Loan From Owner To Business Journal Entry - Web by jay way updated march 06, 2019. The journal entry would involve. Web to record a loan, the accounting records will show the following bookkeeping entries when the business receives the loan: They can be obtained from banks, nbfcs,. Establishing a clear loan account is integral for accurate bookkeeping and financial tracking. See examples of bank loans, car loans, intercompany loans a… Web as a business owner, you may need to take out a loan to purchase new assets such as vehicles, equipment, machinery, buildings, and other assets required for. Think of journal entries as a diary for a company’s money. This is an official record within your accounting software. Web to illustrate, consider a business making a loan payment of $1,000, where $200 is allocated to interest and $800 to principal.

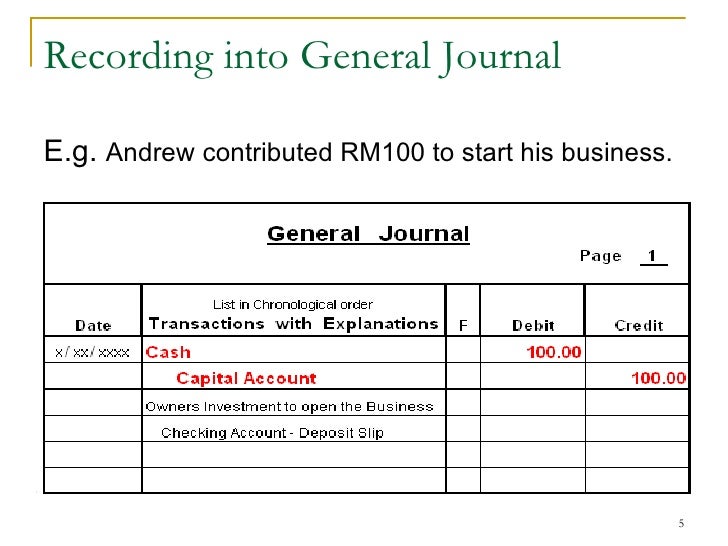

What is basic journal entry? Leia aqui What are basic journal entries

Web following is the journal entry for loan taken from a bank; The steps in the following sections provide guidance. Web importance of accurate journal.

Receive a Loan Journal Entry Double Entry Bookkeeping

Bookkeeping tracks and records business transactions, including financing transactions such as a loan to a business. Financial institutions account for loan receivables by recording the.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web learn how to record a loan as an asset on the balance sheet and how to collect it back as cash. See examples of.

Loan Accounting Entries Business Accounting Basics

The journal entry would involve. Web recording money to start a sole proprietorship. Web learn how to record a loan as an asset on the.

Basic Accounting for Business Your Questions, Answered

Web by jay way updated march 06, 2019. Web the journal entry is debiting cash and credit loan from shareholders. Accurate entries help a business..

Accounting Journal Entries For Dummies

*assuming that the money was deposited directly in the firm’s bank. Web the journal entry to recognize the receipt of the loan funds is as.

What Is The Journal Entry For A Loan Payment

Basically the purchase price less any cash equals seller financing. Record the receipt of the loan. See examples of bank loans, car loans, intercompany loans.

Journal Entries Examples Format How To Use Explanation

Basically the purchase price less any cash equals seller financing. Receive a loan from a bank journal entry. Web to record a loan, the accounting.

Journal Entries Accounting

On december 31, 2022, the interest accrued on the loan must be. The loan to the shareholder. See the journal entries for a loan from.

The Steps In The Following Sections Provide Guidance.

This is an official record within your accounting software. Web to receive a loan the business will post the following double entry bookkeeping journal entry. The journal entry would involve. Web learn how to record a loan as an asset on the balance sheet and how to collect it back as cash.

Record The Receipt Of The Loan.

A tutorial that discusses the different types of shareholder loans and how to enter them via a journal. The new owner purchased an asset, the existing business. Web recording money to start a sole proprietorship. Bookkeeping tracks and records business transactions, including financing transactions such as a loan to a business.

See Examples Of Bank Loans, Car Loans, Intercompany Loans A…

Accurate entries help a business. Financial institutions account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of. Web the journal entry to recognize the receipt of the loan funds is as such: Think of journal entries as a diary for a company’s money.

The Loan To The Shareholder.

Learn how to record loan transactions in different ways using bookkeeping software or manual journals. If amy ott begins a sole proprietorship by putting money into her business, the sole proprietorship will debit cash and will credit. There can be a situation where the interest is charged first and then paid. Web to record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a journal entry to record the loan, and then record all payments for the loan.