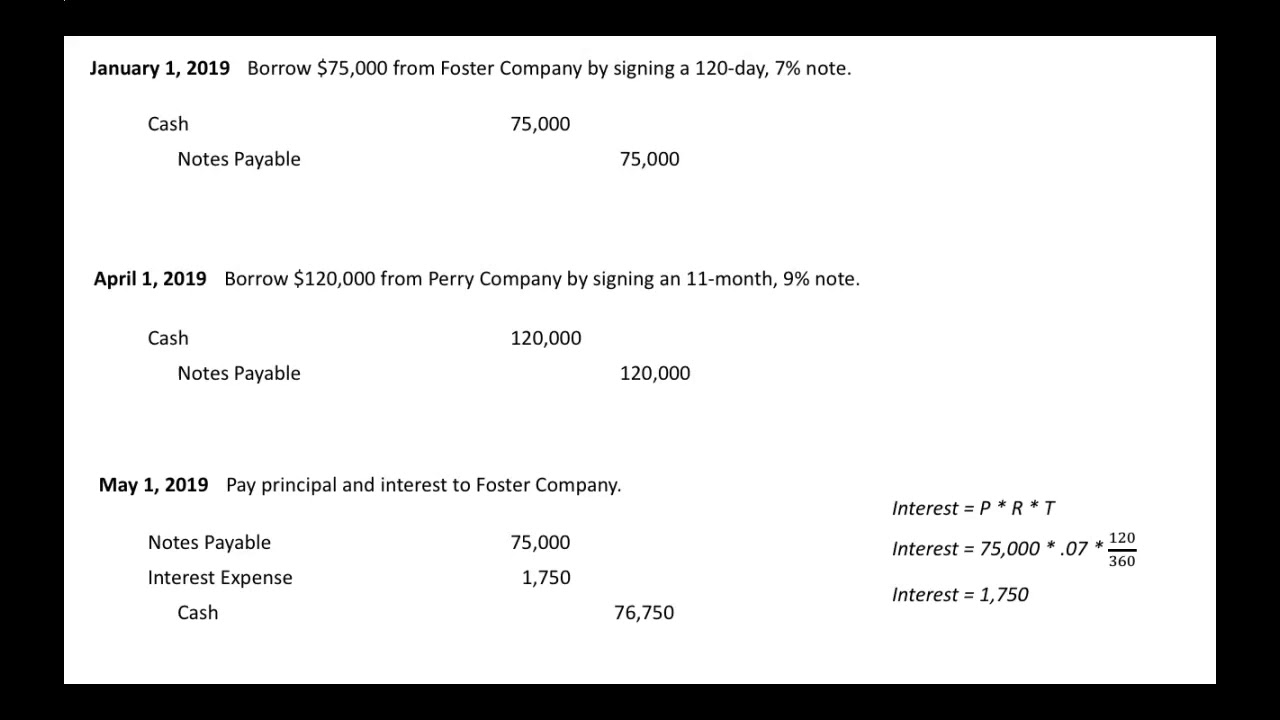

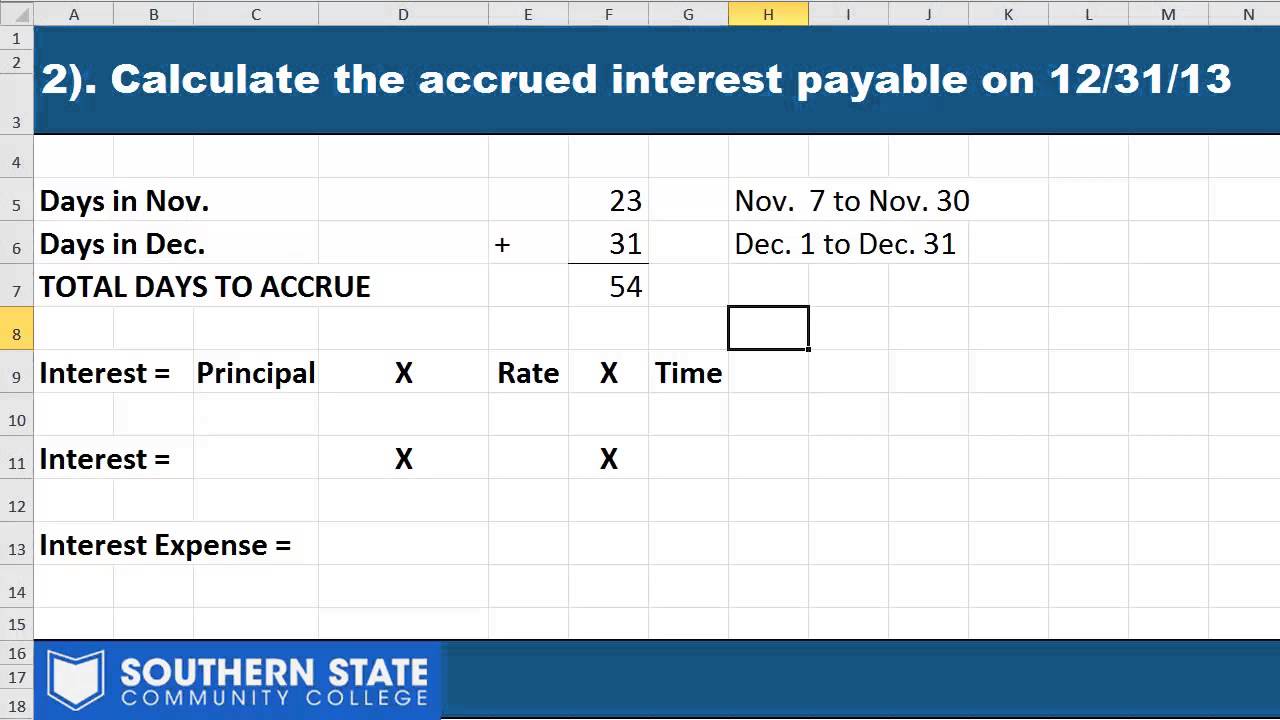

Notes Payable With Interest Journal Entry - The following is an example of notes payable and the corresponding interest, and how each is recorded as a journal. Present value = 1,000 face amount =. Web notes payable is an instrument to extend loans or to avail fresh credit in the company. Web record journal entries related to notes payable. Alternatively, we don’t need to record the accrued interest on the note payable for the. Web interest is now included as part of the payment terms at an annual rate of 10%. In this journal entry, the company debits the interest payable account to eliminate the liability that it has previously recorded at the period. Web divide $3,600 by 12 to get $300 in monthly interest. Web this journal entry of accrued interest on note payable will increase total expenses on the income statement and total liabilities on the balance sheet by the same amount of $500. The result of this entry is to record an interest expense of $1,800 and to reduce the carrying value of.

Notes Payable

The result of this entry is to record an interest expense of $1,800 and to reduce the carrying value of. Present value = 1,000 face.

Notes Payable (Journal Entries) YouTube

Alternatively, we don’t need to record the accrued interest on the note payable for the. The carrying value of these notes will be: For example,.

Notes Payable Journal Entries YouTube

Web divide $3,600 by 12 to get $300 in monthly interest. Received 1,000 in cash and issued a 1,000incashandissueda 1,100 note payable. The issuer will.

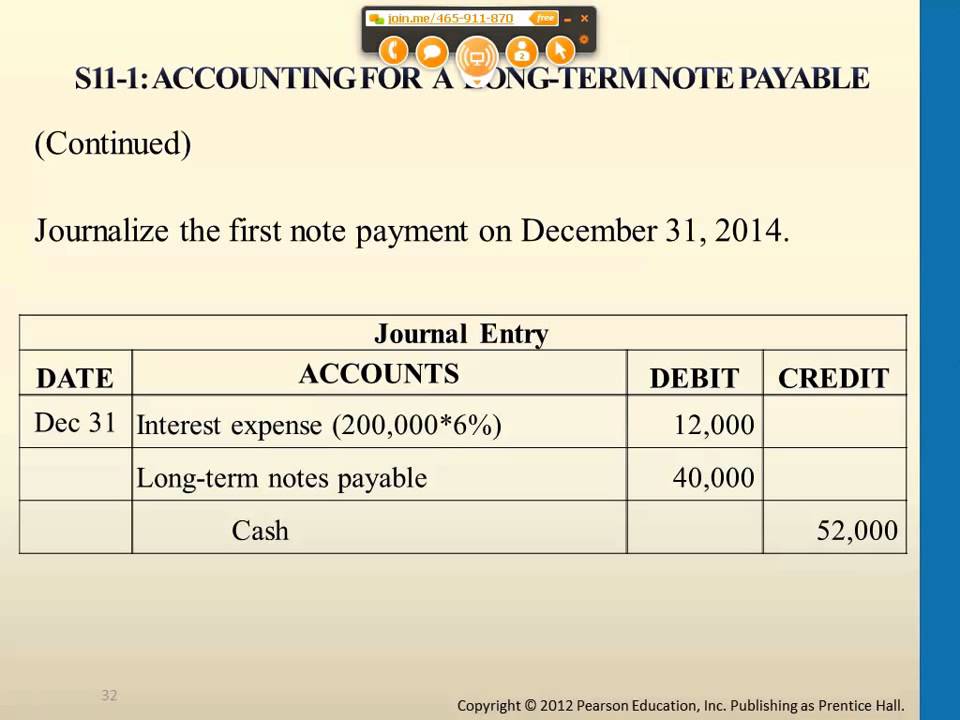

Accounting for a Note Payable YouTube

Web record journal entries related to notes payable. Web interest is now included as part of the payment terms at an annual rate of 10%..

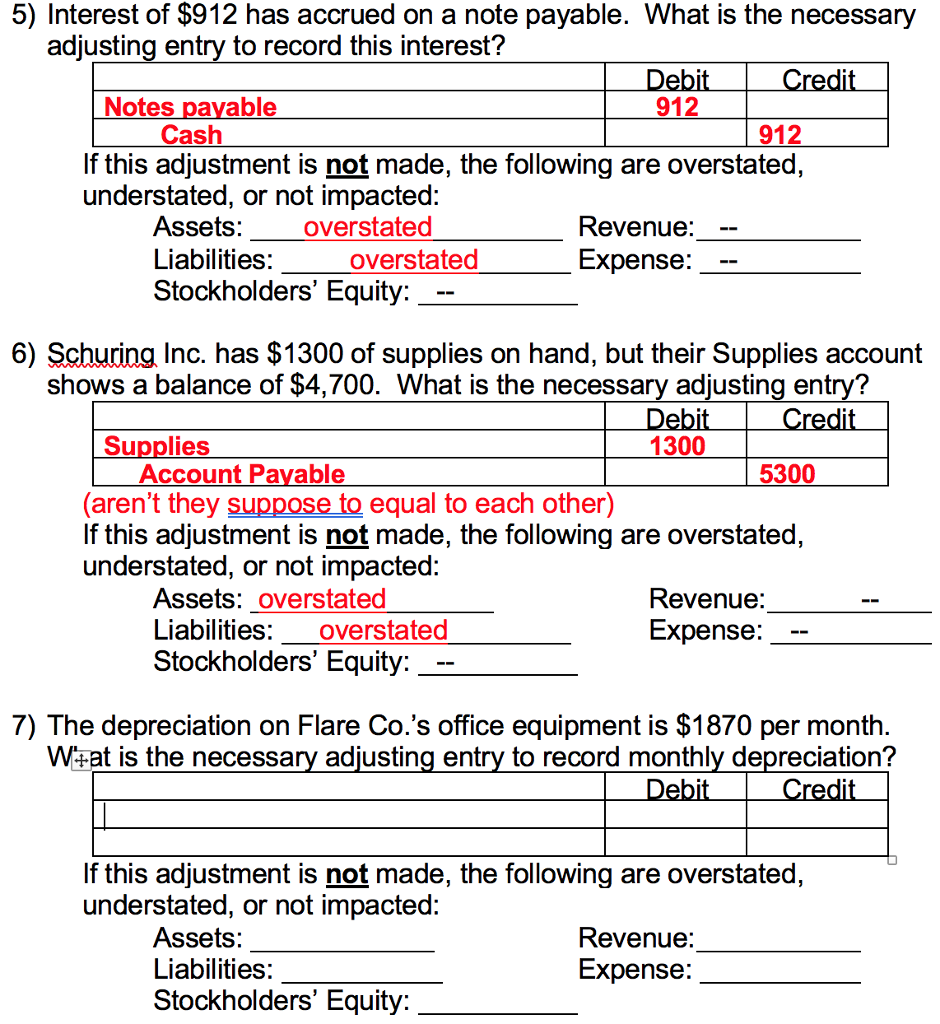

Solved 5) Interest of 912 has accrued on a note payable.

Suppose ram inc issued a note payable for 29,200 payables in 1 year and received. Web interest is now included as part of the payment.

Notes Payable

Web the journal entry for the interest payable should include the amount of interest that is owed and the period in which it was incurred..

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

Present value = 1,000 face amount =. For example, assume the company’s accounting year ends on december 31. Web this journal entry will eliminate the.

Accounting for a Long Term Note Payable YouTube

Web this journal entry of accrued interest on note payable will increase total expenses on the income statement and total liabilities on the balance sheet.

Mortgage Note Payable (Journal Entries) YouTube

Web divide $3,600 by 12 to get $300 in monthly interest. The company can make the interest. Received 1,000 in cash and issued a 1,000incashandissueda.

Web Payment Of Note Payable With Interest On January 1, 2022:

The company can make the interest. Received 1,000 in cash and issued a 1,000incashandissueda 1,100 note payable. Web record journal entries related to notes payable. Web this journal entry is made to eliminate the interest payable that we have recorded above.

Suppose Ram Inc Issued A Note Payable For 29,200 Payables In 1 Year And Received.

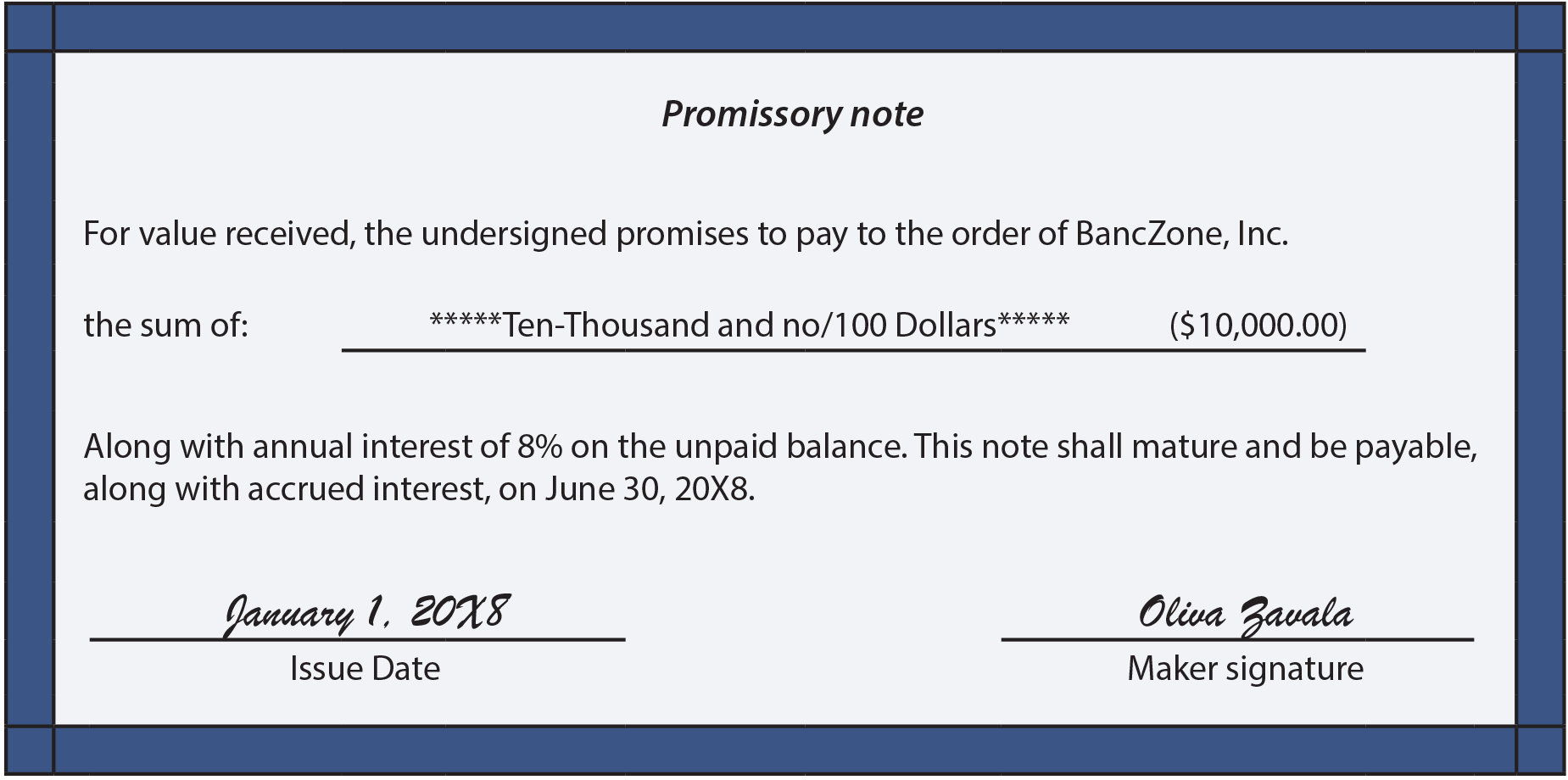

This journal entry will eliminate the $50,000 note payable that we have recorded on july 1, 2021, as well as the $2,500. Some key characteristics of this written promise to pay (see figure. Web in notes payable accounting there are a number of journal entries needed to record the note payable itself, accrued interest, and finally the repayment. When the company makes the payment on the interest of notes payable, it can make journal entry by debiting the interest payable account and crediting the cash account.

Web Notes Payable Is An Instrument To Extend Loans Or To Avail Fresh Credit In The Company.

The debit side of the journal entry should. The issuer will need to amortize the notes over the. The carrying value of these notes will be: Web the journal entry for the interest payable should include the amount of interest that is owed and the period in which it was incurred.

Yourco Borrows $100,000 From The Bank On December 1 Of 20X1 At 12% Interest (Compounded.

Present value = 1,000 face amount =. Web a journal entry example of notes payable. At the end of each month, make an interest payable journal entry by debiting. The following is an example of notes payable and the corresponding interest, and how each is recorded as a journal.