Prepare The General Journal Entry To Correct The Cash Account - Web the adjusting entries for a given accounting period are entered in the general journal and posted to the appropriate ledger accounts (note: Web when your petty cash cashier puts money into the petty cash fund, they must create a journal entry in your books. Web prepare the general journal entry to correct the cash account. At the close of an accounting period, adjusting entries rectify errors and. Checked for updates, april 2022. Web prepare the general journal entry to correct the cash account. Web entries to the petty cash fund itself are fairly rare. The entry must show an increase in your petty. Web make an adjustment so that the ending amount in the balance sheet account is correct. Web petty cash accounts are managed through a series of journal entries.

General Journal in Accounting Double Entry Bookkeeping

Web for purposes of this lesson, we’ll prepare journal entries. The entry must show an increase in your petty. Web when your petty cash cashier.

General Journal Entries Examples

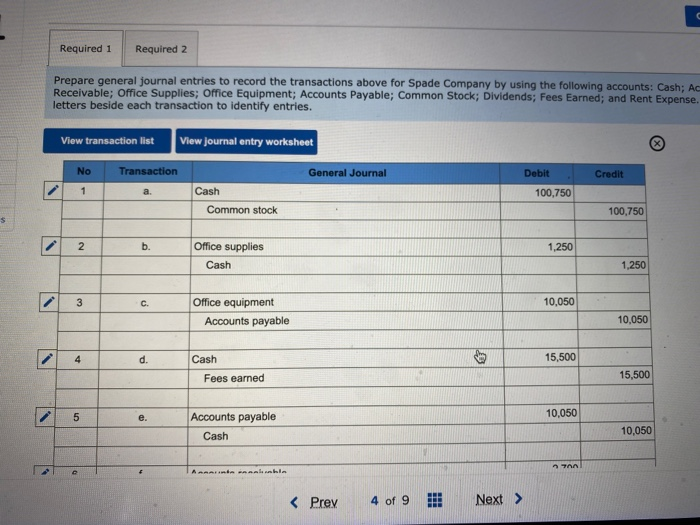

If we added an item in the bank reconciliation, we will debit the checking account (because a debit increases an asset. Web for purposes of.

Journal Entry Problems and Solutions Format Examples MCQs

Web for purposes of this lesson, we’ll prepare journal entries. (if no entry is required, select no entry for the account titles and enter 0.

Journal Entries Accounting

As always, recording begins with an analysis of the. Web the following are selected journal entries from printing plus that affect the cash account. With.

Accounting Journal Entries For Dummies

Web prepare the general journal entry to correct the cash account. Entries are needed to (1) establish the fund, (2) increase or decrease the balance.

Solved Bank Reconciliation? Journal Entries Prepare The

Web the adjusting entries for a given accounting period are entered in the general journal and posted to the appropriate ledger accounts (note: A correcting.

How to use Excel for accounting and bookkeeping QuickBooks

A correcting entry is a journal entry whose purpose is to rectify the effect of an incorrect. Checked for updates, april 2022. Each one of.

General Ledger A Complete and Simple Guide

With your knowledge of accounts, debits and credits, and t accounts, you should be able to figure out any entries that crop up. (if no.

Adjusting Journal Entries Defined Accounting Play

Web prepare the general journal entry to correct the cash account. Checked for updates, april 2022. (if no entry is required, select no entry for.

(If No Entry Is Required, Select No Entry For The Account Titles And Enter 0 For The Amounts.

Web when your petty cash cashier puts money into the petty cash fund, they must create a journal entry in your books. Web prepare the general journal entry to correct the cash account. Brett johnson, avp, global enablement. With your knowledge of accounts, debits and credits, and t accounts, you should be able to figure out any entries that crop up.

Web The Company Prepares A Bank Reconciliation To Determine Its Actual Cash Balance And Prepare Any Entries To Correct The Cash Balance In The Ledger.

Web the adjusting entries for a given accounting period are entered in the general journal and posted to the appropriate ledger accounts (note: If we added an item in the bank reconciliation, we will debit the checking account (because a debit increases an asset. Web the following are selected journal entries from printing plus that affect the cash account. These are the same ledger accounts.

A Correcting Entry Is A Journal Entry Whose Purpose Is To Rectify The Effect Of An Incorrect.

Web petty cash accounts are managed through a series of journal entries. Web prepare the general journal entry to correct the cash account. (if no entry is required, select no entry for the account titles and enter 0 for the amounts. Each one of these entries adjusts income or expenses to.

Web For Purposes Of This Lesson, We’ll Prepare Journal Entries.

Enter the same adjustment amount into the related income statement account. Web what journal entry is prepared by a company’s accountant to reflect the inflow of cash received from a loan? (if no entry is required, select no entry for the account titles and enter 0 for the amounts. Entries are needed to (1) establish the fund, (2) increase or decrease the balance of the fund (replenish the.