Loan Accounting Journal Entries - Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the. When recording your loan and loan repayment in. Record the initial loan transaction. Web journal entry for making loan. Through a bank transaction reconciliation: where you allocate the bank transaction fed. Web updated may 09, 2024. Web following is the journal entry for loan taken from a bank; If you have ever taken out a payday loan, you may have experienced a situation where. Financial institutions account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of their general ledger. Web journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system.

Journal Entries of Loan Accounting Education

Record the initial loan transaction. Web journal entry for making loan. Web to record a loan from the officer or owner of the company, you.

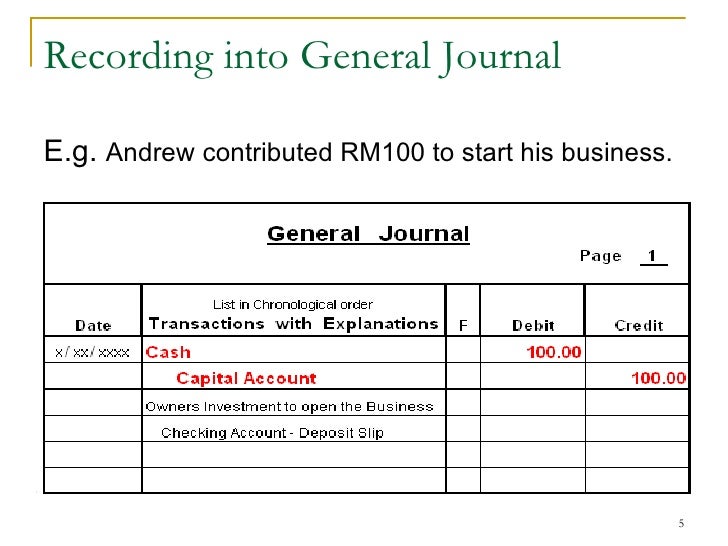

journal entry format accounting accounting journal entry template

It is the balance that company needs to collect back from the customers. When recording your loan and loan repayment in. Web accounting entries for.

Receive a Loan Journal Entry Double Entry Bookkeeping

It is the balance that company needs to collect back from the customers. *assuming that the money was deposited directly in the firm’s bank. If.

What Is The Journal Entry For A Loan Payment

They’re called journal entries because—back in. Web the journal entry for interest paid on loan is as follows; If you have ever taken out a.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web in accounting, journal entries are how you record your financial transactions, including loan payments. Through a bank transaction reconciliation: where you allocate the bank transaction.

Loan Journal Entry Examples for 15 Different Loan Transactions

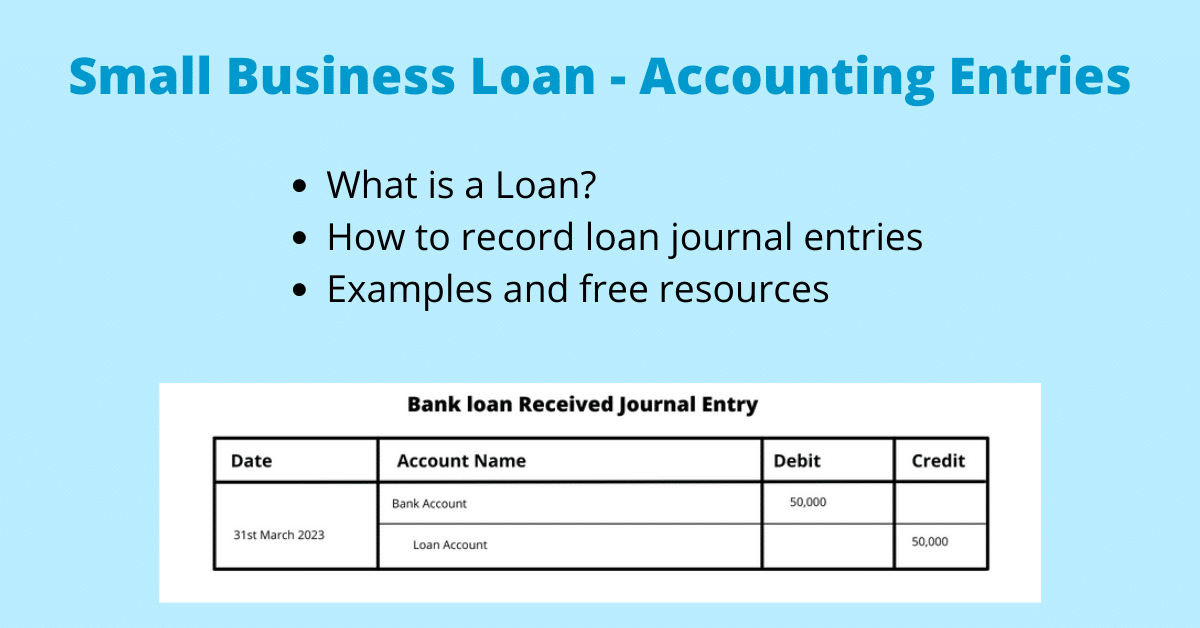

The company will record the loan as the assets on the balance sheet. Web the journal entry to recognize the receipt of the loan funds.

Loan Accounting Entries Business Accounting Basics

Record the initial loan transaction. Web journal entries are the first step in the accounting cycle and are used to record all business transactions and.

Journal Entry Examples

*assuming that the money was due to be paid to abc bank ltd. Web accounting entries for the receipt of loan are as follows: Kittikorn.

Accounting Journal Entries For Dummies

Debit of $3,000 to loans payable (a liability account) debit of $1,000 to. Web the journal entry to recognize the receipt of the loan funds.

Web The Journal Entry For Interest Paid On Loan Is As Follows;

Web journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. Web the journal entry to recognize the receipt of the loan funds is as such: Web the following entry occurs when sierra initially takes out the loan. When recording your loan and loan repayment in.

Web Following Is The Journal Entry For Loan Taken From A Bank;

Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the. Journal entry for a government support loan forgiven. Web to record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a journal entry to record the loan, and then. Web the company’s accountant records the following journal entry to record the transaction:

Web Below Is A Compound Journal Entry For Loan Payment Made Including Both Principal And Interest Component;

Web updated may 09, 2024. Record the initial loan transaction. Kittikorn nimitpara / getty images. To make a journal entry, you enter the details of a transaction into your company’s books.

Web Loan Repayment Journal Entry.

On december 31, 2022, the interest accrued on the loan must be. *assuming that the money was due to be paid to abc bank ltd. If you have ever taken out a payday loan, you may have experienced a situation where. Financial institutions account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of their general ledger.