchased at a. Web in a perpetual system, the journal entry to record the payment on april 25 would include:

Perpetual Inventory Example

Examples of entries for goods purchased at a. From an accounting perspective, it can be seen that when the purchase is made (and the invoice.

Discount Received Journal Entry Cash Purchase of Goods Double Entry

Web the journal entry to account for purchase discounts is different between the net method vs the gross method. Examples of entries for goods purchased.

Purchase Discount in Accounting Double Entry Bookkeeping

This entry typically involves debiting the inventory account to increase. Web your early payment discount journal entry would be a debit to purchases of $2,940.

Discount Received Journal Entry Cash Purchase of Goods Double Entry

In the gross method, we record the purchase transaction at the. Web the journal entry is debiting cash, sales discount, and credit accounts receivable. Web.

Purchase Discounts in a Perpetual Inventory System YouTube

Examples of entries for goods purchased at a. Web discount allowed is a contra account to the sales revenue which its normal balance is on.

(Solved) Exercise 811 (Algo) Trade and purchase discounts; the gross

At the date of sale the business does not know. Web journal entry for trade discount. Web the journal entry is debiting cash, sales discount,.

Entries for Sales and Purchase in GST Accounting Entries in GST

Web sample journal entries using discounts can be found in a later post. Accounting for sales discounts requires two journal entries. Web journal entry for.

Purchases With Discount (gross)

At the date of sale the business does not know. Medici music purchased instruments to sell in its stores from whistling flutes, llc on august.

Journal Entry Problems and Solutions Format Examples MCQs

If the firm had instead. Web simplifying the entry with the help of modern rules of accounting discount allowed by a seller is discount received.

Web Simplifying The Entry With The Help Of Modern Rules Of Accounting Discount Allowed By A Seller Is Discount Received For The Buyer.

This journal entry will reduce both total assets on the balance sheet and. We explore how to recognize discounts in different situations, below. Web the journal entry to account for purchase discounts is different between the net method vs the gross method. Web journal entry for trade discount.

Medici Music Purchased Instruments To Sell In Its Stores From Whistling Flutes, Llc On August 13.

Web in a perpetual system, the journal entry to record the payment on april 25 would include: At the date of sale the business does not know. The following examples explain the use of. In the gross method, we record the purchase transaction at the.

To Run Successful Operations A Business Needs To Purchase Raw Material And Manage Its Stock Optimally Throughout Its.

Web sample journal entries using discounts can be found in a later post. It is generally recorded in the purchases or sales book, but it is not entered into ledger accounts and there is no separate journal entry. When the company makes the purchase from its suppliers, it may come across the credit term that allows it to receive a discount if it makes cash payment. If the firm had instead.

Web Discount Allowed Is A Contra Account To The Sales Revenue Which Its Normal Balance Is On The Debit Side.

This entry typically involves debiting the inventory account to increase. At the time of origination of the sales, the seller has no idea whether. Web there are two common types of discounts for companies buying goods to resell: From an accounting perspective, it can be seen that when the purchase is made (and the invoice is generated), the journal entry to record this transaction is debit.