Lessor Accounting Journal Entries - Web the impact on lessors is not expected to be as significant. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value. 22k views 1 year ago accounting standards. Key aspects of the lessor accounting guidance have been aligned with the guidance in asc 606 (revenue recognition) your customers will now be required to recognize all leases, including operating leases, with terms greater. Web lessee accounting for governments: Ifrs 16 is effective for annual periods beginning on or after 1 january 2019. The white paper to lessor accounting includes guidance and examples to: This implies that the lessee cannot use forward rates or forecasting techniques in measuring variable lease payments (ifrs 16.bc166). Early application is permitted, provided the new revenue standard, ifrs 15 In this lesson, we explain ifrs 16 leases.

Finance Lease Journal Entries businesser

These three types are generally consistent with existing gaap; Web in this article, we’ll provide a clear and straightforward guide to the journal entries a.

Accounting for Leases Chapter 21 Intermediate Accounting 12

Ifrs 16 is effective for annual periods beginning on or after 1 january 2019. Utilizing the amortization table, the journal entry for the end of.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Early application is permitted, provided the new revenue standard, ifrs 15 Key aspects of the lessor accounting guidance have been aligned with the guidance in.

In an Operating Lease the Lessee Records JaelynhasCox

A fourth type, leveraged leases, is eliminated by the new guidance. Web the publication begins with an overview of the lessee and lessor accounting models,.

Problem 19 Journal Entries in the Books of Lessor, Accounting Lecture

Utilizing the amortization table, the journal entry for the end of the first period is as follows: Early application is permitted, provided the new revenue.

Journal entries for lease accounting

Paretta, cpa, ph.d., and james v. Lessors continue to classify all leases as operating or finance leases. To apply their respective models, the lessee and.

Accounting for Leases under the New Standard, Part 2 The CPA Journal

Paretta, cpa, ph.d., and james v. Under ifrs 16, lessors are required to classify leases as either ‘operating’ or ‘finance’ based on the extent to.

journal entries in the books of lessor & lessee Royalty account YouTube

Determine whether a contract is within the scope of asc 842. 22k views 1 year ago accounting standards. Web this guide discusses lessee and lessor.

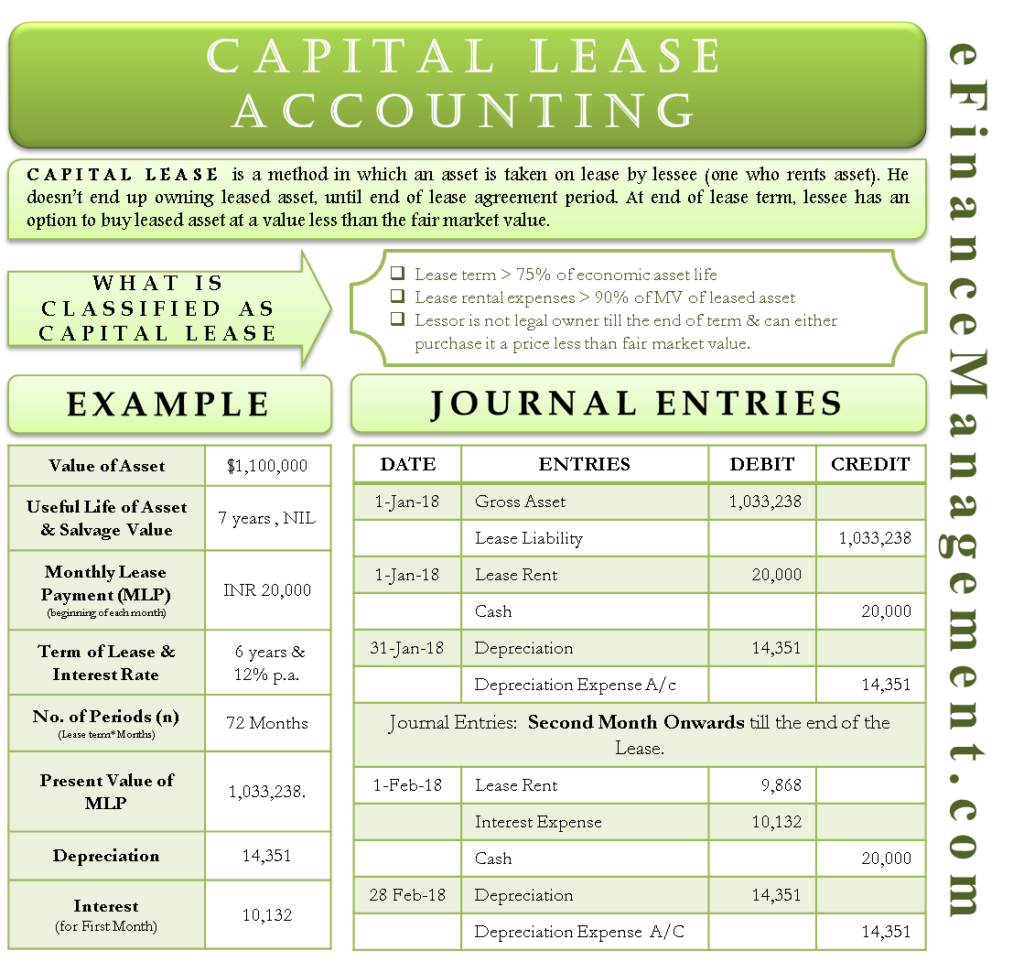

Capital Lease Accounting With Example and Journal Entries

The white paper to lessor accounting includes guidance and examples to: Ifrs 16 specifies how an ifrs reporter will recognise, measure, present and disclose leases..

Utilizing The Amortization Table, The Journal Entry For The End Of The First Period Is As Follows:

Web the comprehensive example below will illustrate the accounting treatment of a lease from a lessor’s perspective under gasb 87. Disclosures required when a lease term ends and grouping options. Lessor accounting is not fundamentally changed, but important differences from asc 840 exist. For more information on this topic, or to learn how baker tilly public sector specialists can help, contact our team.

Web Journal Entries In Case Of A Finance Lease.

At the time of first payment, lessor shall record receipt of cash, reduction in lease receivable and recognition of finance income: Early application is permitted, provided the new revenue standard, ifrs 15 Web lessor corp would record the following journal entry on the lease commencement date. We explain leases from the perspective of a lessor and leases from the perspective of the lessee.

87 With The Help Of These Practical Illustrations.

Web although accounting for leasing arrangements under the new standard for the lessor will not be substantively different from existing standards, a lessor’s recognition of selling profit and revenue from lease transactions must conform to a part of topic 606 regarding revenue recognition; Web in the initial recognition of lease liability, variable lease payments are measured using the actual value of an index or a rate at the commencement date (ifrs 16.27 (b)). To apply their respective models, the lessee and the lessor need to follow preliminary steps that are discussed in more detail in the subsequent Following the example above, if we determine that the lease is a finance lease, the lessor shall pass the following journal entry at the start of the lease contract:

22K Views 1 Year Ago Accounting Standards.

Determine whether a contract is or includes a lease that meets the definition of a lease in asc 842. Web in contrast to the lessee model, the lessor model under fasb’s new lease accounting standard has three different types of leases: Determine whether a contract is within the scope of asc 842. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value.