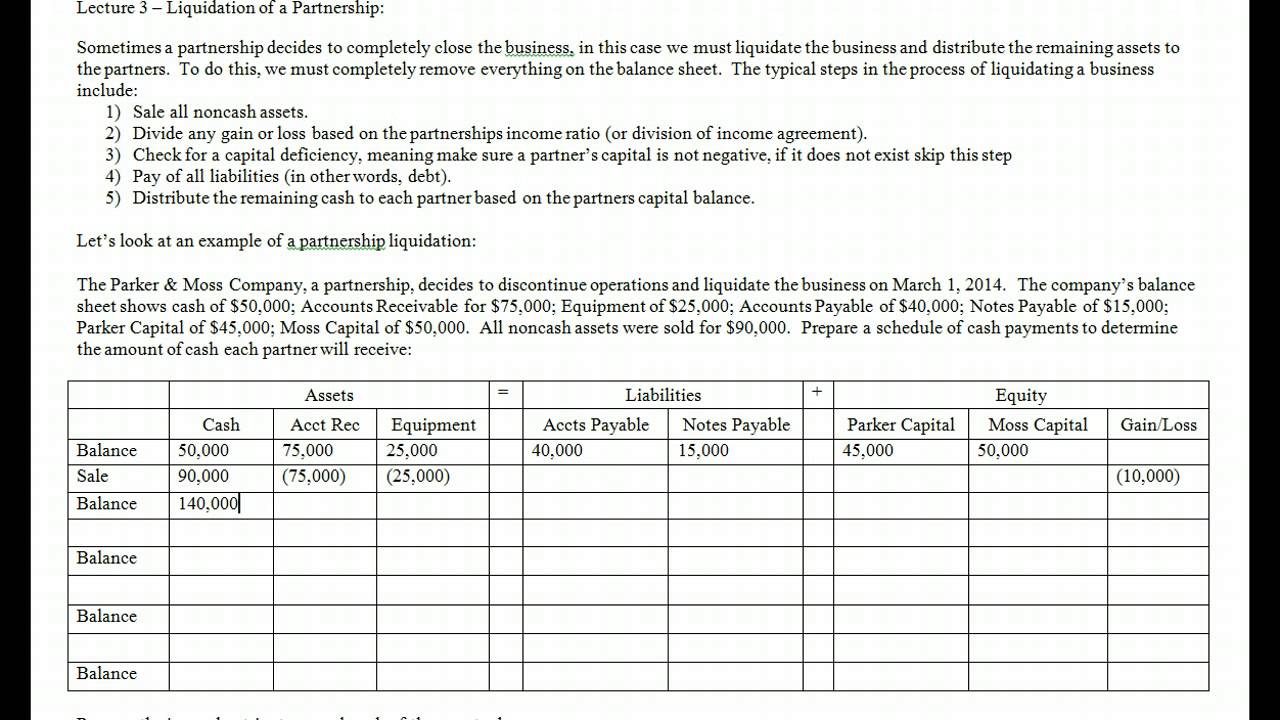

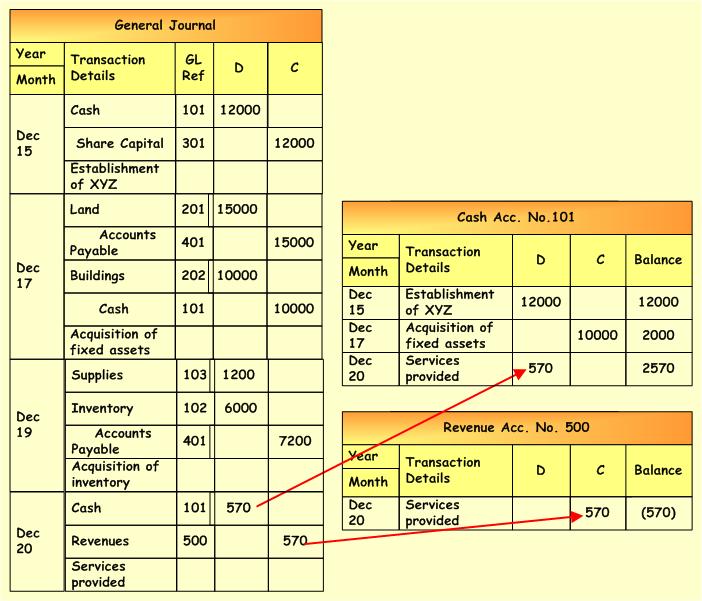

Owner Contribution Journal Entry - Web go to record deposits. Your ask joey ™ answer. Hope this helps you out. Understanding owner distributions is crucial for businesses as it directly impacts their financial health, shareholder relations, and long. Learn how to record capital investments to track money going into your business. With quickbooks online, you can record personal money you. Web to record assets and note contributed by owner. Select the correct owner who contributed the money (this is very helpful if. John is the owner of company abc. See examples of journal entries for shareholder loan method, share capital method, and sole proprietorship.

Capital Introduction Double Entry Bookkeeping

Web learn how to pass a journal entry for owner contribution in the accounting software profitbooks. Hope this helps you out. Web learn how to.

Capital Invested In Business Journal Entry Invest Walls

Web go to record deposits. The entries could be separated as illustrated or it could be combined into one entry with a debit to cash.

How to record owners contributions with personal f...

Web the journal entry reduces the cash balance which needs to distribute to the owners. Pay those expenses to that. Open your checking account register;.

[Solved] Prepare the journal entries for the transactions below for a

Web the journal entry reduces the cash balance which needs to distribute to the owners. Find out the benefits, types, and implications of owner contributions.

General Journal And General Ledger Entries Accounting Corner

Cash balance increases by $20,000. Select the correct checking account. See examples of journal entries for shareholder loan method, share capital method, and sole proprietorship..

Journal Entry Examples

See the journal entry for cash and fixed assets contribution with examples. Understanding owner distributions is crucial for businesses as it directly impacts their financial.

Accounting Journal Entries For Dummies

Select the correct owner who contributed the money (this is very helpful if. Web to record assets and note contributed by owner. John is the.

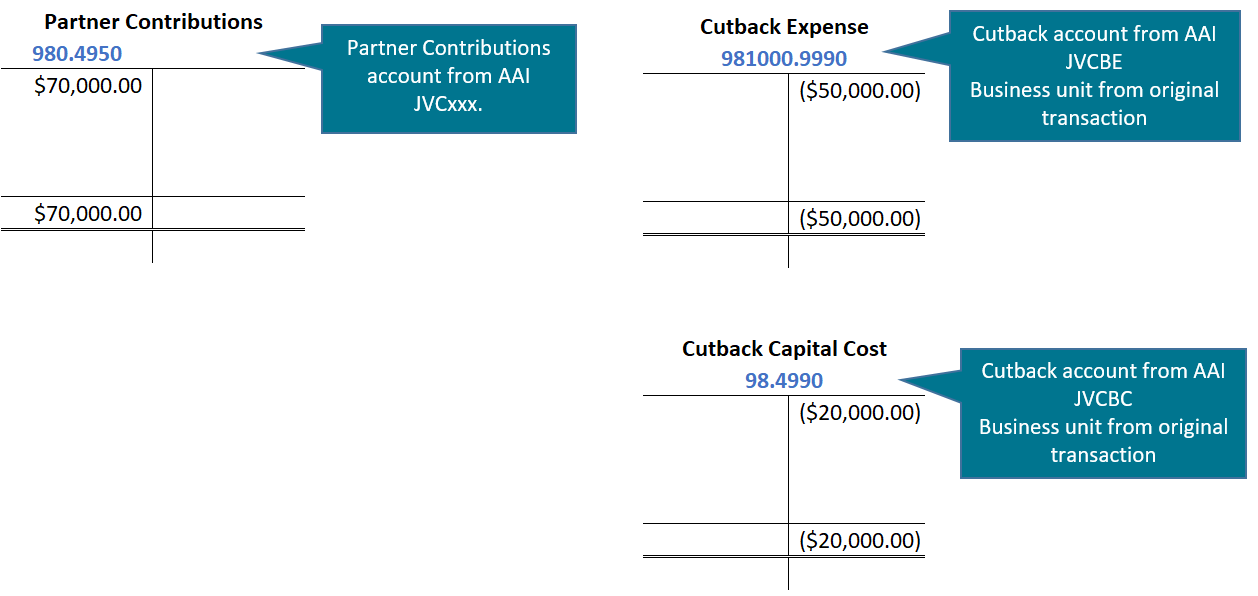

Creating Journal Entries to Draw on the Cash Calls

Follow the steps to create an account for owner's contribution and a. When a donor contributes assets. Web learn how to record owner contribution as.

What Is An Accounting Journal Entry

Web an owner's draw is a draw method used when a sole proprietor or partner in a partnership takes company money for personal use. Web.

When A Donor Contributes Assets.

Open your checking account register; Web learn how to record owner contributions and investments in the form of cash or assets in the books of accounts. Hope this helps you out. See the journal entry for cash and fixed assets contribution with examples.

Web To Record Assets And Note Contributed By Owner.

See examples, impact on balance sheet, and difference. See examples of journal entries for shareholder loan method, share capital method, and sole proprietorship. Web if you are a business owner and want to invest your personal money, stock, or assets into your business, you must record these. Web you can find how to record the journal entries for all three of these types of transactions in my article on common bookkeeping entries.

You Can Easily Record The Capital You Introduce.

Select the correct owner who contributed the money (this is very helpful if. The entries could be separated as illustrated or it could be combined into one entry with a debit to cash for $125,000. You might want to check our learning page to help you get started using xero. Web learn how to record capital contribution by owners or shareholders in a company's accounting system.

Web Go To Record Deposits.

John is the owner of company abc. Web expenses you pay for from your own funds i would suggest the following. Web learn how to record owner contributions into a business using a journal entry. The entries could be separated as illustrated or it could be combined into one entry with a debit to cash for $125,000.