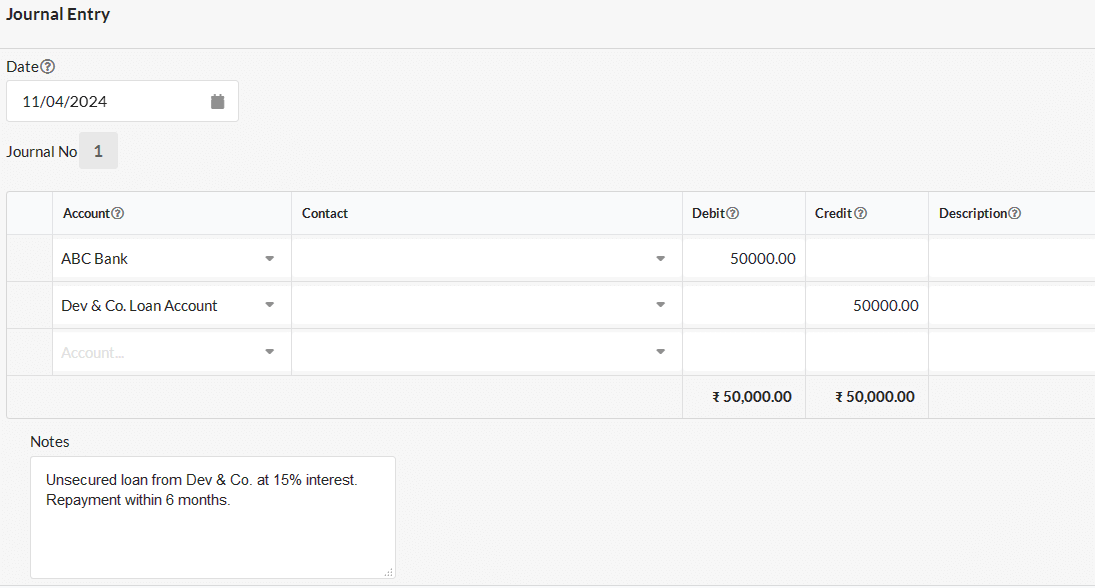

Loan Receivable Journal Entry - On jan 1, 2020, when the company receives cash from the bank for the loan. Once the interest income is accrued (becomes receivable), the journal entry should be. Assignment of accounts receivable is an. Additional journals relating to factoring can be found at our factoring accounts receivable journal entries reference. Web learn how to record loan journal entries for bank loans, car loans, intercompany loans and loan forgiveness in bookkeeping software. By irfanullah jan, acca and last modified on oct 29, 2020. The money is paid direct to the bank account of the business. Web how do you record a loan receivable? To create the journal entry: The bank’s accountant debits the amount in the customer’s loan account.

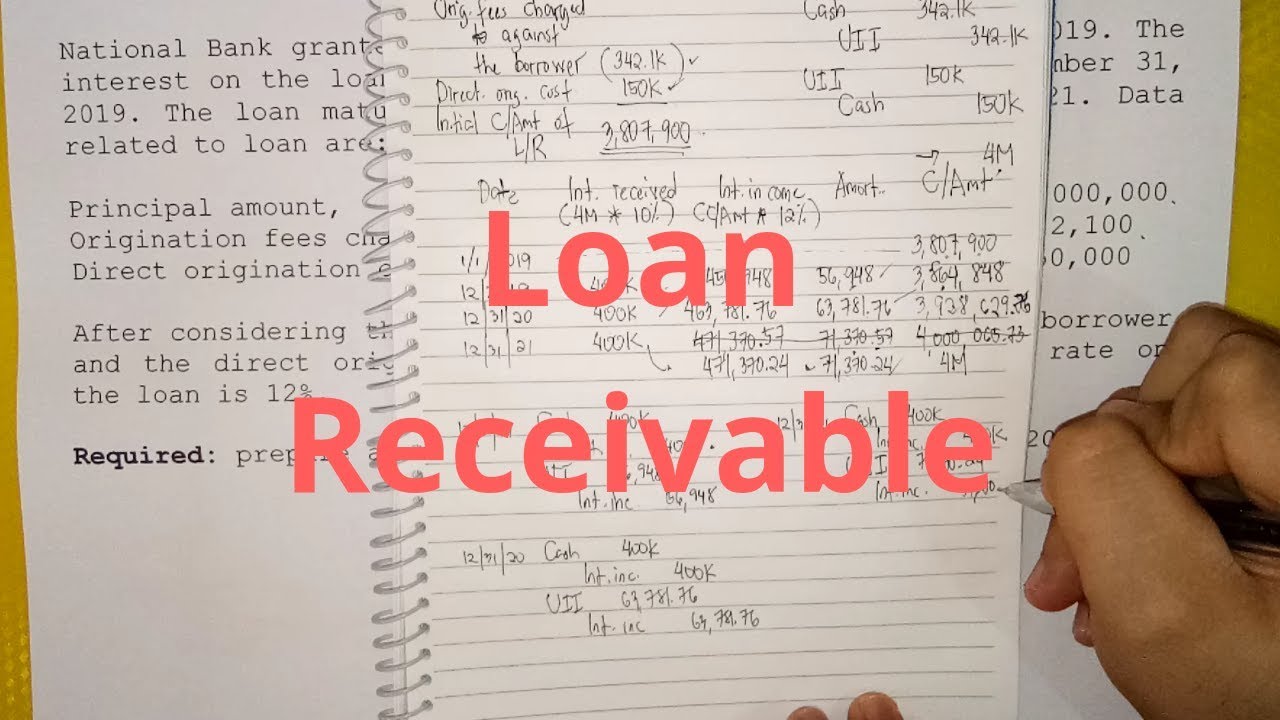

Accounting for Loan Receivable (Part 1) YouTube

Web below is a compound journal entry for loan payment made including both principal and interest component; At the end of the first year when.

Loan Journal Entry Examples for 15 Different Loan Transactions

See the debit and credit accounts, formulas. To create the journal entry: Web journal entries on april 1. Web learn how to record loan journal.

Journal entry for Loan Payable Output Books

Loan/note payable (borrow, accrued interest, and repay) chapter 13: The money is paid direct to the bank account of the business. A business applies to.

journal entry format accounting accounting journal entry template

Web this is how the bank records the transaction: By irfanullah jan, acca and last modified on oct 29, 2020. Web the assignment of accounts.

The Basics Of Loan Receivable What You Need To Know PT. BBU

The bank’s accountant debits the amount in the customer’s loan account. Web journal entries for a loan receivable involve debiting loan receivable and credit cash..

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

To receive a loan the. Web the assignment of accounts receivable journal entries are based on the following information: Once the interest income is accrued.

Bank Loan EMI Entries in Tally ERP9 Loan installment entries Journal

The note comes with a promise from the borrower. This is an official record within your accounting software. Web the main receivables financing journals are.

Journal Entries of Loan Accounting Education

Web the double entries for the asset in year one would be as follows: The notes payable account could have been substituted for. Web loan.

Loan Accounting Entries Business Accounting Basics

Accounts receivable 50,000 on 45 days terms. Interest expense = 50,000 × 12%/12 = 500. Web how do you record a loan receivable? On december.

The Note Comes With A Promise From The Borrower.

To create the journal entry: Web what is the loan journal entry? Web the loan receivable will be recorded as assets on the balance sheet. Under other, select journal entry.

Recording The Initial Loan Is The First Step Of The Payment Process.

Assignment of accounts receivable is an. Notes receivables describe promissory notes that represent loans paid from a company or business to another party. A business applies to a bank and receives a loan of 25,000. Web learn how to record loan journal entries for bank loans, car loans, intercompany loans and loan forgiveness in bookkeeping software.

Web This Is How The Bank Records The Transaction:

This transaction is typically used when a loan is issued by a lender to a borrower. Web journal entries on april 1. The notes payable account could have been substituted for. The money is paid direct to the bank account of the business.

On December 31, 2022, The Interest Accrued On The Loan Must Be Recognized.

At the end of the first year when the company pay the installment. It is considered a current asset when ii is collectible in less than a year and has a normal debit balance. On jan 1, 2020, when the company receives cash from the bank for the loan. Web the double entries for the asset in year one would be as follows: