Notes Payable Accounting Journal Entry - Credit the notes payable account for rs. Interest expense will need to be entered and paid each quarter for the life of the note, which is two years. Web in notes payable accounting there are a number of journal entries needed to record the note payable itself, accrued interest, and finally the repayment. Any transaction related to purchasing goods or services on credit results in an accounts payable liability. The result of this entry is to record an interest expense of $1,800 and to reduce the carrying value of the notes. Notes payable is a promissory note that represents the loan the company borrows from the creditor such as bank. Web a journal entry in accounting records financial transactions, detailing accounts involved, amounts, and dates,. We can suggest a note payable to be the written. Learn the different types of payroll journal entries with examples. On the other hand, when the same is recorded as an asset by lenders, it is.

Notes Payable

Web a note payable is an unconditional written promise to pay a specific sum of money to the creditor, on demand or on a defined.

journal entry format accounting accounting journal entry template

Web the journal entry to record a note with interest included in face value (also known as a note issued at discount), is as follows:.

Accounting Journal Entries For Dummies

We can suggest a note payable to be the written. In addition, the amount of interest charged is recorded as part of the initial. Web.

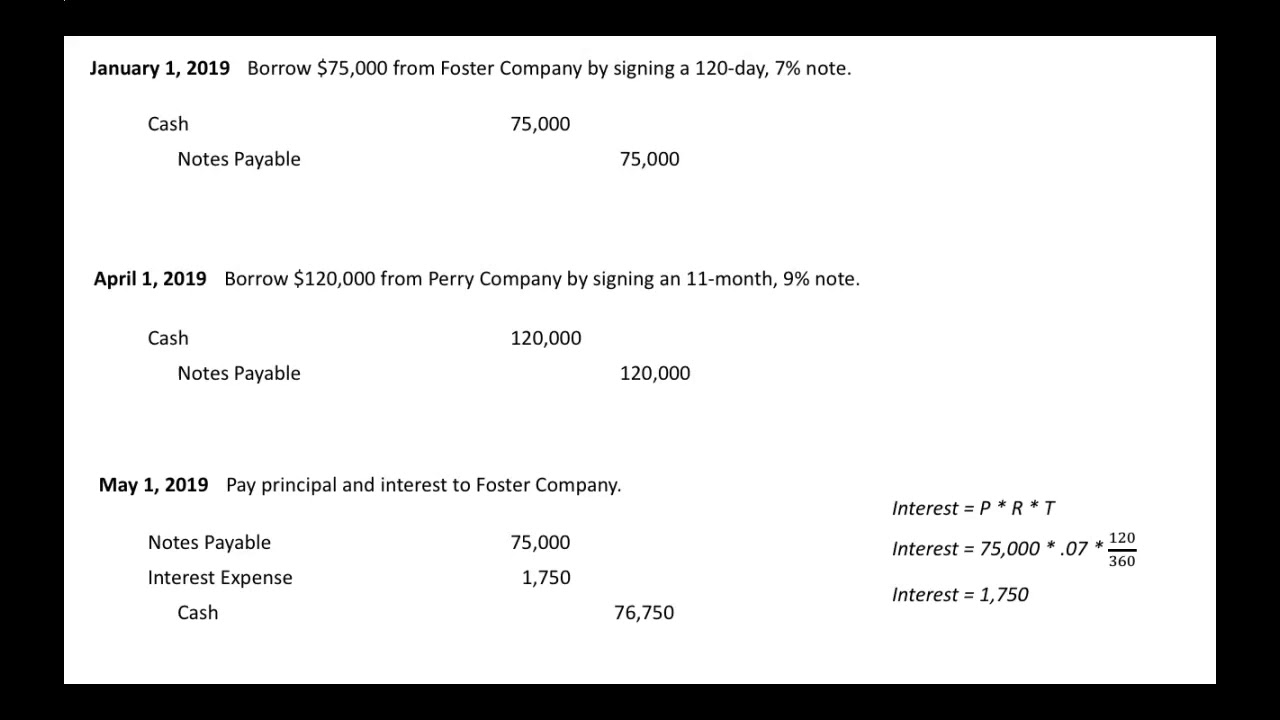

Notes Payable (Journal Entries) YouTube

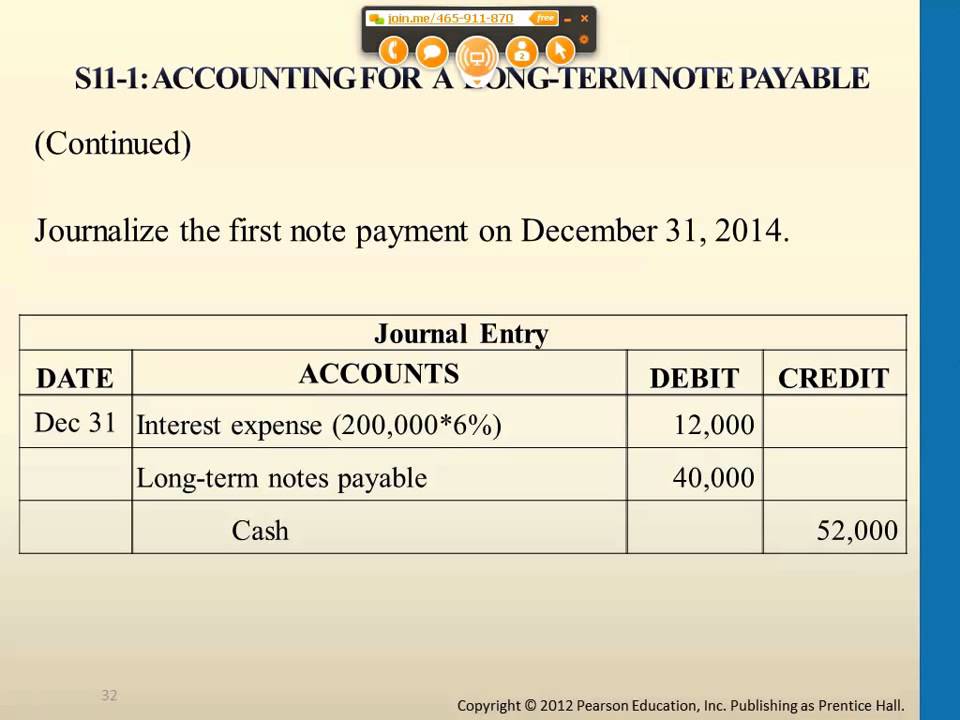

Web the journal entry to record the payment for the first year is: Credit the notes payable account for rs. Web when borrowers make the.

Journal Entries Accounting

Web note payable is credited for the principal amount that must be repaid at the end of the term of the loan. Web what is.

Accounting for a Long Term Note Payable YouTube

Web a note payable is an unconditional written promise to pay a specific sum of money to the creditor, on demand or on a defined.

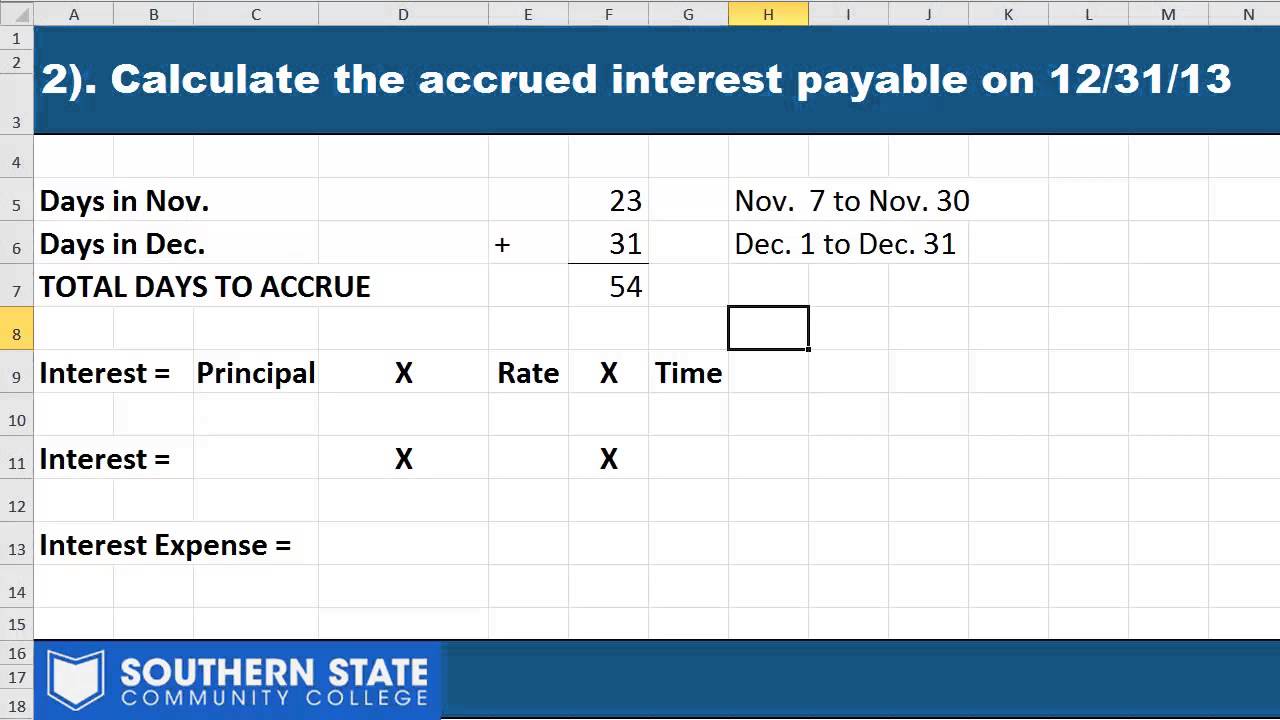

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

Notes payable is a promissory note that represents the loan the company borrows from the creditor such as bank. Any transaction related to purchasing goods.

Accounting for a Note Payable YouTube

Web therefore, a combination of accounts payable and accounts receivable is important for your business’s performance. The concept of accounts payable and notes payable are.

Notes Payable Journal Entries YouTube

Some key characteristics of this written promise to pay (see figure. On the other hand, when the same is recorded as an asset by lenders,.

Some Key Characteristics Of This Written Promise To Pay (See Figure.

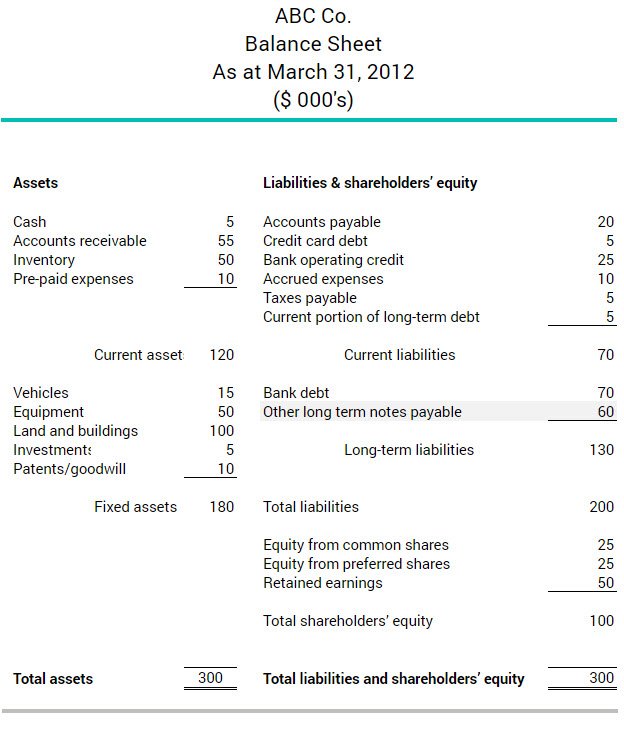

Credit the notes payable account for rs. Web the balance in notes payable represents the amounts that remain to be paid. Notes payable are the portion of the current liability section on the. Notes payable is a promissory note that represents the loan the company borrows from the creditor such as bank.

Accounts Payable Are Recorded In The Balance Sheet Under Current Liabilities.

Web on february 1, 2019, the company must charge the remaining balance of discount on notes payable to expense by making the following journal entry. The concept of accounts payable and notes payable are often mixed up. It is supported by a formal written. This is recorded on the balance sheet as a liability.

Web Accounts Payable Journal Entry Is The Method Of Recording Payables Data In The General Ledger.

Some key characteristics of this written promise to pay (see (figure)). The result of this entry is to record an interest expense of $1,800 and to reduce the carrying value of the notes. Web a journal entry in accounting records financial transactions, detailing accounts involved, amounts, and dates,. Likewise, the company needs to make the notes payable journal entry when it signs the promissory.

Learn The Different Types Of Payroll Journal Entries With Examples.

Web what is the definition of notes payable? Web as you repay the loan, you’ll record notes payable as a debit journal entry, while crediting the cash account. In addition, the amount of interest charged is recorded as part of the initial. Observe that the $1,000 difference is initially recorded.