Lease Accounting Journal Entry - This article serves just that purpose. At the inception of a contract, an entity must assess whether the contract is, or contains, a lease. Reviewed by dheeraj vaidya, cfa, frm. Web the finance lease accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. This lease accounting standard replaced the previous standard ias 17 and brought a major shift to the way organisations should recognise, measure and report on leases in their financial statements. The company can make the journal entry for the operating lease by debiting the rent expense account and crediting the cash account. Details on the example lease agreement; Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Lessor accounting remains largely unchanged from asc 840 to 842. Web what is the journal entry for an operating lease?

Check this out about Capital Lease Accounting Journal Entries

Determining the lease term sometimes requires judgment, particularly when we have renewal and termination options as part of the lease agreement. 1) the lease term.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating.

PPT Leases PowerPoint Presentation, free download ID3337655

Web the two most common types of leases in accounting are operating and finance (or capital) leases. Web according to asc 842, journal entries for.

Finance Lease Journal Entries Lessor businesser

Web the finance lease accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the.

Lease accounting Journal Entries for Modification

Web the two most common types of leases in accounting are operating and finance (or capital) leases. Web updated on may 3, 2024. The company.

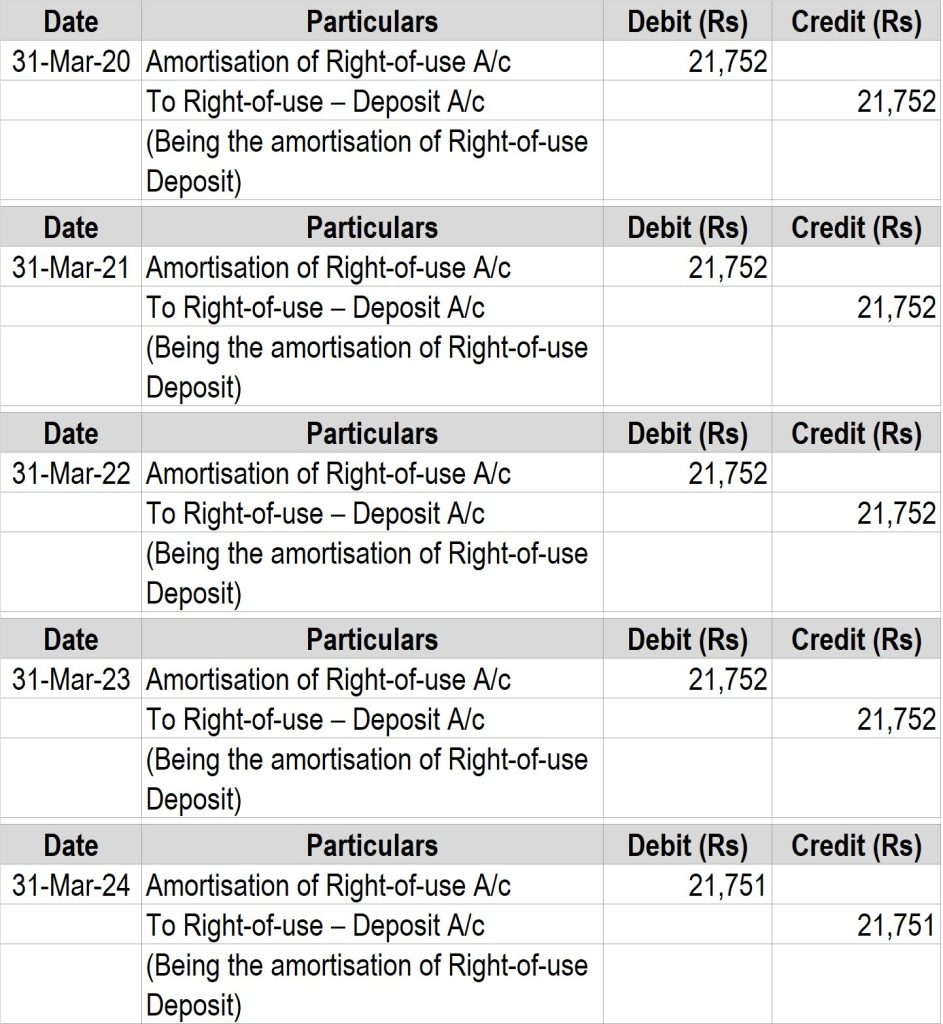

Journal entries for lease accounting

Recognize the lease liability and right of use asset (rou) on the balance sheet at the commencement of the lease for new leases or upon.

Finance Lease Journal Entries businesser

Learn about operating and finance lease entries, equity impact, and cash flow requirements! This will be the case if the contract conveys the right to.

Finance Lease Journal Entries businesser

Web the two most common types of leases in accounting are operating and finance (or capital) leases. Details on the example lease agreement; This will.

PPT Accounting for Leases PowerPoint Presentation, free download ID

On the asc 842 effective date, determine. Lessor accounting remains largely unchanged from asc 840 to 842. Determine the total lease payments under gaap; This.

Determine The Total Lease Payments Under Gaap;

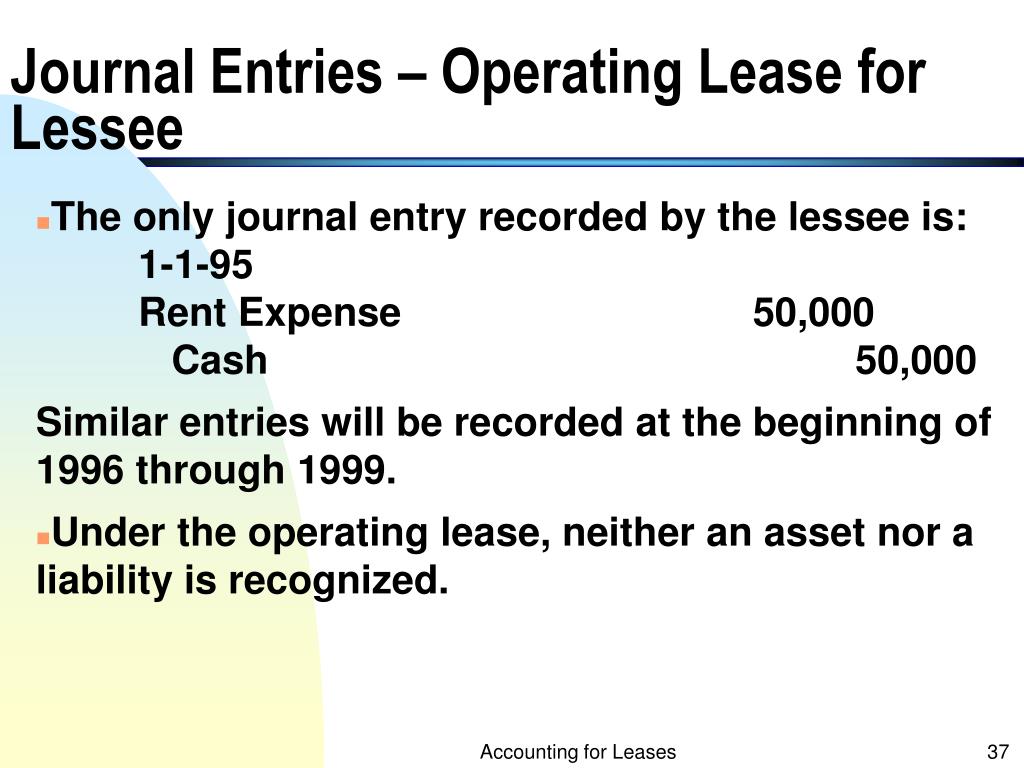

On the asc 842 effective date, determine. This article serves just that purpose. In this journal entry, there is no record of lease asset or lease liability in the balance sheet like those in the finance lease accounting. Web what is the journal entry for an operating lease?

Web Operating Lease Accounting Example And Journal Entries.

Details on the example lease agreement; Sale and leaseback transactions—updated june 2021 6.1 sale and leaseback. Under asc 842, journal entries for operating leases are concise calculations on the debits of your rou assets and the credits on your lease liabilities all recorded on your general ledger. Lessor accounting remains largely unchanged from asc 840 to 842.

The Company Can Make The Journal Entry For The Operating Lease By Debiting The Rent Expense Account And Crediting The Cash Account.

In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Reviewed by dheeraj vaidya, cfa, frm. This will be the case if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date.

At The Inception Of A Contract, An Entity Must Assess Whether The Contract Is, Or Contains, A Lease.

Lessor accounting under asc 842. Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating leases under the new lease standard. Web the finance lease accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. Recognize the lease liability and right of use asset (rou) on the balance sheet at the commencement of the lease for new leases or upon transition to asc 842.