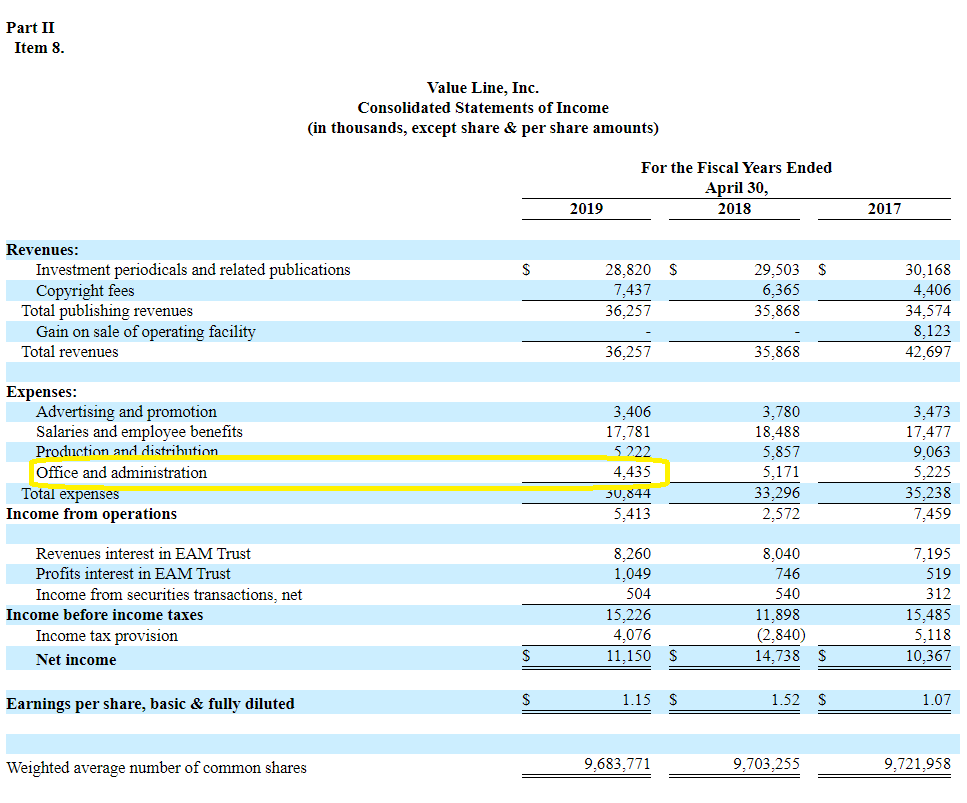

Operating Lease Accounting Journal Entries Example - What does asc 842 mean in practice for you and your team if you lease equipment or real estate under an operating lease? Example 1 example 1 scenario; Effective date for public companies. Let’s walk through a lease accounting example. At the end of the lease, the equipment will revert to the lessor. Operating lease accounting under asc 842 and examples. Annual payments of $28,500 are to be made at the beginning of each year. On the asc 842 effective date, determine the total payments remaining Web operating lease accounting example and journal entries. An operating lease is an agreement to use and operate an asset without the transfer of ownership.

Finance Lease Journal Entries businesser

A lease may meet the lessor finance lease criteria even when control of the underlying asset is not transferred to the lessee (e.g., when the.

Journal entries for lease accounting

Web understanding asc 842 journal entries for lease accounting. What does asc 842 mean in practice for you and your team if you lease equipment.

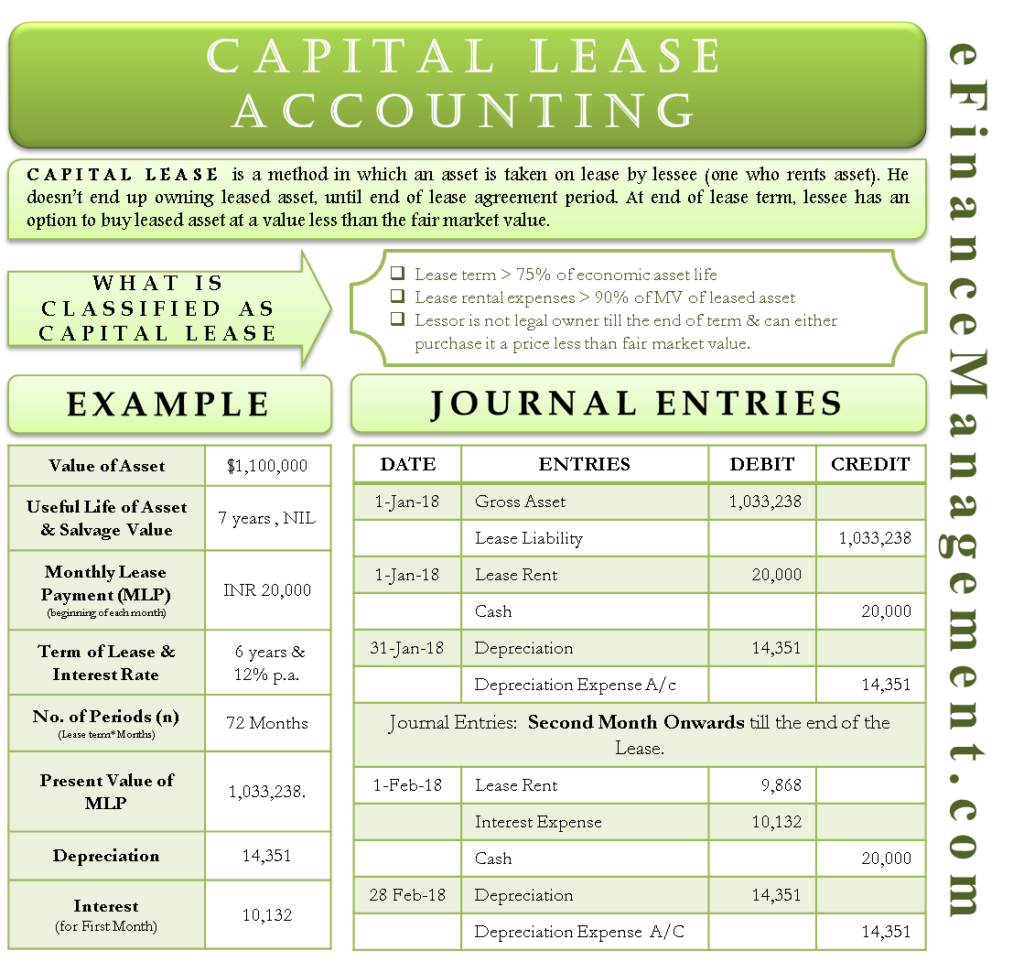

Capital Lease Accounting With Example and Journal Entries

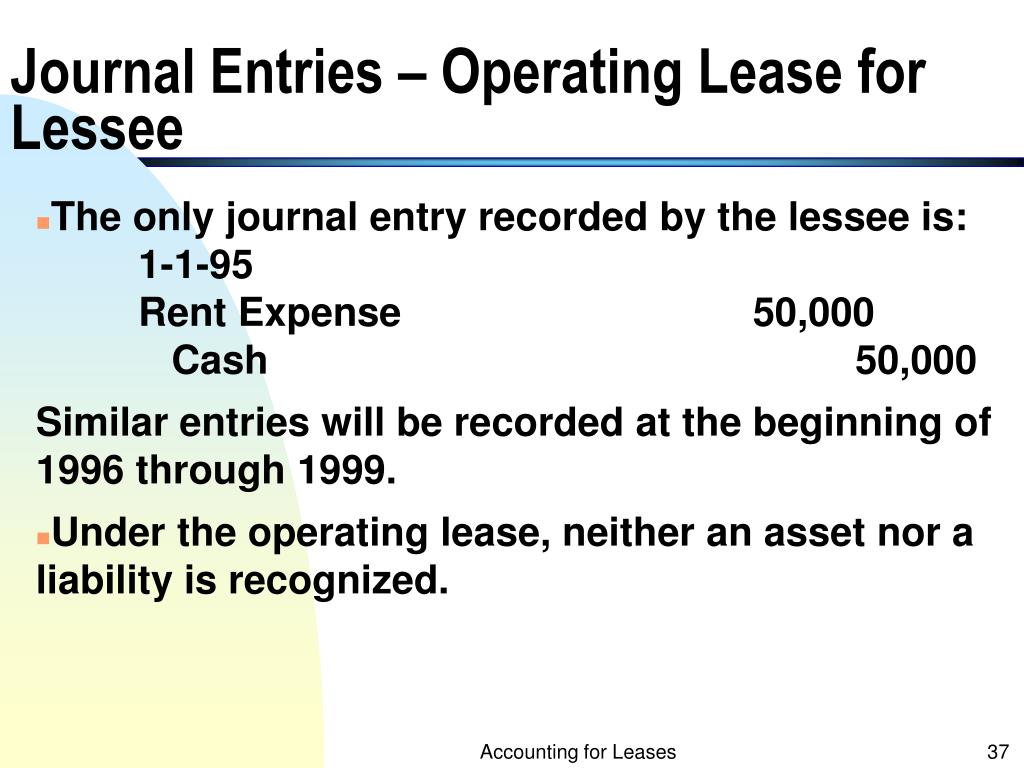

The journal entry for an operating lease happens in two spots. It is debited as a rental expense and credited as cash. Web rent per.

Finance Lease Journal Entries Lessor businesser

First, assume a tenant signs a lease document with the following terms: What’s covered and what’s not covered? Recognizing rou assets and lease liabilities. In.

Journal entries for lease accounting

Here, we’ll break down operating lease journal entries simply and straightforwardly, including both the lessee and lessor sides. As a result, the new journal entries.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Effective date for public companies. The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases. An operating.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Accounting for an operating lease under asc 840; Web what is an operating lease? What’s covered and what’s not covered? Determine the total lease payments.

Finance Lease Journal Entries businesser

Details on the example lease agreement: Web what is an operating lease? Web let us consider the following examples to understand how to record operating.

Journal entries for lease accounting

Let’s walk through a lease accounting example. In this case, the company abc ltd. Common assets that are leased include real estate, automobiles, aircraft, or.

Determine The Total Lease Payments Under Gaap;

On the asc 842 effective date, determine the total payments remaining Annual payments of $28,500 are to be made at the beginning of each year. This article serves just that purpose. Web what is an operating lease?

An Operating Lease Is An Agreement To Use And Operate An Asset Without The Transfer Of Ownership.

Details on the example lease agreement: Modification accounting for an operating lease under asc 842; Recognizing rou assets and lease liabilities. A lease may meet the lessor finance lease criteria even when control of the underlying asset is not transferred to the lessee (e.g., when the lessor obtains a residual value guarantee from a party other.

By Obaidullah Jan, Aca, Cfa And Last Modified On May 8, 2020.

Web under asc 842, all operating leases must be recorded on your balance sheet. Web operating lease accounting example and journal entries. Determine the lease term under asc 840; Leases a car from xyz ltd.

For One Month In November 2020.

Let's consider an operating lease on 1st january 2023 with the following initial values: Operating lease is a lease which does not involve transfer of risks and rewards of ownership of the leased asset to the lessee. Under asc 842 operating lease journal entries require recording: As a result, the new journal entries required by asc 842 to recognize the lease commencement would look like the following: