Journal Entry To Record Depreciation - Web straight line depreciation journal entry. Web our cto shares four key things you need to know when booking a journal entry on a fixed asset depreciation. Debit the accumulated depreciation account for the amount of. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting. Web depreciation is recorded by debiting depreciation expense and crediting accumulated depreciation. Web depreciation expense journal entry. Credit to the balance sheet account accumulated depreciation. Debit to the income statement account depreciation expense. Web the journal entry of spreading the cost of fixed assets is very simple and straightforward. For example, a company purchases a machine for $50,000.

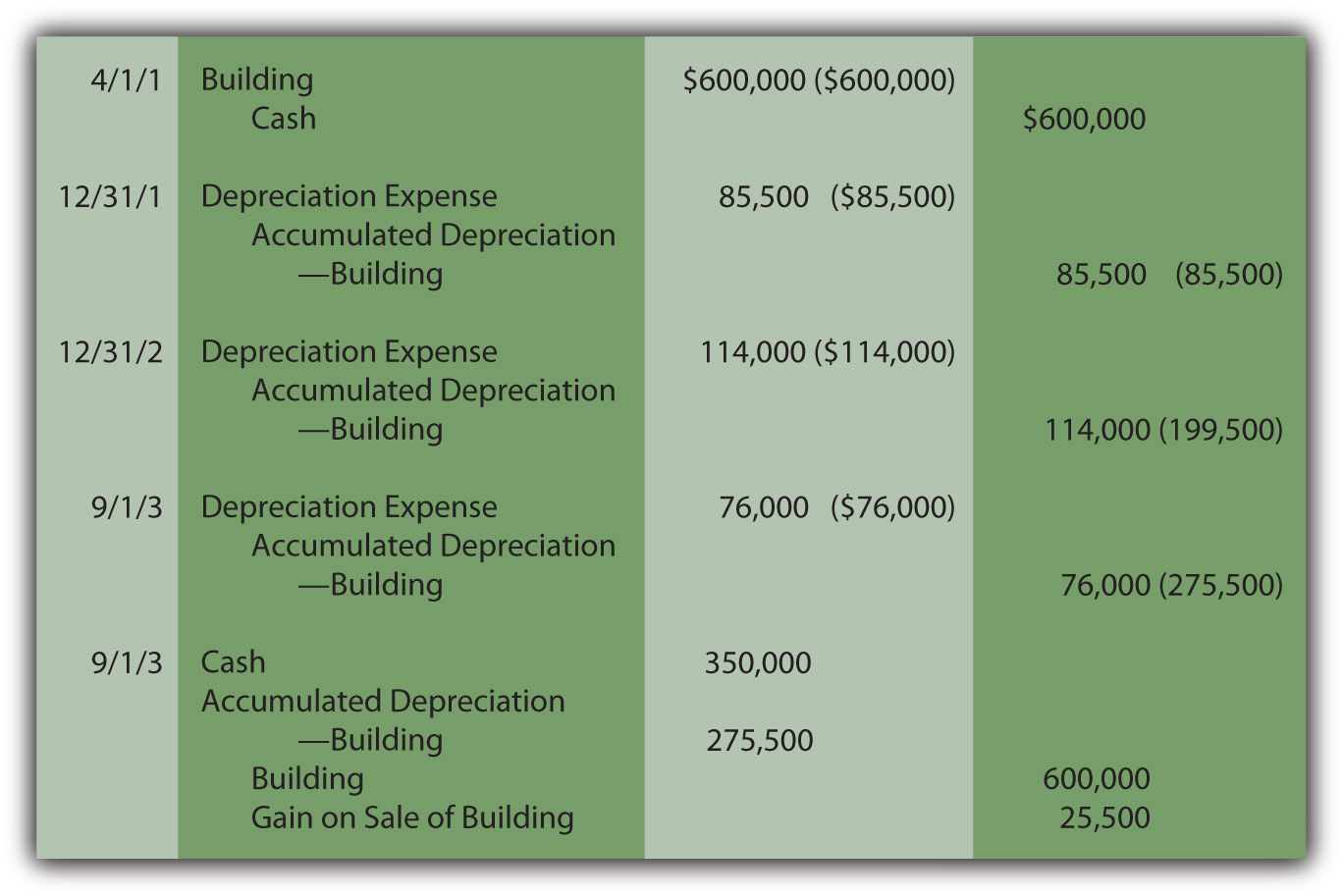

Depreciation and Disposal of Fixed Assets Finance Strategists

Web depreciation expense journal entry. Web journal entry for depreciation. Debit the accumulated depreciation account for the amount of. Web a depreciation journal entry is.

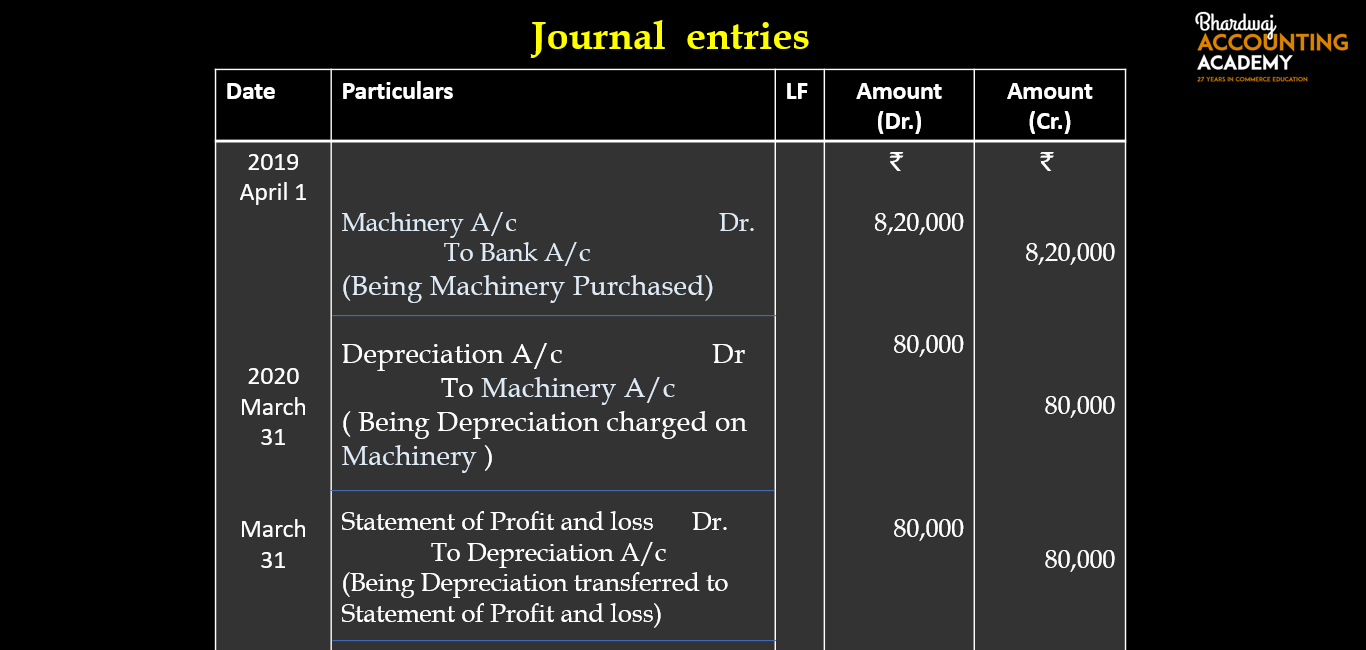

Depreciation journal Entry Important 2021

Debit the accumulated depreciation account for the amount of. Web a depreciation journal entry is used at the end of each period to record the.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

For example, a company purchases a machine for $50,000. Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets..

Journal Entry for Depreciation Example Quiz More..

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. Web a depreciation journal entry is used.

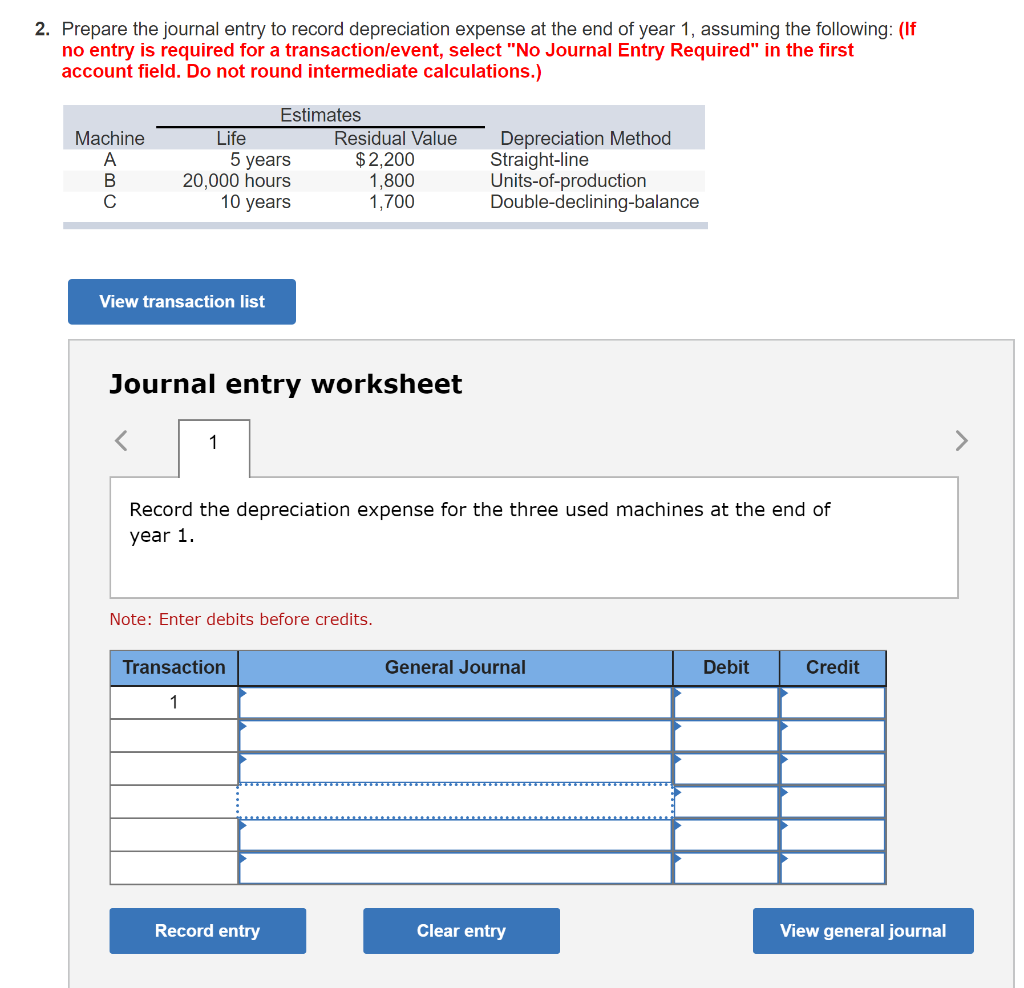

Solved 2. Prepare the journal entry to record depreciation

Web in this article, we will discuss depreciation in accounting, the importance of recording it in financial statements, the need for depreciation for tax purposes,.

What is the journal entry for depreciation? Leia aqui What is

Web journal entry for depreciation. Web depreciation expense journal entry. Web in this article, we will discuss depreciation in accounting, the importance of recording it.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Web journal entry for depreciation. Web the journal entry will have four parts: Web the journal entry for depreciation is: Web depreciation expense journal entry..

Depreciation Expense in a Not for Profit Organization Should Be

Credit to the balance sheet account accumulated depreciation. Web the journal entry for depreciation refers to a debit entry to the depreciation expense account in.

Web Our Cto Shares Four Key Things You Need To Know When Booking A Journal Entry On A Fixed Asset Depreciation.

Web a depreciation journal entry is a journal entry used to record the depreciation of an asset. Web depreciation records an expense for the value of an asset consumed and removes that portion of the asset from the balance sheet. Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the loss. Debit the accumulated depreciation account for the amount of.

Web Journal Entry For The Depreciation Of Fixed Assets.

From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. The journal entry to record depreciation. The company needs to make monthly journal entry by debiting depreciation expenses and credit accumulated depreciation. Therefore, it is very important to understand that when a depreciation expense journal entry is recognized in the.

For Example, A Company Purchases A Machine For $50,000.

When recording a journal entry, you have two options, depending on your current accounting method. Web learn how to record depreciation expense and accumulated depreciation for different types of fixed assets. Web straight line depreciation journal entry. See examples of journal entries, cash impact,.

Credit To The Balance Sheet Account Accumulated Depreciation.

This is recorded at the end of the period (usually, at the end of every. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system. Web the journal entry will have four parts: Debit to the income statement account depreciation expense.