Prepayment Expense Journal Entry - Web learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Web prepayments are when a business pays for certain expenses in advance, but the benefit is received in a later period. An excellent example of a prepayment is insurance. Below are examples of journal entries under two different methods of recording prepaid expenses using the following information: Web a prepaid expense is a payment made in advance for goods or services that will be received in the future. These payments are recorded as assets on the balance sheet until they are used or consumed, at which point they become expenses on. Web guide to journal entry for prepaid expenses. The basic principle behind accrual accounting is to record revenues and expenses regardless of payment. Web prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future. Web prepaid expenses in balance sheet:

What is prepaid expenses Example Journal Entry

Web learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Prepaid.

Journal Entry For Prepaid Expenses

Web guide to journal entry for prepaid expenses. Here we discuss how to record prepaid expense on the balance sheet along with detailed explanations. Within.

Journal Entry for Prepaid Expenses

Web learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. Recall.

Accruals and Prepayments Journal Entries HeathldDunn

Suppose company a paid 6 months upfront for office rent worth $12,000. Brett johnson, avp, global enablement. Here we discuss how to record prepaid expense.

Prepaid Expenses Entry Calculation In Excel Printable Templates

A prepayment is related to unearned income in a sense that one company’s prepayment is. Though salaries of $70,000 were paid on 4 july 2014,.

Journal Entry for Prepaid Insurance Better This World

Web the initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. The basic principle behind accrual accounting.

Journal Entry For Prepaid Expenses

Web learn what prepaid expenses are, how to classify them as an asset or expense on your financial statements, and examples of prepaid expenses. The.

Prepaid Expense Explained With Journal Entry and Adjusting Entry

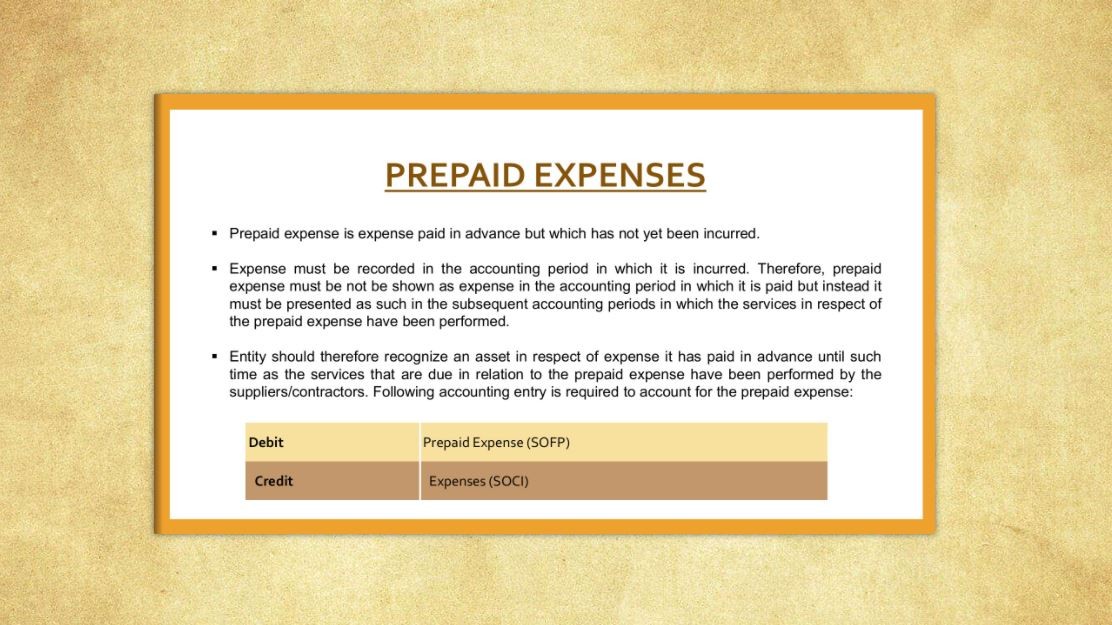

Web prepayments (also known as deferred expense) are assets that represents cash paid in advance for goods or services to be received later. These are.

Journal Entry For Prepaid Expenses

Web prepayments (also known as deferred expense) are assets that represents cash paid in advance for goods or services to be received later. The company.

The Journal Entry In Month 1 For This Would Be Prepaid Rent Increasing By $12,000 As A Debit, And Cash Decreasing By $12,000 As A Credit.

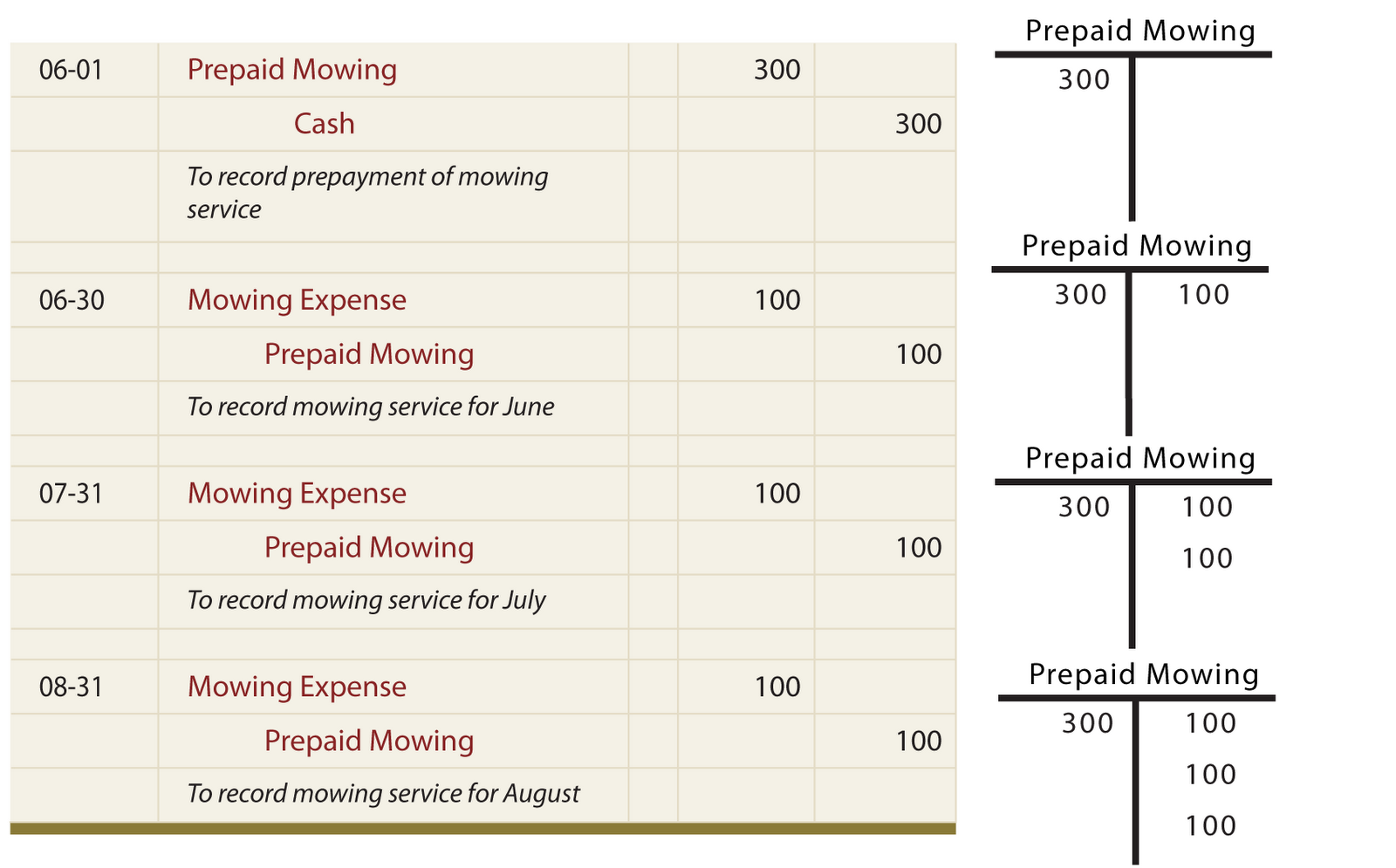

By adjusting the accounts, it ensures that the figures are correct for the financial period. There are two ways of recording prepayments: Learn how to account for them and create a prepaid expenses journal entry! Within a financial year, each time a portion of the expense is paid off, the prepaid account is.

Web For Example, Let’s Say A Journal Entry Is Recorded As Amount X Paid For Abc Prepaid Expense;

The adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Following accrual and prepayment adjustments are required for 2014. $10,000 is paid for an annual insurance policy on october 1. Web when the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account.

Web Prepaid Expenses In Balance Sheet:

Web prepaid expense journal entry example shows how to record a prepaid expense if a business pays rent quarterly in advance of 15,000. Web prepaid expense journal entries. Web the initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Web prepaid expense (also called prepayment) is an asset which arises when a business pays an expense in advance.

Brett Johnson, Avp, Global Enablement.

Web prepayments (also known as deferred expense) are assets that represents cash paid in advance for goods or services to be received later. Web guide to journal entry for prepaid expenses. Here we discuss how to record prepaid expense on the balance sheet along with detailed explanations. These are both asset accounts and do not increase or decrease a company’s balance sheet.