Lease Accounting Journal Entries - Web ifrs 16 specifies how an ifrs reporter will recognise, measure, present and disclose leases. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12. Here we discuss how to record journal entries for capital lease along with examples. The fasb’s new standard on leases, asc 842, is effective for all entities. The first four chapters provide an introduction. Determining the lease term sometimes requires judgment, particularly when we have renewal and termination options as part of the. Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web guide to what capital lease accounting is. See examples, calculations, and tips for lease accounting. Web about the leases guide pwc is pleased to offer our updated leases guide.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

The first four chapters provide an introduction and guidance on determining whether an arrangement is (or contains) a lease and how to classify and account.

Finance Lease Journal Entries Lessor businesser

Web read a summary of ifrs 16 lease accounting with a full example, journal entries, and an explanation of disclosure requirements. 1 an example is.

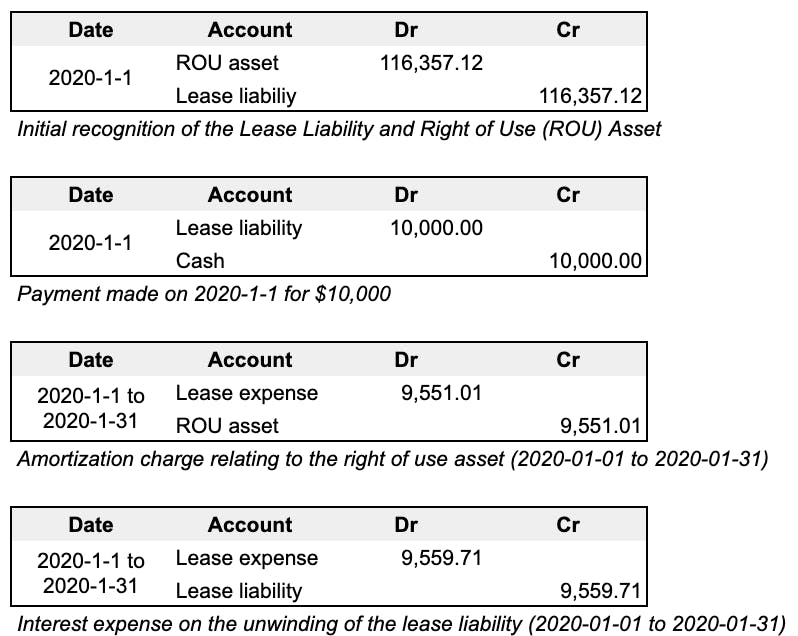

Journal entries for lease accounting

Web guide to what capital lease accounting is. See examples, calculations, and tips for lease accounting. Web as described in lg 3.3.4.7, when collectibility of.

How to Calculate the Lease Liability and RightofUse (ROU) Asset for

Web this guide discusses lessee and lessor accounting under asc 842. Web read a summary of ifrs 16 lease accounting with a full example, journal.

Capital Lease Accounting With Example and Journal Entries

Web this jama guide to statistics and methods article discusses accounting for competing risks in clinical research. See examples, calculations, and tips for lease accounting..

Lessee accounting for governments An indepth look (2022)

Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Web learn how to record operating.

Journal entries for lease accounting

The fasb’s new standard on leases, asc 842, is effective for all entities. Web as described in lg 3.3.4.7, when collectibility of lease payments or.

Finance Lease Journal Entries businesser

Here we discuss how to record journal entries for capital lease along with examples. Web lease accounting software, such as that included in netsuite fixed.

Finance Lease Journal Entries businesser

The first four chapters provide an introduction and guidance on determining whether an arrangement is (or contains) a lease and how to classify and account.

The Standard Provides A Single Lessee Accounting Model, Requiring Lessees To Recognise Assets And Liabilities For All Leases Unless The Lease Term Is 12.

Web in order to record the lease liability on the balance sheet, we need to know these 3 factors: Find out the key changes, differences, and challenges of operating and finance leases under asc 842. Web read a full summary of the new operating lease accounting rules under asc 842, including a complete example and journal entries. Web the two most common types of leases in accounting are operating and finance (or capital) leases.

Web Learn How To Record And Report Leases Under The New Lease Accounting Standard, Asc 842, With Clear Examples And Explanations.

Web learn how to record operating leases on the balance sheet under the new lease accounting standard effective for private companies and nonprofits after december 15, 2021. See examples of journal entries for lease liability, right of use. The first four chapters provide an introduction. The fasb’s new standard on leases, asc 842, is effective for all entities.

Here We Discuss How To Record Journal Entries For Capital Lease Along With Examples.

Web it is the new normal for lease accounting around the world. Web learn how to record leases under the gaap lease accounting standard asc 842 with journal entries for operating and finance leases. The first four chapters provide an introduction and guidance on determining whether an arrangement is (or contains) a lease and how to classify and account for lease and nonlease components. This guide discusses lessee and lessor accounting under asc 842.

Web This Guide Discusses Lessee And Lessor Accounting Under Asc 842.

Determining the lease term sometimes requires judgment, particularly when we have renewal and termination options as part of the. Web learn how to record lease transactions under ifrs 16, the international standard for lease accounting. See examples, calculations, and tips for lease accounting. Web lease accounting software, such as that included in netsuite fixed assets management, captures key lease details, reflects payments, generates amortization schedules and records journal entries for every account affected by the lease, over the.