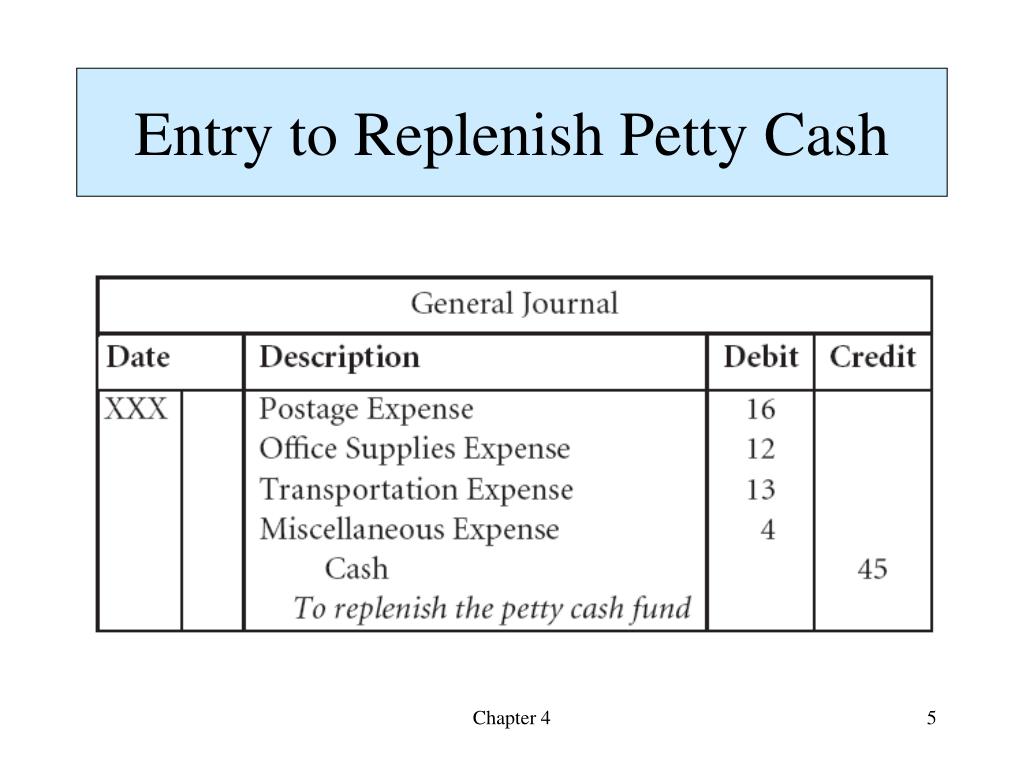

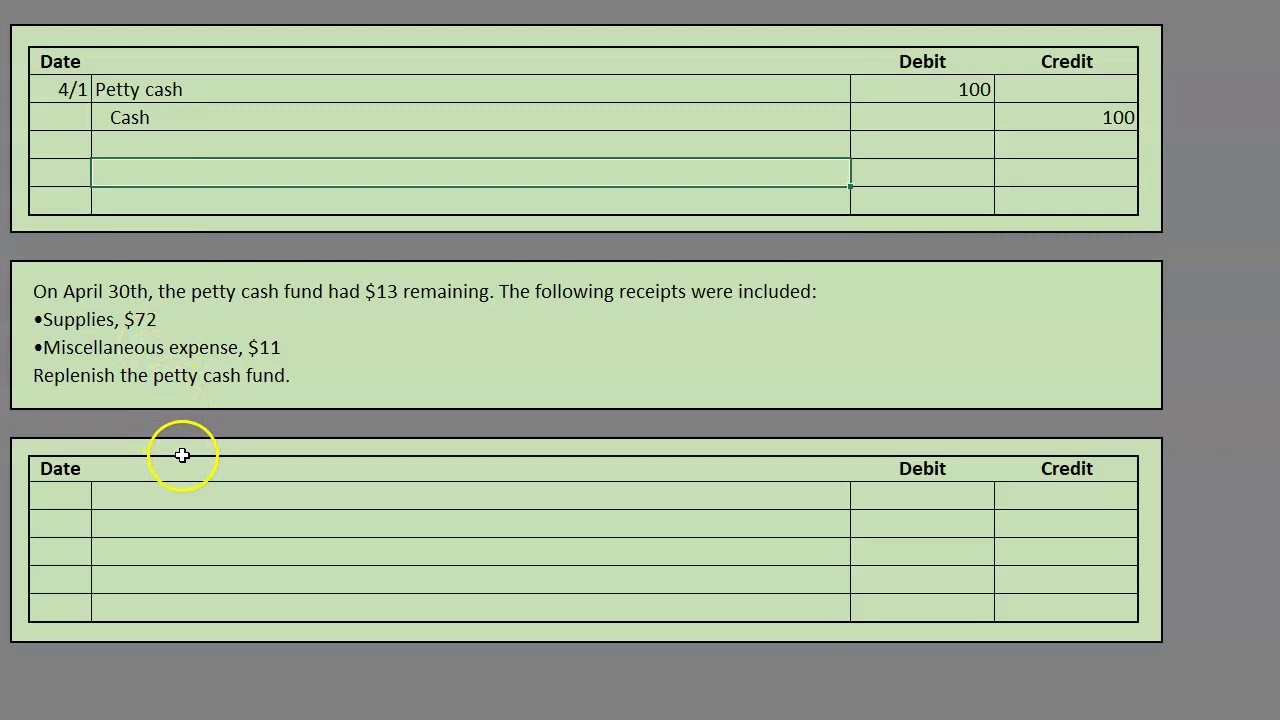

Petty Cash Replenishment Journal Entry - To illustrate suppose a business wants to implement an imprest system and establish a fixed cash fund of 100 at the start of an accounting period. Web a petty cash custodian should be designated to safeguard and make payments from this fund. Usually, they use these funds to pay for minor expenses. Web companies replenish the petty cash fund at the end of the accounting period, or sooner if it becomes low. Web this journal entry is made in order to account for the $80 expenses that have occurred during december as well as to replenish the $80 petty cash that we have spent as we only have $20 which is about to run out. Entries are needed to (1) establish the fund, (2) increase or decrease the balance of the fund (replenish the fund as cash is used), and (3) adjust for overages and shortages of cash. Web recording the journal entry for this system is not complex. To record expense which paid by petty cash: The custodian of the petty cash fund is in charge of approving and making all disbursements from the fund. Web petty cash accounts are managed through a series of journal entries.

PPT Reporting and Analyzing Cash and Internal Controls PowerPoint

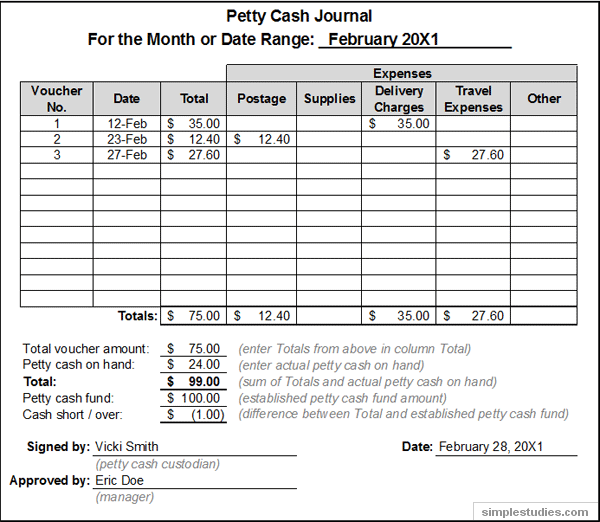

When the volume of transactions to be handled by the petty cash grows, the fund. Many bookkeepers prefer to combine the second and third journal.

Accounting and procedures for petty cash Accounting Guide

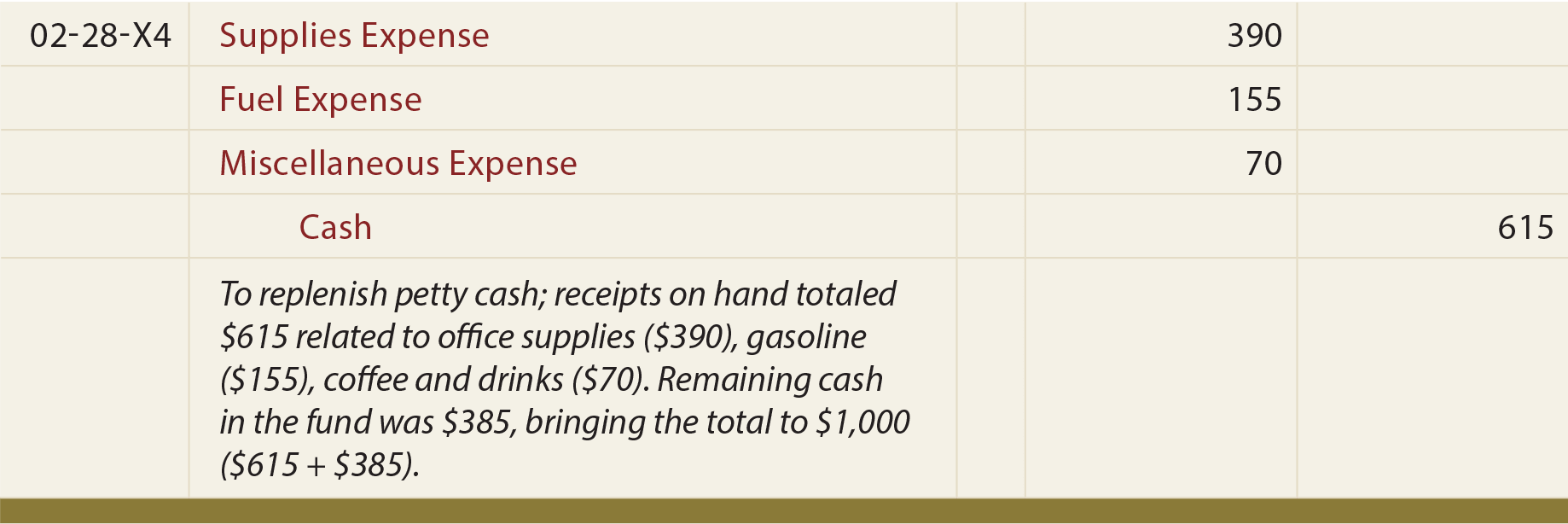

Then petty cash is replenished usually via a check. Petty cash is system companies create to hold insignificant amounts of funds. Suppose for example a.

Petty Cash

Web we outline below the imprest system of petty cash journal entries used to establish, use, and reimburse the imprest account. Making disbursements from the.

PPT Cash, Shortterm Investments and Accounts Receivable PowerPoint

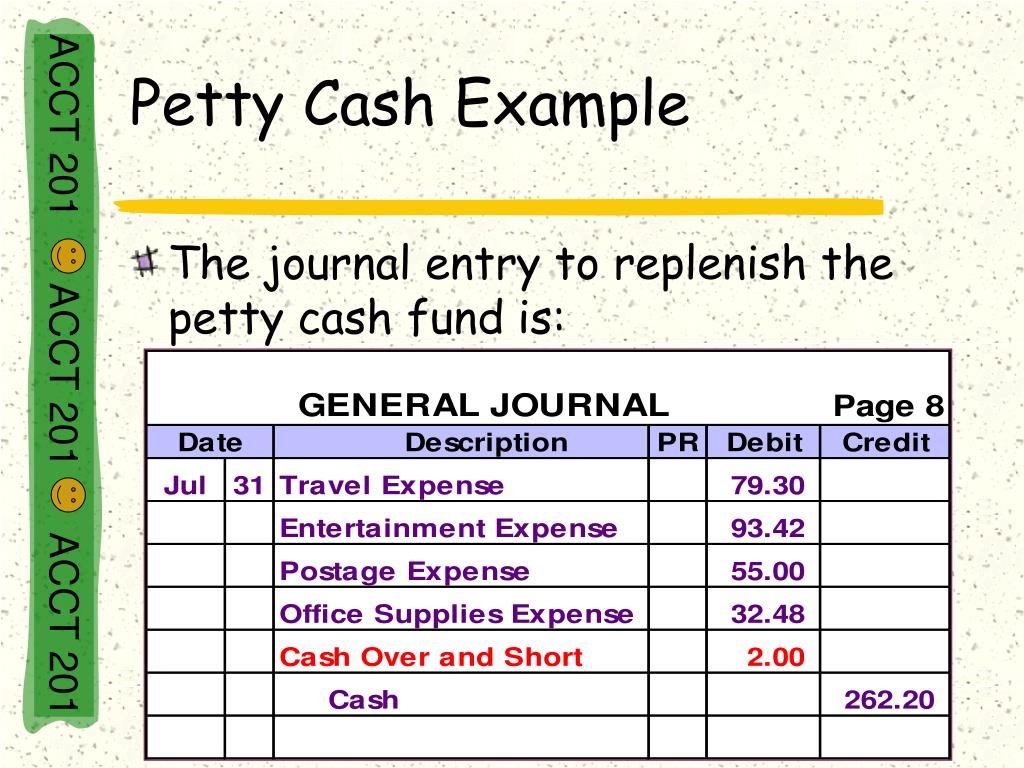

Web journal entry to replenish the petty cash fund. The custodian of the petty cash fund is in charge of approving and making all disbursements.

Accounting and procedures for petty cash Accounting Guide

Web the entry to record the establishment of fund $100 petty cash fund is: Try another version of this question. Making disbursements from the fund..

Petty Cash Replenishment Double Entry Bookkeeping Bookkeeping

The reason for replenishing the fund at the end of the accounting period is that no record of the fund expenditures is in the accounts.

Journal Voucher Format Fill Out and Sign Printable PDF Template

Web we outline below the imprest system of petty cash journal entries used to establish, use, and reimburse the imprest account. Petty cash is used.

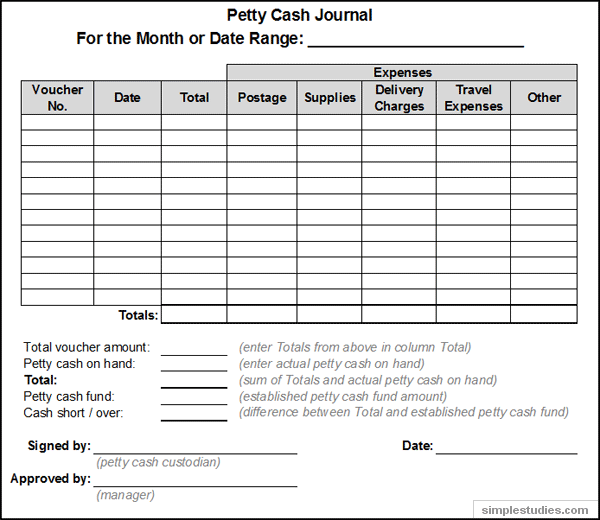

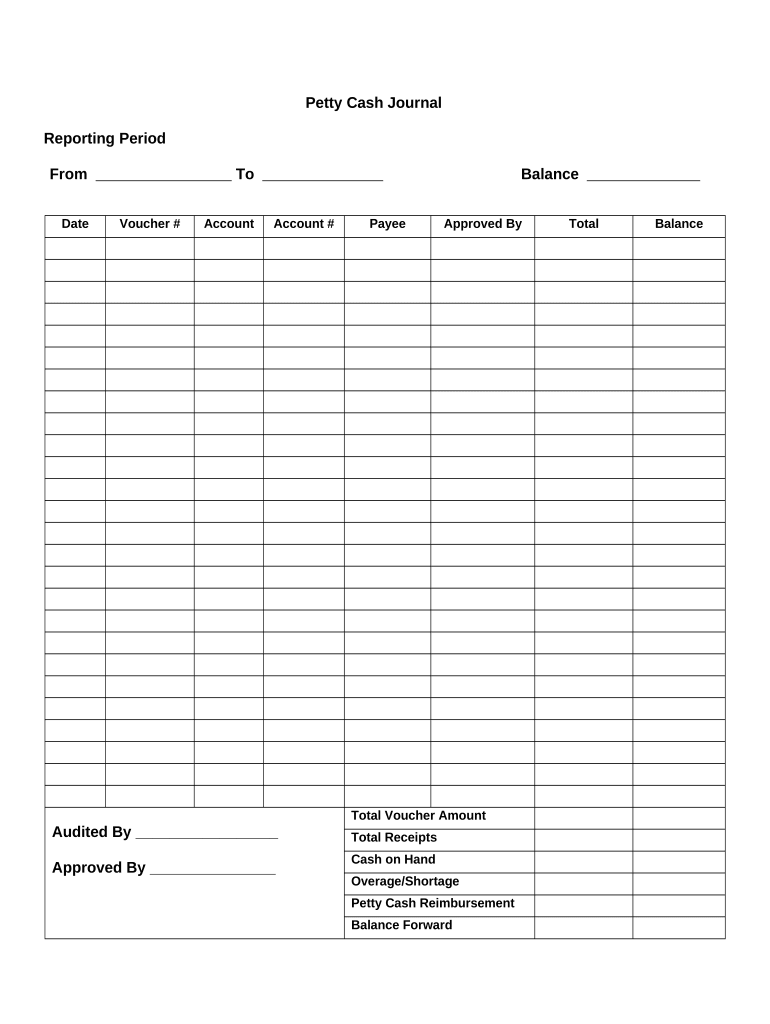

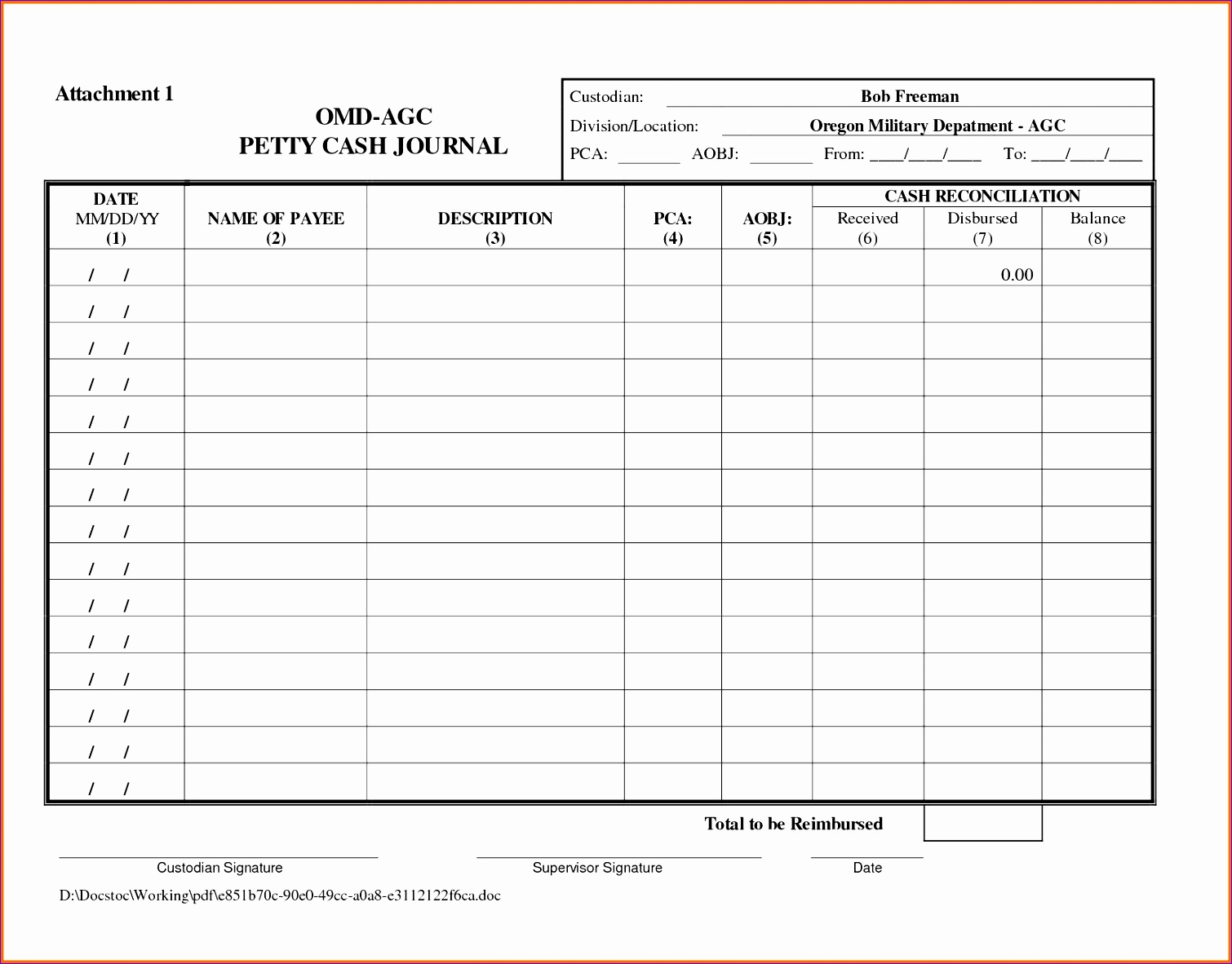

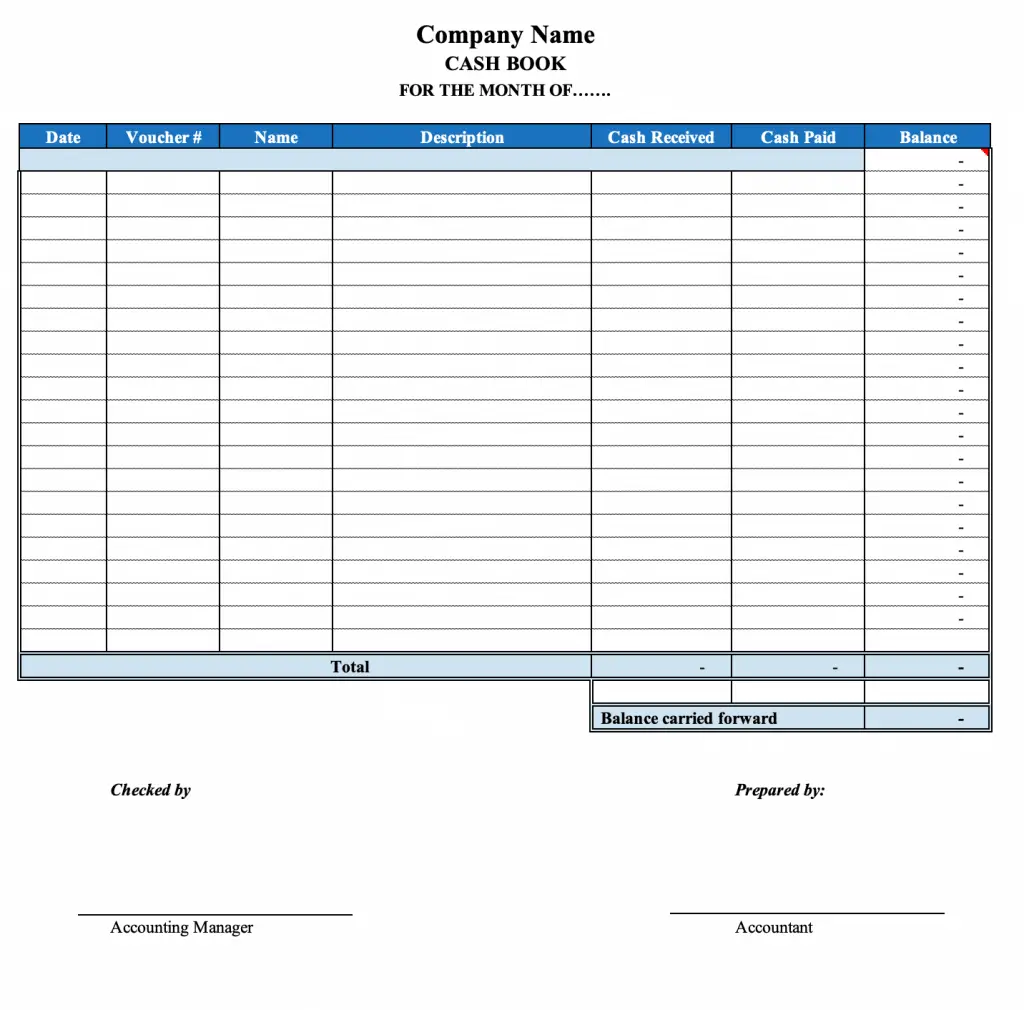

7 Excel Petty Cash Template Excel Templates Excel Templates

Web companies replenish the petty cash fund at the end of the accounting period, or sooner if it becomes low. These are the expenses that.

Petty Cash Book Journal Entry Example Template Accountinguide

Petty cash is system companies create to hold insignificant amounts of funds. And, you must record a petty cash journal entry when you put money.

The Petty Cash Custodian Refills The Petty Cash Drawer Or Box, Which Should Now Contain The Original Amount Of Cash That Was Designated For The Fund.

Company abc uses the petty cash for the expense amount $ 400 and the remaining balance is only $ 100. Greta, the chief financial officer (cfo) of a business, establishes a petty cash fund by writing a check for $100, cashing it at the bank in exchange for five $20s, and putting the cash in a secure box at the front desk. Let’s practice a bit more. Entries are needed to (1) establish the fund, (2) increase or decrease the balance of the fund (replenish the fund as cash is used), and (3) adjust for overages and shortages of.

When The Volume Of Transactions To Be Handled By The Petty Cash Grows, The Fund.

Web a petty cash fund is a small amount of company cash, often kept on hand (e.g., in a locked drawer or box), to pay for minor or incidental expenses, such as office supplies or employee. At the time the fund is established, the following journal entry is needed. Web replenishing the petty cash fund means the petty cash custodian requests and receives cash from the company’s regular checking account in an amount that will return the cash on hand to the amount shown in the general ledger account petty cash. The custodian of the petty cash fund is in charge of approving and making all disbursements from the fund.

Back To Our Example In The Previous Section:

The company record debit expense $ 800 and credit petty cash $ 800. Many bookkeepers prefer to combine the second and third journal entries above if the cash is replenished at the same time as expenses are recorded, which is. Web companies replenish the petty cash fund at the end of the accounting period, or sooner if it becomes low. The reason for replenishing the fund at the end of the accounting period is that no record of the fund expenditures is in the accounts until the check is written and a journal entry is made.

Consider Recording Petty Cash Transactions In Your Books At Least Once Per Month.

It requires replenishment to refill the petty cash balance. Try another version of this question. To record expense which paid by petty cash: Entries are needed to (1) establish the fund, (2) increase or decrease the balance of the fund (replenish the fund as cash is used), and (3) adjust for overages and shortages of cash.