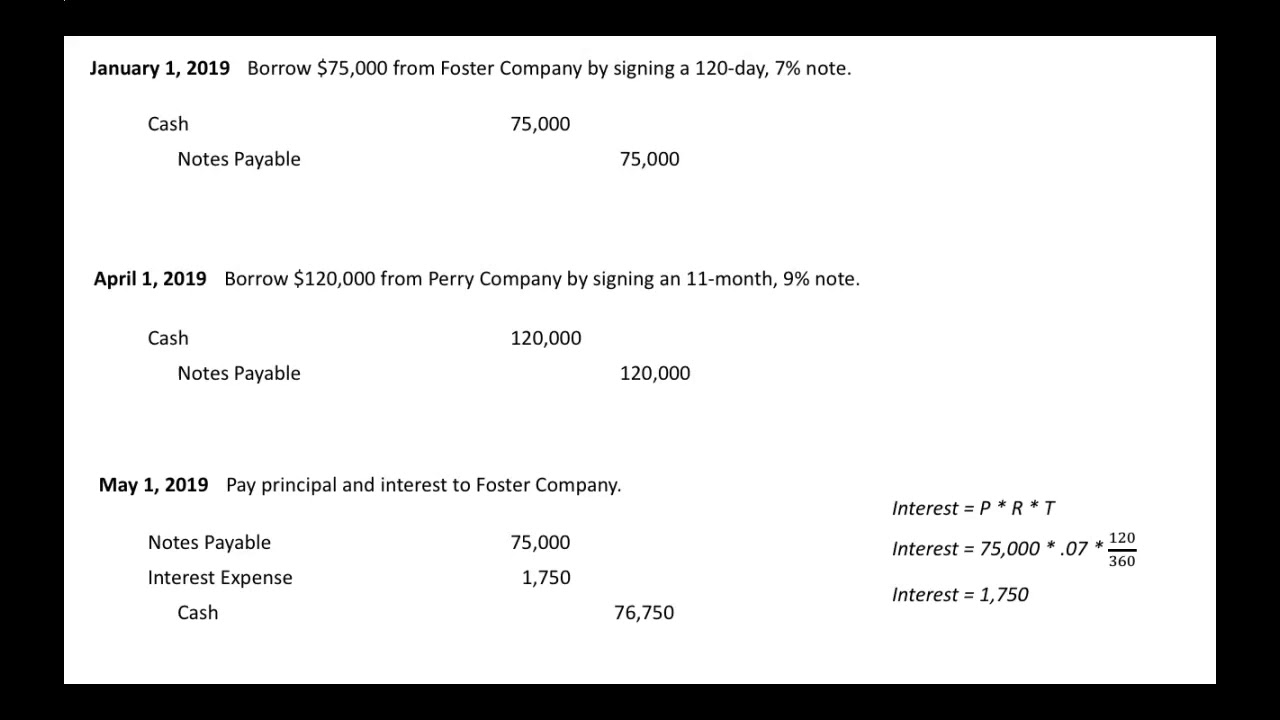

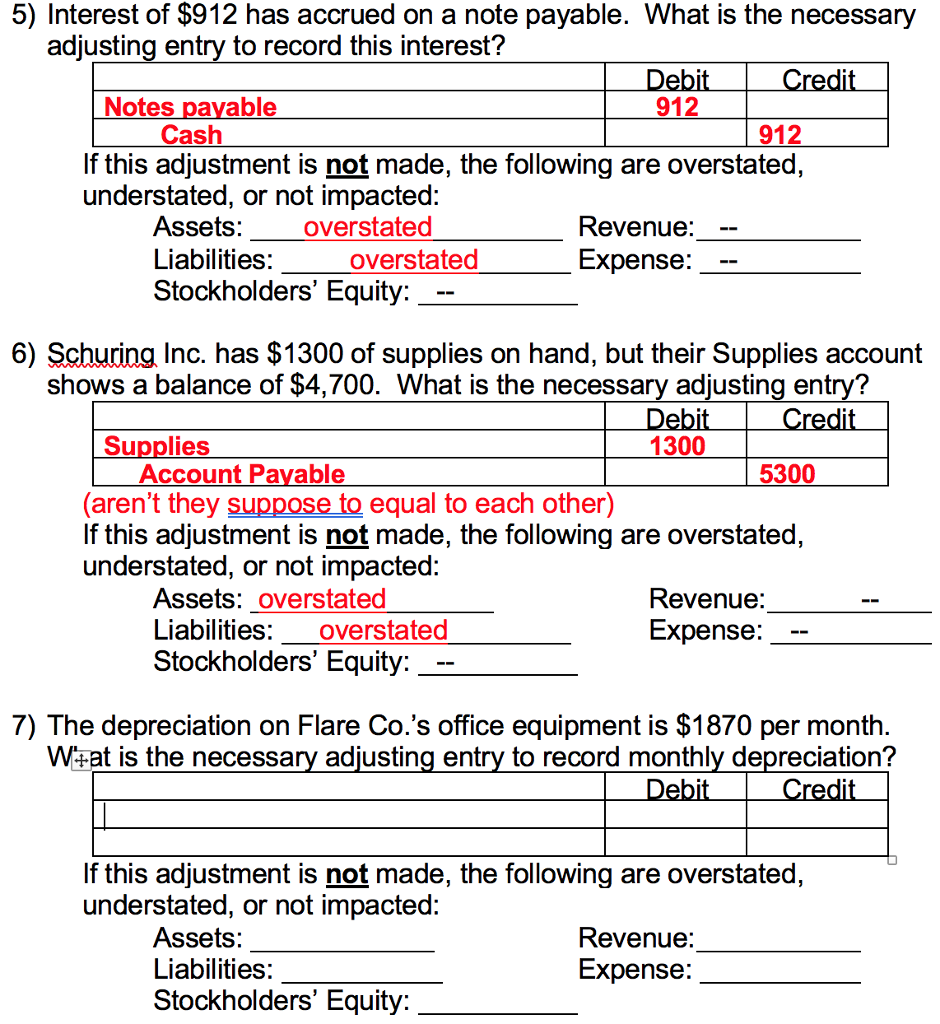

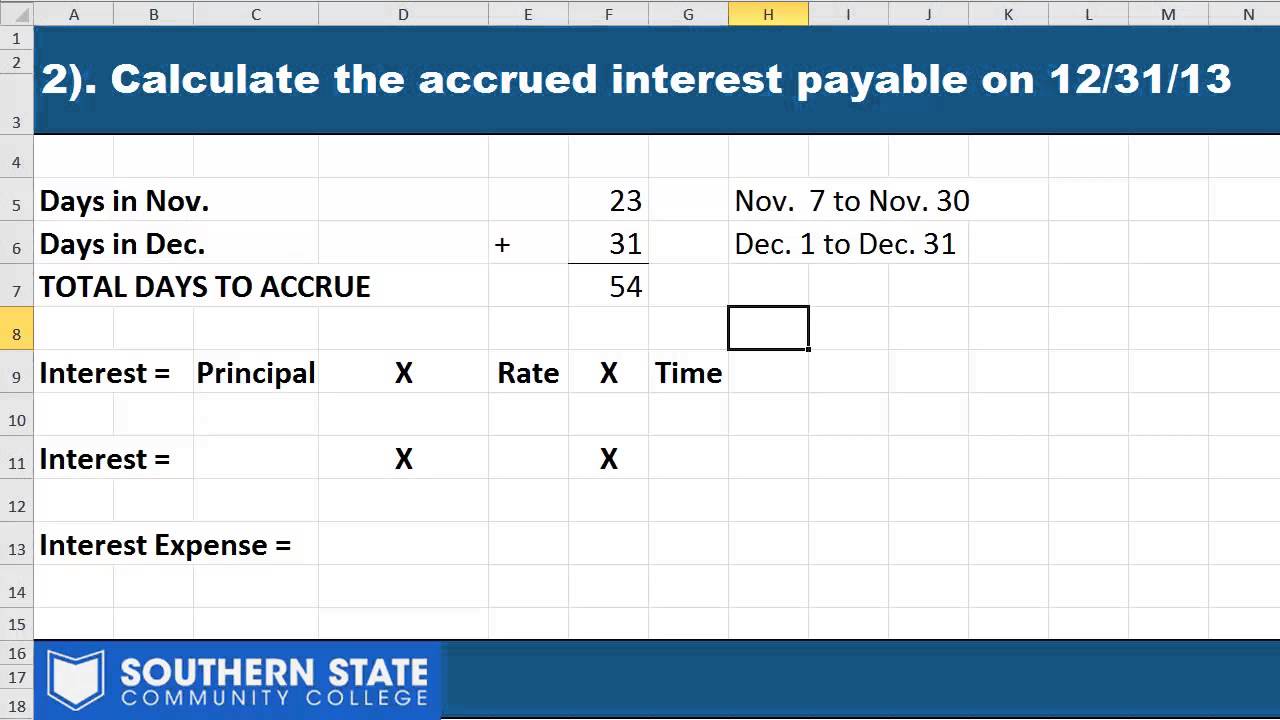

Note Payable Interest Journal Entry - At the end of the month, company needs to record interest payable and interest expense. The company can calculate the interest on note payable by multiplying the face value of the note payable with the interest rate and the. The journal entry debit interest. Note payable scenarios also play a role. Observe that the $1,000 difference is initially. Web record journal entries related to notes payable. Web journal entries for notes payable. It is supported by a formal written. Web a note payable is a loan contract that specifies the principal (amount of the loan), the interest rate stated as an annual percentage, and the terms stated in number of days,. Interest payable is an entity’s debt or lease.

Note Payable Calculating Maturity date and Journal Entries (MOM

In this journal entry, the company debits the interest payable account to eliminate the liability that it has previously recorded at the period. It is.

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

The company can calculate the interest on note payable by multiplying the face value of the note payable with the interest rate and the. The.

Notes Payable (Journal Entries) YouTube

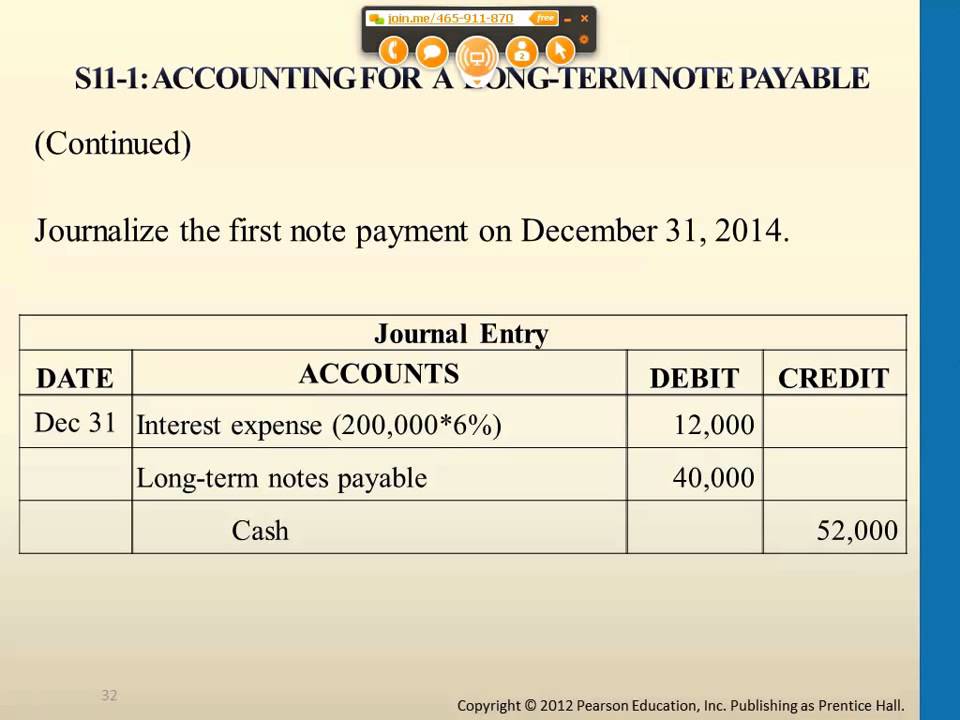

It will be classified as the note payable which is the noncurrent liability on the. Web journal entries for notes payable. Web calculate interest on.

Accounting for a Long Term Note Payable YouTube

The company receives from the bank the principal borrowed; Web calculate interest on note payable. Web journal entries for notes payable. Web the journal entry.

Solved 5) Interest of 912 has accrued on a note payable.

For example, on january 1, 2016, fbk company acquired a computer for $30,000 in cash and a $75,000 note due on. Issued notes payable for.

Mortgage Note Payable (Journal Entries) YouTube

Web a note payable is a loan contract that specifies the principal (amount of the loan), the interest rate stated as an annual percentage, and.

Mortgage Payable Journal Entry

Let’s discuss the various instances of notes payable with examples in each of the following circumstances: Web a note payable is a loan contract that.

Notes Payable Journal Entries YouTube

Observe that the $1,000 difference is initially. Web a note payable is a loan contract that specifies the principal (amount of the loan), the interest.

Notes Payable

Interest payable on balance sheet; It will be classified as the note payable which is the noncurrent liability on the. The company can calculate the.

Observe That The $1,000 Difference Is Initially.

Yourco borrows $100,000 from the bank on december 1 of 20x1 at 12% interest (compounded. Web journal entry to accrue interest payable; When the company makes the payment on the interest of notes payable, it can make journal entry by debiting the interest payable account and crediting the cash account. The company receives from the bank the principal borrowed;

It Will Be Classified As The Note Payable Which Is The Noncurrent Liability On The.

Note payable scenarios also play a role. Your small business must make an adjusting entry in your records at the end of each month to account for the interest. It is supported by a formal written. In this journal entry, the company debits the interest payable account to eliminate the liability that it has previously recorded at the period.

Some Key Characteristics Of This Written Promise To Pay (See (Figure)).

At the end of the month, company needs to record interest payable and interest expense. When the note matures, the. The journal entry debit interest. Web a note payable is a loan contract that specifies the principal (amount of the loan), the interest rate stated as an annual percentage, and the terms stated in number of days,.

Web Journal Entries For Notes Payable.

Web the journal entry to record a note with interest included in face value (also known as a note issued at discount), is as follows: The company can calculate the interest on note payable by multiplying the face value of the note payable with the interest rate and the. Interest payable on balance sheet; Web we can make the journal entry for purchasing equipment with note payable by debiting the equipment account as a fixed asset on our balance sheet and crediting the notes.