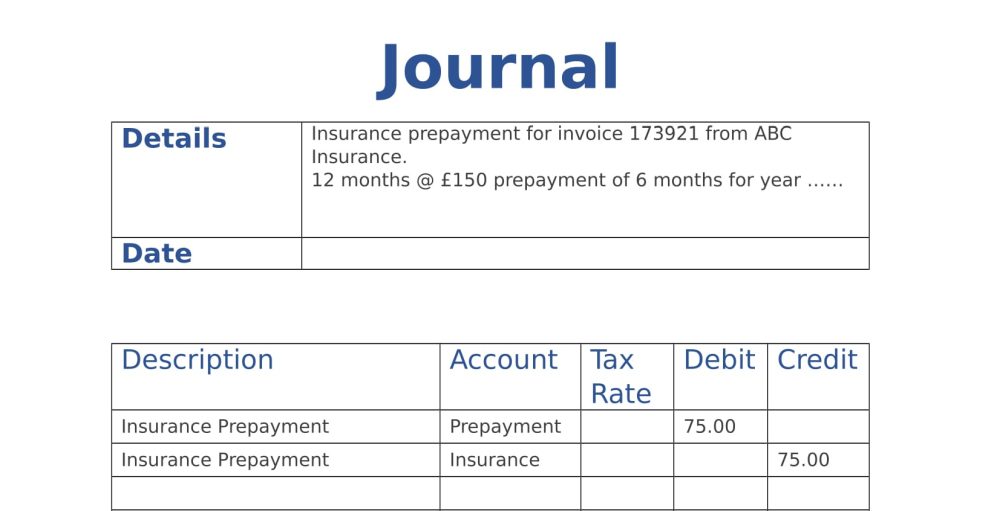

Prepayment Insurance Journal Entry - Updated on january 3, 2024. If companies use the coverage within a year after purchase, prepaid insurance is a current asset. When preparing the profit and loss account, insurance expenses will amount to. Prepayments are when a business pays for certain expenses in advance, but the benefit is received in a later. The adjusting entry for prepaid expense depends upon the journal entry made when it was. The above journal entry would have two effects: Adjusting journal entry as the prepaid rent expires: Example of payment for insurance. The insurance expense account is reduced from 5,400 to the expense for the year of 3,600,. Web following accounting entry is required to account for the prepaid expense:

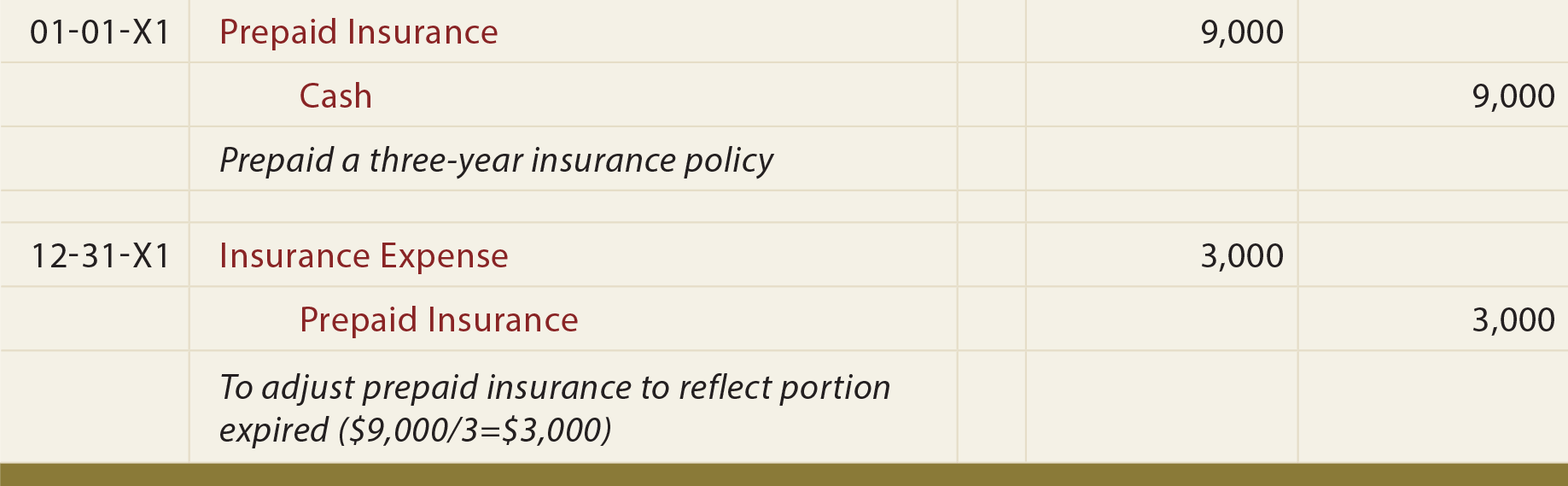

Insurance Expired During the Year Adjusting Entry

Updated on january 3, 2024. Web the journal entries for prepaid rent are as follows: The prepayments made for any expense is a business activity,.

Prepaid Salary Journal Entry

The damage/exp is offset with the. Prepayments are when a business pays for certain expenses in advance, but the benefit is received in a later..

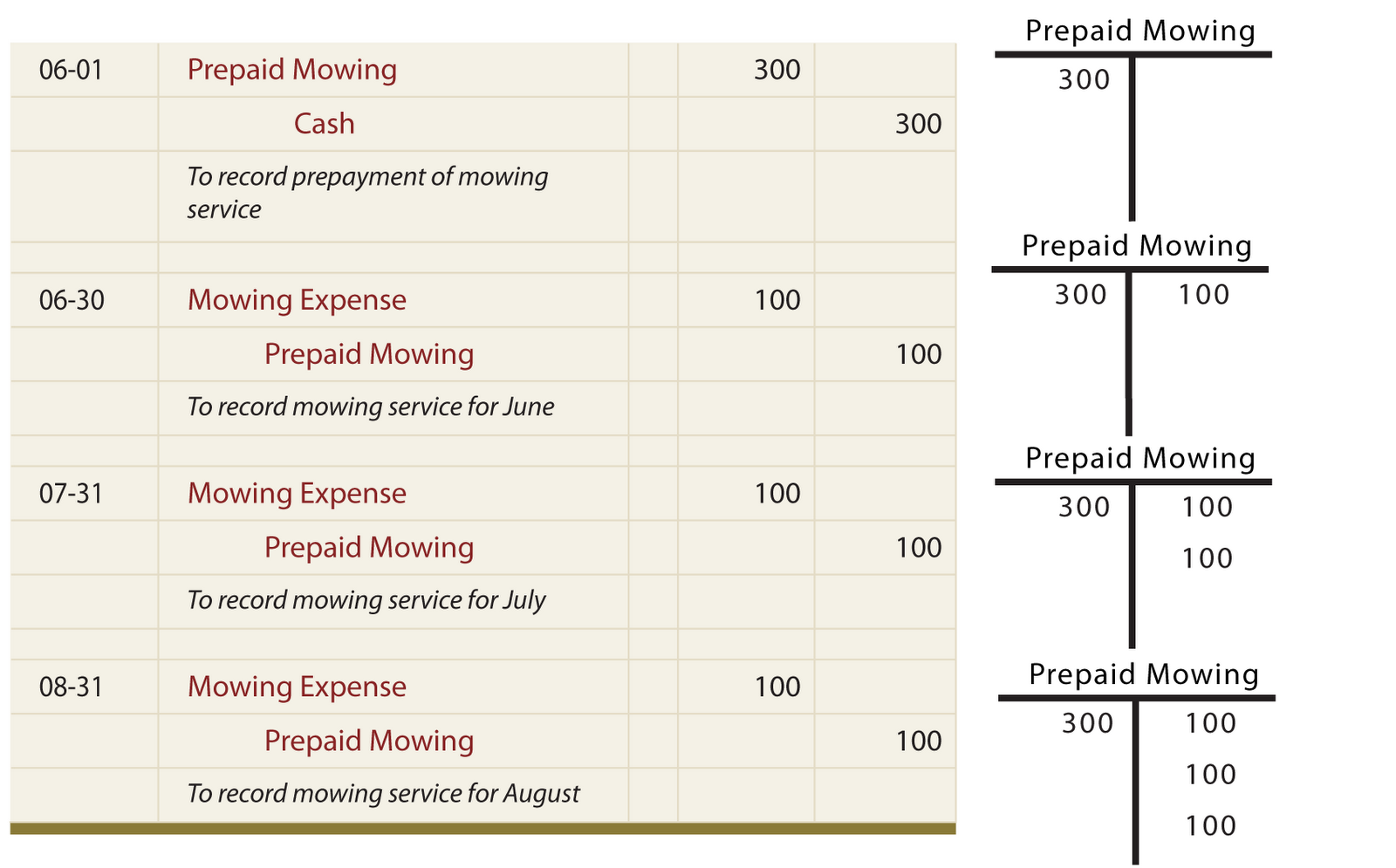

The Adjusting Process And Related Entries laacib

Michael cohen's invoice dated feb. In this case, the company. The damage/exp is offset with the. A prepayment transaction is recorded initially by debiting an.

Accruals and Prepayments Journal Entries HeathldDunn

What are prepayments in accounting. Prepaid expenses are costs that have been paid in advance for goods or services that will be received in the.

Journal Entry For Prepaid Expenses

John's case, the journal entry would show: Web prepaid expenses may need to be adjusted at the end of the accounting period. Web one objective.

Prepaid Insurance Journal Entry Financial

The above journal entry would have two effects: In this case, the company. Prepaid expense a/c and expense a/c. Web accounting for prepayments involves the.

Journal Entry for Prepaid Insurance YouTube

Learn how to account for them and create a prepaid expenses journal entry! What are prepayments in accounting. Web a basic insurance journal entry is.

What is prepaid expenses Example Journal Entry

Web prepaid insurance journal entry. Prepaid expense a/c and expense a/c. Initial journal entry for prepaid rent: If companies use the coverage within a year.

Journal Entry for Prepaid Insurance Online Accounting

The insurance expense account is reduced from 5,400 to the expense for the year of 3,600,. When preparing the profit and loss account, insurance expenses.

Example Of Payment For Insurance.

The damage/exp is offset with the. Edited by ashish kumar srivastav. Prepaid expense a/c and expense a/c. Web in this journal entry, the $500 (6,000 / 12) of insurance expense is the expired cost of insurance in january 2021.

Learn How To Account For Them And Create A Prepaid Expenses Journal Entry!

Journal entry to record the payment. When preparing the profit and loss account, insurance expenses will amount to. The adjusting entry for prepaid expense depends upon the journal entry made when it was. Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions:

Web When The Asset Is Charged To Expense, The Journal Entry Is To Debit The Insurance Expense Account And Credit The Prepaid Insurance Account.

Web in each successive month for the next twelve months, there should be a journal entry that debits the insurance expense account and credits the prepaid expenses (asset). Web one objective of the adjusting entry is to match the proper amount of insurance expense to the period indicated on the income statement. John's case, the journal entry would show: The insurance expense account is reduced from 5,400 to the expense for the year of 3,600,.

If Companies Use The Coverage Within A Year After Purchase, Prepaid Insurance Is A Current Asset.

Web our journal entry to record the prepaid rent expense is: Web how to book prepaid expense amortization journal entry. Initial journal entry for prepaid rent: The company can record the prepaid insurance with the.