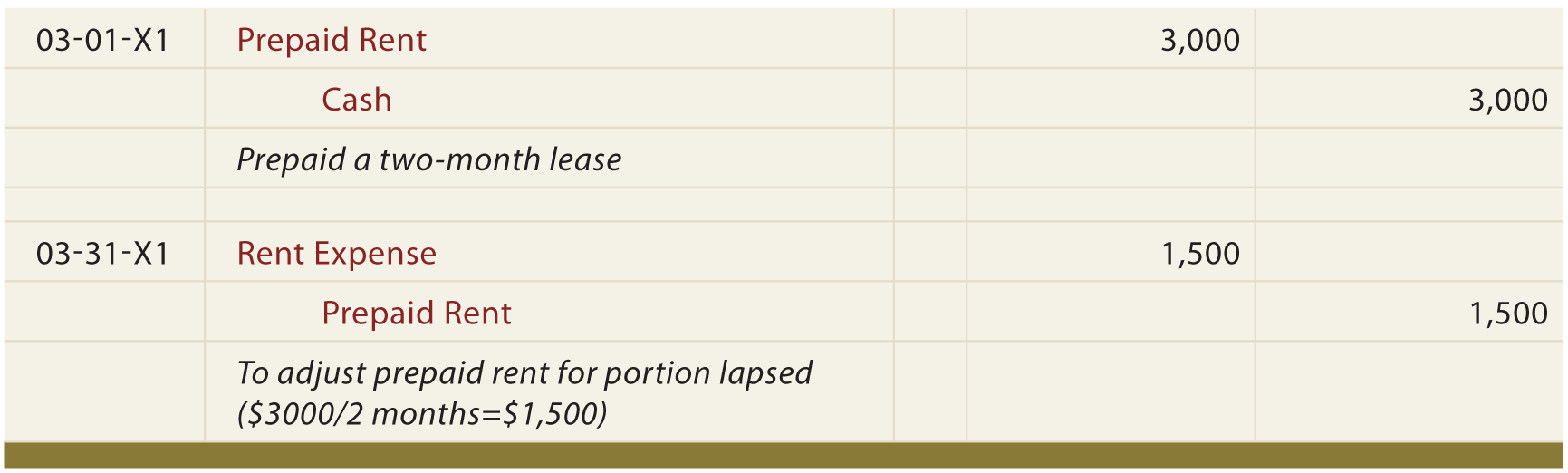

Paid Rent For The Month Journal Entry - Income and expense a/c is debited to record the journal entry of rent paid. And the debit to rental expense is plus $1,500. Web accrued rent expense example. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they were incurred and how much they cost. Web journal entry to record the payment of rent. Michael cohen's invoice dated feb. Such an obligation is included in the list of current liabilities for a business and the account is treated as a representative personal account. Entry #6 — pgs has a grand opening and makes it first sale. Period of rent prepayment = 3 months. These entries will continue to record until the full prepaid rent amount is recognized.

Accounting Journal Entries For Dummies

Income and expense a/c is debited to record the journal entry of rent paid. A rent which is past its due date is called outstanding.

How to Adjust Journal Entry for Unpaid Salaries

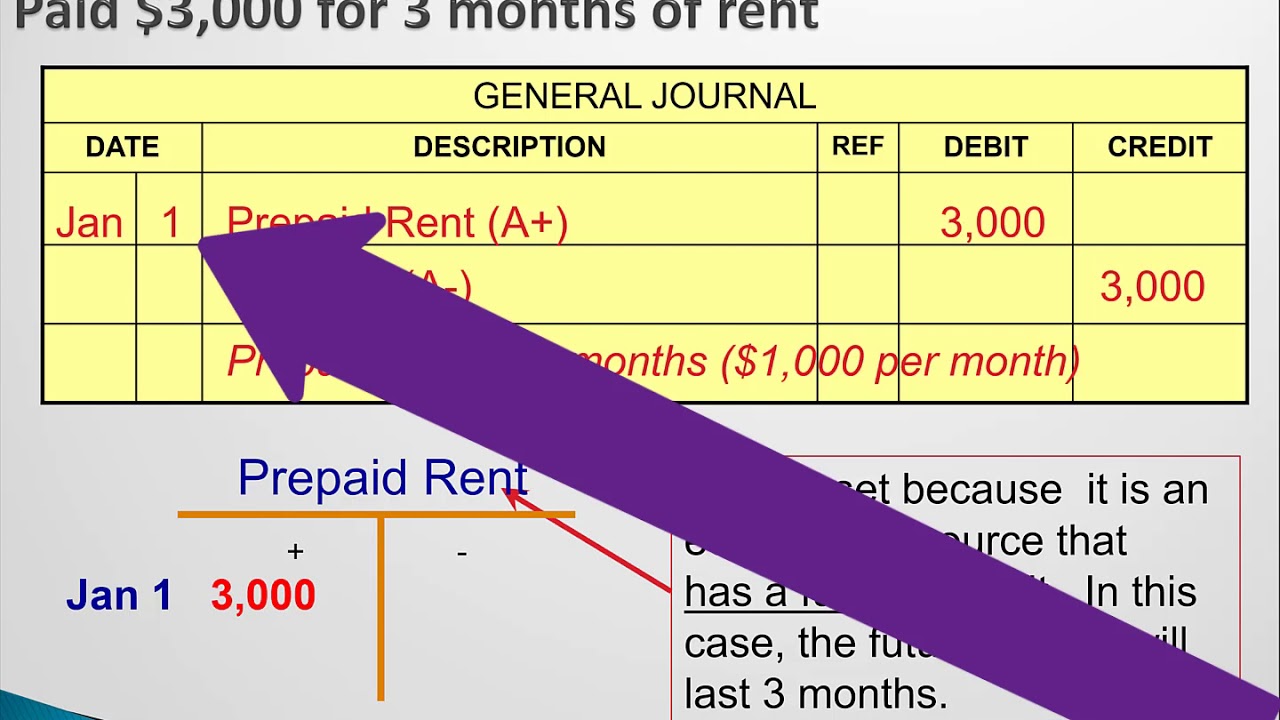

They pay the lessor three months in advance on the first day of every quarter. Web in this case, the company abc can make the.

Self Study Notes The Adjusting Process And Related Entries

Such an obligation is included in the list of current liabilities for a business and the account is treated as a representative personal account. Entry.

What is the Adjusting Entry for Prepaid Rent? YouTube

Record the necessary journal entry for the month ending march 2023. They pay the lessor three months in advance on the first day of every.

Paid rent by cheque chequesekiryadiyajournal

Web journal entry to record the payment of rent. Rent payable (or accrued rent) is simply the unpaid rent expense of a business entity at.

Prepaid Salary Journal Entry

For example, on january 01, 2021, we rent a car to use in our business operation. Prepaid rent is rent paid in advance of the.

journal entry format accounting accounting journal entry template

Business expenses can include a range of things, like rent, payroll, and inventory. Web abc’s accounts team would prepare the following entry for the accrued.

Prepaid Salary Journal Entry

Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet. Entry #7 — pgs sells.

Journal entries for lease accounting

Prepare the journal entry for the following transaction: And the debit to rental expense is plus $1,500. In the first scenario, the is paid rent.

Please Prepare A Journal Entry For The Rental Fee Paid For The Month.

Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet. On december 29, the company paid rent for december, $ 1,500. At the end of april one third of the prepaid rent expense (1,000) will have been used up as the business has used the premises for that month. Such an obligation is included in the list of current liabilities for a business and the account is treated as a representative personal account.

Web As Each Month Passes, One Rent Payment ($2,000/5 = $400 Per Month) From The Prepaid Rent Account Will Be Credited And The Rent Expense Account Will Be Debited Against It.

These entries will continue to record until the full prepaid rent amount is recognized. Web following are the steps for recording the journal entry for rent paid by cheque. Rent payable (or accrued rent) is simply the unpaid rent expense of a business entity at the end of its accounting period. Web journal entry to record the payment of rent.

The Rental Fee Is $800 Per Month And Due To Special Conditions, We Are Allowed To Make The First Payment Of $2,400 (800 X 3) At The End Of The Third Month Of The Rent Period.

Web in this case, the company abc can make the journal entry for the rent paid in advance on december 29, 2020, as below: Income and expense a/c is debited to record the journal entry of rent paid. Web prepaid rent journal entry. Web accrued rent expense example.

They Pay The Lessor Three Months In Advance On The First Day Of Every Quarter.

Entry #7 — pgs sells another guitar to a customer on account for $300. Probably the easiest part of working out the journal entry is the cash (or bank). The company records the rental expense and reduce the cash balance. For example, on january 01, 2021, we rent a car to use in our business operation.