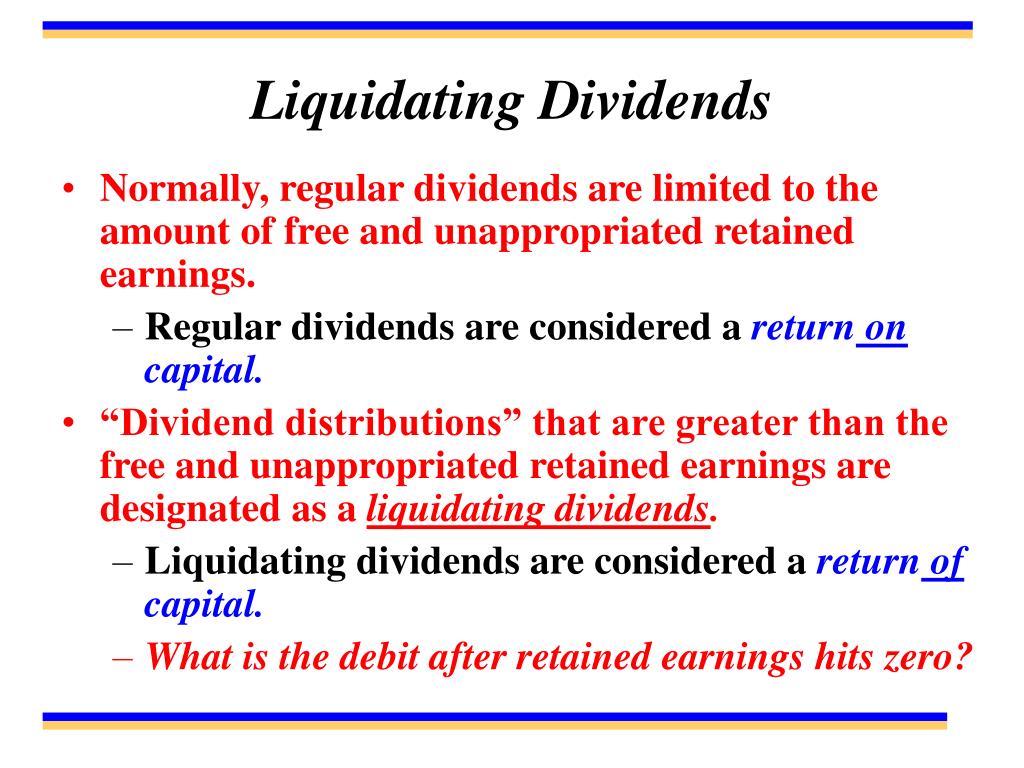

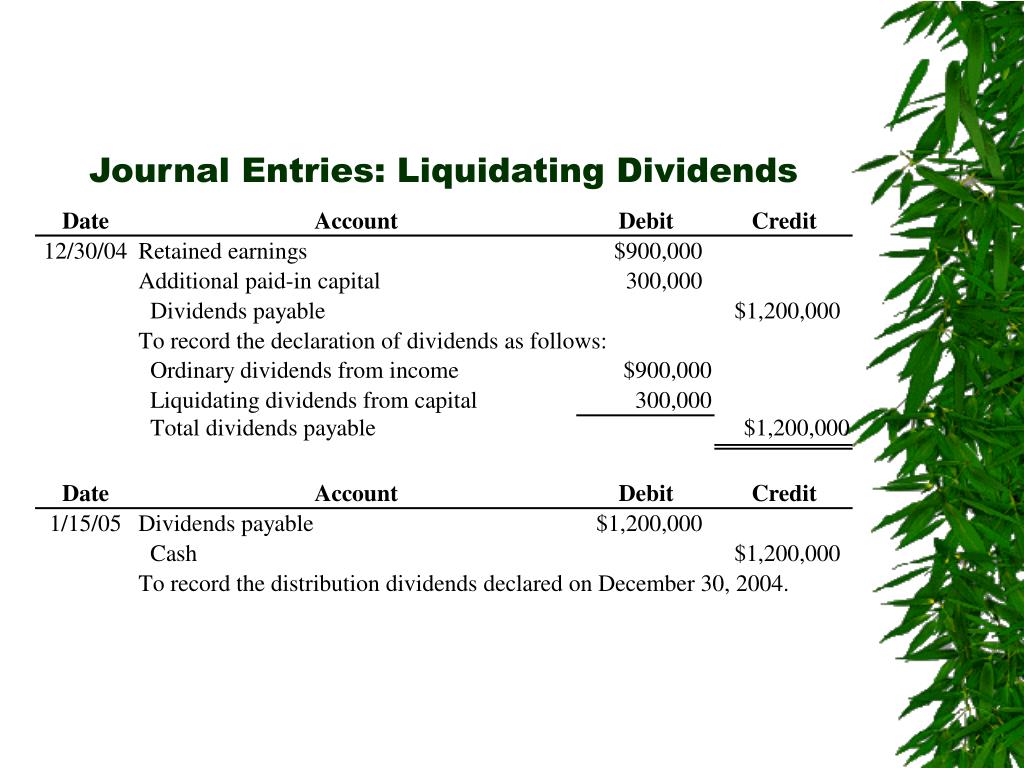

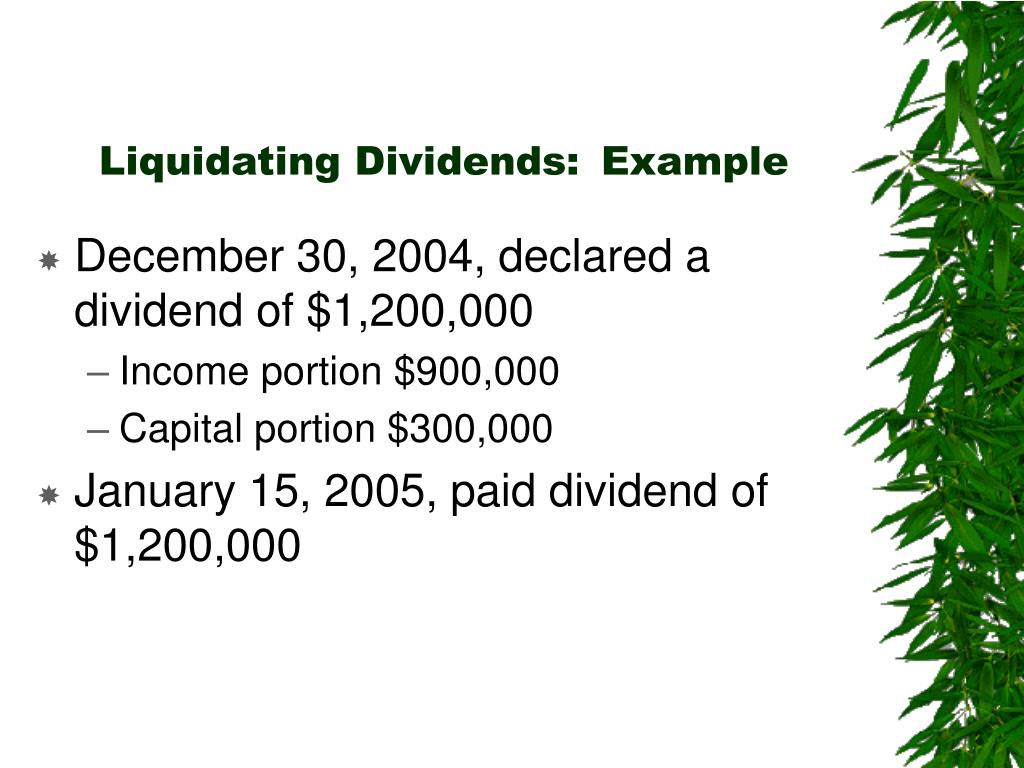

Liquidating Dividend Journal Entry - When a company declares liquidating dividends to shareholders, the bookkeeper will debit the common stock and. Web the following entry is required: In case of liquidating dividends, some portion of the dividends result in a reduction of. Web updated on april 4, 2024. Web section 73 (a) of the tax code provides that any gain derived or any loss sustained by the stockholder from its receipt of liquidating dividends shall be treated as taxable income. Distribution to shareholders in excess of earnings, representing a return of capital. Reviewed by dheeraj vaidya, cfa, frm. Web journal entry for declaring a dividend. Liquidation can be voluntary or involuntary (forced). Web this journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of the dividend.

PPT MANAGEMENT DECISIONS AND FINANCIAL ACCOUNTING REPORTS PowerPoint

What is the difference between a regular. Reviewed by dheeraj vaidya, cfa, frm. Entry to record year x2 dividend: When a company declares liquidating dividends.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Stockholders' equity | financial accounting. Web journal entry for liquidating dividends at declaration date: Reviewed by dheeraj vaidya, cfa, frm. Web think of liquidating dividends.

How to Record Dividends in a Journal Entry Accounting Education

Web lee company would record the income using the following journal entry: Web the following journal entry must be made in third year: Web the.

Calculating Dividends, Recording Journal Entries YouTube

Web this section explains the two types of dividends—cash dividends and share dividends—showing the journal entries involved and the reason why companies. Web lee company.

Dividend Paid Double Entry

Web the following entry is required: This dividend is paid out after. Web a liquidating dividend is a type of dividend distributed among the shareholders.

Liquidating vs Nonliquidating Dividends with Journal Entries (FAR CPA

By obaidullah jan, aca, cfa and last modified on jun 12, 2018. Web think of liquidating dividends as dividends that are in excess of that.

PPT Shareholders’ Equity PowerPoint Presentation, free download ID

Web liquidation is the process by which a company ends its business activities and exits the market. What is a liquidating dividend? Web journal entry.

PPT Shareholders’ Equity PowerPoint Presentation, free download ID

Web journal entry for declaring a dividend. What is the difference between a regular. This dividend is paid out after. In case of liquidating dividends,.

Understanding The Process Of Recording A Liquidating Dividend And Its

Web a liquidating dividend is a type of payment that a corporation makes to its shareholders during a partial or full liquidation. When a company.

Cash Paid = Shares Of Common Stock X Dividend.

Web the journal entry to record the stock dividend distribution requires a decrease (debit) to common stock dividend distributable to remove the distributable amount from that. Web section 73 (a) of the tax code provides that any gain derived or any loss sustained by the stockholder from its receipt of liquidating dividends shall be treated as taxable income. For the most part, this form of distribution. When a company declares liquidating dividends to shareholders, the bookkeeper will debit the common stock and.

Web A Liquidating Dividend Is A Type Of Dividend Distributed Among The Shareholders Or Owners Of A Company When The Company Goes Through The Partial Or.

To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained. Reviewed by dheeraj vaidya, cfa, frm. By obaidullah jan, aca, cfa and last modified on jun 12, 2018. Web this section explains the two types of dividends—cash dividends and share dividends—showing the journal entries involved and the reason why companies.

Web The Following Entry Is Required:

Web this journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of the dividend. Web the dividends declared journal entry is shown in the accounting records using the following bookkeeping entries: Web a dividend is a payment, either in cash, other assets (in kind),. Web the following journal entry must be made in third year:

Distribution To Shareholders In Excess Of Earnings, Representing A Return Of Capital.

This dividend is paid out after. 331, a liquidating distribution is considered to be full payment in exchange for the shareholder’s stock, rather than a dividend distribution, to the extent of the corporation’s earnings and profits (e&p). Web a liquidating dividend is a type of payment that a corporation makes to its shareholders during a partial or full liquidation. What is a liquidating dividend?