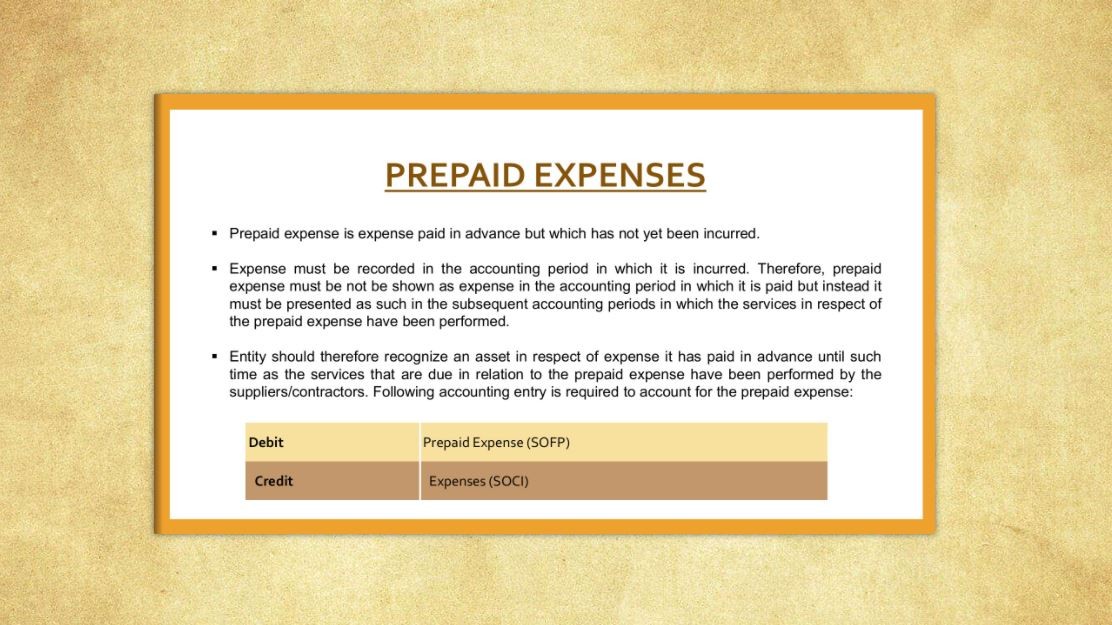

Prepaid Expenses Journal Entries - Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Automate prepaid expenses with accounting software. On december 1, 20×1, entity a purchased a new. As the related expense is incurred, prepaid expense is written off. Web a prepaid expenses journal entry is a vital accounting record that acknowledges an expense paid in advance. Web unveiling the accounting magic: Understanding the journal entry mechanics behind prepaid expenses empowers you to accurately record and. Web prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future. As a financial consultant or business owner, it is. Web journal entries for prepaid expenses.

What is Prepaid expense Example Journal Entry Tutor's Tips

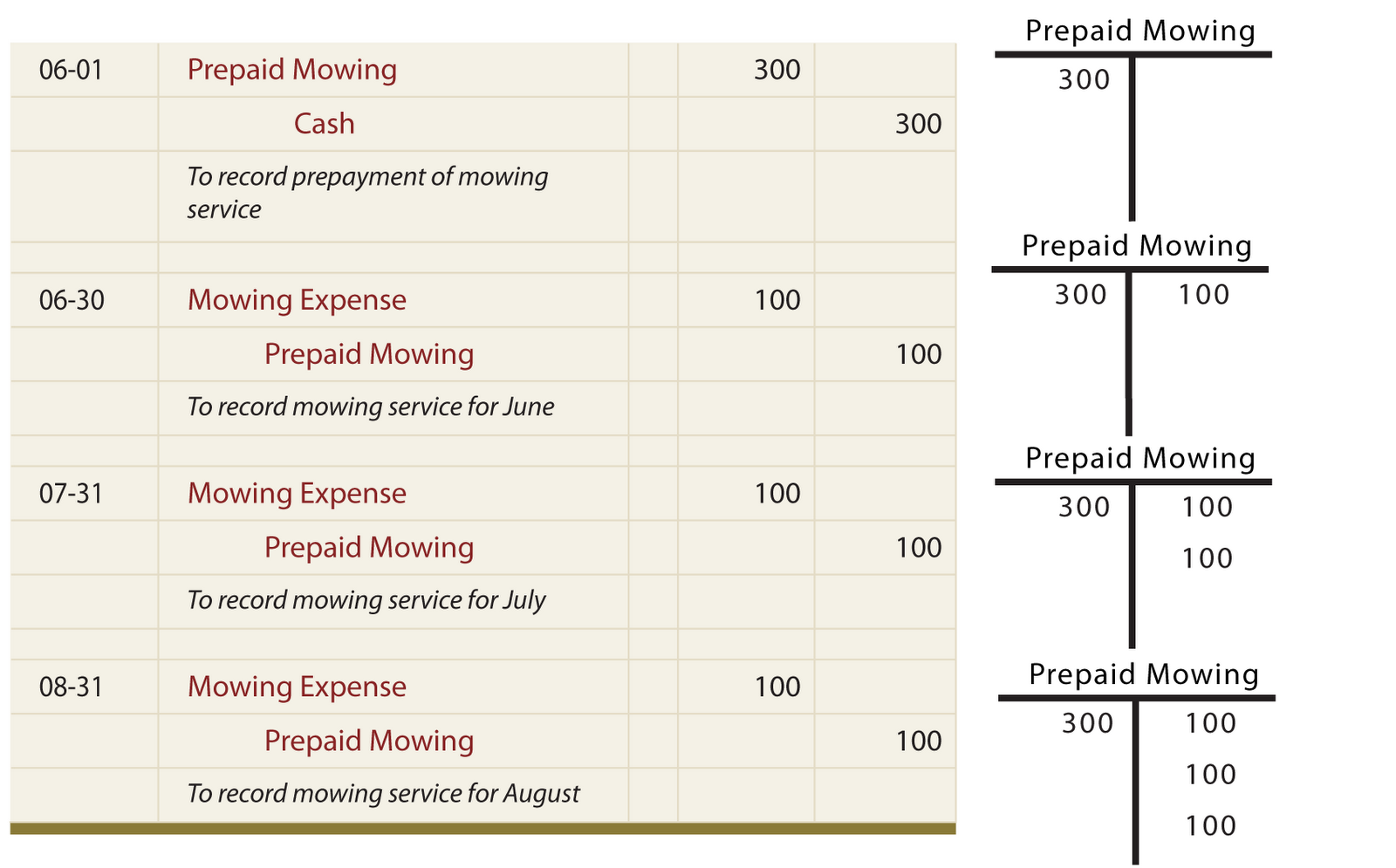

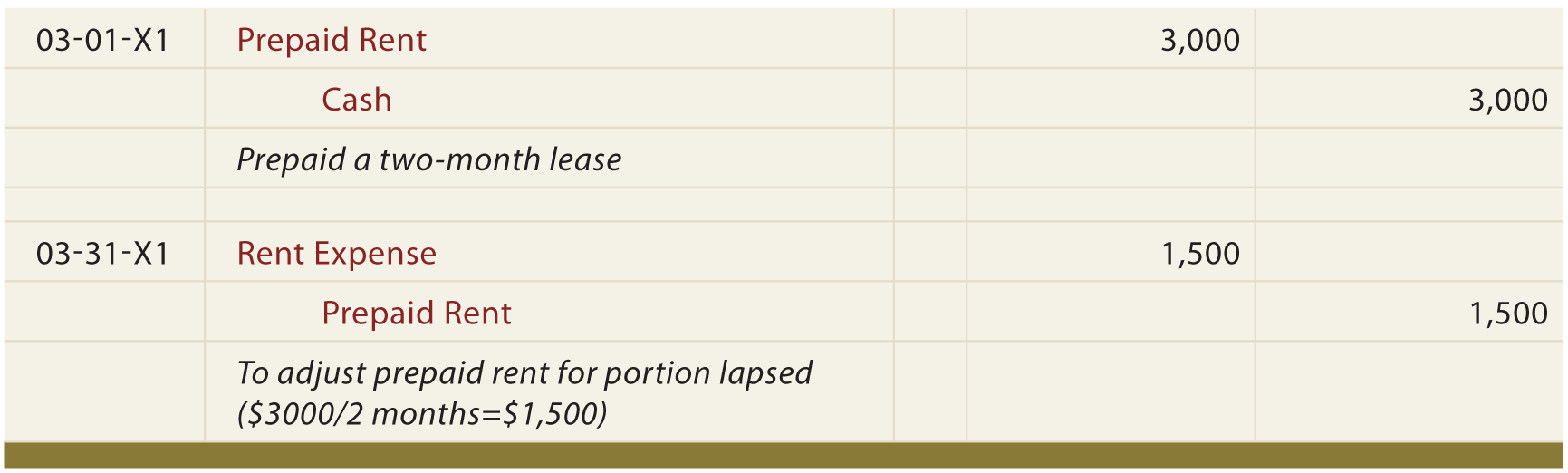

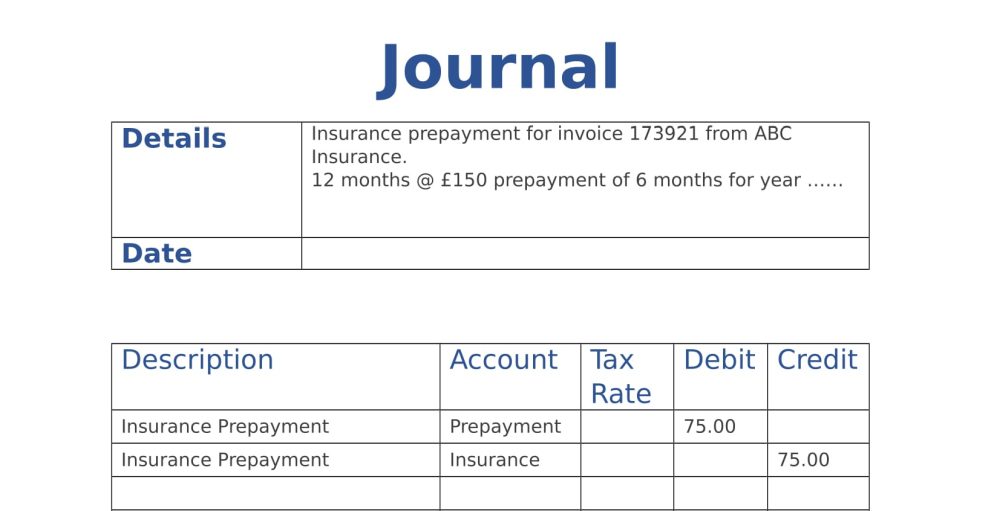

Also known as deferred expenses, recording these expenses is part of the accrual. The two most common uses of prepaid expenses are rent and insurance..

Journal Entry For Prepaid Expenses

This entry plays a crucial role in maintaining. Web journal entries for prepaid expenses. Web a prepaid expenses journal entry is a vital accounting record.

Journal Entry For Prepaid Expenses

As the related expense is incurred, prepaid expense is written off. (proforma invoice being received and. There are two ways of recording prepayments: Web prepaid.

Journal Entry For Prepaid Expenses

They do not record new business. Below is the journal entry for prepaid expenses; This entry plays a crucial role in maintaining. Web once the.

Self Study Notes The Adjusting Process And Related Entries

(proforma invoice being received and. When a payment is made for a future expense, the following journal entry is made: Web prepaid expenses refer to.

Prepaid Expenses Journal Entry Meaning, Examples

A guide to prepaid expense accounting. This entry plays a crucial role in maintaining. Web journal entries for prepaid expenses. Web prepaid expenses refer to.

What is Prepaid expense Example Journal Entry Tutor's Tips

Web prepaid expenses journal entry: Web this journal entry is made to record the expense incurred during the period as well as to eliminate the.

(PDF) Adjusting Journal Entries Prepaid Expenses adler gabriel

Web once the amount has been paid for the expenses in advance (prepaid), a journal entry should be passed to record it on the date.

Journal Entry for Prepaid Insurance Online Accounting

Their primary purpose is to allocate costs. Web prepaid expenses refer to payments made in advance for goods or services that a company will receive.

Web Prepaid Expenses Refer To Payments Made In Advance For Goods Or Services That A Company Will Receive Or Use In The Future.

Automate prepaid expenses with accounting software. Web a prepaid expense is any expense you pay that has not yet been incurred. A guide to prepaid expense accounting. Prepaid expense a/c (a newly opened account).

Web Journal Entries For Prepaid Expenses.

Understanding the journal entry mechanics behind prepaid expenses empowers you to accurately record and. Below is the journal entry for prepaid expenses; Web a full guide on accounting for prepaid expenses including journal entries and amortization schedules for leases, subscriptions, and insurance. Web what is the journal entry for prepaid expenses?

The Following Journal Entry Accommodates A Prepaid Expense:

In the journal, prepaid expenses must be entered as debiting prepaid expense accounts and crediting cash or. The two most common uses of prepaid expenses are rent and insurance. There are two ways of recording prepayments: Their primary purpose is to allocate costs.

Web How Does This Affect The Balance Sheet And Your Journal Entries?

Also known as deferred expenses, recording these expenses is part of the accrual. Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. According to the three types of accounts in accounting“prepaid expense” is a personal account. When making a payment, the cash balance will decrease and increase the prepaid.