Lessor Operating Lease Journal Entries - Key aspects of the lessor accounting guidance have been aligned. In addition, the lessor must account. Lessor accounting is not fundamentally changed, but important differences from asc 840 exist. Web learn how to calculate and record the lease liability and right of use asset for an operating lease under the new lease accounting standard asc 842. Web under asc 842, journal entries for operating leases are concise calculations on the debits of your rou assets and the credits on your lease liabilities all recorded on your general. The lessor keeps the ownership rights throughout the lease. The company can make the journal entry for the operating lease by debiting the rent expense account and crediting the cash account. See the balance sheet, income statement, and cash flow effects of operating leases. Details on the example lease agreement. Leases that transfer substantially all of the risks.

Journal entries for lease accounting

Ifrs 16 finance lease example (lessee) amortization schedule. The business completes the operating lease accounting entries by recording the rental payments as an operating expense..

Problem 19 Journal Entries in the Books of Lessor, Accounting Lecture

Web discover asc 842 journal entries with leasecrunch's guide. Web journal entries in case of a finance lease. The business completes the operating lease accounting.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web in accordance with ifrs 16.61, a lessor should classify each of its leases as either a finance lease or an operating lease. Key aspects.

Finance Lease Journal Entries businesser

Web an operating lease refers to a lease contract where the ownership of the asset does not transfer to the lessee. Determine the lease term.

In an Operating Lease the Lessee Records JaelynhasCox

Web what is considered a lease under ifrs 16? Web operating lease journal entries. Lessor accounting is not fundamentally changed, but important differences from asc.

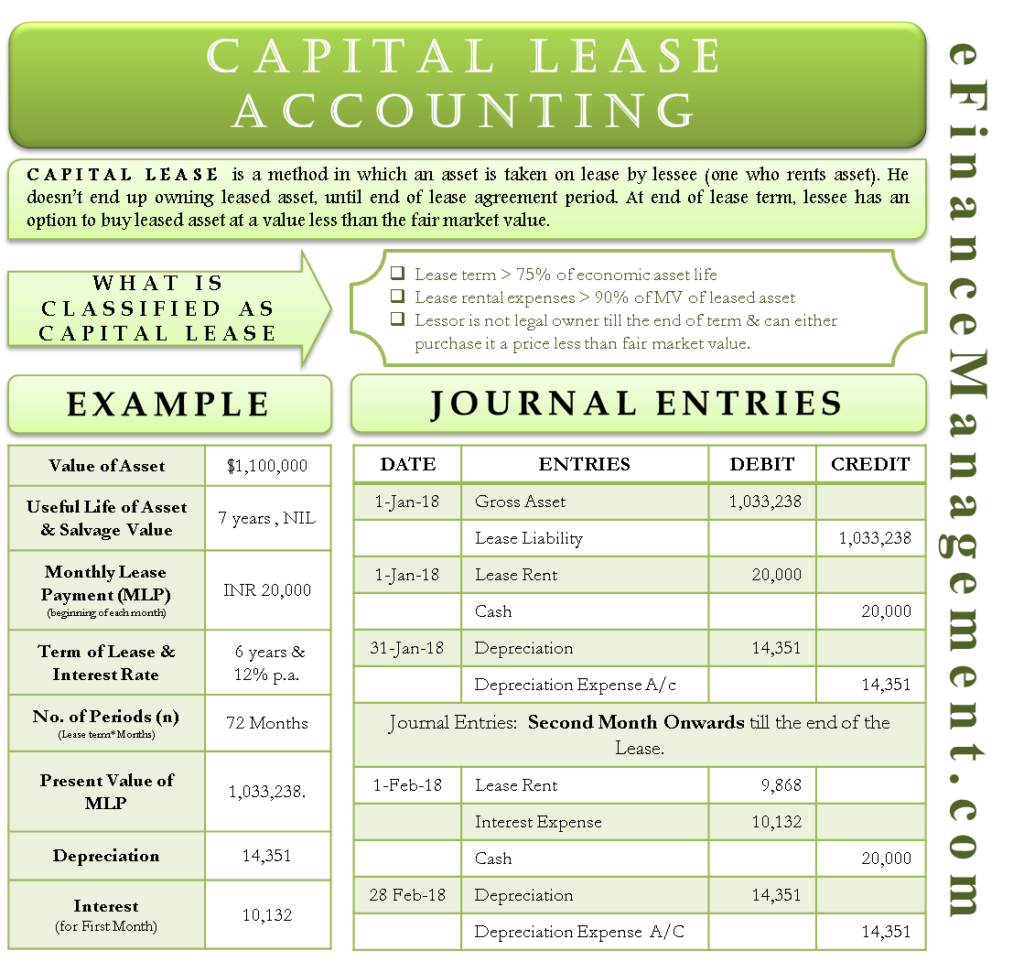

Capital Lease Accounting With Example and Journal Entries

Web the journal entry at the end of year 2 would be as follows: Determine the lease term under asc 840. Web under asc 842,.

Journal entries for lease accounting

Leases that transfer substantially all of the risks. Web what is considered a lease under ifrs 16? Following the example above, if we determine that.

Finance Lease Journal Entries businesser

Operating lease is a lease which does not involve. The business completes the operating lease accounting entries by recording the rental payments as an operating.

PPT Accounting for Leases PowerPoint Presentation, free download ID

Web operating lease journal entry. Web a lease is a legal agreement by which the owner of a specific asset (lessor) allows a second party.

Leases That Transfer Substantially All Of The Risks.

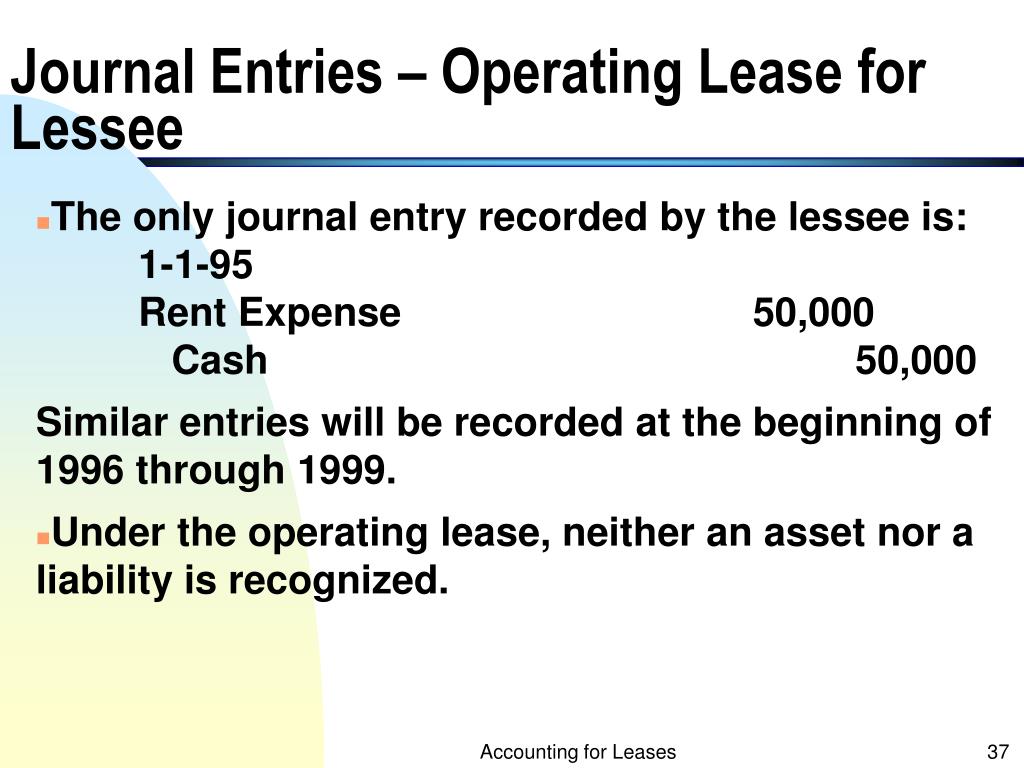

Web in accordance with ifrs 16.61, a lessor should classify each of its leases as either a finance lease or an operating lease. Web operating lease accounting example and journal entries. Web operating lease journal entries. Operating lease is a lease which does not involve.

Web An Operating Lease Refers To A Lease Contract Where The Ownership Of The Asset Does Not Transfer To The Lessee.

Web operating lease accounting refers to the accounting methodology used for leasing agreements where the lessor retains the ownership of the leased asset. Web under asc 842, journal entries for operating leases are concise calculations on the debits of your rou assets and the credits on your lease liabilities all recorded on your general. For finance leases, lessors recognize interest. Effective date for public companies.

Web Learn How To Record Operating Lease Transactions For Lessees And Lessors Under Asc 842 With Simple Examples And Calculations.

Learn about operating and finance lease entries, equity impact, and cash flow requirements! Effective date for private companies. Web as a lessor reporting under gasb 87, the initial journal entry to record a lease on the commencement date or transition date for an existing lease establishes a lease. The business completes the operating lease accounting entries by recording the rental payments as an operating expense.

Web Operating Lease Accounting By Lessor.

Web operating lease accounting journal entries. Web learn how to calculate and record the lease liability and right of use asset for an operating lease under the new lease accounting standard asc 842. What is a lease under asc 842? Web what is considered a lease under ifrs 16?