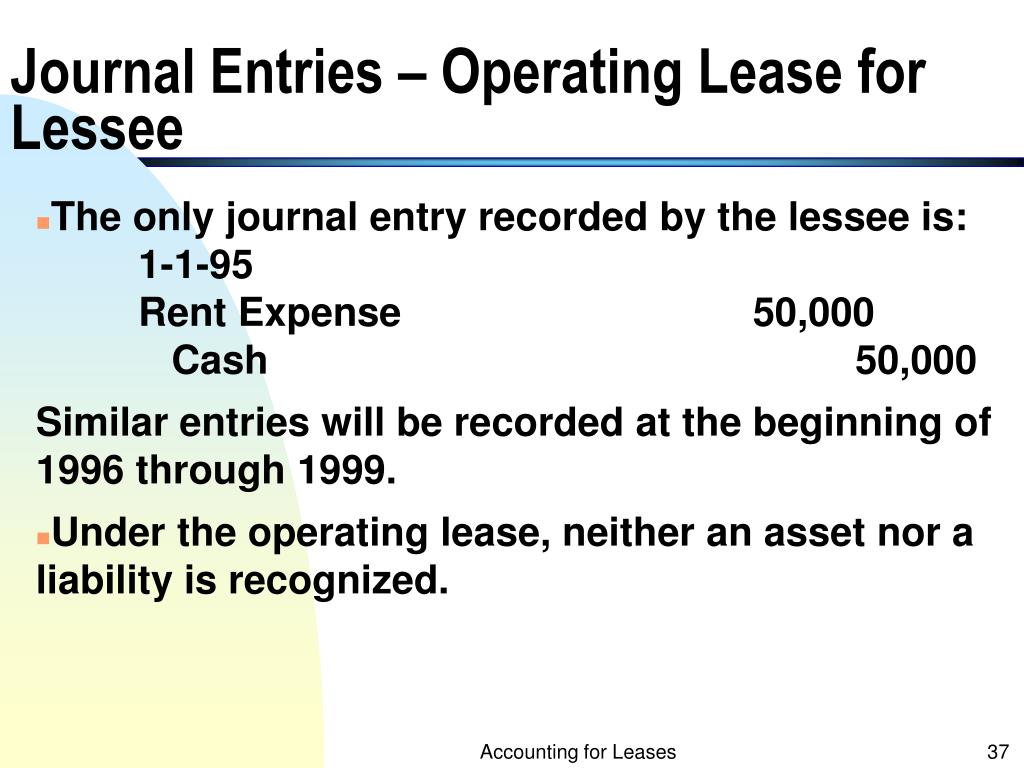

Operating Lease Lessor Journal Entries - As stated above, the required journal entries at commencement and subsequent measurement will not change from a lessor’s. If a lessor determines a contract to contain only an operating lease, it is not required to recognize any asset or liability. Web operating lease accounting by lessor. At the commencement date of an operating lease, the lessor shall defer all initial direct costs. The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases. Web lessor operating lease journal entries specifically pertain to leases where the lessor (the owner) provides equipment or property for use by another party (the lessee). Web according to asc 842, journal entries for operating leases are as follows: If the assessment of collectibility subsequently changes from not probable to probable (without a lease modification), the lessor would. Web operating lease accounting example and journal entries. Web journal entries in case of an operating lease.

Finance Lease Journal Entries businesser

By obaidullah jan, aca, cfa and last modified on may 8, 2020. In addition, the lessor must account for the. Web operating lease accounting journal.

PPT Accounting for Leases PowerPoint Presentation, free download ID

If a lessor determines a contract to contain only an operating lease, it is not required to recognize any asset or liability. Determine the lease.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Web according to asc 842, journal entries for operating leases are as follows: Web in accordance with ifrs 16.61, a lessor should classify each of.

Finance Lease Journal Entries businesser

Web operating lease journal entries. For companies that have not. Web lessor operating lease journal entries specifically pertain to leases where the lessor (the owner).

Journal entries for lease accounting

Web in accordance with ifrs 16.61, a lessor should classify each of its leases as either a finance lease or an operating lease. The new.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Determine the lease term under asc 840. Web gasb 87 lessor accounting example with journal entries. The business completes the operating lease accounting entries by.

Finance Lease Journal Entries businesser

Web gasb 87 lessor accounting example with journal entries. Lessor accounting under gasb 87. In addition, the lessor must account for the. Web 2.6 recognition.

In an Operating Lease the Lessee Records JaelynhasCox

An executive overview of the lease accounting standard from a lessor’s perspective. As stated above, the required journal entries at commencement and subsequent measurement will.

Journal entries for lease accounting

Web 2.6 recognition exemptions for lessees 17 2.7 presentation and disclosure 20 3 lessor accounting 23 3.1 lessor accounting model 23 3.2 lease classification 24.

An Executive Overview Of The Lease Accounting Standard From A Lessor’s Perspective.

The business completes the operating lease accounting entries by recording the rental payments as an operating expense. Details on the example lease agreement. Web as a result, on the commencement of the lease, you will recognize the following journal entries: As stated above, the required journal entries at commencement and subsequent measurement will not change from a lessor’s.

Operating Lease Is A Lease Which Does Not Involve.

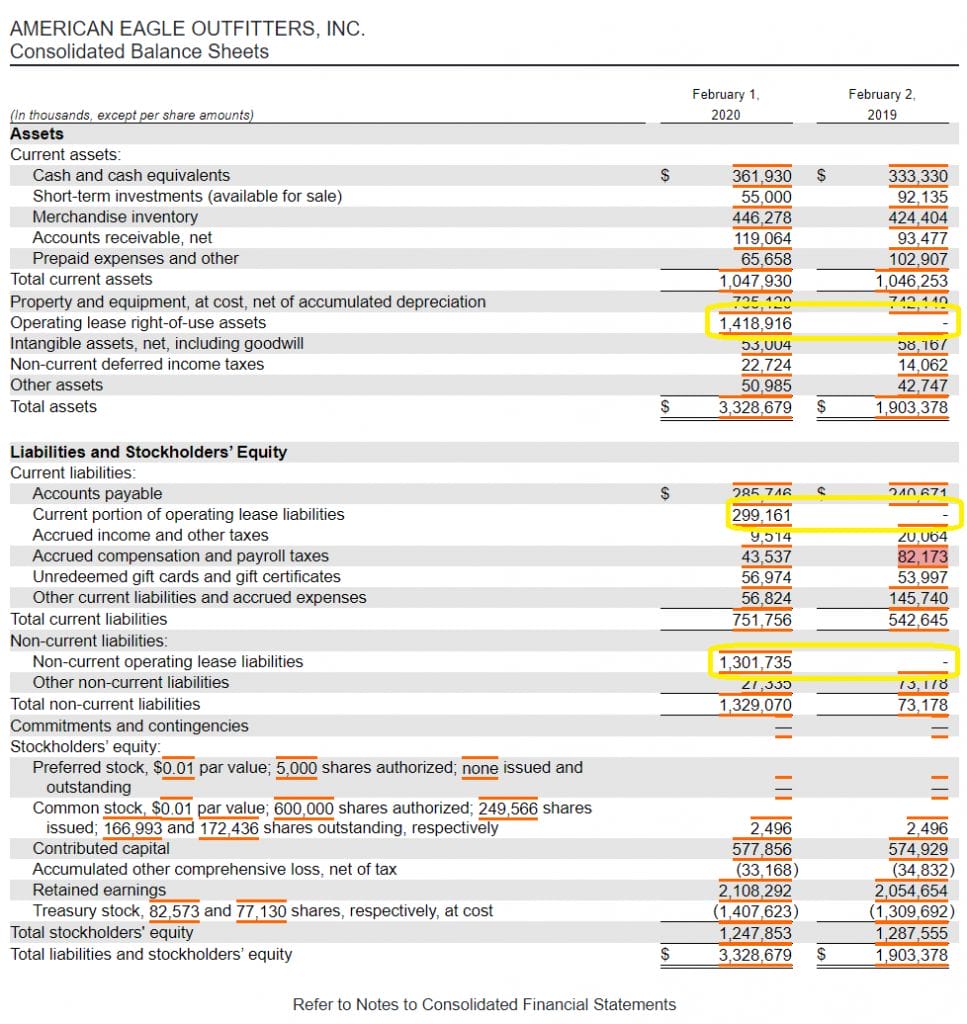

The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases. In the journal entry, the payment for the. We often just need a quick journal entry example to understand the concept or refresh our memory. Web under asc 842, journal entries for operating leases are concise calculations on the debits of your rou assets and the credits on your lease liabilities all recorded on your general.

Here, We’ll Break Down Operating Lease Journal.

Web operating lease journal entries. If a lessor determines a contract to contain only an operating lease, it is not required to recognize any asset or liability. By obaidullah jan, aca, cfa and last modified on may 8, 2020. Web gasb 87 lessor accounting example with journal entries.

Lessor Accounting Under Gasb 87.

This article serves just that purpose. Web lessor operating lease journal entries specifically pertain to leases where the lessor (the owner) provides equipment or property for use by another party (the lessee). Web the journal entry would be as follows: At the commencement date of an operating lease, the lessor shall defer all initial direct costs.