Loan Payment Journal Entry - For the next line, select. *assuming that the money was due to be paid to abc bank ltd. Debit of $1,500 to loans payable. Web no matter how you track your finances, every journal entry must consist of three things: Enter the amount of the loan under credits. The loan receivable will be recorded as assets on the balance sheet. Web for the purpose of making the loan repayment journal entries it is necessary to split each of the cash payments into the principal and interest elements as they are posted to. Terms of the loan agreement. Web the company’s accountant records the following journal entry to record the transaction: Web following accounting entry is used to account for the repayment of loan:

Loan Journal Entry Examples for 15 Different Loan Transactions

The date of the journal entry, the debit side of the journal entry, and the credit side of the. Web no matter how you track.

Bank Loan Repaid Journal Entry Info Loans

Web learn how to record loan journal entries for bank loans, car loans, intercompany loans and loan forgiveness in bookkeeping software. This is the exact.

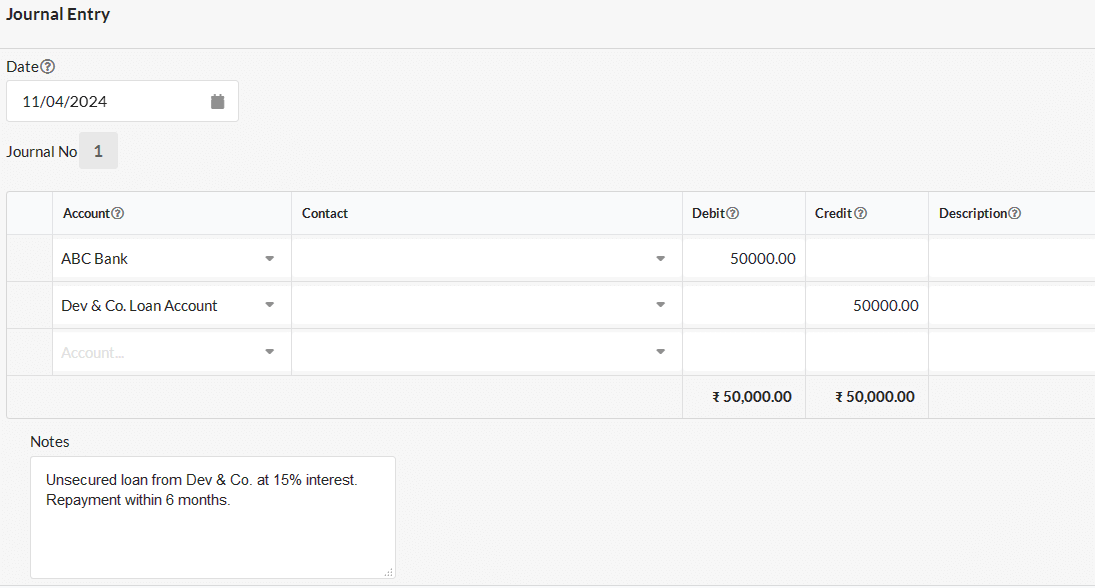

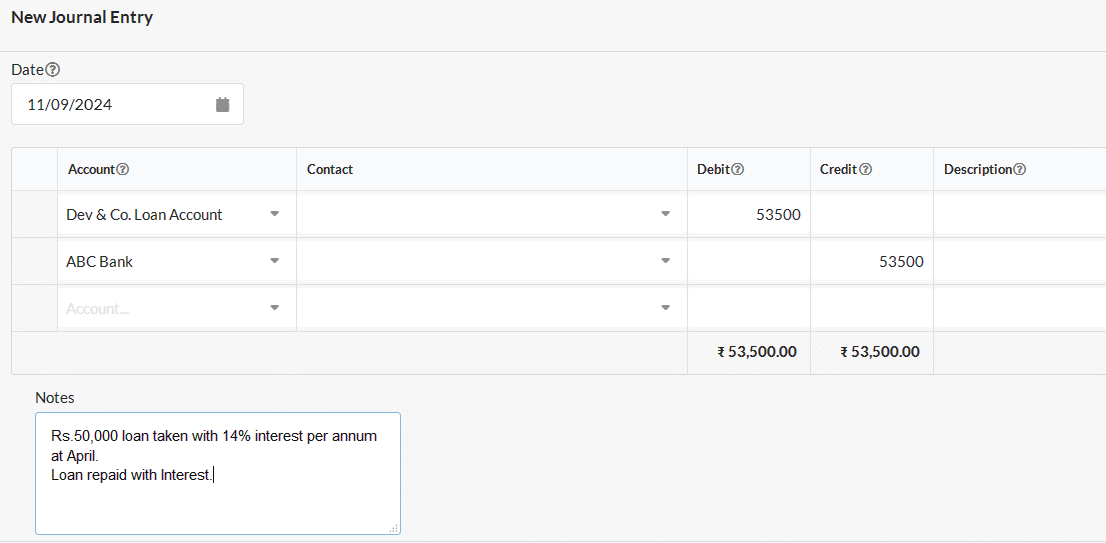

Journal entry for Loan Payable Output Books

Web here are four steps to record loan and loan repayment in your accounts: The date of the journal entry, the debit side of the.

Mortgage Payable Journal Entry

Web no matter how you track your finances, every journal entry must consist of three things: Abc plc received a bank loan of $100,000 on.

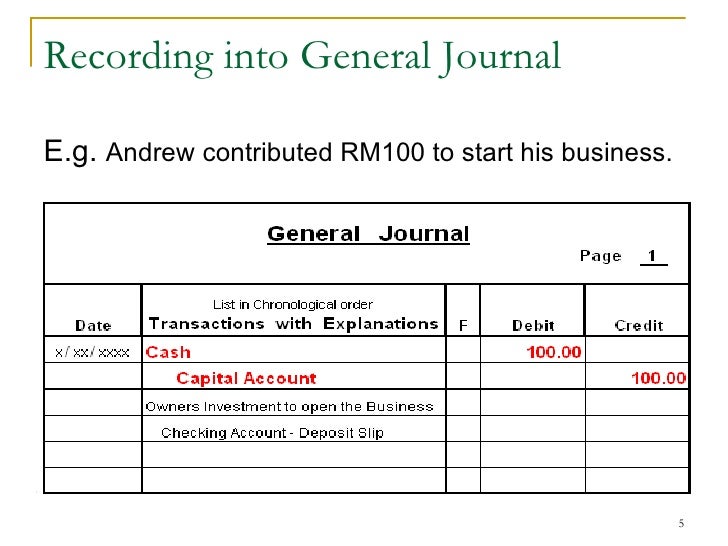

Journal Entry Examples

Web following accounting entry is used to account for the repayment of loan: Web to record a loan from the officer or owner of the.

Journal entry for Loan Payable Output Books

As at december 31, 2022, interest in the amount of $30,000 [$600,000 x 5%] has been accrued on the royal trust bank loan. Web to.

Journal Entries of Loan Accounting Education

Web following accounting entry is used to account for the repayment of loan: The loan receivable will be recorded as assets on the balance sheet..

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Credit of $2,000 to cash. Assets increase on the debit side. The notes payable account could have been substituted for. Web prepare journal entries to.

What Is The Journal Entry For A Loan Payment

Bank (or cash) is an asset. Web to record a loan from the officer or owner of the company, you must set up a liability.

At The End Of The First Year When The Company Pay The Installment.

What is a loan receivable? Debit of $1,500 to loans payable. Web the journal entry is debiting loan receivable and credit cash. Web learn how to record loan journal entries for bank loans, car loans, intercompany loans and loan forgiveness in bookkeeping software.

Assets Increase On The Debit Side.

Web the journal entry for interest paid on loan is as follows; For the next line, select. Debit of $3,000 to loans payable (a liability account) debit of $1,000 to interest. Web here are four steps to record loan and loan repayment in your accounts:

Record The Initial Loan Transaction.

*assuming that the money was due to be paid to abc bank ltd. The notes payable account could have been substituted for. Web no matter how you track your finances, every journal entry must consist of three things: Web following accounting entry is used to account for the repayment of loan:

Web What Is The Loan Journal Entry?

Web i have all the steps you'll need to pay back the business loan using your personal money. Click the + new button. Web for the purpose of making the loan repayment journal entries it is necessary to split each of the cash payments into the principal and interest elements as they are posted to. As at december 31, 2022, interest in the amount of $30,000 [$600,000 x 5%] has been accrued on the royal trust bank loan.