Payment Of Loan Journal Entry - The journal entry would involve. I will make an electronic payment to this loan periodically. Web enter the date and journal entry number. It involves recording your initial loan,. Interest paid to bank/person on the loan: Debit of $500 to interest expense. Debit of $1,500 to loans payable. Web best way to enter a loan payment? (on payment of interest) example: This will bring the total amount.

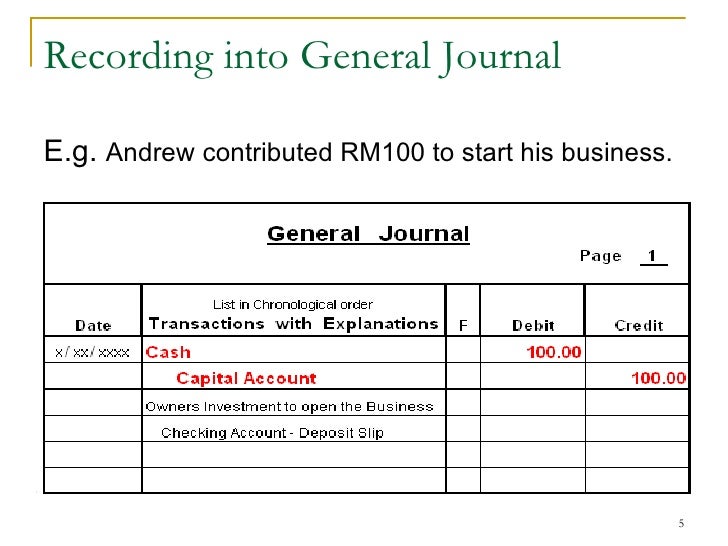

journal entry format accounting accounting journal entry template

Web washington (ap) — the biden administration is canceling student loans for another 160,000 borrowers through a combination of existing programs. Web we can make.

Mortgage Payable Journal Entry

Web to illustrate, consider a business making a loan payment of $1,000, where $200 is allocated to interest and $800 to principal. When recording your.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Interest due ₹500 on loan taken is paid. It involves recording your initial loan,. The journal entry would involve. It is the balance that company.

Journal Entries of Loan Accounting Education

Debit of $3,000 to loans payable (a liability account) debit of $1,000 to. I have a loan set up as a balance sheet account in.

Journal Entry Examples

Interest due ₹500 on loan taken is paid. I have a loan set up as a balance sheet account in qbo. Abc plc received a.

What Is The Journal Entry For A Loan Payment

The journal entry would involve. Debit of $500 to interest expense. Then, select the second line and credit the liability account. Abc plc received a.

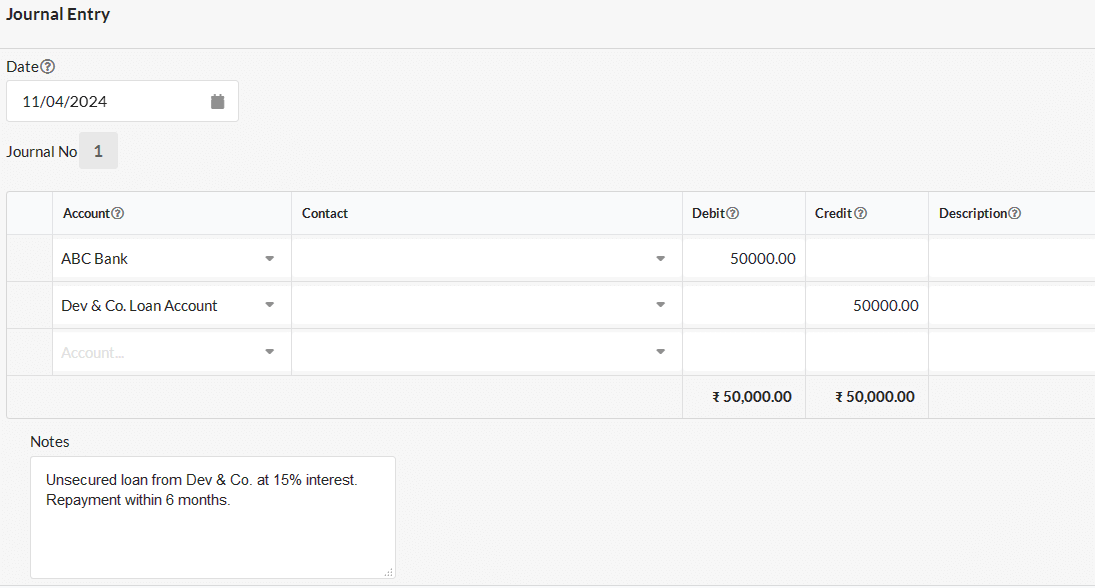

Journal entry for Loan Payable Output Books

On december 31, 2022, the interest accrued on the loan must be. Web the company’s entry to record the loan payment will be: Debit of.

Bank Loan Repaid Journal Entry Info Loans

On december 31, 2022, the interest accrued on the loan must be. Web the company’s entry to record the loan payment will be: Abc plc.

Loan Journal Entry Examples for 15 Different Loan Transactions

Terms of the loan agreement. If you have ever taken out a payday loan, you may have experienced a situation where. Web best way to.

Abc Plc Received A Bank Loan Of $100,000 On 1 January 20X1.

Terms of the loan agreement. Web finally, the proposed rule would further clarify in paragraph (3) that program income includes payments and repayments of grants, loans, or investments made. On december 31, 2022, the interest accrued on the loan must be. Web on wednesday, the biden administration announced an additional $7.7 billion in loan debt relief was approved for 160,500 borrowers.

Web The Debt Ceiling Deal Finalized Between President Joe Biden And House Speaker Kevin Mccarthy On Sunday Would Reinstate Student Loan Payments And The.

It involves recording your initial loan,. This will bring the total amount. Web washington (ap) — the biden administration is canceling student loans for another 160,000 borrowers through a combination of existing programs. Receive a loan from a bank journal entry.

When Recording Your Loan And Loan Repayment In.

Web the company’s entry to record the loan payment will be: Whole amount including interest is repaid either together at once or in instalments (emi) entry for loan. I will make an electronic payment to this loan periodically. Web following accounting entry is used to account for the repayment of loan:

Web To Receive A Loan The Business Will Post The Following Double Entry Bookkeeping Journal Entry.

Record the initial loan transaction. Debit of $500 to interest expense. Interest due ₹500 on loan taken is paid. Show journal entry for loan payment in year 1 & year 2.