Lease Journal Entry - The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date. Web here’s an example to show what asc 842 journal entries would look like for finance leases. Determine the lease term under asc 840. Whether you're an accountant or a business. We often just need a quick journal entry example to understand the concept or refresh our. The lessee's right to use the leased asset. Under asc 842, an operating lease you now recognize: The lease is noncancellable during this time. The only changes in the. Web learn how to record finance lease transactions in the balance sheet and income statement.

Finance Lease Journal Entries businesser

The lessee's right to use the leased asset. The lease is noncancellable during this time. Web learn how to calculate and record the lease liability.

Finance Lease Journal Entries businesser

Suppose you have a 5 year lease beginning 7/1/23 through 6/30/28. Web to help accounting teams at businesses and nonprofits, here are some of the.

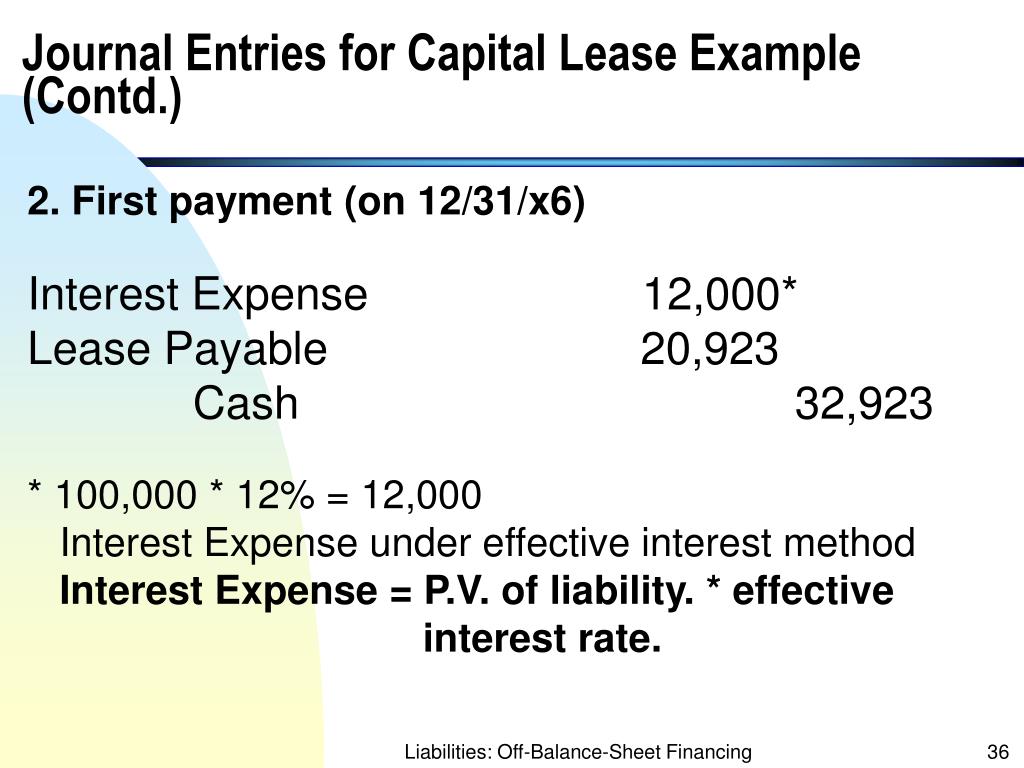

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

It's essentially like accounting for all your leases as if they were capital leases under asc 840. Determining the lease term sometimes requires judgment,. Whether.

Finance Lease Journal Entries Ifrs businesser

Web learn how to calculate and record the lease liability and right of use asset for an operating lease under the new lease accounting standard.

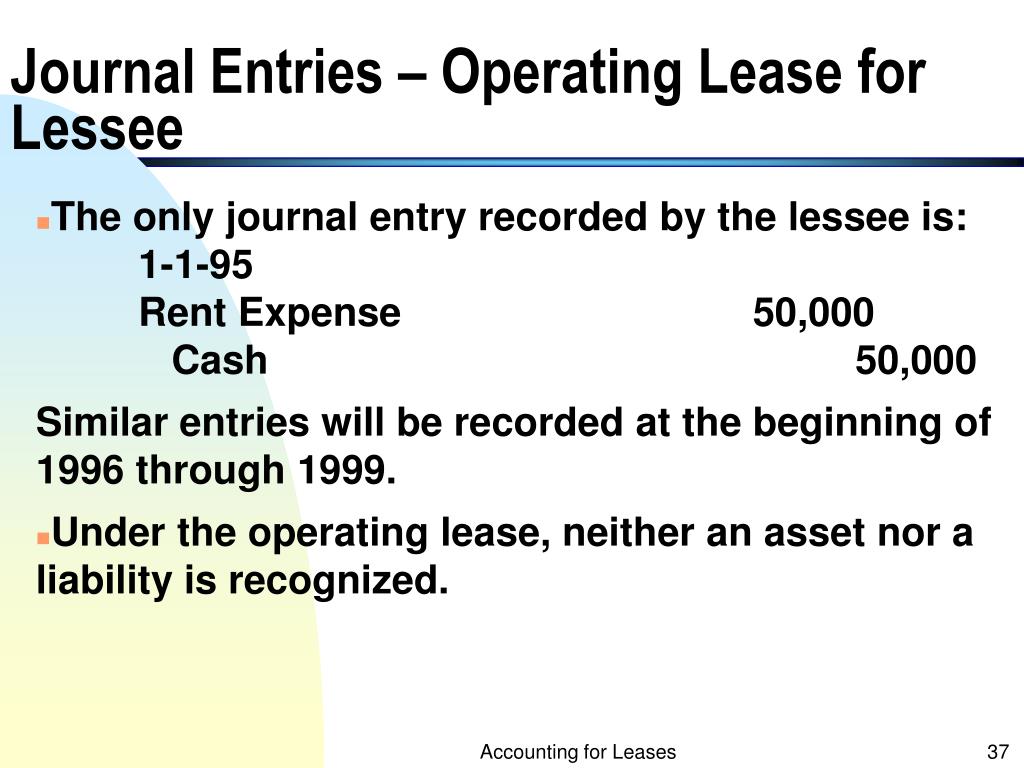

PPT Accounting for Leases PowerPoint Presentation, free download ID

The present value of all known future lease payments. Details on the example lease agreement. • lessees apply a single accounting model for all leases,.

Lessee accounting for governments An indepth look Journal of

Below we present the entry recorded as of 1/1/2021 for our example: Web at the lease commencement date, the lessor is required to calculate the.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web recording journal entries appropriate for the lease accounting standard being tracked is critical for accurate financial reporting. Presentation in the financial statements. Web the.

Check this out about Capital Lease Accounting Journal Entries

Web the finance lease accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the.

Journal entries for lease accounting

Web the initial journal entry under gasb 87 will establish the asset and liability on the statement of financial position and relieve the prepayment from.

The Year’s Closing Balance Is.

The lessee's right to use the leased asset. Web operating lease accounting example and journal entries. Web learn how to calculate and record the lease liability and right of use asset for an operating lease under the new lease accounting standard asc 842. The lease is noncancellable during this time.

Web Operating Lease Accounting Refers To The Accounting Methodology Used For Leasing Agreements Where The Lessor Retains The Ownership Of The Leased Asset.

Web so what does this mean? Effective date for private companies. Journal entries for lease accounting. • lessees apply a single accounting model for all leases, with certain exemptions.

Asc 842 Can Be Overwhelming;

Lessees need to carefully consider the terms of. Below we present the entry recorded as of 1/1/2021 for our example: Details on the example lease agreement. Web at the lease commencement date, the lessor is required to calculate the selling profit or loss as (1) the fair value of the underlying asset (or the sum of lease receivable and any.

This Lease Accounting Standard Replaced The Previous Standard Ias 17 And.

Web the entries in exhibit 4 illustrate how the lessee accounts for a finance lease given initial direct costs and residual value (guaranteed and unguaranteed). Determining the lease term sometimes requires judgment,. Web learn how to record finance lease transactions in the balance sheet and income statement. Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard.