Paid Cash For Supplies Journal Entry - Web paid cash for supplies example. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. Web the cash receipts journal is used to record all transactions involving the receipt of cash, including transactions such as cash sales, the receipt of a bank loan, the. Web the normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. Paid cash on account journal entry 4. Web an it firm purchases office supplies worth $20,000 from its vendor on credit on 20 august 2023 with net30 payment terms. Web paid $300 for supplies previously purchased. This paid cash for supplies journal entry is one of many examples used in double entry bookkeeping, discover another at the links below. Example of the accounting entry for payment to creditor. Company abc is purchasing the machinery from the supplier cost $ 120,000.

3 Purchase goods for Cash journal entry YouTube

Web it is important to show prepaid expenses journal entry in the financial statements to avoid understatement of earnings. The firm notes down the journal.

Paid Cash for Supplies Double Entry Bookkeeping

Web you paid, which means you gave cash (or wrote a check or electronically transferred) so you have less cash. Web when a business transaction.

Accounting Journal Entries For Dummies

Many businesses buy goods or. The firm notes down the journal entry for. Web you paid, which means you gave cash (or wrote a check.

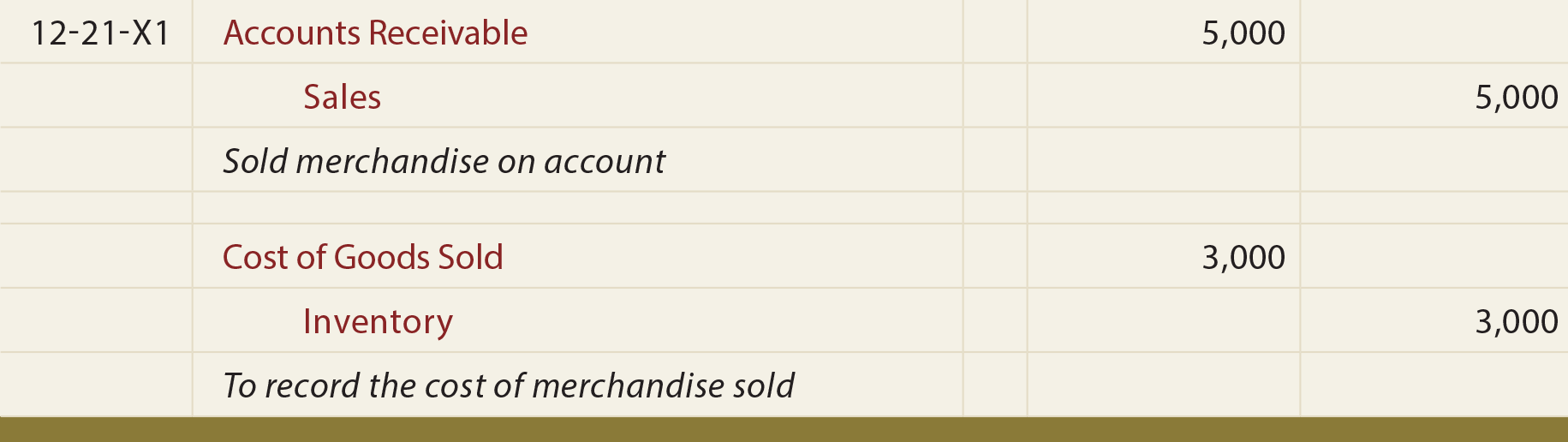

Perpetual Inventory

Web the normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. Web journal entry for.

How to use Excel for accounting and bookkeeping QuickBooks

Web paid cash for supplies example. On june 3, 2021, our company purchased computer equipment for its main office and paid $1,200.00 in cash. Web.

Journal Entry Problems and Solutions Format Examples

Let's say that you bought $1,000 worth of office supplies and you pay the vendor the same day. Accounting for funds held in escrow 2..

Purchased Supplies On Account Journal Entry / Property Plant And

Example of the accounting entry for payment to creditor. Web this will result in a compound journal entry. Opening entry in accounting see more Company.

Journal Entry Examples

To decrease the total cash, credit the account because asset. Web you paid, which means you gave cash (or wrote a check or electronically transferred).

Perpetual Inventory System Journal Entry

Many businesses buy goods or. Web an it firm purchases office supplies worth $20,000 from its vendor on credit on 20 august 2023 with net30.

Let's Try To Prepare The Journal Entry For This Transaction:

Web an it firm purchases office supplies worth $20,000 from its vendor on credit on 20 august 2023 with net30 payment terms. (in may the company recorded the purchase and the accounts payable.) on june. Web this will result in a compound journal entry. Every entry contains an equal debit and credit along with the names.

The Entry Must Have At Least 2 Accounts With 1 Debit Amount And At Least 1 Credit.

For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by paying with cash immediately. Web the normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. There is an increase in an asset account (debit service equipment, $16,000), a decrease in another asset (credit cash, $8,000, the. Paid cash on account journal entry 4.

Web Journal Entries For Cash Expenses.

This paid cash for supplies journal entry is one of many examples used in double entry bookkeeping, discover another at the links below. Prepaid rent accounting entry 3. To decrease the total cash, credit the account because asset. Web paid $300 for supplies previously purchased.

The Firm Notes Down The Journal Entry For.

Web it is important to show prepaid expenses journal entry in the financial statements to avoid understatement of earnings. Opening entry in accounting see more On june 3, 2021, our company purchased computer equipment for its main office and paid $1,200.00 in cash. Web the journal entry is debiting assets/expense and credit cash advance, cash payment.