Journal Entry To Record Purchase Of Equipment - $24,612.69 (price, taxes, & fees) interest paid on equipment loan after 48 months: Web once done, create a journal entry that will debit the expense and credit the asset account. And, credit the account you pay for the asset from. And each distinct asset, including different buildings if we. Under memo, enter the item reference. The credit is based on what form of payment you use as the customer. Web a fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle. Web what the journal entry to record a purchase of equipment? Web journal entry to record the purchase of equipment. On january 5, 2019, purchases equipment on account for $3,500, payment due within the month.

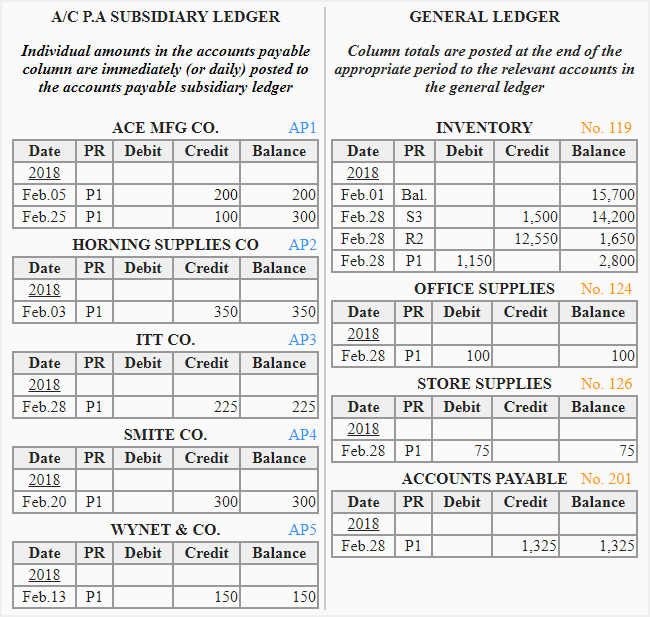

Purchases journal explanation, format, example Accounting For

On january 5, 2019, purchases equipment on account for $3,500, payment due within the month. Web when writing a journal entry for procurement, it’s important.

Accounting Journal Entries For Dummies

Web once done, create a journal entry that will debit the expense and credit the asset account. Web the journal entry to record the purchase.

How to use Excel for accounting and bookkeeping QuickBooks

Web the company has purchased the equipment, and it has already been received. Web accounting for inventory. Let’s say you buy $10,000 worth of computers.

Accounting Journal Entries For Dummies

Web below are the five steps in recording the disposal of fixed assets: And each distinct asset, including different buildings if we. Insurance premium for.

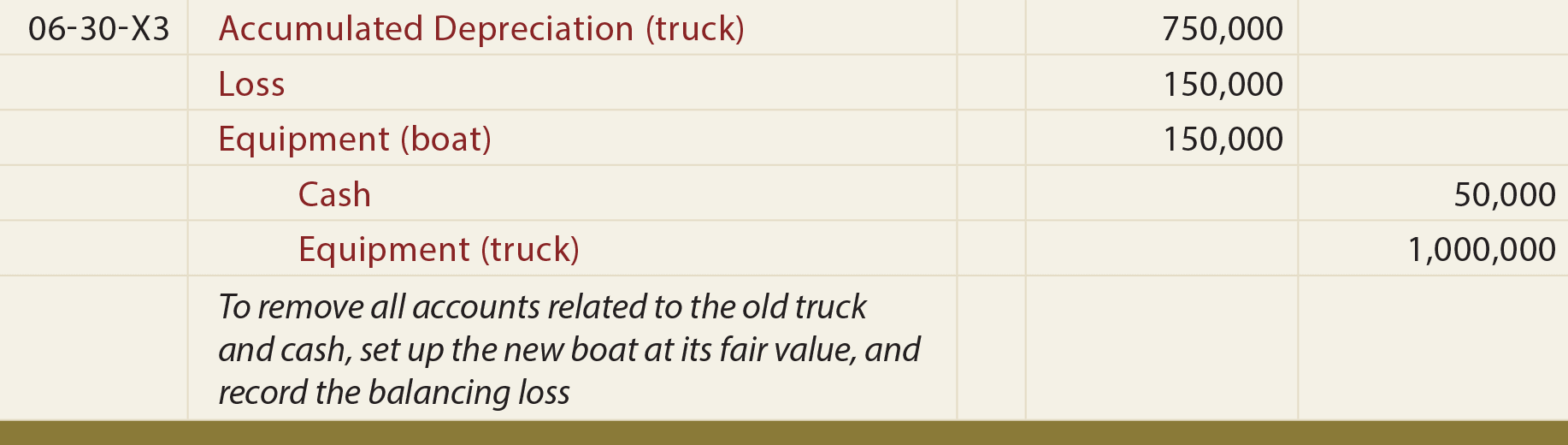

Accounting For Asset Exchanges

Web accounting for inventory. Web creating a journal entry is the process of recording and tracking any transaction that your business conducts. The purchase of.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

This type of entry reflects the receipt of new asset items and the associated expense in a business's. The buyer will make an initial down.

Accounting Journal Entries For Dummies

Equipment purchase journal entry is an accounting record that documents the purchase of equipment, such as machinery and tools. The credit is based on what.

Journal Entry Examples

Journal entries for sales discounts are posted in the following manner: Web the double entry bookkeeping journal entry to record the purchase of the networking.

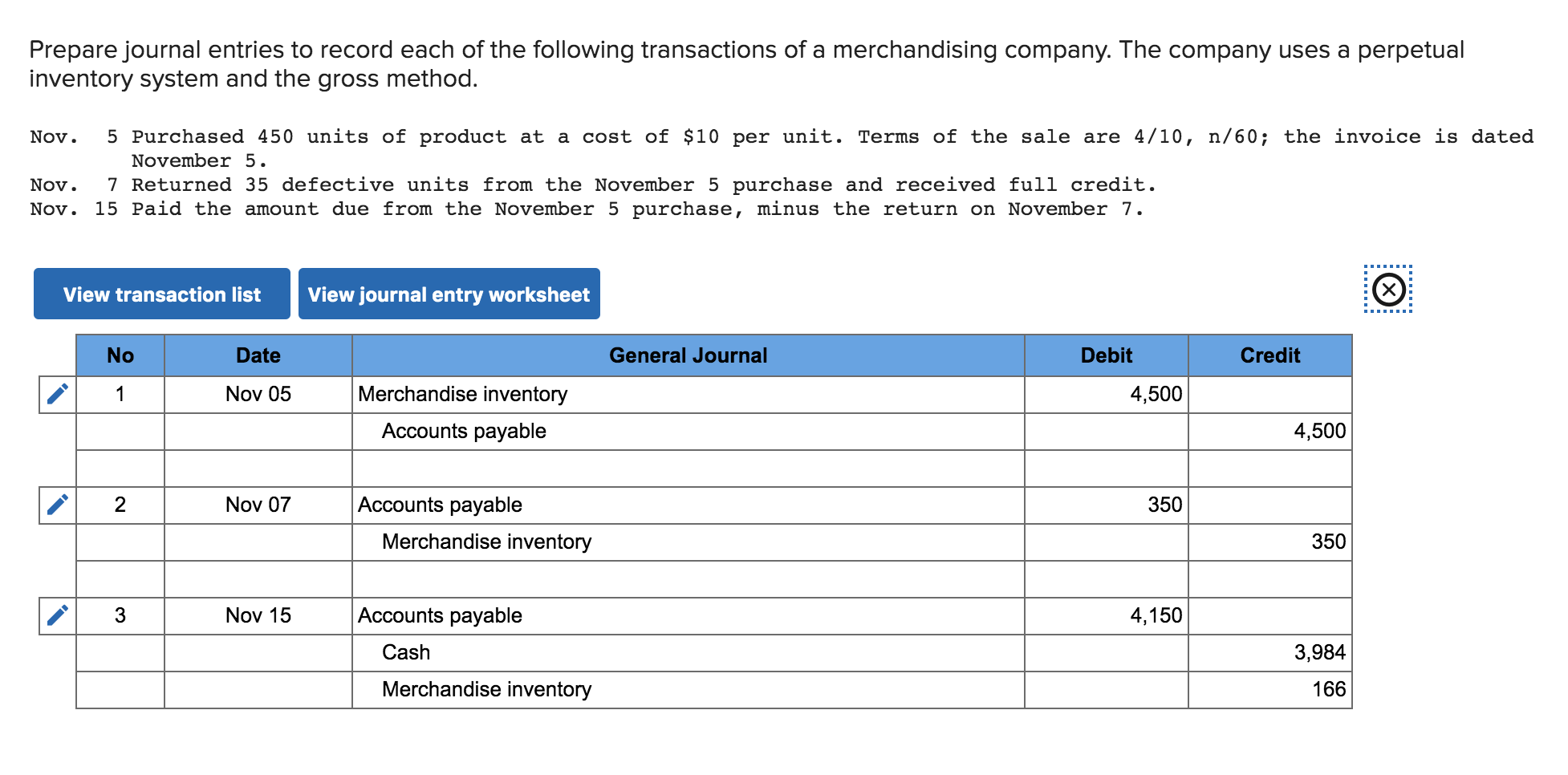

Solved Prepare journal entries to record each of the

Web a fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a.

Web Accounting For Inventory.

Want to learn how to correctly write journal entries for your business? Go to the accountant menu. [q1] the entity purchased new equipment and paid $150,000 in cash. This is the initial inventory purchase, which is routed through the system.

Fill In The Necessary Information.

Hire purchase is the agreement that seller allows buyer to purchase assets with installment rather than paid full amount. The debit will be to either the or the account, depending on the nature of the goods purchased. Journal entries for sales discounts are posted in the following manner: This entry records the full cost of the equipment, including initial payment as well.

Buy Equipment With Down Payment In Cash Journal Entry.

When the buyer avails of the cash discount offered, the following journal. Web to record purchase of new equipment in reality, the cost of the machinery would be allocated in detail, because we want to be able to track computers; Web what the journal entry to record a purchase of equipment? Let’s say you buy $10,000 worth of computers and pay in cash.

On January 5, 2019, Purchases Equipment On Account For $3,500, Payment Due Within The Month.

As it is a credit purchase, it will record the accounts payable as well. The credit is based on what form of payment you use as the customer. Web the company has purchased the equipment, and it has already been received. Web creating a journal entry is the process of recording and tracking any transaction that your business conducts.