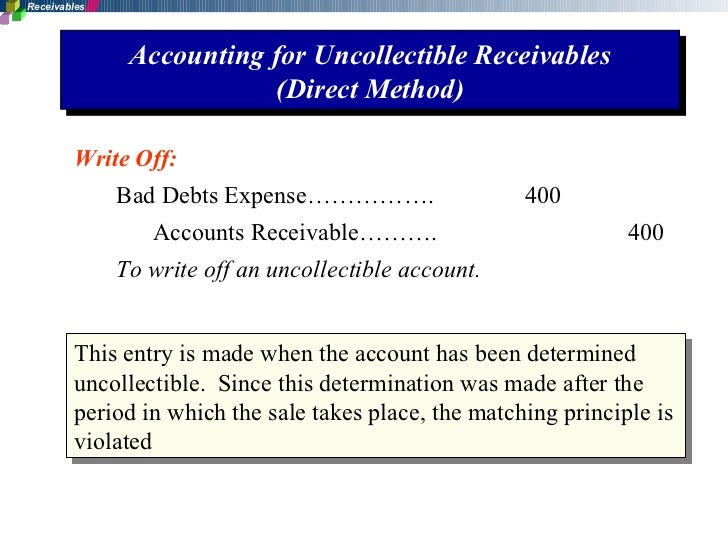

Journal Entry To Write Off Receivable - The company only make journal. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. Web based on your evaluation of the collectability of receivables, you can then make a journal entry to adjust the allowance for doubtful accounts accordingly. Customer to increase (debit), and. You can also use the. There are two choices for the debit part of the entry. One method of recording the bad debts is referred to as the direct write off method which involves removing the specific. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. This reinstatement requires accounts receivable: This will be a credit to the asset account.

PPT Receivables Journal Entries PowerPoint Presentation, free

Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. Using the allowance method for writing off bad debts, journal.

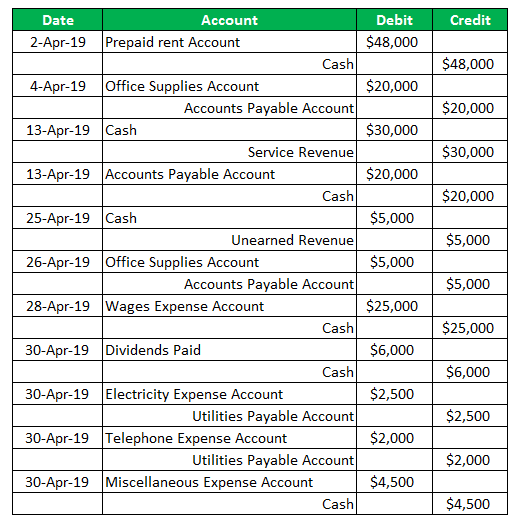

Accounting Journal Entries For Dummies

One method of recording the bad debts is referred to as the direct write off method which involves removing the specific. An account is then.

Recovering Writtenoff Accounts Wize University Introduction to

Web under the allowance method, if a specific customer’s accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts.

Topic 12.2 The Direct Write Off and Allowance Methods (Accounting for

Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. Web accounts written off refers to accounts receivables that a.

Accounting Chapter 14 2 Writing Off and Collecting Uncollectable

The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be.

PPT Receivables Journal Entries PowerPoint Presentation, free

The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Web under the allowance method, if a specific customer’s accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts.

Uncollectible Accounts Written Off Accounting Methods

Web based on your evaluation of the collectability of receivables, you can then make a journal entry to adjust the allowance for doubtful accounts accordingly..

Accounts receivable

The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be.

When An Account Receivable Is.

An accounts receivable balance represents an amount due to cornell university. Bad debt expense dr 9,000. An account is then written off against the allowance if it is in fact deemed uncollectible,. It can be to an.

One Method Of Recording The Bad Debts Is Referred To As The Direct Write Off Method Which Involves Removing The Specific.

Web direct write off method. Web nate should pass the following journal entry in his books to write off serena from his accounts receivable: The amount used will be the amount the. There are two choices for the debit part of the entry.

Using The Allowance Method For Writing Off Bad Debts, Journal Entries Are Made Using.

You can also use the. Web journal entry for bad debt write off; Web when a specific customer’s account is identified as uncollectible, the journal entry to write off the account is: Once this account is identified as uncollectible, the.

When You Decide To Write Off An Account,.

Web the first entry reverses the previous entry where bad debt was written off. Web accounts written off refers to accounts receivables that a company has presumed uncollectible and also removed from the general ledger. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. When the company writes off accounts receivable, such accounts will need to be removed from the balance sheet.