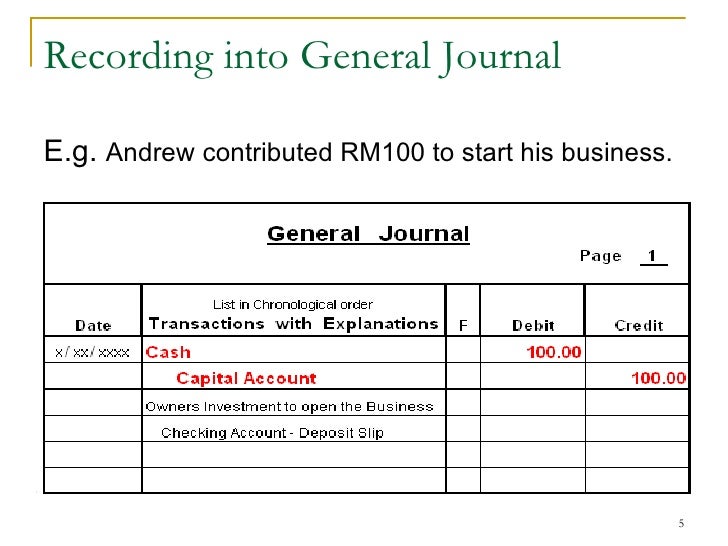

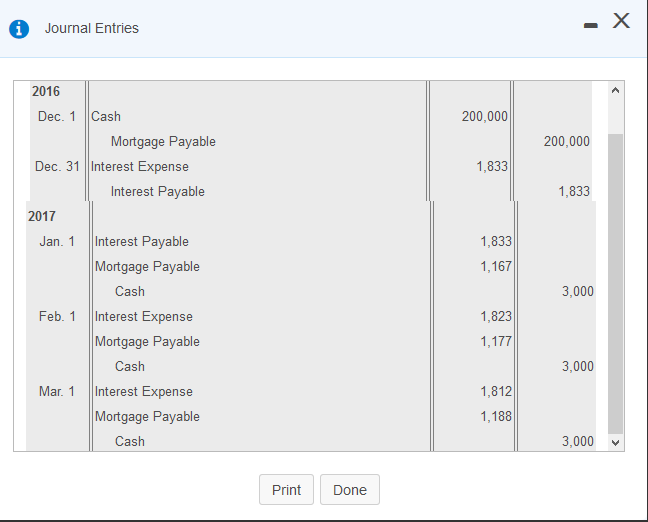

Loan Payable Journal Entry - Web loan repayment journal entry explained. Web loan interest payable journal entry. In this journal entry, only balance sheet items will be affected as the interest on mortgage payable which is an expense will only incur with the passage of time. Kittikorn nimitpara / getty images. In this case, only a single entry is passed because interest is directly paid. Company abc has borrowed loan $ 100,000 from the bank with an interest rate of 6%. It involves recording your initial loan, the loan interest, and the payments you make on both. Web start recording loan payment journal entries now. Is a loan payment an expense? Interest of ₹500 has been paid to the bank on the loan taken.

What Is The Journal Entry For A Loan Payment

It also depends on the type of loan you’ve taken out: On december 31, 2022, the interest accrued on the loan must be recognized. Web.

Mortgage Note Payable (Journal Entries) YouTube

It also depends on the type of loan you’ve taken out: Web updated may 09, 2024. Web the loan has a one year maturity in.

Mortgage Payable Journal Entry

Web the journal entry is debiting interest payable and credit cash. received a loan from its bank for $19,000 bearing interest at 4%. Loan payable.

Loan Journal Entry Examples for 15 Different Loan Transactions

What is the difference between loan payable and loan receivable? Loan/note payable general journal entry. Interest paid to bank/person on the loan: The first of.

Notes Payable

Had the above note been created on october 1, the entries would appear as follows: The company will continue with these payments until the loan.

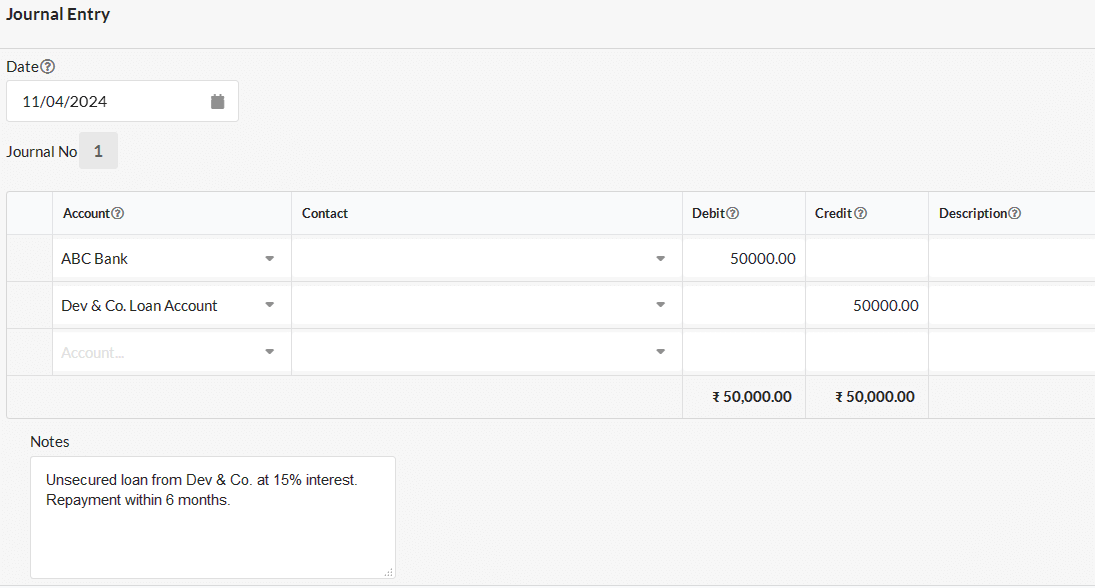

Journal entry for Loan Payable Output Books

Loan payable account is a liability account on the balance sheet, in which its normal balance is on the credit side. Adding interest to the.

Mortgage Payable Journal Entry

What is a loan receivable? The company is required to pay the interest on the 2nd of the next month. The notes payable account could.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web following accounting entry is used to account for the repayment of loan: Web the journal entry to recognize the receipt of the loan funds.

Journal Entries of Loan Accounting Education

Show journal entry for loan payment in year 1 & year 2. How do you record a loan in accounting? received a loan from its.

What Is The Difference Between Loan Payable And Loan Receivable?

Is a loan payment an expense? Web the company’s accountant records the following journal entry to record the transaction: Please prepare journal entry for paid interest on loan. Web loan repayment journal entry explained.

Web The Journal Entry Is Debiting Interest Payable And Credit Cash.

The loan is payable in two annualinstalments of $10,074 principal and interest on june 30 each year. Loan payable refers to the amount an organization owes to lenders, typically financial institutions, for borrowed funds. Interest of ₹500 has been paid to the bank on the loan taken. In this journal entry, only balance sheet items will be affected as the interest on mortgage payable which is an expense will only incur with the passage of time.

Had The Above Note Been Created On October 1, The Entries Would Appear As Follows:

When you’re entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash. Your lender’s records should match your liability account in loan payable. Web loan interest payable journal entry. The company is required to pay the interest on the 2nd of the next month.

It Involves Recording Your Initial Loan, The Loan Interest, And The Payments You Make On Both.

If you’re the borrower, you’ll work the following accounts: Show journal entry for loan payment in year 1 & year 2. Likewise, the company needs to make the notes payable journal entry when it signs the promissory note to borrow money from the creditor. Web the company can make the journal entry for the borrowing of money by debiting the cash account and crediting the loan payable account.