Owner Deposits Money Into Business Journal Entry - Web this article aimed to discuss the journal entries to record owner contribution or owner’s investment with logical reasoning referring to the accounting standards. Web go to the journal entries page and enter transfer: [q1] owner invested $700,000 in the business. Web a cash deposit is a bank transaction in which a company or individual puts money into their bank account. Web february 9, 2018 accta. Web by angie mohr. Create a journal entry to record the loan. Web how to reimburse yourself. Prepare a journal entry to record this transaction. Web this entry is typically used to record an owner contribution, which is a monetary payment made by the owner (or owners) of a business to their own company.

Journal entries for lease accounting

Published on 26 sep 2017. Web if you are a business owner and want to invest your personal money, stock, or assets into your business,.

Basic Accounting for Business Your Questions, Answered

Web learn how to record capital investments to track money going into your business. Web this article aimed to discuss the journal entries to record.

Accounting Journal Entries For Dummies

Web this entry is typically used to record an owner contribution, which is a monetary payment made by the owner (or owners) of a business.

Cash Deposit into Bank Journal entry CArunway

Published on 26 sep 2017. Web how to reimburse yourself. Create a receive money transaction and select the owner funds introduced account code. Accountants call.

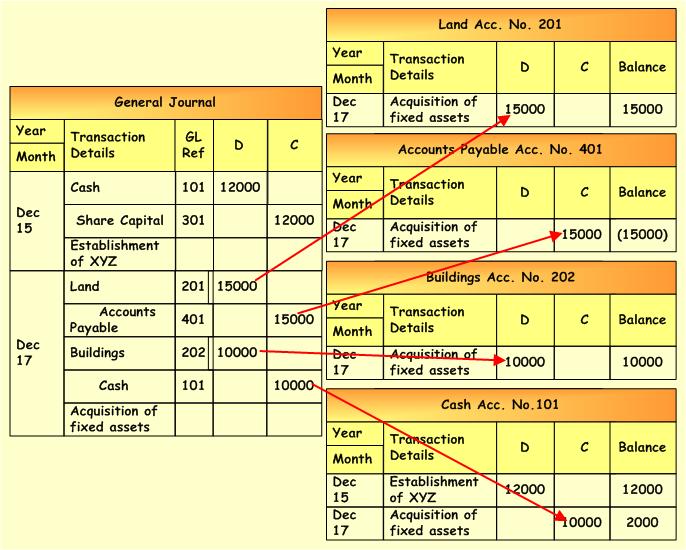

General Journal And General Ledger Entries Accounting Corner

With quickbooks online, you can record personal money you use to pay bills or start your business. Web this article aimed to discuss the journal.

Accounting Journal Entries For Dummies

Accountants call this a capital investment. Web a cash deposit is a bank transaction in which a company or individual puts money into their bank.

What Is A Cash Receipts Journal Report Printable Form, Templates and

Web go to the journal entries page and enter transfer: This transaction increases the bank balance within that account. You can easily record the capital.

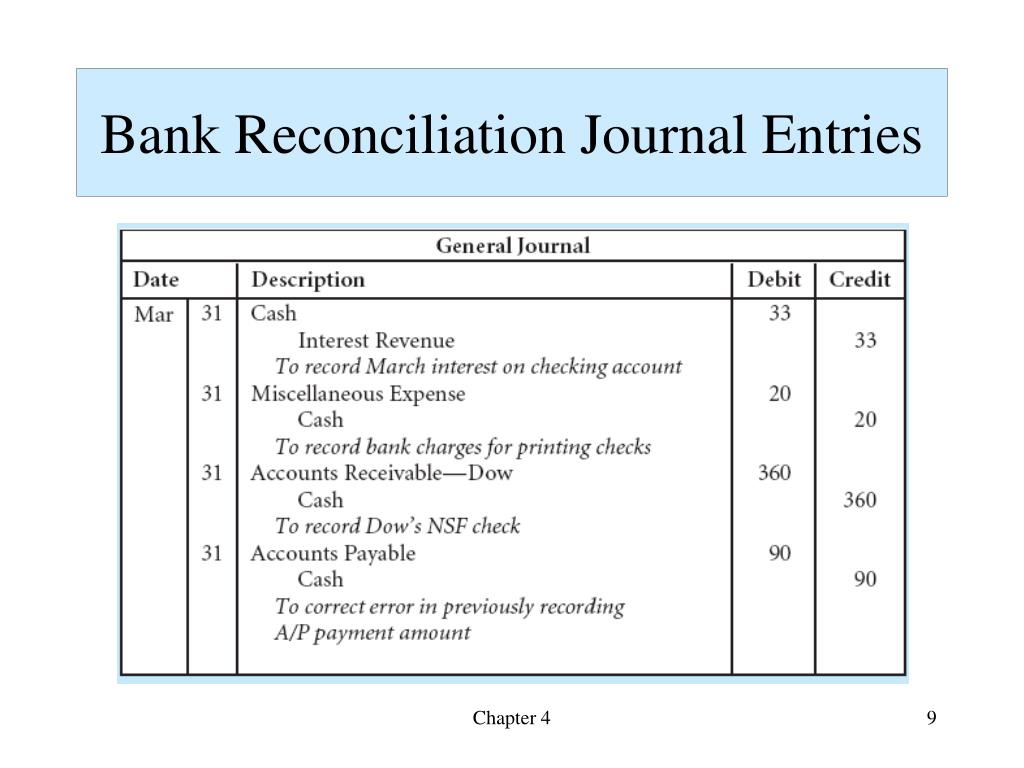

PPT Cash, Shortterm Investments and Accounts Receivable PowerPoint

Web how do you record an owner's money that is used to start a company? Web this entry is typically used to record an owner.

Journal entries Meaning, Format, Steps, Different types, Application

Web learn how to record capital investments to track money going into your business. Web a cash deposit bank journal entry is required when a.

Web If You Are A Business Owner And Want To Invest Your Personal Money, Stock, Or Assets Into Your Business, You Must Record These.

Recording money to start a sole proprietorship. Web go to the journal entries page and enter transfer: Web how do you record an owner's money that is used to start a company? Web by angie mohr.

You Must Create A Journal Entry To Record The Loan, Not Only To Record What The Company Owes You But Also To.

[q1] owner invested $700,000 in the business. Web this article aimed to discuss the journal entries to record owner contribution or owner’s investment with logical reasoning referring to the accounting standards. Accountants call this a capital investment. You can easily record the capital you introduce.

Web Cash Deposited Into The Business By Owners Can Be Recorded As Funds Introduced.

Web a cash deposit bank journal entry is required when a business takes cash and deposits it into the bank account using a paying in slip. It is also called a withdrawal. Web this entry is typically used to record an owner contribution, which is a monetary payment made by the owner (or owners) of a business to their own company. The owner has lent money $ 100,000 to the company.

Web Capital Contribution Is The Process That Shareholders Or Business Owner Invests Cash Or Asset Into The Company.

Web how to reimburse yourself. Shareholder loan accounts are now treated as a current liability. Web in accounting, assets such as cash or goods which are withdrawn from a business by the owner (s) for their personal use are termed as drawings. Prepare a journal entry to record this transaction.