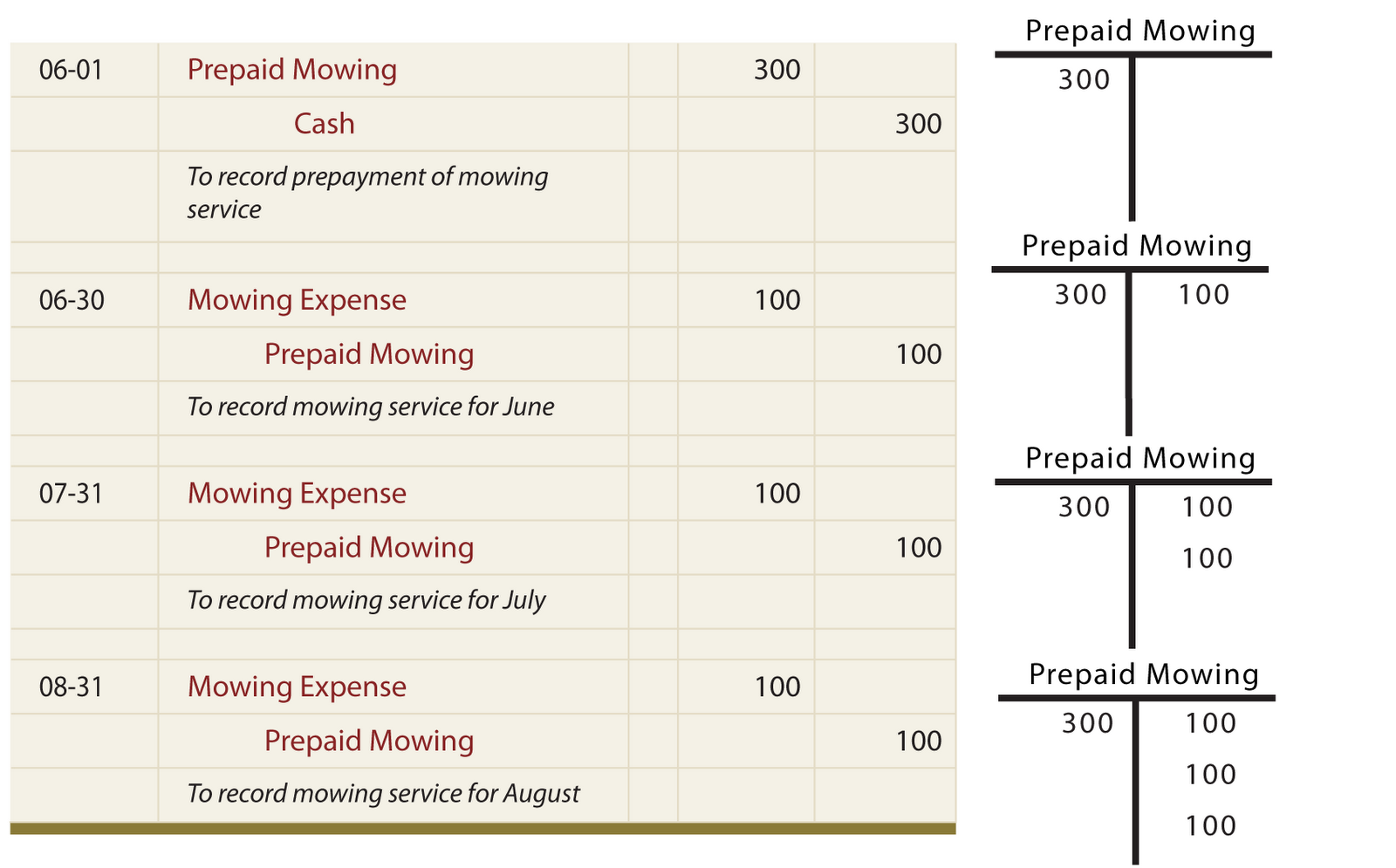

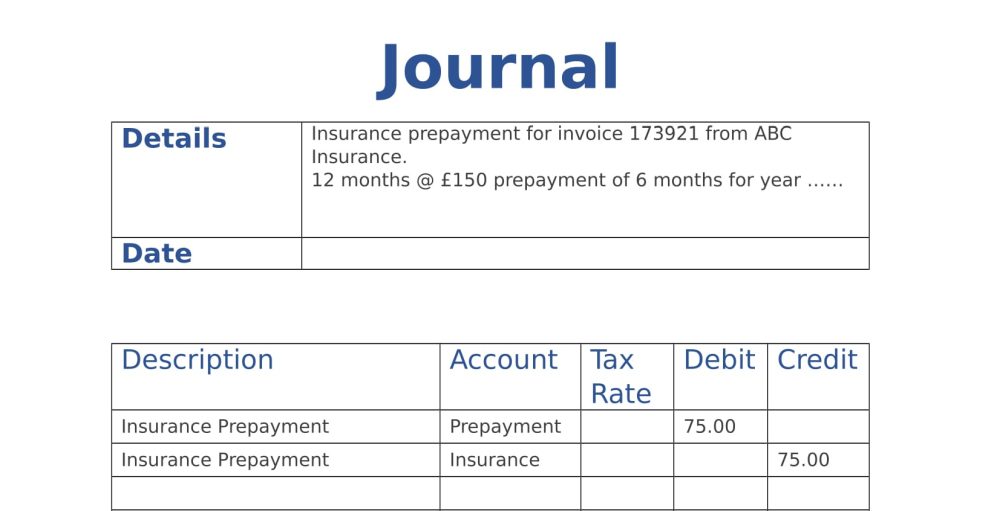

Prepaid Account Journal Entry - Web sometimes, your accounting software can handle the amortization expense creation process, so your monthly journal entries will be completed automatically. These are both asset accounts and do not increase or decrease a company’s balance. Prepaid expense a/c and expense a/c. Prepaid expenses are payments made in advance for products expected to be used in. The company can make prepaid expense journal entry by debiting prepaid expense account and crediting cash account. When the benefits have been. If you want to create a prepaid. Journal entry to record the payment. Their primary purpose is to allocate costs accurately. Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded.

What is Prepaid expense Example Journal Entry Tutor's Tips

Prepaid expense a/c and expense a/c. Web the journal entry for prepaid expenses involves two accounts: (proforma invoice being received and. Web the initial entry.

Journal Entry For Prepaid Expenses

Web accordingly the prepaid expenses journal entry to post the insurance is as follows: Web our journal entry to record the prepaid rent expense is:.

Accruals and Prepayments Journal Entries HeathldDunn

Web prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future. When preparing.

Journal Entry For Prepaid Expenses

Prepaid expenses are payments made in advance for products expected to be used in. When the benefits have been. Web following accounting entry is required.

Journal Entry For Prepaid Expenses

The insurance expense account is reduced from 5,400 to the expense for the year of 3,600,. In this scenario, we’ve recognized a prepaid asset which.

Prepaid Expenses Entry Calculation In Excel Printable Templates

Web income tax installments, also known as prepaid taxes, are payments made by individuals or companies to the government in advance to cover their estimated.

Adjusting Journal Entries Jojonomic Officeless Operating System, No

Web the initial entry is a debit of $12,000 to the prepaid insurance (asset) account, and a credit of $12,000 to the cash (asset) account..

Journal Entry for Prepaid Insurance Online Accounting

To record the payment of cash which created the prepaid expense, the accounting records will show the following bookkeeping entries on. The company can make.

Prepaid Salary Journal Entry

Learn how to account for them and create a prepaid expenses journal entry! Web steps involved in journal entry of prepaid expenses: Web accordingly the.

Web The Journal Entry Is:

Prepaid expense a/c and expense a/c. Web the adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. These are both asset accounts and do not increase or decrease a company’s balance. Web the initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

If You Want To Create A Prepaid.

There are two ways of recording prepayments: As a financial consultant or business. A guide to prepaid expense accounting. When the benefits of prepaid expenses are realised, they can be.

Web Steps Involved In Journal Entry Of Prepaid Expenses:

Web prepaid expenses journal entry. Web accordingly the prepaid expenses journal entry to post the insurance is as follows: In the balance sheet, prepaid expenses are recorded as current assets. Journal entry to record the payment.

To Record The Payment Of Cash Which Created The Prepaid Expense, The Accounting Records Will Show The Following Bookkeeping Entries On.

Web following accounting entry is required to account for the prepaid expense: Web the journal entry for prepaid expenses involves two accounts: Web income tax installments, also known as prepaid taxes, are payments made by individuals or companies to the government in advance to cover their estimated income tax liability for. Web (step by step) accounting.