Payroll General Journal Entries - Web the key types of payroll journal entries are noted below. Here are five steps to. This entry records the gross wages earned by employees, as well as all withholdings from their. Each payroll journal entry is paired with. Study examples of payroll journal entries and. Web a payroll journal entry is a record of employee earnings for an accounting period. Web salaried payroll entry #1: Also known as an initial recording, this first entry is very important. Identify payroll expenses and liabilities. An accountant typically includes these entries in the company's general ledger.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

There’s a different practice for each. Web there are diverse types of payroll journal entries, including: The gross wage is the expense charged to the.

Payroll

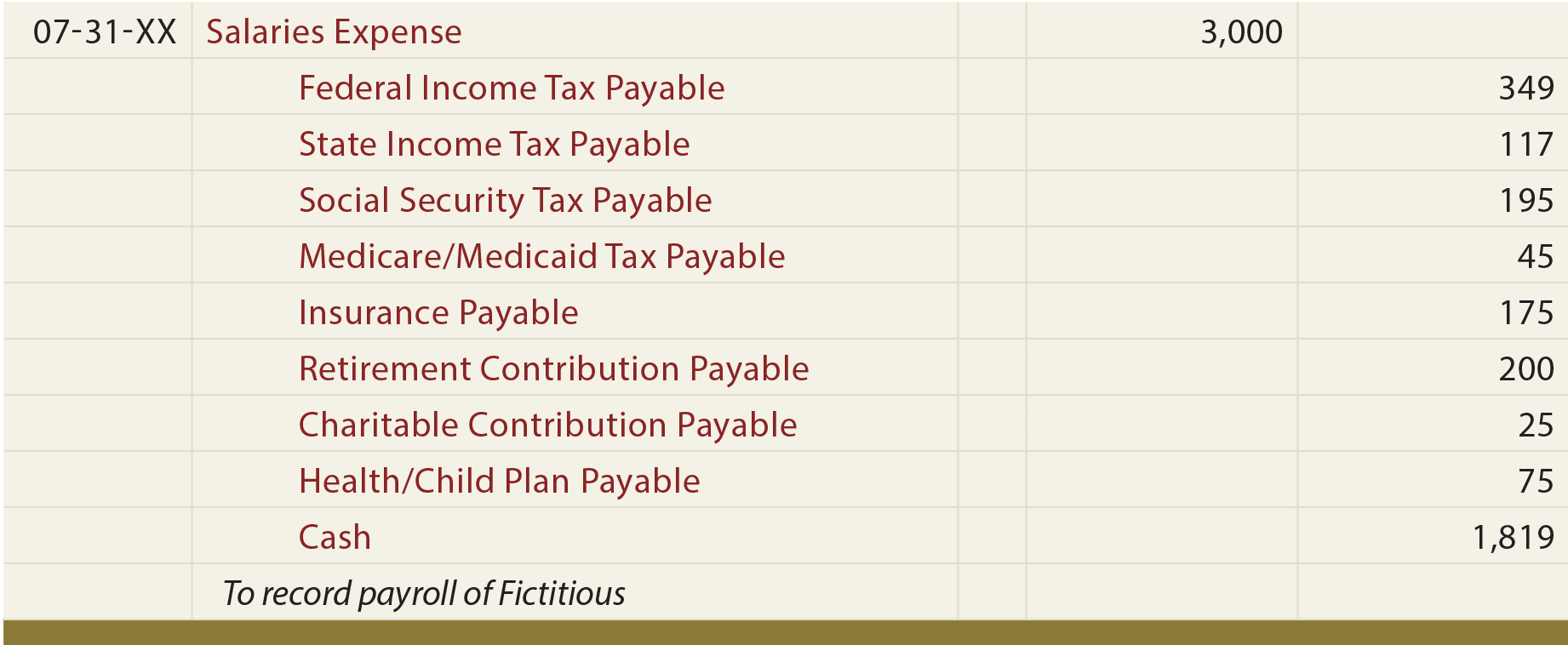

Web the payroll accounting journal entries would be as follows: The primary payroll journal entry is for the initial recordation of a payroll. The control.

10 Payroll Journal Entry Template Template Guru

The control accounts are all balance. An accountant typically includes these entries in the company's general ledger. Lesson 12 in the basic accounting series. Subtract.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web the key types of payroll journal entries are noted below. There’s a different practice for each. Each payroll journal entry is paired with. Web.

General Ledger A Complete and Simple Guide

Payroll accounting is simply recording. The control accounts are all balance. Web payroll journal entries are what an accountant (or in many cases the small.

Payroll Journal Entries Demonstration YouTube

Assume a company had a payroll of $35,000 for the month of april. Each payroll journal entry is paired with. Study examples of payroll journal.

Payroll Journal Entry Example Explanation My Accounting Course

The primary payroll journal entry is for the initial recordation of a payroll. This entry records the gross pay earned by employees during a pay.

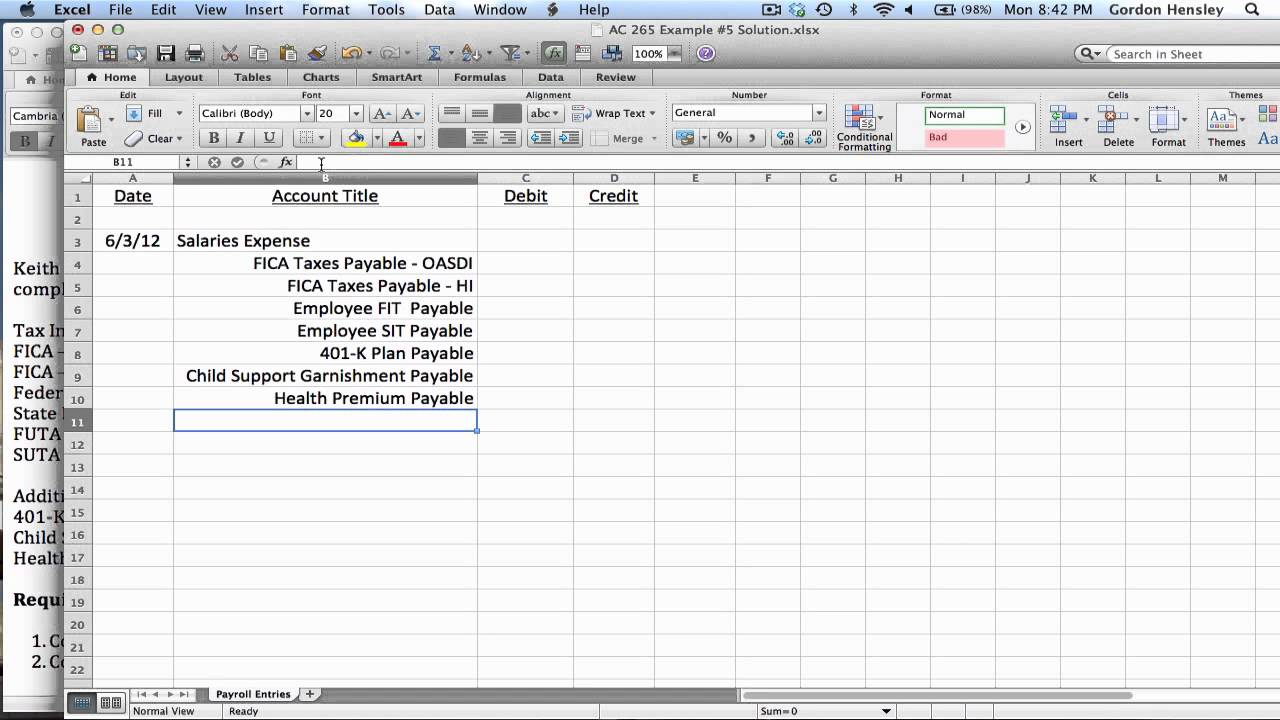

How to manually process payroll using the General Journal.

There’s a different practice for each. The primary payroll journal entry is for the initial recordation of a payroll. In the following examples we assume.

[Solved] 1. Using the payroll registers, complete the General Journal

There’s a different practice for each. Each payroll journal entry is paired with. Web payroll journal entries are the numbers you record in your small.

This Entry Records The Gross Pay Earned By Employees During A Pay Period.

Web the payroll accounting journal entries would be as follows: Web having the right information will ensure your payroll journal entries are accurate and save you from having to do correcting entries later. Identify payroll expenses and liabilities. Web payroll accounting with payroll journal entry examples.

Lesson 12 In The Basic Accounting Series.

Web the key types of payroll journal entries are noted below. There’s a different practice for each. Payroll accounting is simply recording. The control accounts are all balance.

Web There Are A Few Type Of Payroll Journal Entries To Consider:

Each payroll journal entry is paired with. This entry records the gross wages earned by employees, as well as all withholdings from their. The gross wage is the expense charged to the income statement. The primary payroll journal entry is for the initial recordation of a payroll.

In The Following Examples We Assume That The Employee’s Tax Rate For Social Security Is 6.2% And That The Employer’s.

Web payroll journal entries are what an accountant (or in many cases the small business owner) uses to record business activity. Assume a company had a payroll of $35,000 for the month of april. An accountant typically includes these entries in the company's general ledger. Web examples of payroll journal entries for wages.