Pension Expense Journal Entry - Web pension funding is governed by laws described in the internal revenue code (irc), which determine the annual minimum required contribution and the annual maximum tax. The increase in pbo attributable to one. In this type of plan, the employer. Web now that pensions contributions/payments have come into effect, your salary journal template will need to be changed to track this new type of expense. Web the result is a significantly larger pension expense in the current year. The contributions are posted as an. There are four important components that must be considered when determining pension expense: Pension expense reported on income statement equals the (a) service cost i.e. Web prepare the journal entry to record pension expense and the employer's contribution to the pension plan in 2020. (credit account titles are automatically indented when amount.

16 Accounting Worksheet Template /

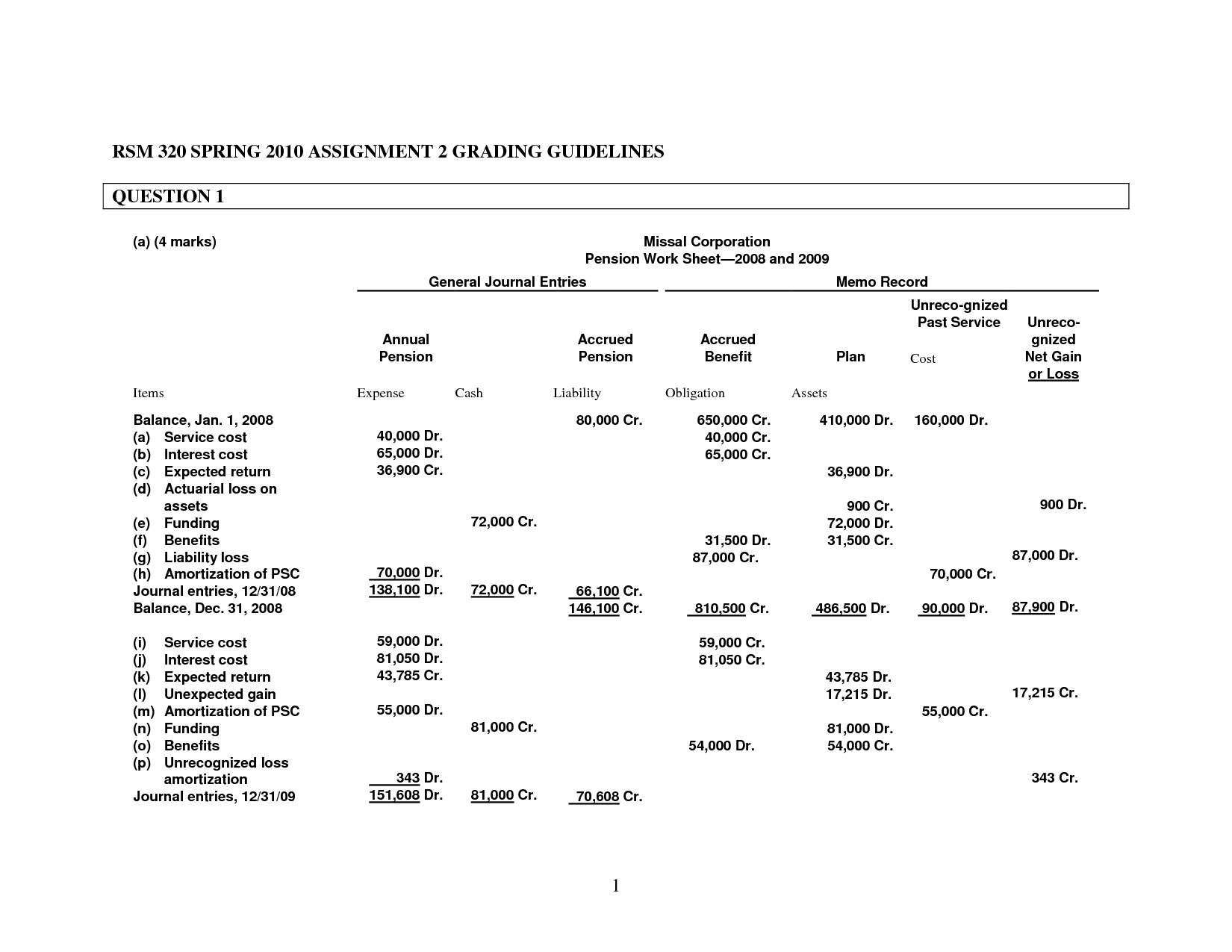

Reconciliation of accrued pension cost pbo in excess of plan assets $70,400. Web now that pensions contributions/payments have come into effect, your salary journal template.

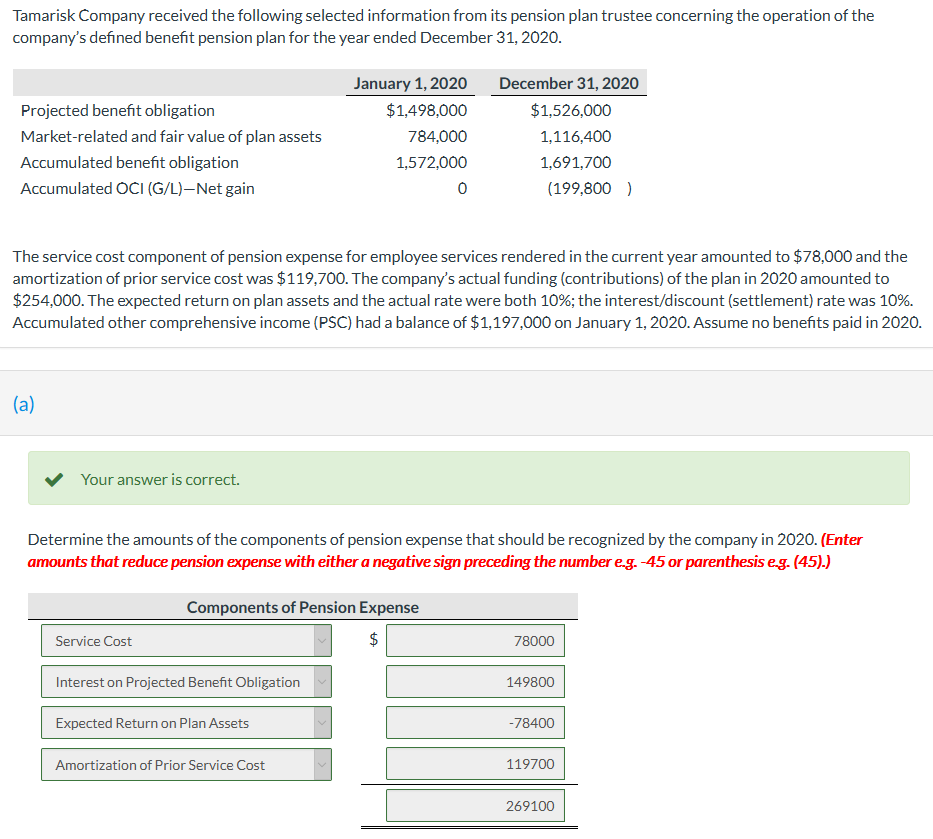

Solved Exercise 1711 Components of pension expense, journal

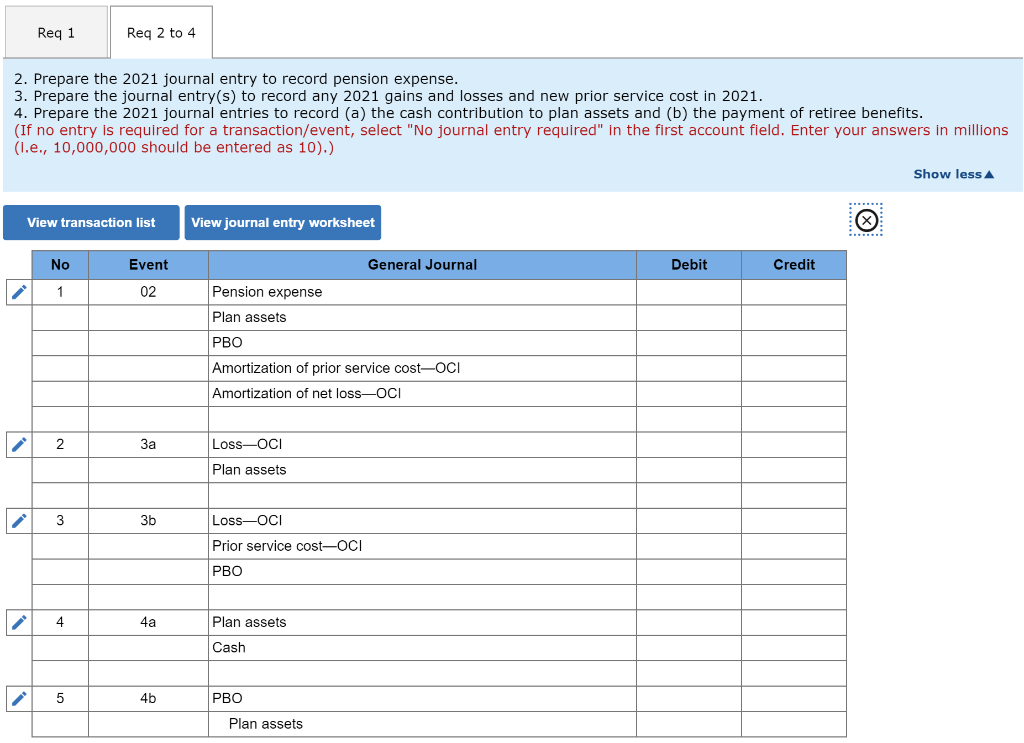

(credit account titles are automatically indented when amount. The pensions sorp gives guidance on best practice for financial accounting and reporting of pension schemes. Pension.

PPT Pensions and Postretirement Benefits PowerPoint Presentation

The company will also report a significantly higher liability, $125,663, on its balance sheet. Web journal entries for expenses are records you keep in your.

A partially completed pension spreadsheet showing

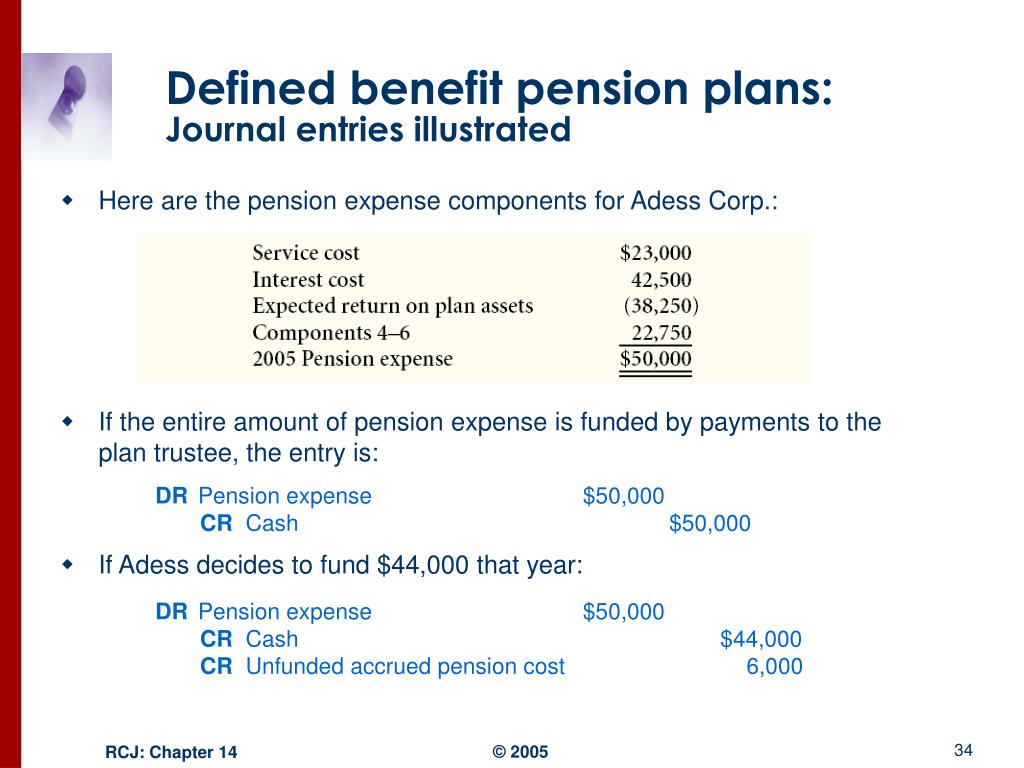

The proper journal entry is crucial for. Pension expense is the amount that a business charges to expense in relation to its liabilities for pensions.

Pension Expense Journal Entry YouTube

Web the guidance in asc 715, compensation—retirement benefits, applies to an employer’s accounting for pension plans, as well as postretirement benefits other than pensions. Pension.

How to Record Pension Expense (journal entry) YouTube

Your ask joey ™ answer. Web journal 1 (staff cost charge): Web the journal entry for pension expense involves debiting the pension expense account and.

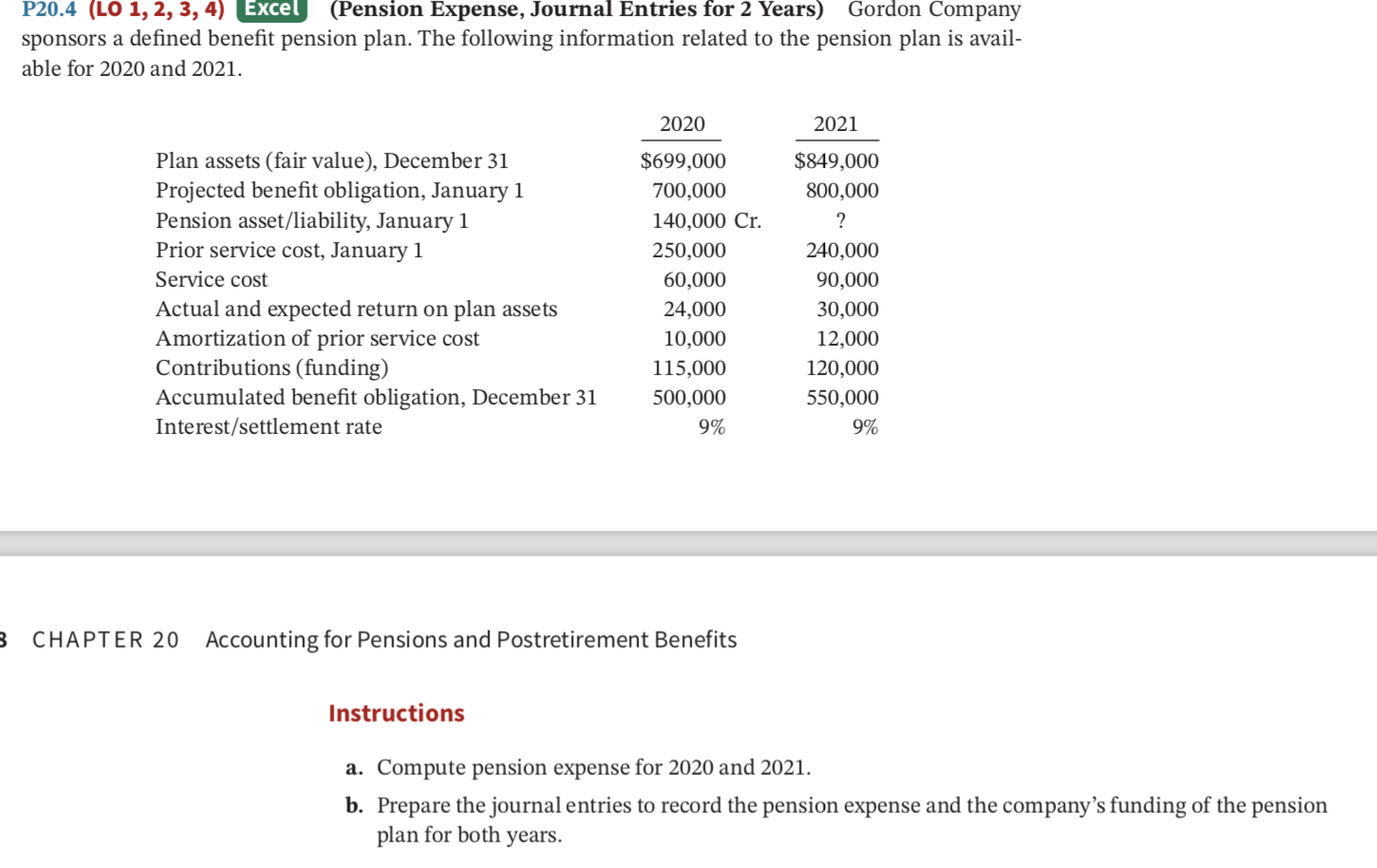

Solved P20.4 (LO 1, 2, 3, 4) Excel (Pension Expense, Journal

Current service cost:the increase in the present value of the pension obligation that results from the employees’ current services 2. Web what is the journal.

[Solved] Determine pension expense for 2021, prepare journal entries

Web pension funding is governed by laws described in the internal revenue code (irc), which determine the annual minimum required contribution and the annual maximum.

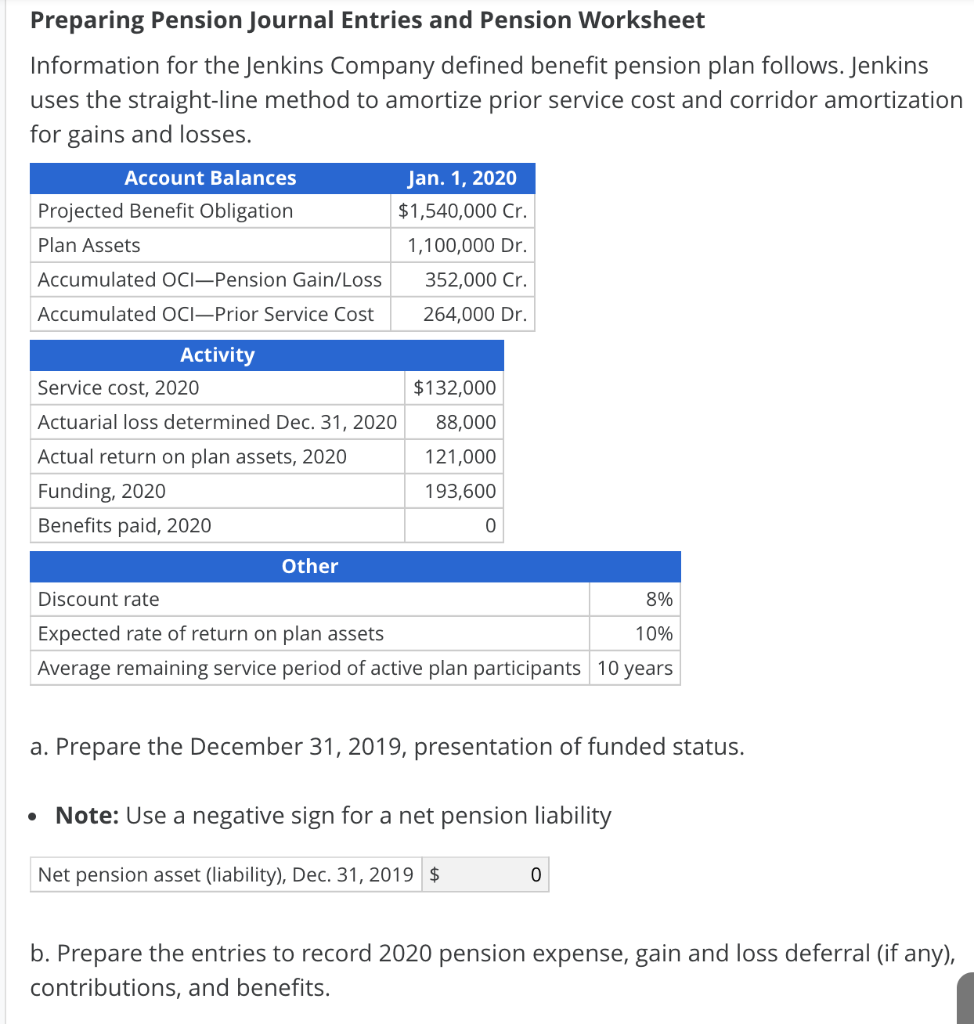

Solved Preparing Pension Journal Entries and Pension

Web now that pensions contributions/payments have come into effect, your salary journal template will need to be changed to track this new type of expense..

Web Prepare The Journal Entry To Record Pension Expense And The Employer's Contribution To The Pension Plan In 2020.

(credit account titles are automatically indented when amount. Web pension funding is governed by laws described in the internal revenue code (irc), which determine the annual minimum required contribution and the annual maximum tax. Web the double entry bookkeeping journal entry to post the defined contribution pension plan expense would be as follows: Current service cost:the increase in the present value of the pension obligation that results from the employees’ current services 2.

Web 4.3.6 Partial Settlement Of A Pension Plan.

The first journal entry is to account for the change in the deferred outflows, deferred inflows, net pension liability or asset, and. Reconciliation of accrued pension cost pbo in excess of plan assets $70,400. There are four important components that must be considered when determining pension expense: Web the journal entry for pension expense involves debiting the pension expense account and crediting the cash account.

The Contributions Are Posted As An.

The increase in pbo attributable to one. The pensions sorp gives guidance on best practice for financial accounting and reporting of pension schemes. Your ask joey ™ answer. Web ias 26 outlines the requirements for the preparation of financial statements of retirement benefit plans.

Web Journal 1 (Staff Cost Charge):

The proper journal entry is crucial for. What is the journal entry when a company funds. Web the result is a significantly larger pension expense in the current year. In this type of plan, the employer.