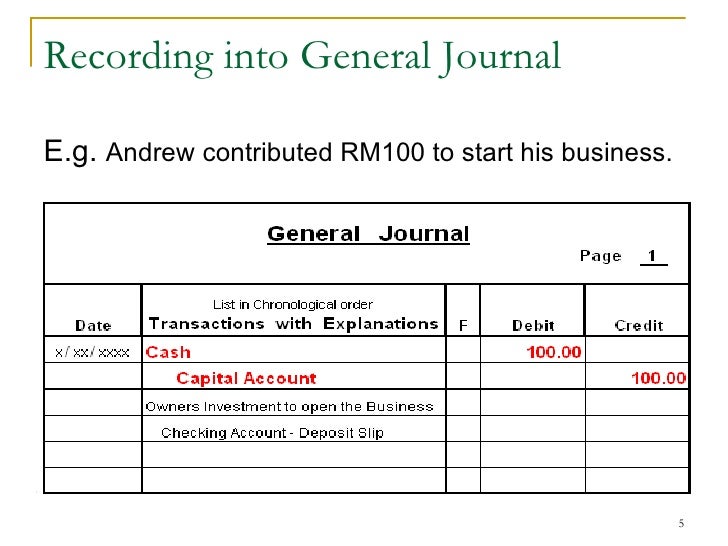

Loan Journal Entry - Web the journal entry is debiting interest expense $ 5,000 and crediting interest payable $ 5,000. When the company makes a payment to bank, they need to reverse the interest. Debit of $3,000 to loans payable (a liability account) debit of $1,000 to. Every entry contains an equal debit and credit along with the names. Web start recording loan payment journal entries now. Web the journal entry is debiting loan receivable and credit cash. Web the journal entry for interest paid on loan is as follows; The loan to the shareholder. Now the journal entry for repaying the loan is as follows: Then, select the second line and credit the liability account.

What Is The Journal Entry For A Loan Payment

Web the journal entry to recognize the receipt of the loan funds is as such: Web in order to record the transaction: When the company.

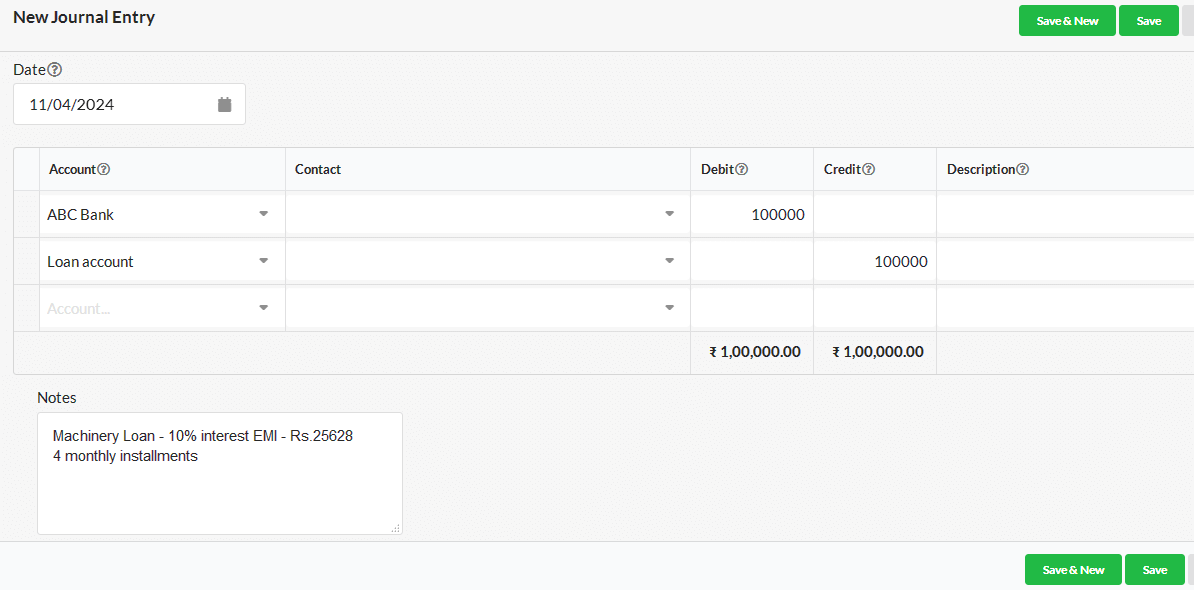

Journal entry for Loan Payable Output Books

At the end of the first year when the company pay the installment. Web loan is given to a person: Web the journal entry would.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web the journal entry for interest paid on loan is as follows; The loan receivable will be recorded as assets on the balance sheet. Debit.

Journal Entry Examples

*assuming that the money was due to be paid to abc bank ltd. On jan 1, 2021, when the company abc gives the loan to.

Journal Entries Examples Format How To Use Explanation

On jan 1, 2021, when the company abc gives the loan to employee. The loan receivable will be recorded as assets on the balance sheet..

Journal Entries of Loan Accounting Education

Web start recording loan payment journal entries now. *assuming that the money was due to be paid to abc bank ltd. Every entry contains an.

Loan Accounting Entries Business Accounting Basics

On december 31, 2022, the interest accrued on the loan must be. This is the exact opposite of the first. On jan 1, 2020, when.

Loan Journal Entry Examples for 15 Different Loan Transactions

Web the journal entry is debiting loan receivable and credit cash. This is the exact opposite of the first. Web loan is given to a.

Bank Loan Repaid Journal Entry Info Loans

Select the first line and debit the loan asset account. The loan to the shareholder. Web enter the date and journal entry number. Web the.

On Jan 1, 2020, When The Company Receives Cash From The Bank For The Loan.

Web the journal entry is debiting cash and credit loan from shareholders. Web below is a compound journal entry for loan payment made including both principal and interest component; When the company makes a payment to bank, they need to reverse the interest. Web what is the loan journal entry?

*Assuming That The Money Was Due To Be Paid To Abc Bank Ltd.

Web for the purpose of making the loan repayment journal entries it is necessary to split each of the cash payments into the principal and interest elements as they are. Every entry contains an equal debit and credit along with the names. The loan receivable will be recorded as assets on the balance sheet. Debit of $3,000 to loans payable (a liability account) debit of $1,000 to.

At The End Of The First Year When The Company Pay The Installment.

The loan to the shareholder. Web the loan was also increasing. Web start recording loan payment journal entries now. Select the first line and debit the loan asset account.

Web The Journal Entry Is Debiting Interest Expense $ 5,000 And Crediting Interest Payable $ 5,000.

Since it's a liability account, it had to be credited. Then, select the second line and credit the liability account. Web what is the journal entry for the loan given to employee? Web the company’s accountant records the following journal entry to record the transaction: