Non Controlling Interest Journal Entries - Presenting the new standards in the classroom. Nci can be created in. Web under the proportionate interest model only the acquirer’s interest in the goodwill is recognised (a lesser amount). Web accounting for noncontrolling interests: Owns >= 50% + 100% of sub co. Web noncontrolling interests = old nci + net income to nci + dividends received from partially owned companies if parent co. The following example shows the basic effect. The share value is measured by the fair value of the subsidiary’s net asset plus the retain earning portion minus the dividend since the acquisition date. Nci based on fair value. Web the shift to the term “noncontrolling interest” will emphasize a parent’s substantive control over a subsidiary rather than a simple ownership percentage and will more usefully.

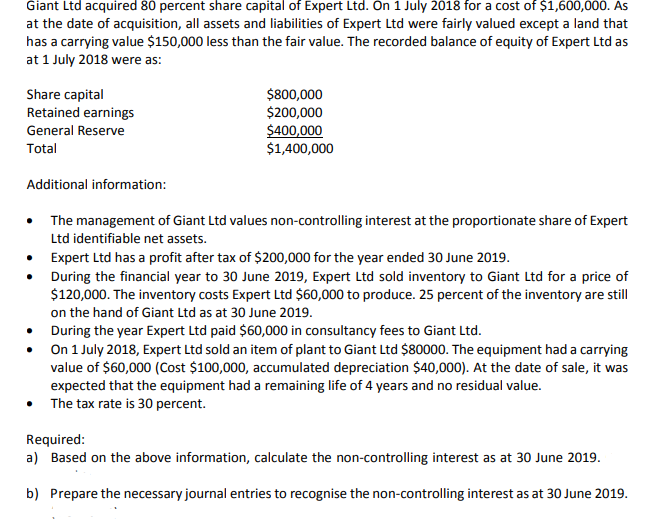

(Answered)Questionhelp_outlinea) Based on the above information

Web the objective of accounting for noncontrolling interests is to present users of the consolidated financial statements with a clear depiction of the portion of.

NonControlling Interests (NCIs) Financial Edge

Nci can be created in. Web the objective of accounting for noncontrolling interests is to present users of the consolidated financial statements with a clear.

Accounting Entries Noncontrolling Interest Accounting Entries

Web under the proportionate interest model only the acquirer’s interest in the goodwill is recognised (a lesser amount). Web noncontrolling interests = old nci +.

Noncontrolling Interests The Full Consolidation Accounting Tutorial

Owns >= 50% + 100% of sub co. Web for subsequent changes in ownership interest that do not result in a change of control, the.

NonControlling Interest (NCI) Formula Example Accountinguide

Fv of net assets at acquisition (w2). Nci can be created in. Web accounting for noncontrolling interests: The share value is measured by the fair.

NonControlling Interest (NCI) Formula + Calculator

Web for subsequent changes in ownership interest that do not result in a change of control, the change in the nci is recorded at its.

Accounting Entries Noncontrolling Interest Accounting Entries

The share value is measured by the fair value of the subsidiary’s net asset plus the retain earning portion minus the dividend since the acquisition.

NonControlling Interest (NCI) Formula + Calculator

Web the objective of accounting for noncontrolling interests is to present users of the consolidated financial statements with a clear depiction of the portion of.

Oracle FCCs Minority Interest Journal Entry FCCs Journal Entry Non

Web the objective of accounting for noncontrolling interests is to present users of the consolidated financial statements with a clear depiction of the portion of.

Web The Shift To The Term “Noncontrolling Interest” Will Emphasize A Parent’s Substantive Control Over A Subsidiary Rather Than A Simple Ownership Percentage And Will More Usefully.

Presenting the new standards in the classroom. Web under the proportionate interest model only the acquirer’s interest in the goodwill is recognised (a lesser amount). Nci based on fair value. Web the objective of accounting for noncontrolling interests is to present users of the consolidated financial statements with a clear depiction of the portion of a less than.

Owns >= 50% + 100% Of Sub Co.

Web accounting for noncontrolling interests: Web noncontrolling interests = old nci + net income to nci + dividends received from partially owned companies if parent co. Web for subsequent changes in ownership interest that do not result in a change of control, the change in the nci is recorded at its proportionate interest of the carrying. Nci can be created in.

The Following Example Shows The Basic Effect.

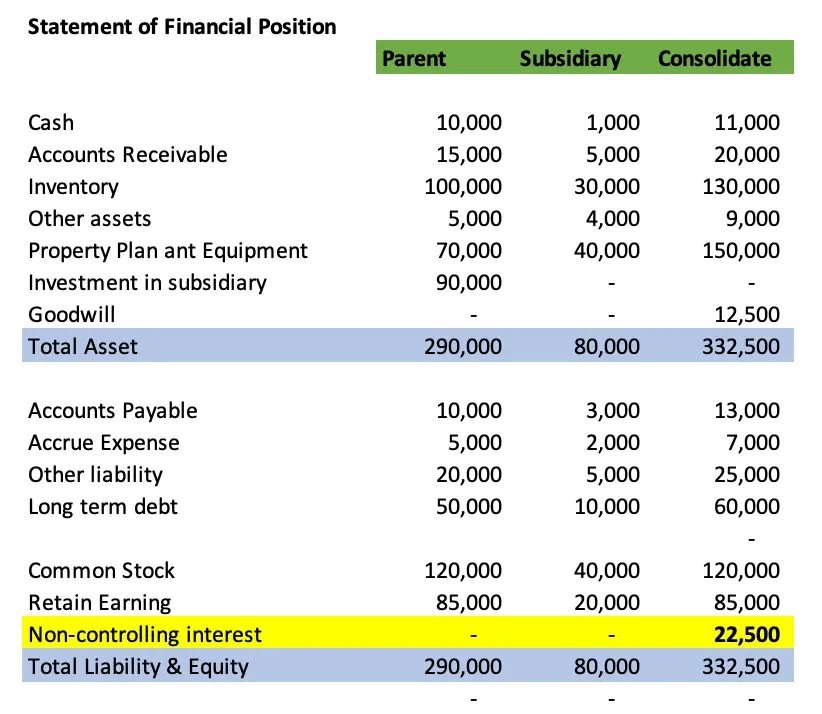

The share value is measured by the fair value of the subsidiary’s net asset plus the retain earning portion minus the dividend since the acquisition date. Fv of net assets at acquisition (w2).