Operating Lease Journal Entries - Details on the example lease agreement. While lessees are required to record a lease. Since it is an operating lease accounting, the company will book the lease rentals uniformly over the. Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the total payment of $1,000. Web learn how to record the payment for the operating lease as the rent expense in the journal entry. Preparation of a roll forward report. With asc 842 on the horizon, many entities are evaluating the. See the example of operating lease for a car and the difference with finance lease. Web show the journal entry for the operating lease transaction. Effective date for private companies.

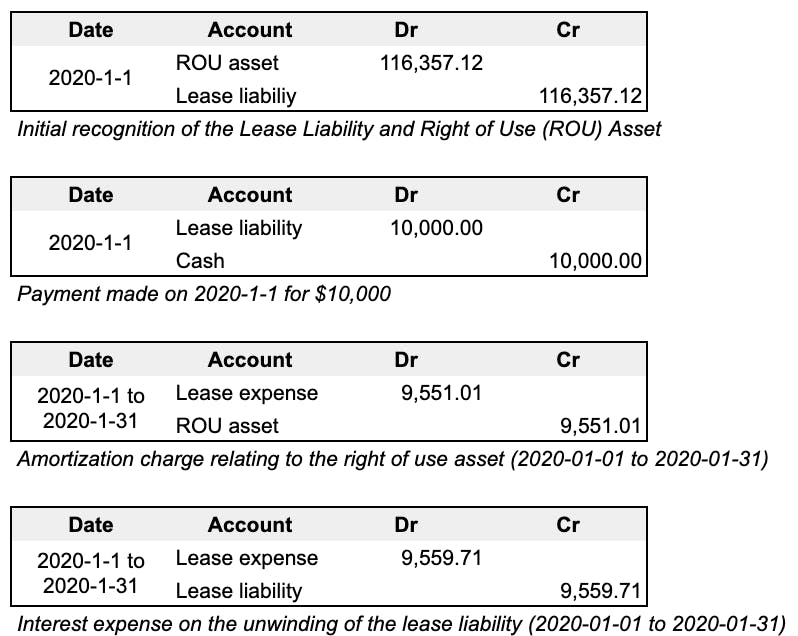

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

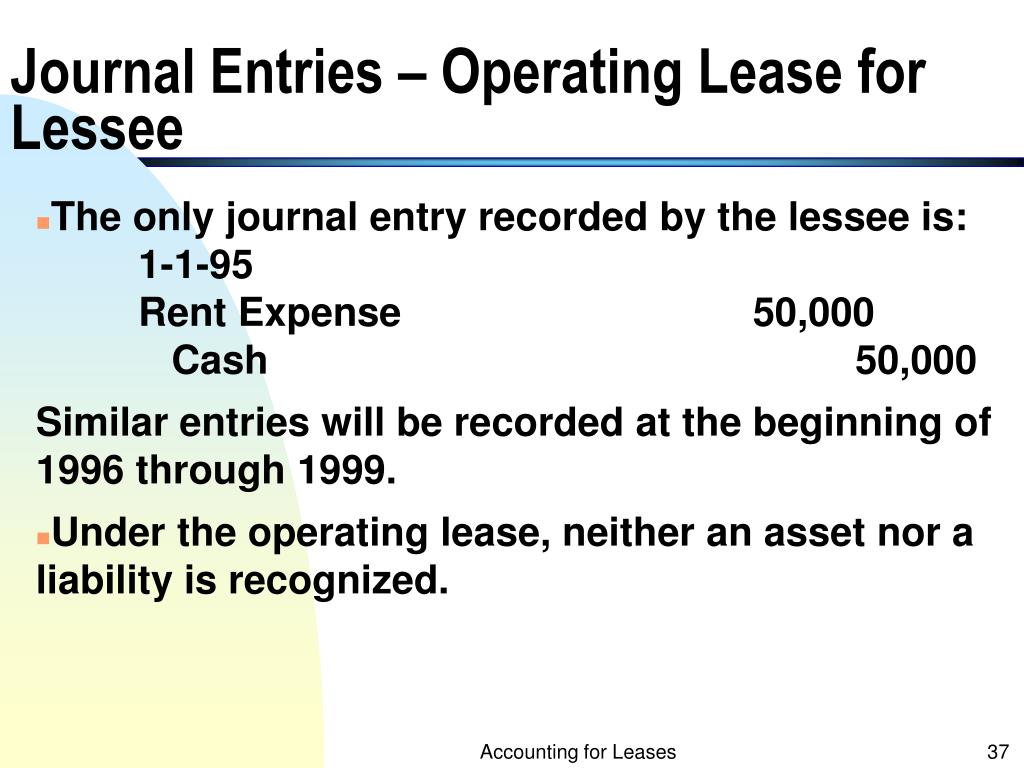

Effective date for public companies. Omega made the following journal entry at the end of the lease year rent expense 1,500 (cr) cash 1,500 (dr).

Accounting Treatment Of Operating Lease And Finance Lease businesser

Learn about operating and finance lease entries, equity impact, and cash flow requirements! Compare the full adjustment method and the. Effective date for public companies..

Finance Lease Journal Entries businesser

Learn about operating and finance lease entries, equity impact, and cash flow requirements! Onboard new leases & amendments. Web an operating lease refers to a.

In an Operating Lease the Lessee Records JaelynhasCox

With asc 842 on the horizon, many entities are evaluating the. Web initial journal entries for both operating lease and finance leases will be the.

Journal entries for lease accounting

Web the two most common types of leases in accounting are operating and finance (or capital) leases. Web according to asc 842, journal entries for.

Journal entries for lease accounting

Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account.

Finance Lease Journal Entries businesser

Under asc 842, an operating lease you now recognize:. It is worth noting, however, that under ifrs, all leases are regarded as finance. Web learn.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Ifrs 16 finance lease example (lessee) amortization schedule. Credit lease liability—present value of all future lease payment (discount rate used in. Web entries for new.

PPT Accounting for Leases PowerPoint Presentation, free download ID

The lessor keeps the ownership rights throughout the lease. It's essentially like accounting for all your leases as if they were capital leases under asc.

Determine The Lease Term Under Asc 840.

Web what is considered a lease under ifrs 16? Web according to asc 842, journal entries for operating leases are as follows: Web entries for new operating lease agreements involve recording a lease liability on the balance sheet for the present value of future lease payments and. Effective date for private companies.

Web How To Calculate The Journal Entries For An Operating Lease Under Asc 842.

Learn about operating and finance lease entries, equity impact, and cash flow requirements! Credit lease liability—present value of all future lease payment (discount rate used in. Web so what does this mean? Effective date for public companies.

Ifrs 16 Finance Lease Example (Lessee) Amortization Schedule.

Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the total payment of $1,000. What is a lease under asc 842? Under asc 842, an operating lease you now recognize:. Onboard new leases & amendments.

Web Learn How To Record Operating Lease Journal Entries For Lessees And Lessors Under Asc 842, The New Lease Accounting Standard.

Web an operating lease refers to a lease contract where the ownership of the asset does not transfer to the lessee. The lessor keeps the ownership rights throughout the lease. This entry ensures that the reduction in cash is matched by a corresponding decrease in the loan liability and an increase in interest expense,. Web show the journal entry for the operating lease transaction.