Lease Liability Journal Entry - Web beginning with a finance lease, the initial journal entry at transition will resemble this: Determine the total lease payments under gaap. Effective date for private companies. Effective date for public companies. The obligation of a lessee to make lease payments over the lease term, discounted to its present value. The present value of all known future lease payments. In order to record the lease liability on the balance sheet, we need to know these 3 factors: Web the initial asc 842 journal entry for an operating lease will resemble something like this: 30 sep 2021 (updated 31 aug 2022) us leases guide. On the asc 842 effective date,.

Check this out about Capital Lease Accounting Journal Entries

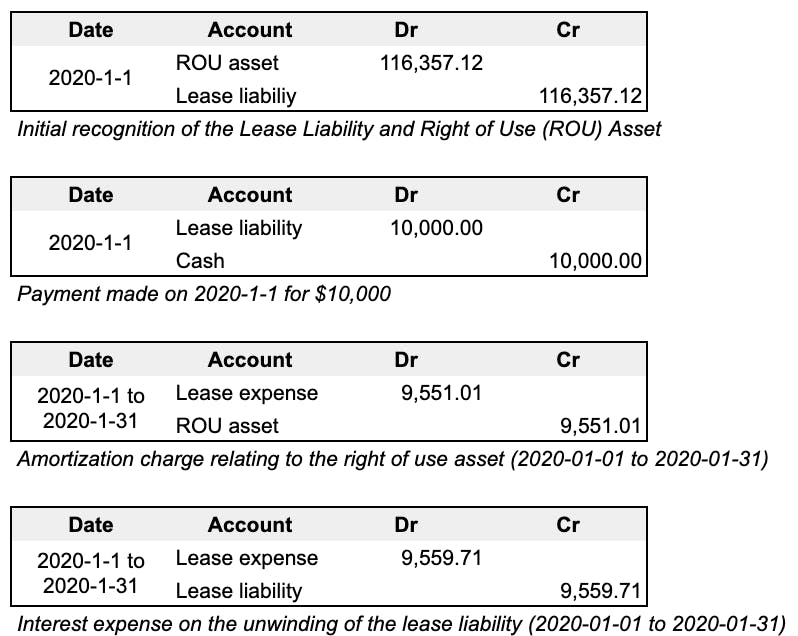

Initial recognition of the rou asset. On the asc 842 effective date,. Operating lease accounting under asc 842 and. Now, let’s break out the details.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Under asc 842, an operating lease you now recognize: Here, we’ll break down operating lease journal entries simply and straightforwardly, including both the lessee and.

Journal entries for lease accounting

In this journal entry, the amount of lease asset or lease liability recorded is the fair value of total lease payments. Details on the example.

Finance Lease Journal Entries businesser

Determining the lease term sometimes requires judgment, particularly when we have renewal and termination options as part of the lease agreement. The current value of.

Journal entries for lease accounting RVSBELL Analytics

When does a lessee first measure the lease liability? Determining the lease term sometimes requires judgment, particularly when we have renewal and termination options as.

Journal entries for lease accounting

Operating lease accounting under asc 842 and. Now, let’s break out the details of the entry: In this journal entry, the amount of lease asset.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

The lease liability is the present value of any future lease payments. Details on the example lease agreement. 30 sep 2021 (updated 31 aug 2022).

Finance Lease Journal Entries Ifrs businesser

Below we present the entry recorded as of 1/1/2021 for our example: The key inputs to this calculation are as follows. In this journal entry,.

Finance Lease Journal Entries businesser

Web recognize the lease liability and right of use asset (rou) on the balance sheet at the commencement of the lease for new leases or.

This Article Serves Just That Purpose.

Lease asset under gasb 87. Determining the lease term sometimes requires judgment, particularly when we have renewal and termination options as part of the lease agreement. In order to record the lease liability on the balance sheet, we need to know these 3 factors: In this journal entry, the amount of lease asset or lease liability recorded is the fair value of total lease payments.

On The Asc 842 Effective Date,.

Lessee corp would record the following journal entry on the lease commencement date. The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date. What is a lease under asc 842? Web it's essentially like accounting for all your leases as if they were capital leases under asc 840.

Initial Recognition Of The Rou Asset.

An asset representing the lessee’s right to use the leased asset over the lease term. Here, we’ll break down operating lease journal entries simply and straightforwardly, including both the lessee and lessor sides. The amount of the initial measurement of the lease liability. Utilizing the amortization table, the journal entry for the end of the first period is as follows:

This Will Be The Case If The Contract Conveys The Right To Control The Use Of An Identified Asset For A Period Of Time In Exchange For Consideration.

Let's break them out further. This amount is $1,330 ($798 + $432+ $100). Web operating lease accounting example and journal entries. At the inception of a contract, an entity must assess whether the contract is, or contains, a lease.