Journal Entry To Zero Out Balance Sheet - Making the correct balance sheet check may seem obvious however, there are a few things we must. All equipment, property and other assets would have corresponding liabilities, with no extra cash from investors or from combining assets to create profitable. Web october 15, 2018 06:32 pm. Web the assets and liabilities sections of balance sheets for a fully equipped business with no people would zero out. The increase and decrease should both be the same amount. Web select make general journal entries. Go to the company menu and select make. Web you'll want to create a journal entry to write off the balance. Web closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to. Select save or save & close.

Understanding Your Balance Sheet Financial Accounting Protea

Web you can create a journal entry to zero out the other current liabilities account. Web a closing entry on a balance sheet is a.

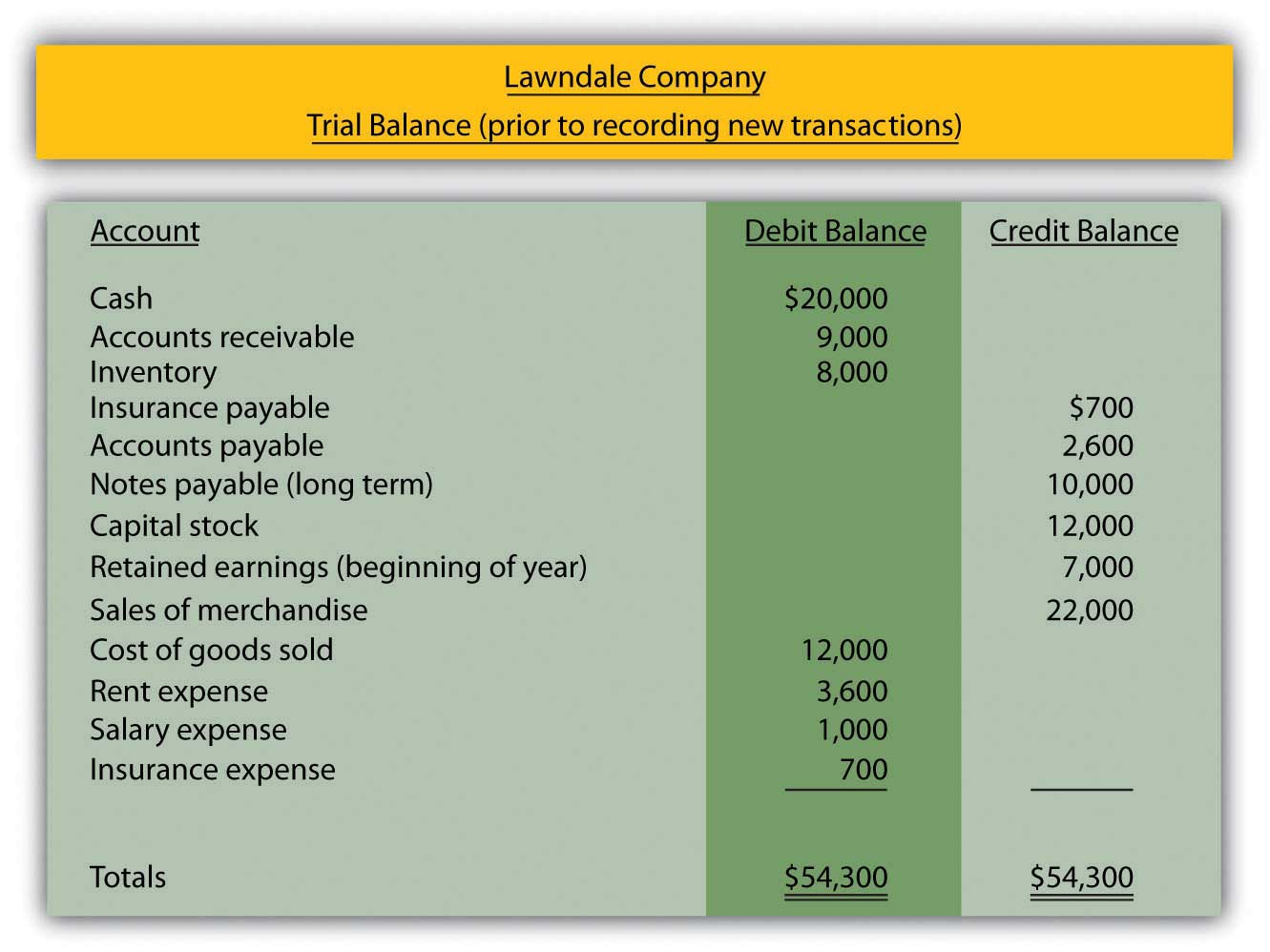

20 transactions with their Journal Entries, Ledger and Trial balance to

Web the assets and liabilities sections of balance sheets for a fully equipped business with no people would zero out. If tax returns have already.

Basic Balance Sheet Statement Double Entry Bookkeeping Balance

I'd also recommend contacting your accountant to know what is the best account to use against. Web october 15, 2018 06:32 pm. Web the closing.

Accounting Journal Entries For Dummies

The increase and decrease should both be the same amount. The balance in the liability account accounts payable at the end of the year will.

Journal Entries and Trial Balance in Accounting Video & Lesson

Making the correct balance sheet check may seem obvious however, there are a few things we must. Go to the company menu and select make..

40 transactions with their journal entries ledger trial balance to

Web zero out balance sheet amount and distribute the amount through schedule k. Web the adjusting entry for accounts payable in general journal format is:.

Balance Sheet Journal Entries Examples Verkanarobtowner

A reasonable way to begin the process is by. Others prefer to keep the old account balances immediately prior to dissolution and transfer those numbers.

Balance sheet example Accounting Play

The shareholder would report the amount to. Making the correct balance sheet check may seem obvious however, there are a few things we must. Others.

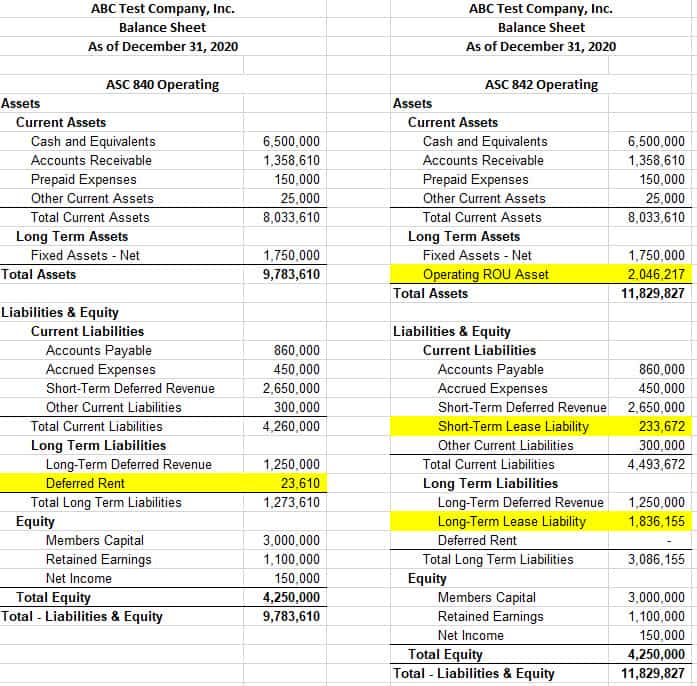

Lease Liabilities in Journal Entries & Calculating ROU Visual Lease

Web closing, or clearing the balances, means returning the account to a zero balance. Web revenues, expenses, and dividends represent amounts for a period of.

Web The Closing Journal Entry Will Be A Credit To Partner Distributions Of $30,000, A Debit To Partner A's Partnership Equity Account Of $15,000, And A Debit To Partner B's Partnership.

If tax returns have already been filed. I'd also recommend contacting your accountant to know what is the best account to use against. Web zero out balance sheet amount and distribute the amount through schedule k. Web a closing entry on a balance sheet is a journal record an accountant makes at the end of an accounting period when moving balances from a temporary account to a permanent.

Make Sure Your Balance Sheet Check Is Correct And Clearly Visible.

The balance in the liability account accounts payable at the end of the year will carry forward to the next. Web october 15, 2018 06:32 pm. All equipment, property and other assets would have corresponding liabilities, with no extra cash from investors or from combining assets to create profitable. Web you can create a journal entry to zero out the other current liabilities account.

Web You'll Want To Create A Journal Entry To Write Off The Balance.

I would also recommend consulting with a professional accountant to help you clear out or handle the amount. Web once done, create a journal entry to move the amount and zero out your opening balance equity account's balance. Web the adjusting entry for accounts payable in general journal format is: It appears you have two distinct general ledger entries to make.

The Increase And Decrease Should Both Be The Same Amount.

If your balance sheet is in balance these. Web the dividends account is a debit account, so we will credit the dividend account by $500,000 in the closing entry. A reasonable way to begin the process is by. Determine the increase and decrease to enter to zero out the capital.