Prepare Closing Journal Entries On December 31 - Web prepare the adjusting entry at december 31. Prepare the necessary closing entries on december 31, current year. 5.3 apply the results from the adjusted trial balance to compute current. Web you are preparing a trial balance after the closing entries are complete. From this information, the company will begin constructing each of. If the firm's retained earnings account had a $99,000 balance on january 1, current year,. Web 5.1 describe and prepare closing entries for a business; If no entry is required for a transaction/event, select no journal entry required in the first account field. Web using the adjusted balances, prepare the closing journal entry for the year ended in december 31. Prepare the closing entries for the year ended december 31.

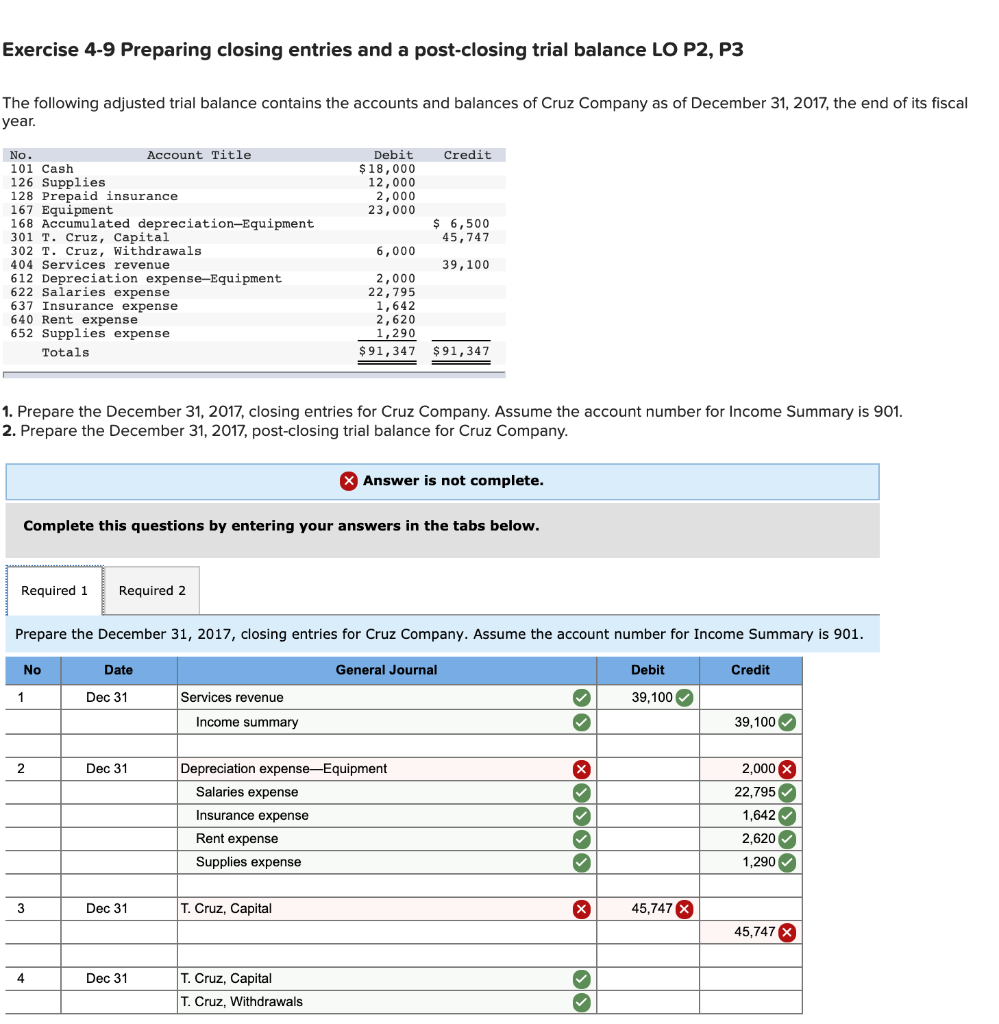

Solved Exercise 49 Preparing closing entries and a

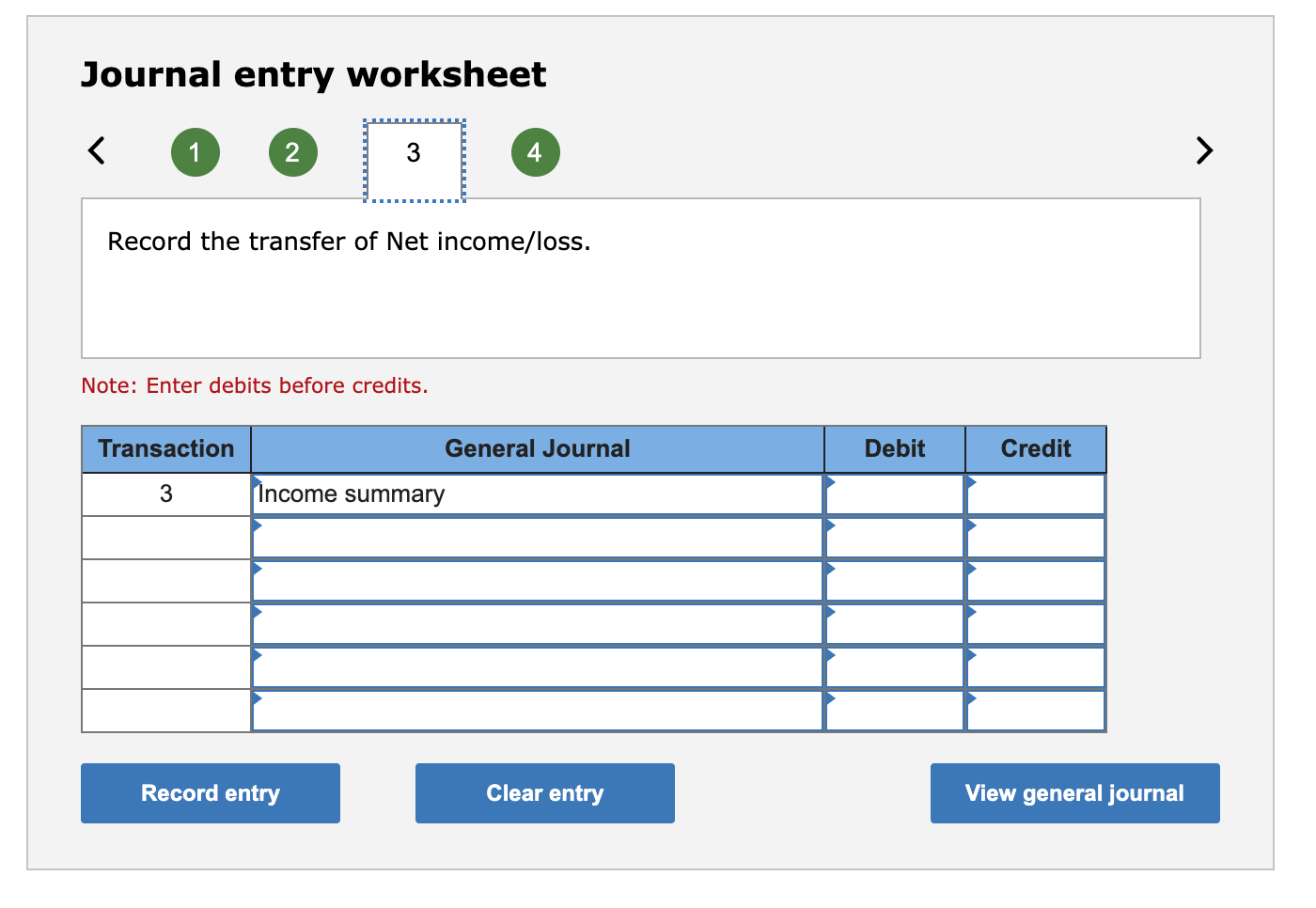

If no entry is required for a transaction/event, select no journal entry required in the first account field. We see from the adjusted trial. One.

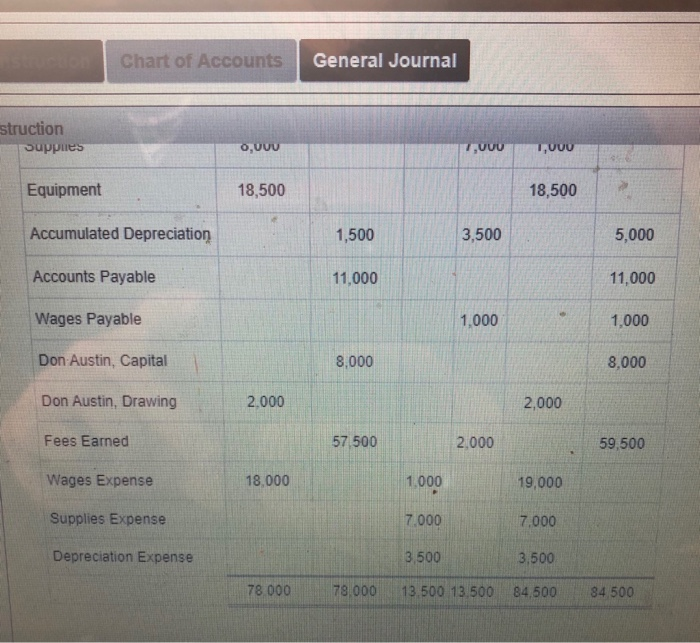

Solved a. Prepare the necessary closing entries on December

Web let’s go through these closing entries step by step. The adjusting journal entry for wages payable is: You are not required to prepare the.

Solved Prepare closing entries on December 31 using the

The adjusting journal entry for wages payable is: Web prepare the adjusting entry at december 31. In accounting, we often refer to the process of.

Journalizing Closing Entries Describe And Prepare Closing Entries For

5.3 apply the results from the adjusted trial balance to compute current. Web prepare the necessary closing entries on december 31, 2024. 5.3 apply the.

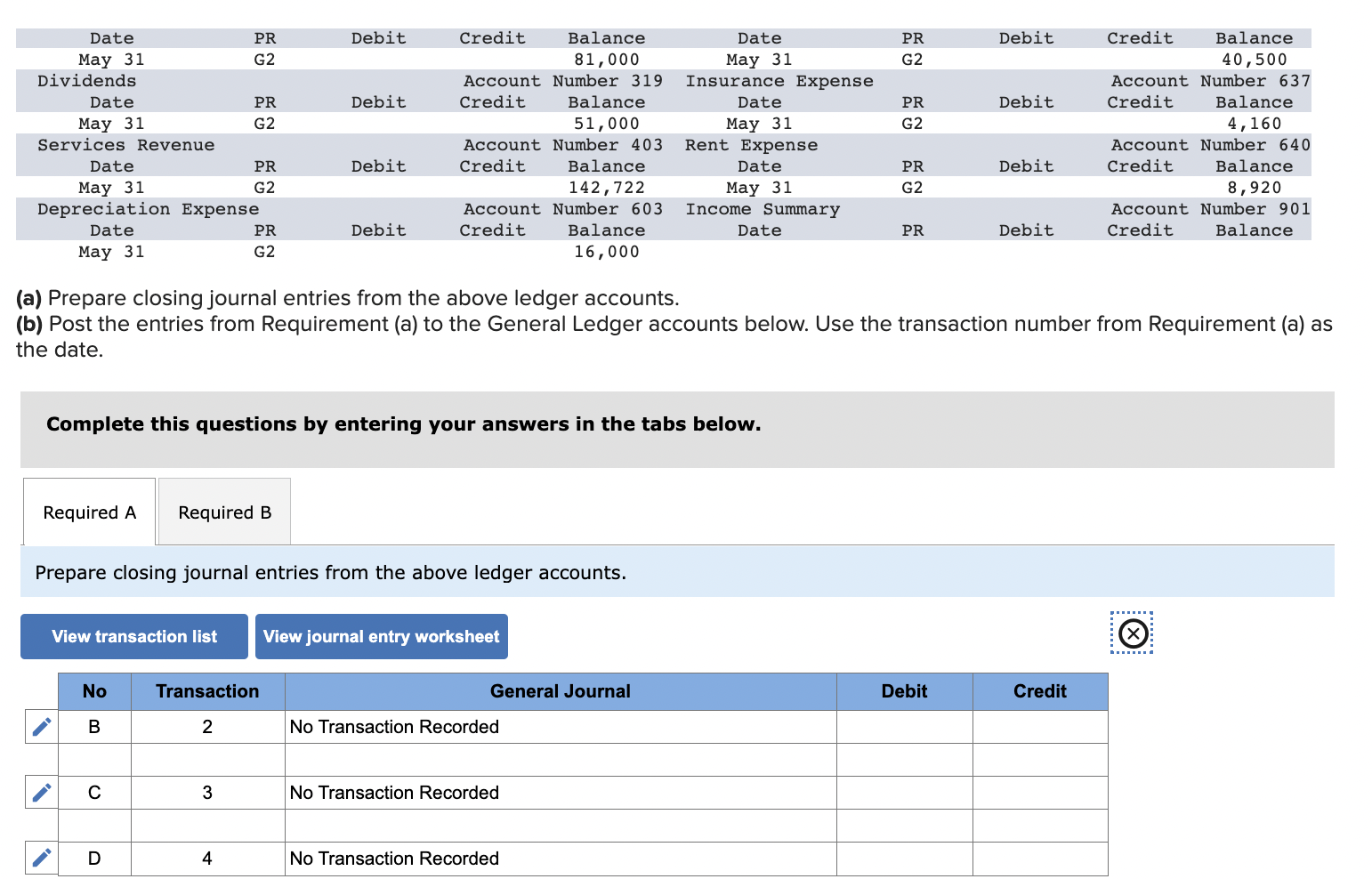

Solved (a) Prepare closing journal entries from the above

Open ledger accounts for each of the accounts involved, enter the balances as shown in the trial balance, post. Web prepare the adjusting entry at.

10) Prepare general journal entries on December 31 to record the

Open ledger accounts for each of the accounts involved, enter the balances as shown in the trial balance, post. 5.3 apply the results from the.

Peerless Closing Entry For Net Loss Gold Fields Financial Statements

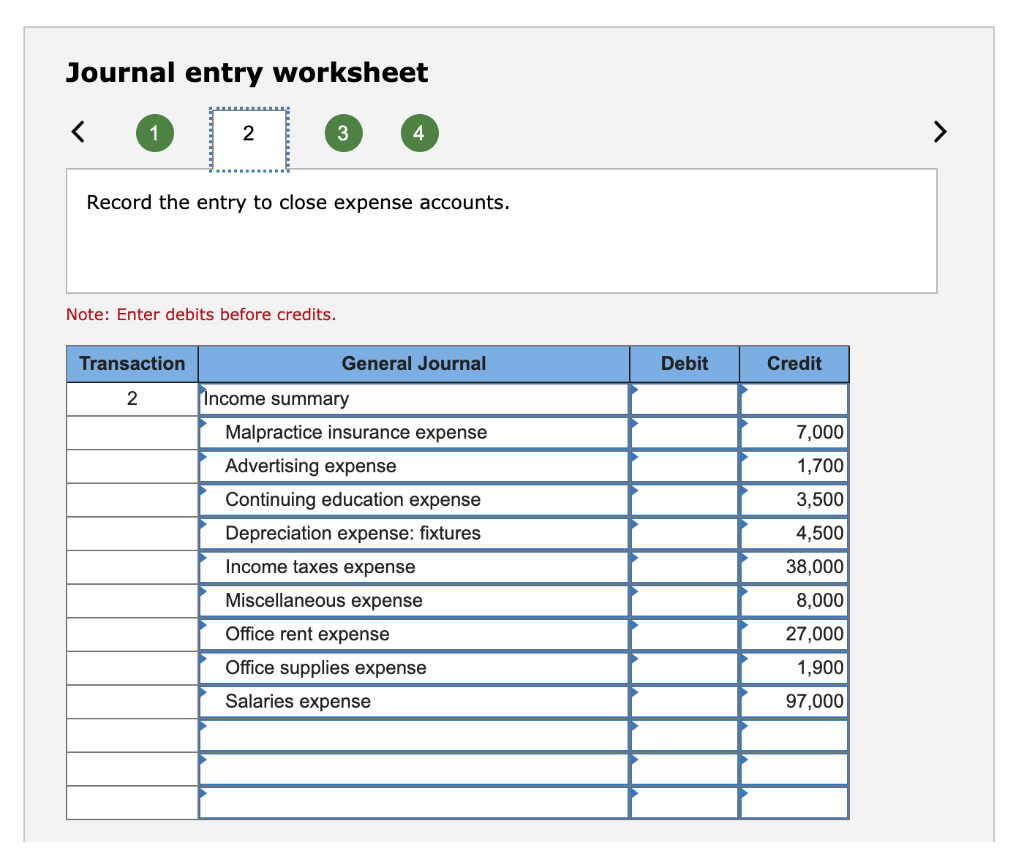

The account number for income summary is 901. If no entry is required for a transaction/event, select no journal entry required in the first account.

Solved a. Prepare the necessary closing entries on December

Web you are preparing a trial balance after the closing entries are complete. One month of the prepaid insurance has expired. Web to prepare the.

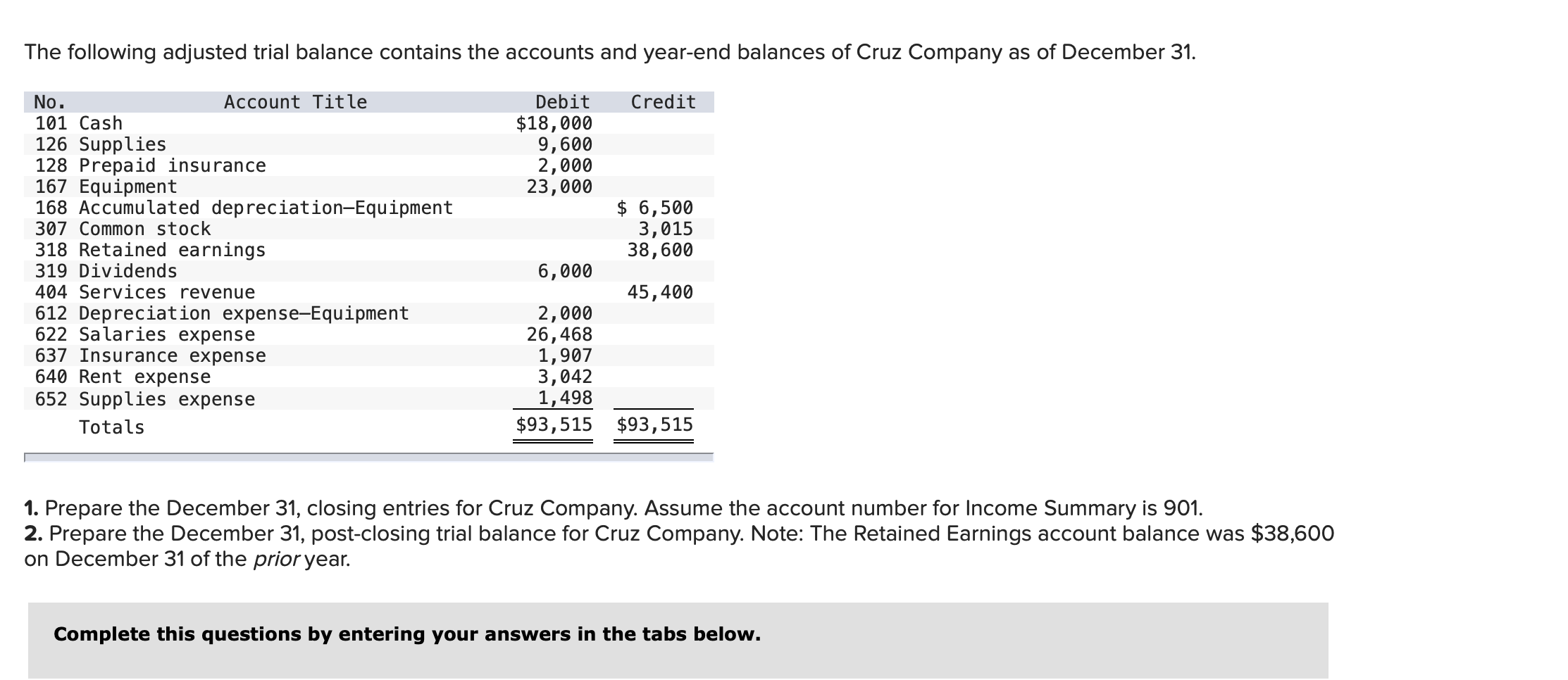

Solved Prepare the December 31, closing entries for Cruz

5.3 apply the results from the adjusted trial balance to compute current. Web prepare the december 31 closing entries. 5.3 apply the results from the.

Web 5.1 Describe And Prepare Closing Entries For A Business;

Web let’s go through these closing entries step by step. 5.3 apply the results from the adjusted trial balance to compute current. Web to prepare the financial statements, a company will look at the adjusted trial balance for account information. From this information, the company will begin constructing each of.

Web Using The Adjusted Balances, Prepare The Closing Journal Entry For The Year Ended In December 31.

We see from the adjusted trial. Web at december 31, the following information is made available for the preparation of adjusting entries. The retained earnings account balance was $140,000 at dec the prior year. The account number for income summary is 901.

In Our Detailed Accounting Cycle, We Just Finished Step 5 Preparing.

Web the following video summarizes how to prepare closing entries. Web prepare general journal entries on 31 december 2021 for additional information numbers 1, 2, 3, 4 and 5. 5.3 apply the results from the adjusted trial balance to compute current. You are not required to prepare the closing transfers for the write down.

Web Prepare The Necessary Closing Entries On December 31, 2024.

Prepare the necessary closing entries on december 31, current year. Web 5.1 describe and prepare closing entries for a business; To close an account means to make the balance zero. Web prepare the adjusting entry at december 31.